It’s time to hit you up with another edition of the Financial Panther side hustle report! It’s hard to believe it, but it’s now been over 2 months since I quit my job to try my hand at making a living as a blogger and sharing economy/gig economy worker. After years of being pretty unhappy professionally, for the first time in a long time, I actually look forward to working the next day!

As a quick recap, last month, I revealed that after 5 years of working as an attorney, I finally worked up the courage to quit my job and take a chance on becoming a full-time blogger. I debated whether to continue to call these posts side hustle reports since eventually, I’ll likely need to start digging into the income I earn from these different gigs (at the moment, I have a pretty solid runway simply from cash savings I put aside before making this leap to self-employment).

Still, I’m doing most of these gigs during my lunch and evening hours, so for the most part, my schedule hasn’t changed too much, and hence, why I’m still calling it a side hustle report (and why I think it’s still something that you can read and learn from).

Eventually, I’ll probably write a post about what my typical day looks like, but in general, I try to keep regular 9-5 type hours at a coworking space that I have downtown. I try to do most of my gig stuff during lunch and on my commute home from work. And of course, I have a lot more flexibility now since I don’t have to sit at a desk for 8 hours each day.

Importantly, what all the stuff I do has taught me is that there are a lot of ways to make money in today’s world, especially if you’re scrappy and willing to try things out. Hopefully, these side hustle reports give you the inspiration to try things out in your own life.

Remember, even a few bucks of extra income per day can add up to hundreds of thousands of dollars if you can simply stick to it and let it compound over time.

Side Hustle Income for May 2019

- Airbnb: $2,117.51

- Rover: $63.75

- Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub: $654.51

- Wag: $243

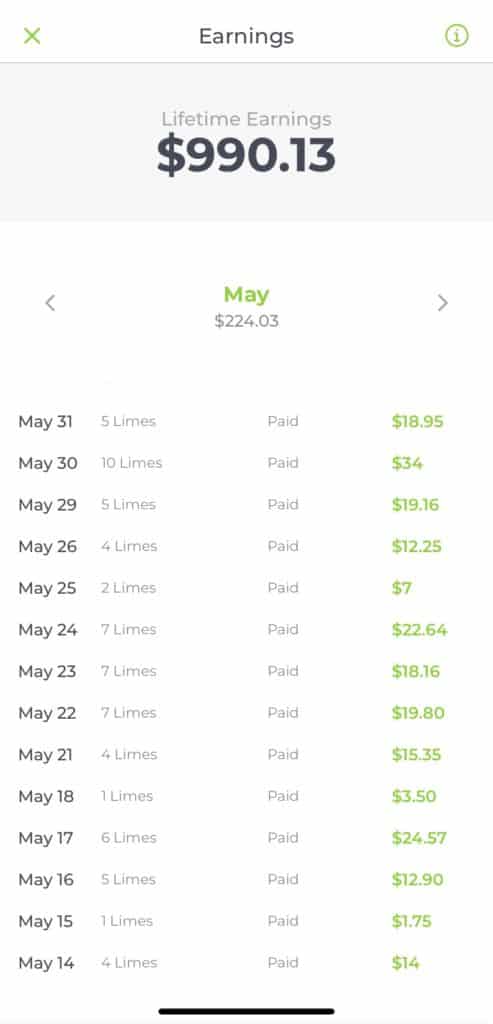

- Bird/Lime: $224.03

- Selling Trash Finds/Flipping: $146.51

- Job Spotter: $36.24

- Gigwalk/EasyShift/Field Agent/Observa/Merchandiser: $116.65

- WeGoLook: $20

- ProductTube: $35

- Google Opinion Rewards/1Q/Surveys On The Go: $22.77

- User Interviews: $200

Total Side Hustle Income for May 2019 = $3,879.97

May was once again a huge month, as I made almost $4,000 hustling in the sharing economy and gig economy. That $4,000 came from 12 different sources. The crazy thing is that when you include my blog income for this past month, I actually ended up making just as much as I did from my day job. That’s a pretty encouraging thing to hear and makes me feel a lot more comfortable about making this leap.

Of course, there are some caveats. The bulk of my income came from Airbnb, which admittedly isn’t something that everyone can do – and isn’t something that I can do forever either once I have a family. I also made a lot more income from my delivery and dog walking apps, mainly because I now have a lot more flexibility in when I do my deliveries – something that I didn’t have when I was working a 9-5 job.

Still, I think there’s a lot you can learn from this side hustle report. Just take what works for you and ignore what doesn’t. The main point is that there’s something that everyone can do to make extra income on their own time. And this money means something. Even just an extra $10 per day of side income can add up to over $350,000 if consistently invested over 30 years.

With that said, let’s take a deeper look at everything I did to earn extra income in May 2019.

Airbnb Income: $2,117.51

As you can probably tell, May was a big Airbnb month. That’s because May is college graduation season, and since we live near a large university, we were able to rent out our entire house for a weekend to a family that was in town for their kid’s graduation.

Renting our entire house out during graduation season was actually an idea that I had last year since it occurred to me that a lot of families come into town during graduation and might want to stay in a central location close to campus. My initial hope was to get every weekend in May booked, but we only ended up getting the main graduation weekend booked. Still, that single stay brought in over $800 – enough to cover our entire mortgage payment just from renting our house out for 3 days.

We also rented out our home for a second weekend in May to a family that was coming into town to visit their son. This was actually an unexpected booking, but I feel like it shows that there is demand for short-term housing, even if it doesn’t seem like it.

Being able to generate this type of income from the house that we live in is a pretty big deal. Most people’s houses act as a huge liability, but our house actually generates income for us without requiring us to do a ton of work. (Pro-Tip: I recently got a robot vacuum, which has saved me a ton of cleaning time each month – it’s been well worth the cost.)

- If you have extra space and want to earn extra income from your home, you can sign up to be an Airbnb host using my referral link.

- Airbnb is also one of the most affordable ways to travel. If you’ve never used Airbnb, sign up for Airbnb with my link and you’ll get $40 off your first stay.

Rover Income: $63.75

I had a slow Rover month in May, watching only one pup during the month. A couple of things accounted for this. First, I was out of town for the first weekend in May while my wife was taking her board exams (sidenote – she passed). Second, we rented out our entire house for two weekends on Airbnb, so that meant we couldn’t watch any dogs during those weekends.

The one pup we did watch was a French Bulldog that we’ve watched several times now and that is probably our favorite pup to watch. She’s super well behaved and is honestly a pup I’d watch for free. That’s the beauty of setting up a dogsitting business with Rover – I’m getting paid to do something I’d probably do for free.

Dogsitting is a pretty easy introduction to entrepreneurship. You really just need to know how to take care of dogs and live somewhere that allows you to have dogs. If like me, you already own a dog, then it becomes even easier.

If you’re interested, feel free to sign up to be a dogsitter on Rover using my referral link (it’ll also help support this blog).

Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub Income: $654.51

Deliveries continue to be my favorite side hustle and the gig that I enjoy doing the most. There’s something about being able to bike around outside and explore a city on a nice day that I think really works for me.

The big thing you’ll notice this month is that I added Grubhub to my repertoire of delivery apps. Grubhub is an app that I’ve been trying to get signed up with for two years, but every time I applied, I would get a message telling me to contact driver support. I’d then email driver support and would never hear back. This was pretty frustrating, so about a year ago, I set up an auto-messenger that would send an email to driver support once per month asking if I could get activated. I guess the emails must’ve finally gotten to someone because last month, I received a message telling me that my account was now active and I could go and make deliveries.

Adding Grubhub to my list of delivery apps is a big deal for me, as I’ve heard from multiple sources that Grubhub usually pays the most. So far, I’ve found this to be true. Regardless of how much it pays though, the big thing is that it gives me another delivery app to use, which is especially helpful since I’m always running multiple delivery apps at once (which is what I recommend everyone do).

Below is a breakdown of my earnings on each delivery platform in May 2019:

- Postmates: $113.94

- DoorDash: $273.27

- Uber Eats: $124.42

- Amazon Flex: $64

- Grubhub: $78.88

Besides finally getting onto Grubhub, one of the other interesting things I did in May was to do some Postmates and Uber Eats deliveries while I was in Dallas for a week. One of the advantages of these food delivery apps is that most of them allow you to do deliveries in any city you want (Postmates and Uber Eats, in particular). I’ve done deliveries in multiple cities and I find this to be a really great and fun way to explore a city, especially if you have some time you need to kill.

Doing deliveries in other cities is made particularly easy by the fact that almost every major city has a bikeshare or scooter program that you can use, which makes getting around very easy. Scooters aren’t normally a cost-effective way to do deliveries, but I happen to have a lot of scooter credits from running this blog, so I was able to get in a few deliveries scooting around Dallas. I might need to write a post about this strategy of earning money while traveling because I think it’s an interesting way to make money while traveling that isn’t talked about that much.

Wag Income: $243

I had a good month on Wag, walking many of my usual clients during the month. Since I now work out of a coworking space downtown, it’s gotten easier for me to find walks to do most days since there are a lot of dogs to walk in the downtown area.

The interesting thing I did this month with Wag was taking my dog walking on the road! Like with Postmates and Uber Eats, Wag is something that you can do in any city – all you have to do is just turn on the app and see if there are any walks nearby. I’ve done this a few times, walking dogs in Chicago last year, then walking dogs in April when I was visiting my friend in Atlanta (that one worked out really well because the dogs I walked literally lived in my friend’s building). And arguably, this might be the best way to explore a city like a local.

I was staying close to the Uptown area in Dallas, which had a ton of dogs that I could walk. Most of them lived close to the Katy Trail, which happens to be a popular walking trail in Dallas, so I was able to go and explore the trail, walk a few pups, and make some cash. Not a bad way to spend a few nice days.

If you’re looking for more info about how Wag works, you can check out my in-depth post about Wag. It should hopefully give you a good idea of how it works and how I’ve incorporated it into my life.

Bird/Lime Income: $224.03

After a long winter, the scooters finally came back to Minneapolis! As a quick recap since it’s been a while since I last talked about scooters, last year, I became obsessed with electric scooters, and especially with making extra money by charging them. I happen to live in a dense neighborhood that has a lot of scooters around it, and after exploring how it worked, it seemed like a no-brainer way to make some extra money without a ton of effort. Unfortunately, Minneapolis also has some major winters, which meant that the scooters were pulled off the streets at the end of November. So, for the past 5 months, I haven’t been able to charge any scooters.

In May, Lime finally came back to Minneapolis. Unfortunately, the city council didn’t approve Bird for the 2019 season, instead opting to approve four different companies – Lime, Spin, Jump, and Lyft. Jump and Lyft both use employees to charge their scooters, so that doesn’t really work for me. I tried to apply for Spin, but they told me that they didn’t need any more 1099 contractors. As a result, it looks like Lime will be the only scooter company I charge for this year in Minnesota (I can still charge Bird scooters if I’m in other cities).

So far, Lime is going very well and adding up to some solid extra income. I’ve gotten especially good at stacking them – I can stack 4 at a time with no problem. The big thing is that Minneapolis increased their scooter allotment to 500 scooters per company, which means there are a ton more Lime scooters out for me to charge. Right now, I only need about 4 scooters per night to make some decent cash, and with so many scooters, it’s really not hard for me to snag my target of about 4 scooters each night.

Scooters are a good example of my Reverse Latte Factor idea that I wrote about earlier this month. Depending on where you live, making just $10 per day from scooters is not a hard thing to do. And that money can add up to literally hundreds of thousands of dollars if you stay consistent and give it time to grow.

I’m planning to write an updated post about Lime since that’s probably the scooter company that I have the most personal experience with right now. I wrote a post last year about my experience charging electric scooters, so make sure to give that a read to understand how you can fit scooter charging into your day-to-day life.

Trash/Flipping Income: $146.51

This category consists primarily of two things: (1) things I find in the trash and sell locally or on eBay; and (2) things I buy at Goodwill and flip for a profit on eBay.

May was a pretty good month on the trash front. I ended up selling $75 worth of trash finds, much of which I found in the trash at my mother-in-law’s apartment. If you live in a luxury apartment, I seriously think most people can make $1,000 in a year literally just from selling the stuff people toss out.

One of the things I always like to sell when I find them are barstools. I found these in April and ended up selling them in May for $30. That’s a good deal for the buyer and I find that barstools sell really quickly and are easy to carry away.

I didn’t sell too much stuff on eBay, and things have really started to slow down on eBay simply due to the fact that I’m not adding inventory as fast as I used to. It’s also the summer season when things start slowing down. Still, I sold about $32 worth of stuff on eBay, so it’s better than nothing. These included an Ohio State hoodie and a Columbia ski jacket I picked up at the Goodwill Outlet.

My final sale for the month was some old shoes that I sold on eBay. These sold for about $39 after fees, so not too bad for a pair of shoes that have literally been sitting in my closet for 10 years.

Job Spotter Income: $36.24

I had another record month on Job Spotter, likely due to the fact that I’m just out and about more these days (instead of being stuck in an office). Job Spotter just works like clockwork and based on how much you make versus the time it takes, it’s well worth it. You can read my in-depth review on Job Spotter if you’re looking for more info about how Job Spotter works. Trust me, Job Spotter is a no-brainer app for you to use.

Gigwalk/EasyShift/Field Agent/Observa/Merchandiser Income: $116.65

I actually made some decent money doing a bunch of little gigs with Gigwalk, EasyShift, Field Agent, and the like. Here’s a breakdown of what I made on each of these apps:

- Gigwalk: $24.20

- EasyShift: $74.75

- Field Agent: $10

- Observa: $7.70

- Merchandiser: $0

The interesting app this month was EasyShift simply due to the fact that they had a ton of gigs available where you had to take pictures of soda machines at certain restaurants. These gigs each paid between $6 and $7 and literally took me 2 minutes each to complete. That made it very lucrative. I did a bunch of these gigs while I was in Dallas (another way to make money while you travel).

Observa was another app that made an appearance this past month. It’s definitely one of my least used apps simply because they rarely have any gigs on it. However, this past month I saw a gig right next to my office, so I walked over there and did it. It paid a little over $7 and took me about 10 minutes to complete, so not too bad for the time it took.

WeGoLook Income: $20

I did one WeGoLook gig in May – good for $20. These WeGoLook gigs are pretty useful because they pay very well for the amount of time they take – they never take me more than 10 or 15 minutes to complete. Any gig on WeGoLook is almost always worth doing so long as the gig is close to you (I never travel farther than a few miles to do a gig and I always bike to my gigs).

ProductTube Income: $35

I had another good month using ProductTube. This app is weird because you have to film yourself in a store reviewing products, but it pays a lot for very little work. The videos never take me more than 5 minutes to make and they pay between $5 and $25 for a short video. I ended up making $35 in May doing two gigs with this app. It’s worth trying out to see if it makes sense for you.

Google Opinion Rewards/Surveys On The Go/1Q Income: $22.77

These short survey apps continue to make me solid money for very little work, as each survey takes me literally seconds to complete. Here’s the breakdown of what I earned on each survey app in May:

- Google Opinion Rewards: $10.59

- Surveys On The Go: $11.93

- 1Q: $0.25

Google Opinion Rewards continues to be the best app to use because of how quick the surveys are and how much you can make. Surveys On The Go is my new addition to this category and so far, it seems like a winner to me. I’ve made at least $10 each month for the past three months with that app and the surveys, while a little longer, are quick enough that I can do them while I’m walking around. 1Q continues to stick around in the rotation just because it makes me about a quarter each month for 1 second of work.

User Interviews Income: $200

I had a very interesting market research thing that I did in May with a website I found called User Interviews. This is a website that matches people up with companies looking to do market research for new products. I’m not even sure how I found out about this website or even how I signed up to get emails from them. But in any event, it seems legit (and interestingly enough, they were on a recent podcast episode of “The Pitch”).

The one market research thing I did in May was very lucrative. I answered a few qualifying questions through the User Interviews website and then this company came to my house and interviewed me for 2 hours about how I use smart home products. The whole thing was pretty painless and it paid me $200 for those 2 hours (or $100 per hour). $100 per hour was definitely worth my time!

Obviously, this isn’t something that I can do consistently, but this world of market research is pretty interesting. There’s probably money to be made out there, so grab them when you see them.

And that concludes the May 2019 Side Hustle Report!

Bringing in close to $4,000 in a month from all of these different gigs is pretty incredible. There’s a lot of comfort in knowing that I can figure out ways to get by – it’s just about being willing to do whatever it takes.

In a way, these different side hustles have the power to act as a sort of side hustle emergency fund, allowing me to cover emergencies and float my life for longer. It can even act as a sort of F-you fund for when you’re unhappy with your job and/or are looking to make a career change. It’s a lot easier making a move when you have other ways to bring in income, and having all of these gigs in my back pocket is part of the reason I was pretty comfortable taking a chance on becoming a full-time blogger.

Check out my side hustle report page to see what I’ve made in other months. It’s a big world out there and there are a lot of ways to make money. You just need to be willing to try things out. Thanks for stopping by!

FP:

Kudo’s and Congrats on leaving your job! Hope to follow in your shoes before too much longer. Your consistent Side Hustle income is such an inspiration!!

Sherry

Thanks Sherry! Appreciate the kind words.

I also made some money this month while traveling with the various apps. I went from Houston area to the Rockies and back with family with a number of activities over a week’s time. I continued to have plenty of receipts income doing what we were doing. I continued with some survey income when I wasn’t driving. I had to get up on Sunday at 3:30am to take my son and girlfriend to the Denver Airport. On the way back to our cabin, I picked up 3 quick and easy Field Agent gigs within ~1/4 miles along my route back and being tired and needing to exercise a bit, at the last Field Agent gig at a Walmart, I also picked up some Sidekicks points walking the store. Lastly, everywhere I went, I picked up hiring signs for JobSpotter. Even while vacationing and putting family time first , I still picked up quite a bit of side income. The various apps really make this possible!

That’s awesome! You know exactly how to play this game!

I do but I’m still a rookie compared to you. Keep leading the way!

Wow. Do you get to spend much time with your wife???

Yeah. Probably more time than you. Remember, I’m a bum with no job.

Me too. I’m retired. Hehehe.

Ah nice. Haha.

In the post it says you wokr at a “coworking space” 8 hours per day. What do you there? Why don’t you do it at home?

I work out of a WeWork because I got a free 1 year membership when I opened my AmEx Biz Plat card. I don’t work well at home, so I usually need to get out of the house to do work. It helps keep structure to my day as well.