I can’t really believe it, but this past weekend, I turned 30 years old. It’s sad to say, but my 20s are now officially over. I think I have to become a responsible adult now or something.

I’ve been casually tracking my net worth over the past couple of months, and back in October, I published my first quarterly net worth report. You can take a look at that post here. My plan is to continue these reports so that folks can see where I’ve been and where I’m going. It’s also not bad for me to have these numbers documented for my own records so that I can get a picture of where I’m going.

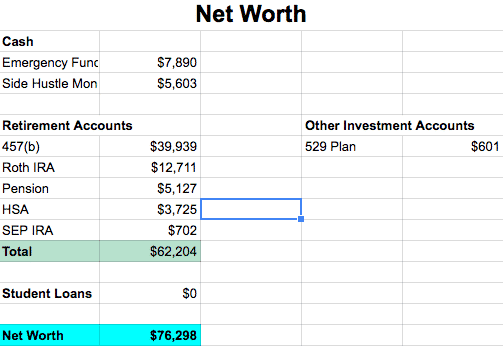

Here’s the current picture of my net worth:

As shown above, my current net worth as of this post is $76,298. That’s up from $61,526 back in October 2016. The growth is pretty surprising to me, but it goes to show how much money you can put away when you don’t have all that many bills. In particular, getting rid of all those student loans and having an employer that offers a generous match is huge. I’ve been able to sock away a ton of money in the past few months.

There are a few things that aren’t included in this net worth report. I have money saved away in various buckets for future, anticipated expenses. Since that’s money that will likely be spent at some point in the near future, I don’t consider that in my net worth calculation.

Related: I use Qapital to help me save money for short term goals. It’s a terrific, totally free app that I highly recommend. Check out my review for Qapital here.

Cash

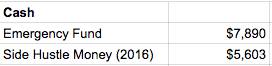

The emergency fund continues to grow steadily. I’ve been doing the 52-week money challenge for a while now, and all of that money gets funneled right into my emergency fund. Right now, I’m pretty comfortable with the size of my emergency fund, so I don’t feel a ton of urgency to build it up quickly. The bulk of my emergency fund – $5,000 worth – is kept in an FDIC insured savings account earning 5% interest. I keep the remainder in a high yield savings account earning 1%.

In addition, I have a lot of money set aside in other buckets to cover other, future anticipated expenses. While I’d prefer to keep that money to be used for their intended purposes, the money can serve as a sort of backup emergency fund if necessary.

The side hustle income doesn’t include about $6,700 worth of Airbnb income, so that amount should actually be higher. I opened up a Solo 401(k) last month and plan to get as much of the side hustle income into there as possible. I’m just waiting to get all my taxes together before I make that move.

Investments

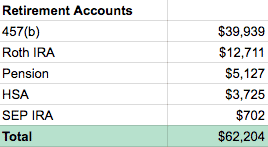

457(b) and Pension

The retirement funds continue to grow at a steady clip, powered primarily by my contributions. A few months ago, I rolled over the funds that were in my 401(k) from my previous employer into my 457 plan at my new job. The process was pretty simple. All I had to do was call up my old 401(k) provider and ask them to roll over the funds into my new plan. I then had to fill out a form telling my 457 plan provider how to invest the new funds.

Rolling over the funds into the 457 plan made sense for me. It cost me $89 per year to keep my funds in my old 401(k), so it didn’t really make much sense to continue paying that fee while also paying an annual maintenance fee for my 457 plan. My 457 also has great investment options (primarily Vanguard), so I was comfortable rolling my 401(k) contributions into it.

I also didn’t want to roll my 401(k) into a traditional IRA because I anticipate my household income rising to the point where I won’t be able to contribute to a normal Roth IRA. By keeping my traditional IRA space empty, I make it much easier for me to utilize a backdoor Roth in the future.

My defined contribution pension plan continues to grow at a steady rate as well thanks to consistent contributions. My employer requires all of us to put in 5.5% of our salary into it and my employer throws in 6%. All together, that’s 11.5% of my salary going into my pension plan. It’s a nice benefit that allows me to save much more into tax-advantaged savings compared to a regular person.

Roth IRA

My Roth IRA continues to grow steadily as well. I maxed out my Roth in 2015 and maxed it out again in 2016. The plan hopefully is to continue maxing it out in 2017. The funds are invested in a 100% equity portfolio with Betterment.

I’m still debating on whether I’ll keep the funds invested in Betterment or whether I’ll move it all over to Vanguard and save myself the 0.25% management fee. I do find some comfort in knowing that I have an appropriate, diversified asset allocation that I can’t mess up so long as I don’t mess with the account. And I do like knowing that I have a fiduciary watching my back for me.

HSA

My HSA also continues to benefit from regular contributions. I initially had these funds invested with Fidelity and was putting after-tax money into the HSA (rather than opting for payroll deductions) because the options offered by my employer’s preferred HSA provider were horrible.

Luckily, a few months ago, my employer’s preferred HSA provider started offering Vanguard funds with low expense ratios. I’ve since moved all of my HSA funds to my employer’s preferred HSA provider and I’m now opting for payroll deductions. The good thing about payroll deductions into an HSA is that you can avoid paying FICA taxes on those contributions. That’s good for a 7.9% tax savings that otherwise isn’t possible to get. For whatever reason, if you opt to invest after-tax money into your HSA and then deduct those contributions, you still have to pay FICA taxes on those contributions. Payroll deductions into your HSA are basically the only way I know to avoid FICA taxes.

I maxed out my HSA for 2016 and my plan is to continue maxing it out for as long as I happen to have a high deductible health plan. My employer happens to contribute $800 per year into my HSA, so I only need to put in $2,600 for 2017 in order to max the whole thing out.

SEP IRA

The SEP-IRA funds remained basically unchanged. This is money that I plan to rollover into my Solo 401(k), but I just haven’t gotten around to doing yet. For now, this money is invested in a Wealthfront account and, because of the low balance, I pay no management fees to keep it there.

Other Investment Accounts

My 529 plan continues to grow slowly. I still automatically invest $25 per month into my 529 plan, mainly just as a learning exercise. My thinking is that at some point when I do have kids, I’ll understand how a 529 plan works and can easily transfer the 529 into my kid’s name. And $25 per month is basically unnoticeable to me.

I also used to have a couple hundred bucks invested in various individual stocks using an app called Loyal 3. About a month ago, I ended up liquidating that entire account and putting those funds into my Roth IRA. I was just getting tired of looking at my individual stock performance. And I didn’t want to spend mental bandwidth on it anymore.

That concludes this quarterly net worth report!

I’m pretty happy to see my net worth growing steadily. It’s surprising how fast you can save money when you don’t have any debt. Obviously, at 30 years old, I’m nowhere near where some of the early retiree folks are. But I am making progress.

I also didn’t start my career until I was 26, then didn’t really start saving a ton until I paid off my student loans this past year. If you’re a young professional in a field like law or medicine, you’ve got to remember that you need to save extra hard once you start working. A lot of people start working when they’re 22 years old. Most lawyers won’t start working until they’re in their mid-20s. Doctors might not start their careers until they’re in their 30s (Ms. FP will be 32 when she starts her first job). You’ve got to play a little catch-up, which is what I’m doing now.

Hope you enjoy that insight into my financial life. How’s your net worth doing?

Congratulations on the growth so far! I’m in big law too, and it’s extremely rare to see someone as disciplined as you were to pay off loans and establish a positive net worth. I doubt many 3rd or 4th years at my firm have a positive net worth.

Thanks so much! You see so many people in big law do nothing with their loans. Very easy to get to 3rd or 4th year and basically have nothing to show for it if you aren’t thinking about it. It takes some planning!

First off, happy birthday! Although it’s a bit late but I hope you had a good one! I think you’re doing great in terms of growing your net worth. I am only a couple of years younger but I am barely at a third of what you have. Hopefully I can pick things up in 2017!

Thanks! And I bet you’ll get there faster than you think!

Happy belated 30th! A key takeaway for me is your statement early on about how easy it is to amass savings when your bills are low.

Thanks for answering Ryan’s question because I had to read that section several times to make sure my eyes weren’t deceiving me about the 5%.

Congratulations on your net worth growth!

Thanks Mrs. Groovy. And I’m happy with that takeaway! Definitely pretty crazy how much you can save when you’re not spending it all on bills.

To be honest I don’t check my net worth all that often. I am more focused on my income and working towards increasing it. But I know that my net worth is going the right direction because each paycheck I have $ going into various accounts. I do check my net worth every 3-6 months, though.

I don’t check my net worth all that often as well. In fact, before I started this blog, I probably wouldn’t have been able to tell you what my net worth was (other than to say it was negative). I do like the exercise though, because when I do it, it basically just lets me see where I’ve been going every few months.

Happy belated birthday FP, and congrats on the impressive net worth growth in this last quarter! Best wishes for 2017!

Thanks Matt! Best wishes to you as well.

Congrats on the strong work in Q4 2016, FP! I quit my Loyal3 account a while back as well; they just weren’t offering as many IPOs as they were at the beginning.

I really liked Loyal3 alot, and maybe I might jump back on it one day if I ever want to do dividend stock investing. The one thing I liked about it – besides it being totally free – is the ability to buy fractional shares. It wouldn’t be so hard to just invest the same amount into Coke or something over a long period of time.

I had a lot of fun with Netspend a few years ago when it was $5k max per account and you could have up to 5 total of the different variants….I closed mine when they nerfed it to $1k per card. I guess I could have kept $1k in each one and then I would have had $5k earning 5%, but I opted for simplicity. Still waiting for all my 1099’s from those accounts!

I think Insight Card is one that still allows $5k @ 5%, but I never jumped on that one. I’ve had more fun chasing bank account bonuses and such. 😀

Netspend is exactly what I use to keep my emergency fund. I also had it back when it was 5k each, allowing me to put away 25k at 5% interest. They nerfed it, which sucks, but I didn’t feel the need to close them out. $5k still isn’t bad, and the entire process is automated, so it doesn’t really complicate anything for me. I just think of the netspend accounts as one big emergency fund bucket.

The great thing with Netspend though is that if you’re a two person household, each person in the household can have an account. That means you can put away $5k each, or $10k total, which is a perfectly fine emergency fund.

I also did the bank account bonus chasing last year. Actually brought in a little over $1,000 last year doing random bank account bonuses.

Hey! Happy belated!! Your 30’s ain’t so bad and you’re in great company 😉

It seems that this 5% interest account is a hot topic. That post better be out soon or you may incite a riot!! In other news – how nice is it to see 0 where student loans once were? Do you have any other debts working against these assets? If not, you’re sitting pretty for 30!! I wish I had been a bit better with my finances back then and not jumped into real estate the way I did but I am happy to see a lot of movement happening in the right direction. It’s crazy how quick you can turn things around and it’s awesome you have these posts to keep track of it. Great job!!

It’s awesome to see that zero. So for me personally, I have no debt at all. BUT…I’m getting married in April. My fiance still has 130k in student loans from dental school, plus a mortgage on the house that we live in.

The good thing is that we’ve worked a plan here. Basically, we’re gonna keep living the same and crush her debt out in a year. With our combined salaries, I don’t think it’ll be hard. After that, we’ll have to play it by ear on how we handle the mortgage. We’re pretty good on living on less, so with an attorney salary and a dentist salary, we’re going to have a lot of discretionary income coming in.

Happy late birthday! The big 3-0! I have two years left but it’s coming up fast. You’ve been able to make some killer progress this year, great job! I feel ya on the student loans. It’s so frustrating when you start to think where you’d be if you didn’t have to pay those off but at least you did! I try to keep positive when I think about the student loans we paid off. Good luck to you in 2017!

Thanks Julie! Yeah, I sometimes get bummed out at all those people who are turning 30 and have six figures already. I really didn’t get started saving until this past year basically, so I’m pretty happy about that, but I always think about how much more I could have if I didn’t have those loans. Oh well!

Good luck to you in 2017 as well. Enjoyed hearing you on Mad Fientist’s Podcast.

Happy Birthday, FP! Great progress on the net worth as well!

Thanks man!

I rushed over to the comments section to ask about the 5% account and saw that that has been asked and answered. I’ll wait patiently for that post.

Congratulations on the steady NW increase and welcome to your 30s. I’ve loved this decade of my life, and I hope you do too. Don’t ruin it with too much #adulting.

A question about Betterment: given that all your money is not with Betterment do you need to worry about wash sales if Betterment automatically does not TLH on your behalf?

Okay, I definitely need to share that 5% savings account I’ve got going. It’s something I’ve wanted to write about for a while, but just haven’t gotten around to doing yet.

Good question. My Betterment account is actually in a Roth, so there’s no tax loss harvesting going on at all. That probably begs the question, why do I have a non-taxable account in Betterment? And honestly, there’s not a ton of reason now. When I started investing, I really had no idea what I was doing and wanted someone to handhold me. The investing nerds online are always nit picking every little investment decision and it’s scary when you’re a new investor. Since I didn’t know what I was doing, I went with Betterment since they give me the asset allocation and I can trust them. Now, I’ve just been too lazy to switch it out, and honestly, the 0.25% management fee doesn’t bother me all that much.

At some point, I probably will consider moving my Roth funds directly into Vanguard and do some sort of 60% total US stock and 40% international fund.

Ah, I see, that makes sense. Thanks for the explanation. Going with something like Betterment when you first start out is probably smart. I did a few stupid things when I started investing (e.g. holding REITs in a taxable account) because I didn’t know any better/had not yet read enough.

That’s one argument I have for why Roboadvisors are awesome. We think investing is simple, but for 99% of the population, it’s not simple at all. Going with a roboadvisor early on is just an easy way to get started without having to worry if you’re doing it right or not.

“I turned 30 years old….I think I have to become a responsible adult now or something.”

HA! I’m in my 30s I still have the sense of a humour of 10 year old. So no you don’t need to be a responsible adult. I plan to never be one…don’t fall for it, it’s a trick! 😛

Good job on the net worth increase from Oct! Very impressive. Once you get going, your wealth snowballs and it really does get easier over time.

Thanks! I’m definitely just continuing to build wealth as much as I can and hoping I can reach your level one day! I’ll be able to do a ton of damage once we’re a two income household as well. We’re thinking that once we’re married and both working, we’ll just bank my entire paycheck and live off half of her income. Good way to avoid lifestyle inflation if we can pull that off.

And I’ll definitely stay forever young!

Welcome to your 30s FP! It’s a weird feeling when you’re officially no longer a kid. You’re off to a good start. I too am amazed at the change in my net worth during the 4th quarter of last year. Thank you crazy November stock market!

I utilized Loyal3 and also Robinhood last year. At one point I was planning on building a dividend portfolio and was using these to platforms to do it. I like dividends for the passive income they provide but it’s not an efficient investment in an after-tax portfolio when you don’t need the income. I still have a small amount in there, and use it occassionally to buy individual stocks when I see a good deal or stock up on more Berkshire. But for the most part I invest in ETFs and mutual funds. I just don’t want to dedicate the time to researching individual stocks to buy.

I’ve used both Loyal3 and Robinhood as well. Both apps make it so easy to buy individual stocks, but that might not necessarily be a good thing for some people. That was my problem with the individual stocks – having to spend time researching what to buy. The volatility is also just too much for me. If I ever have a ton of money, maybe I’ll try out dividend stock investing as a form of retirement income.

Welcome to your 30s! It’s so much better than your 20s. I think you’re going to have a pretty good time.

Have you written before about the tax consequences of AirBnb? Do you get to deduct rent against the income to keep it sheltered?

It’s a good question about the Airbnb income, and to be honest, I have absolutely no idea. I’ve done some preliminary research, but not near enough to really know how to handle it. My future cousin-in-law (is that a thing?) is an accountant, and I’m hoping she can crack an egg of knowledge on me about how to deduct as much of that Airbnb income as possible. I’ll definitely report back if/when I learn more.

Nice work, Panther! I used to keep individual stocks, but got tired of tracking them and stressing about my decisions as well. Now I use the Vanguard Total Stock Market index fund for my hassle free investments. I think the ETF version doesn’t even have a minimum investment.

Happy belated birthday! You might end up enjoying your thirties more than your twenties, I am 😉

That’s exactly why I got rid of the individual stocks. Even with play money, it didn’t seem very fun to me. Honestly, I just prefer index funds because I don’t have to think about them at all. And yep, I’m definitely looking forward to my 30s.

First of all, happy (belated) birthday, and welcome to the “how the heck am I not in my twenties anymore and what does it actually mean, do I have to start adulting and stuff now?”-club. I’ve been a member for a year and a half now, and this is where all the fun ends. Nah, just joking, I haven’t noticed much change at all. Age is just a number, really!

It looks like you’re making great progress with building your wealth. You’re already so much better off than many, and have set yourself up with a pretty decent security net already. I know your goals are higher than that, but don’t forget to enjoy the feeling!

It’s a good reminder! I sometimes get bummed out because a lot of people in the personal finance community are so far ahead, but gotta remind myself to take a step back and remember that I’m still doing alright.

Great job on growing the net worth, FP! You’ve made awesome progress in a very short amount of time. Looking forward to learning more about that 5% rate on savings…

Thanks Amanda! I’m still surprised at how fast the savings can grow when you don’t have a ton of bills.

That is excellent progress in four years: paying off massive debt and then saving almost into the six figures!! Impressive.

I’m also curious where you found the 5% interest rate for your savings!

I get the 5% savings account through a company called Netspend. It’s a prepaid debit card that gives you access to a 5% interest savings account. But, don’t open one up without doing a bunch of research on it first. I plan to do a post in the future where I walk through the process and how it works. The good thing is that once they’re set up, you don’t have to do anything again. The entire thing runs itself.

Love the net worth updates. I plan on doing the same very soon. Keeps me accountable! One question. Where on earth did you find a FDIC insured savings account with 5% interest!?!? That’ amazing.

I totally need to write a post about the 5% accounts. I learned about them originally from the churning subreddit on Reddit. It’s basically a prepaid debit card that comes with a 5% interest account. You just need to open these accounts up, then put the cards away and never use them. (the company is called Netspend). BUT, whatever you do, don’t just open it up. You need to do some research first because if you don’t do it right, you’ll get hit with exorbitant fees. It takes some front end work to set up, but once that’s done, you basically don’t have to do anything again. Keep an eye out for my tutorial about these accounts in a future post. I just haven’t gotten around to writing about it.

Very very interesting! 5%! Please do that post. I haven’t seen an account like that since my high school days.

Great to see you are making progress toward you goals. I think I’ll be doing something similar in the future.

Thanks! I know, I need to write about 5% account. It’s sort of a secret thing that I learned from the credit card churning community. They are all up on this kind of stuff.