*Unfortunately, Qapital, like many other Fintech apps, has switched to a monthly fee model that ranges from $3 to $12 per month. I’m leaving this post as is, but because of this change, I can no longer recommend Qapital.

My goal here at the Financial Panther is to help you improve your financial life, and one easy way to do this is by taking advantage of all the new FinTech apps out there. The only problem with the world of FinTech is that there are a ton of apps. It’s sometimes hard to figure out what’s useful and what isn’t. Luckily for you, I happen to be a pretty big FinTech geek and I go through dozens of apps every year. Why wade through all the apps when I can do it for you?

About a year and a half ago, I found an amazing app called Qapital. If you’re the type of person who likes apps that help you save your spare change, then this is the app for you.

To be sure, the Qapital app isn’t the only app that can help you save your spare change. There are definitely other apps out there that have this feature. But the reason I find Qapital superior to those other apps is because it’s 100% free. There’s no cost to set up an account, no monthly fees, and no transaction costs. It’s the only round-up app I know that is totally free.

Saving isn’t easy. The key to making it easier is to take away the friction that comes with it. And automating your savings is the one fool proof way to remove all of this friction. But, while saving something is always good, I also think it’s good to push yourself just a little bit more. It’s easy to fall into paycheck complacency, where you start thinking that you need all of the money that you bring in when in reality, you probably don’t.

Qapital is one of the apps I use to help me push myself to save just a little bit more.

What Is Qapital?

Qapital is a savings app that helps you automate your savings towards your specific goals. I like to think of it as a technology company built on top of a savings account. When you put money into your Qapital account, it gets divided up into separate buckets. You can create a bucket for your spare change and create another bucket for yearly bills you know you have to pay. Or create buckets for whatever goals you have. And the great thing about the Qapital app is that any money you put into your Qapital account is FDIC insured. You can rest easy knowing your money is safe.

Here’s a video from Qapital if you want a quick explanation of how the Qapital App works:

What makes Qapital a really awesome app is how easy it makes it to automate your savings. All you have to do is open up the Qapital app on your phone, set up a new goal with a few taps of your finger, and then set up whatever automated savings rule you want for that goal. It literally takes less then a minute to set up a savings goal.

For example, let’s say you want to use the Qapital app to save for an insurance bill which you know comes due every year. You can use Qapital to save for this bill just like any other savings account. Set up a goal and label it “insurance bill.” Then, tell Qapital to save a certain amount every month. By the time your bill comes due, you’ve got a chunk of cash earmarked specifically for that purpose.

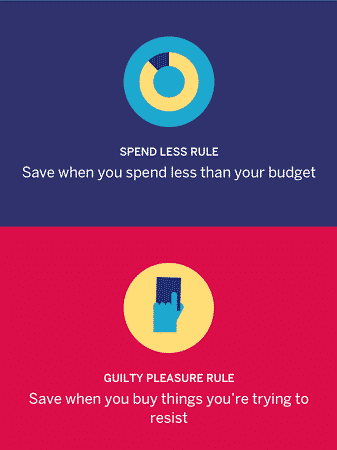

Or, if you want to get fancy, you can have Qapital save money for you based on certain, more advanced rules. For example, take a look at the “spend less” rule. If you pick this rule, Qapital will monitor your budget in certain categories that you pick, and if you come in under budget in that category, Qapital will save the excess for you into your Qapital account. That’s a pretty good way to make sure you’re not wasting that surplus!

The guilty pleasure rule is another interesting rule. If you find yourself buying Starbucks too often, set the guilty pleasure rule to charge yourself an extra $5 every time you buy a coffee from Starbucks. Throw that extra money into a fund to remind yourself how much money you’ve spent on coffee. It’s an easy way to motivate yourself into changing your behaviors for the better.

There are a ton of other rules that you can create too. The app can connect to IFTTT, so you can literally set up any rule you want. It’s totally customizable! Explore the app and see what rules work for you.

The Best Thing About The Qapital App – A Free Round-Up Feature!

The absolute best feature of Qapital – and the one I use the most – is the round-up rule. If you activate this rule, Qapital will monitor all of your credit card transactions and round up each transaction to the nearest dollar.

So for example, say you buy a soda for $1.25. Qapital will round up the transaction to $2. Then, Qapital withdraws the remaining 75 cents from your bank account. It’s basically the digital equivalent of the spare change jar that we all used to keep in our bedrooms.

This type of micro-saving won’t make you rich by any means. But it’s a great way to put some of your money to good use. You’ll be surpised at how much spare change you can accumulate over the course of a year. And you won’t even notice it getting saved away.

And Did I Mention That The Qapital App Is 100% free?

Seriously, totally free. There are a lot of apps out there that can round-up your transactions and help you save your spare change. But all of these apps have monthly fees or transaction costs that eat into your savings. When you’re just saving small amounts like this, you can’t afford to pay fees in order to have a technology company help you save your own money. Why pay to get this feature when the Qapital app can give it to you totally free.

If you’re curious, take a look at Qapital’s fee schedule. You’ll notice a lot of zeroes there! That’s definitely something I like to see when it comes to banking fees.

How I Use The Qapital App To Save Spare Change.

I try to keep things simple, so I only have two rules activated in my Qapital account – the “round-up” rule and the “set it and forget it” rule.

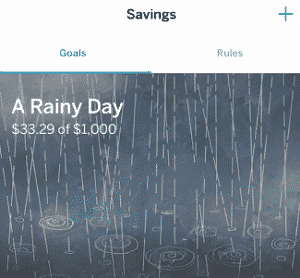

With the round-up rule, Qapital rounds up every transaction I make and saves away the spare change for me. Below is a screenshot of my spare change bucket, which I’ve labeled “A Rainy Day.” I also picked that nice picture of raindrops to go with the goal.

Every time I make a transaction, Qapital rounds up my transaction to the nearest dollar and throws the spare change into this fund. I’ll note that my account earns barely any interest. As a result, every couple of months, I withdraw all of my spare change and throw it into an emergency fund that I keep in a high yield savings account. The great thing is that I bolster up my emergency fund using my spare change, and I don’t even realize I’m doing it.

I also have a number of rules I set up for some of my services where I have to pay a yearly subscription. For example, my Amazon prime subscription comes with a yearly fee. I set up a goal labeled Amazon prime subscription and every month, I move $8.25 into that account. By the time my Amazon prime subscription is due, I’ve already got that money set aside, ready to roll.

If you’re thinking of longer term savings, such as saving for a house or a car, I’d probably recommend using a high yield savings account at a place like Ally or Capital One 360. That’s what I personally do. You might as well get your 1% of interest.

But if you’re looking for an app that can help you save your spare change or an app that makes it really easy to save for short term goals, then I think Qapital is the perfect solution.

Related: For your emergency fund, I recommend putting it into a 5% interest savings account with Netspend and Insight. Click here to read my step-by-step guide on how to get 5% interest on your emergency fund.

Conclusion

Qapital is an app that I really like a lot. I’m always surprised that it doesn’t get mentioned as much as some of the other big apps. In my opinion, it doesn’t make much sense to pay money in order to save your spare change. The fees will just eat up any returns that your spare change could earn anyway.

That’s why Qapital is so great. It’s the only app I know that is completely free and allows you to round up your transactions. Plus, you can use it to save for any other short term goals you might have. I wouldn’t use it as my primary savings account simply because it’s not earning any interest, but when you’re saving small amounts, the amount of interest doesn’t really matter. What matters is that you’re saving at all.

It takes 10 minutes or less to set up an account, and I highly recommend you try it out. If this review was helpful to you, download the Qapital app using this link and we both get 5 bucks!

Yeah, you won’t get rich off that five bucks. But start using Qapital as a digital spare change jar and you might be surprised at how much more you save each year without even realizing it.

Related: Check out my other FinTech reviews as well. I previously reviewed a great bill pay app called Prism, that I also highly recommend.

STAY AWAY from this company. They are like an underworld organization — once you sign up you will NEVER be able to cancel. I have been trying to cancel my account for weeks and it is impossible. They will not cancel my account until I have a zero balance, but thdespite my turning off all transactions and complaining to my bank they continue to debit my checking account ! So they’ve set up a catch-22 where it is impossible to cancel. You will NEVER be able to connect with a human being ever. SAVE YOUR SANITY! SAVE YOUR MONEY! STAY AWAY.

I second Amanda’s comment. I love the guilty pleasure rule. It’s like a virtual rubber band snap on the wrist, except it costs more. Good to know there’s another cool app out there, and it’s totally free! Thanks for sharing.

It’s an awesome app to pull some extra money out of your bank accounts. And fact that it’s free is what makes it so good. I really think Qapital is super underrated!

Qapital sounds like a great app! I really like the spend less and guilty pleasure rule – this would be really handy for people who are trying to reign in their spending. It seems like you could customize in whatever works best for you. Thanks for the review!

Glad you enjoyed it Amanda. If you like these apps that help you save your spare change (like Acorns), then give Qapital a shot. You get the same functionality as Acorns basically, except it’s done for you completely for free.

I’ve seen a lot of these types of apps lately. Thanks for the review. I like to think I’m a FinTech geek but you’ve definitely got my beat.

Do you think these apps, and apps like this, would be useful to somebody who budgets? It seems like the premise for the apps is that you use your checking account balance as your “available money”. So, if you are looking at your checking account when deciding whether you have enough money to make a purchase, something like this would make a lot of sense. But if you’re already following a budget, it seems like this would mess things up. What do you think?

That’s a good question. If you’re someone who literally budgets every single cent of your income, then of course, using an app like Qapital or Digit (a subject of a future post hopefully) won’t help you.

But the thing is, what percentage of the population really budgets every single cent they bring in? My guess is that, even among the personal finance community, it has to be a really tiny number.

Most people who are good with money save a certain percentage right off the top, and then also spend less than they earn. For these people, they’ll have a surplus at the end of each month and most likely, will end up with some money sitting idle without realizing it. It’s those people where having some extra savings pulled out every once in a while is helpful.

And for people who don’t budget and spend a lot, having an app that makes you think you have less money in your checking account is a great solution.

I don’t doubt that you’re right. I just can’t imagine looking at my checking account to decide if I have enough money for X purchase. But I’m pretty sure that’s how most people do it.

Interesting. I recall seeing a few of these apps out there. I guess this takes advantage of helping you save without you actively being aware, and makes it more palatable. They are basically holding onto your money and accruing the interest differential on the money that they hold.

I’m guessing that for most people, the amount taken out is relatively small so that the interest that you ‘lose’ from having Qapital store your money isn’t going to break the bank, as you mentioned.

Cheers!

Exactly. When you’re doing microsaving like this, the interest is negligible. If you save 1000 bucks per year and earn 1% in a savings account on it, that’s 10 bucks a year. That’s nothing I’m going to lose sleep over. And if I can put some extra savings away without even realizing it, then that’s a perfectly fine trade off for me.

In any event, if you want to get more interest, all you have to do is transfer money out of Qapital every few months as you notice the balance starting to increase. When I see my spare change get up over 100 bucks or so, I just transfer it out to my emergency fund that earns a bit more interest.

I happened upon you site and have read several of your articles. Thank you. Love them.

I just read this one and see that you are no longer recommending Qapital. Is there another “round-up” app that you do recommend? I’m desperate to start saving! 🙂 I

I’ve had trouble finding a good round-up app. One app that I have been testing, but haven’t gone to full-out endorsing yet, is an app called Astra Finance. It’s not as good as Qapital was, but it has potential. I’ve had some bugs with it, so it’s not perfect, but might want to consider checking it out.