My wife and I are currently in the market for a new house. We have plenty of money saved, have a high household income, and after a decade of living well below our means, we think we’re ready to start inflating our lifestyle a bit more (or a lot more if we’re being real). I’m not talking about buying Teslas or a boat or anything crazy like that. But getting a nice house for our family – that’s something we’d like to have at this point in our life.

Of course, I’m nervous about making such a big change to our lifestyle. We only pay $882 per month for our mortgage right now, which is laughably low when you think about what most people pay for housing and what our household income is. Our biggest monthly expense at the moment is our son’s daycare, which while expensive, doesn’t hurt our bank account very much considering how low our other expenses are. With such low fixed expenses, I’ve always felt like I’m in a position where I can do anything I want.

The type of houses we’re looking at, however, will likely triple or quadruple our monthly housing costs. And when you include the higher maintenance costs and property taxes that we’ll end up paying, it means a massive increase in our fixed yearly expenses.

This is lifestyle inflation – all of us, no matter who are, tend to spend more money as we make more money. You might inflate your lifestyle more or less than others, but it will inevitably happen.

There’s one thing I’ve noticed though. As you save money, at some point, you can reach a level where your money, by itself, will continue to grow to absurd amounts – even if you don’t save another penny ever again. This is commonly referred to as Coast FIRE. It’s a turning point in our financial lives. And when you get to that point, things get much easier.

The Math Behind Coast FIRE

I’ve written about what Coast FIRE is in another post, but the short of it is that Coast FIRE is a point in your savings lifetime where the amount of money you’ve saved will grow into enough money to support your lifestyle at traditional retirement age, even in the unlikely event that you never save any money ever again. You can think of it as a tipping point in your saving and investing journey.

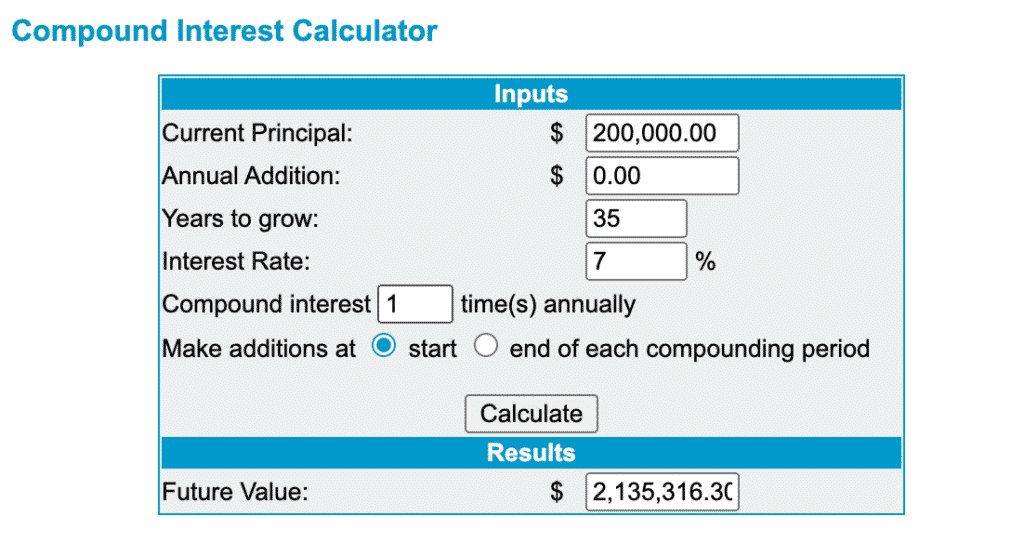

For example, if you’ve managed to save $200,000 by the time you’re 30 years old, you put yourself in a wonderful position. Even if you never save another dollar for the rest of your life, by the time you’re 65 years old, that $200,000 will likely grow to over $2 million. And every $100,000 more you have saved by the time you’re 30 essentially increases what you’ll have by $1 million.

Three things make Coast FIRE work:

- Time

- Compound Interest

- A Large Amount of Money Already Saved

Time is fairly self-explanatory. The more time you have, the longer you have for the money you’ve saved to continue to grow. This is why it’s so important to save as much as you can early in your investing lifetime.

Compound interest works by taking advantage of time. In the early days, compound interest doesn’t do much. But as more time passes, your money continues to grow and get larger. And the bigger your nest egg is, the more impact compound interest has. By the time you get into the later stages of your life, your money will grow in huge amounts simply because of how much money you already have.

This brings us to the final thing you need – a large amount of money already saved. If you can save enough money early in your life, it’s almost inevitable that you’ll have a large sum of money in the future. That’s of course easier said than done. Getting to several hundred thousand dollars by the time you’re in your early 30s isn’t easy. You need a good income. And you need low expenses. Both of these things are often difficult to find in those early days of your career. But if you can figure this part out, don’t waste it – it’s all too common to see people with high incomes walk into their 30s with nothing.

Coast FIRE Allows You To Take Chances

As much as I like to think I know what my yearly expenses will be for the rest of my life, the truth is, I really don’t know. Life is way too complicated for someone as young as I am to know what my yearly expenses will be a few years from now, let alone decades from now.

Because the future is so unknown, it’s really important to have backup plans in place. That’s why I keep a sizeable emergency fund and recommend everyone do the same. And when I quit my job to write and side hustle full-time, I wrote down several backup plans for myself just in case I realized I couldn’t make this self-employment thing work.

In a way, Coast FIRE is the backup plan of all backup plans. It puts you in a position where you still have to earn income, but you also put yourself in a position where you can save less if you need to. If you reduce your savings one year or miss out on saving completely for whatever reason, it won’t ruin you.

Importantly, Coast FIRE puts you in a position where you can take chances with the things you choose to do with your life. I made the move to self-employment specifically because I’d set aside enough money that I felt comfortable with my future, even if I didn’t save very much money for an extended period of time. Buying a much more expensive house is also made more comforting by the fact that I’ve already saved a lot of money – enough that I’ll likely have millions when I’m in my 60s, even if I never save another dime again.

Hitting that magic Coast FIRE number allows you to take chances. It can even allow you to inflate your lifestyle with a bit more confidence. When you have a backup plan like Coast FIRE in place, life becomes much easier.

Lifestyle Inflation Will Happen – Try To Hit Coast FIRE First

There’s no doubt about it – lifestyle inflation is going to happen. I think one thing my wife and I did right was to try to delay it for as long as we could. For our 20s and early 30s, we lived fairly lean. It allowed us to amass a big chunk of savings.

This is advice I would recommend to anyone. Take the early years of your working life and do your best to save as much as you can. Live lean during this time and try to get as much money saved and invested early in your investing life. If you can get $100,000 or more saved by the time you’re in your early 30s, it’ll give you so much more flexibility to try things.

We haven’t found a house yet. The market here is so crazy that I’m starting to second guess whether we’ll ever find a house that’s right for us and that we can actually buy without having to overbid like crazy. But eventually, we will find a house and it will dramatically increase our lifestyle. And even if our housing costs go way up, we’re still in a position where no matter what happens, we’ll likely have enough to support whatever our lifestyle may be in the far-off future.

*Mortgages are an interesting thing to think about too when it comes to how you think about Coast FIRE. By its very definition, if you inflate your lifestyle, you’re no longer going to be at Coast FIRE. But if you have 30 or more years left until traditional retirement age, increasing your housing expenses now might not impact your Coast FIRE number at all. That’s because, in 30 years, you’ll pay off your mortgage. By the time you hit traditional retirement age, you’ll remove the largest monthly expense from your budget – and you’ll be right back at what you hope to spend.

Soooo true. We’re at the same point, although in our case it’s not a house but a job opportunity for my husband… that will likely require me to quit my job and take a huge pay cut with anything new. We’re going to be in an amazing place with tons of opportunities for fun and travel, but our savings rate is going to plummet. It would be extremely stressful if we didn’t already have a hefty pile of investments. Instead, it’s going to be weird not saving as much, but otherwise totally fine. We’ll still be on track for early retirement, so it’s exciting! Coast FIRE opens up lots of opportunities and gives a lot more freedom for sure. And good luck with your house search! You’ll find the right one when you’re supposed to.

Awesome to hear, good luck in your search! Any plans to have an Airbnb at the new home (basement/separate entrance type situation?) I know your room Airbnb was quite profitable, we have a basement Airbnb that has been great, but I’m sure it is different with a new young roommate in your home!

So we’ve been looking at houses with walk-out basements. It would be nice, but not a must. One thing I may do is that wherever we move, I may try to remodel a basement for Airbnb. I figure that could be one way to increase home value and potentially do it for free by getting it back from Airbnb income.

I think I first learned the idea of Coast FIRE by reading mymoneywizard’s blog. The idea where you can save nothing by the age of 25 if you just save $100,000 by 25 and let it ride to the millions by 65. Just keep earning and spend 100% of your earnings, and even then you’ll be well set.

I can’t believe I only learned the different sides of FIRE until recently. Have to stay on top of my game by reading more personal finance blogs like yours.

There’s a lot of comfort in knowing that you’re going to be better off than most even in the unlikely even you never save money again. Here’s one thing though – someone who can hit the Coast FIRE point young is not the type of person who’s just going to never save again

You do a great job of explaining Coast Fire and showing how saving as much as possible in your 20s makes a difference. I’m wondering though how many people are able to achieve this savings level given that student loan debt for undergrad is often in excess of $100k. How are you factoring student loan debt into the equation?

Wishing you happy and prosperous househunting!

I had about $80k in student loans when I graduated with my Econ Major. I made around $55-65k since I graduated and paid all of it off and also have about $116k in my retirement funds right now at 29 years old. I lived very frugally, but was still able to hang out with friends, travel hack, so on. I saved money with roommates. I biked to work and packed lunches. My recommendation to live like a college student until you hit coast fire. Then start to inflate your lifestyle. Hoping to hit coast fire by 32.

It’s true – I’m not going to sugar coat it and say that the number of people that can pull of something like this is high. It’s not easy and you do have to come from a position of privilege to pull this off.

For myself, I came out of law school with $87k of student loans. Got my first real job at 27 years old. Paid off the loans, then started piling up cash as fast as I could through a combination of a high income and low expenses.

panther, are you planning to do networth update post? its been while lol

You know, I wasn’t planning on it. I guess I could but now that I’m married, I kind of like to keep my overall net worth stuff to myself just because it’s no longer just me.

Yeah the housing markets are pretty out of control right now. I’m not sure if it is a good time to buy (because of interest rates) or if it’s better to wait for more inventory to open up and turn into more of a buyers market. But we ran into the same issue trying to secure a rental property. The math just didn’t work.

Agree on inflation @steveark. Gotta factor that in!

Yeah, the housing market is nuts right now. The way I think about housing is that it’s a consumption item. I have enough saved that I can afford a nice house – so it’s really a consumer choice I’m making, rather than any sort of investment.

The only danger I see in the coast fire concept is that people do not always factor in inflation in their target. $200,000 growing to $2 million is impressive but the fact that the $2 million will probably only have the buying power of about $700,000 of today’s dollars. I know you factor in everything because you are extremely detailed and accurate but I think some people think that as long as future investments can generate their current cost of living they’ll be fine in thirty years, and that isn’t necessarily the case. Of course most people will also save more and more money as their incomes go up so you could argue it all balances out.

So the inflation thing is something that I’ve seen conflicting information about. Some people seem to use the 7% number as including inflation in it. Others don’t. If you want to be safe, using an average rate of return of 4-5% would take into account inflation and give you a more accurate number.

wow – what a co-incidence. We are looking as well – but disappointed at how little value for money we are seeing. We’ll probably wait and see how the housing market plays. Are you paying 20% down? We put down 25% the first time we bought, and in hindsight, we could’ve probably gone a lot lower, and invested instead. Even with the PMI.

The plan would be to put 20% down unless we’re close enough to conventional loan territory – in that case we’d throw down more to make things easier.

Agree – the housing market is just so crazy right now. I’m starting to resign myself to just keep an eye out on houses, but not get too beat up when we inevitably lose in a bidding war.