One of the things you have to figure out whenever you start a new job is what retirement plan options your new employer offers.

If you’re lucky, you’ll be in a job that has a good retirement plan that doesn’t take too much work to set up. That’s the situation I was in when I got my first job out of law school (way back before I knew anything about personal finance or investing).

Since it was a big firm, my 401k had good, low-cost, index funds that you could be happy investing in. If you did absolutely nothing, the firm automatically enrolled you in the 401k plan at a 5% contribution rate and defaulted your contributions to a Vanguard Balanced Fund – basically a 50% stock, 50% bond fund with low expense ratios. It wasn’t the optimal asset allocation for a 20-something, but at least it was something. And most importantly, people like me who knew nothing about investing weren’t getting scammed by our 401k provider. The costs for investing were low and the investments were sound.

My recent switch into a non-traditional legal career with a small, non-profit employer reminded me of just how vigilant we all need to be when it comes to our retirement savings. Not all retirement plans are created equal. Most of the time, there’s no one to help you. And some of the time, if you’re not careful, you might very well get scammed. That’s why it pays to learn about this stuff.

The World Of Non-Profit Retirement Plans

As I wrote about last month, I recently pivoted in my legal career, moving out of the traditional practice of law and into a non-traditional legal role with a branch of my state bar association. This non-traditional legal role is with a small organization – only 30 employees or so – and importantly, it’s a non-profit organization.

I never knew it before, but apparently, the non-profit world is riddled with employers offering bad retirement plan options. The New York Times recently wrote a five-part series about this issue that I think is worth reading. Basically, non-profit employers often don’t have the size or institutional knowledge to make sure that their employees get good retirement plan options. Many times, non-profit employers get stuck with high fee, crappy retirement plans. 403(b) plans – which are what most non-profit organizations offer – are also apparently less regulated compared to traditional 401(k) plans in the for-profit sector. As explained by the New York Times, its a significant cost for people:

In fact, millions of people who save in 403(b) plans may be losing nearly $10 billion each year in excessive investment fees

When you think about it, it makes sense that small, non-profit organizations would end up with bad retirement plans. The employers I worked at in biglaw or state government were giant organizations with large assets and dedicated employees who could scrutinize retirement plans and make sure that employees weren’t getting screwed by whatever retirement company they used.

In contrast, a small organization – like my current employer – doesn’t have dedicated employees to handle that kind of stuff. Instead, these small employers are pretty much in the same position as most people – they don’t really know anything and trust that whoever is handling their money for them is doing it right. But as we all know, when money is on the line, not everyone will have your best interests at heart.

Signing Up For My New Retirement Plan

The process of signing up for my 403(b) plan was unlike anything I’d encountered in biglaw or state government. In both of those places, I didn’t have to do anything really – I was just automatically enrolled in the plan and all I needed to do was go online, set up a username and password, and then pick how much I wanted to invest and what funds I wanted to invest in. My choices were clear and limited, and I didn’t have to really talk to anyone.

Here, in order to signup for my organization’s 403(b), I had to actively go and do it myself. I first talked to our HR person, who basically handles all of the administrative stuff in the office. She told me to get in touch with some outside financial advisor guy who administered the organization’s 403(b) plan. I looked him up on LinkedIn and saw that he was a financial advisor for an independent financial advisory firm in the suburbs.

When I contacted him, he sent me a basic form to fill out that analyzed my risk tolerance. Naturally, my risk tolerance ended up being very aggressive, which made sense given my age and expected investment time horizon.

The confusing thing to me was how little information there was out there. Because my 403(b) was administered by this small financial firm, there didn’t seem to be any way for me to just look at every investment option I had. My last retirement plans were administered by Fidelity or by the state retirement system, and in both of those jobs, I could just go to a website and see exactly what options were offered in my plan. In this case, it felt like I was buying insurance from an insurance salesman.

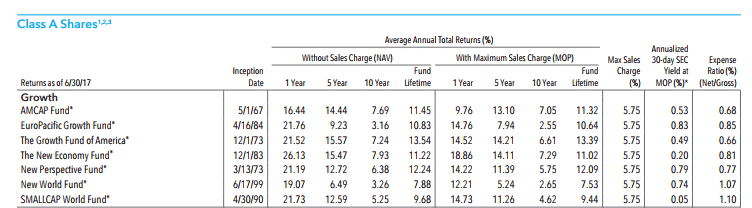

After reviewing my risk tolerance profile, the financial advisor guy sent me what he thought would be good options for me to invest in. Take a look at a partial list of what he sent me:

My jaw dropped when I saw these options. The funds carried a front-load of over 5% plus expense ratios near 1% (there were even more expensive options he showed me that I couldn’t fit in this screenshot). And worse yet, all of these were actively managed funds – which study after study has shown doesn’t lead to higher returns. This was pretty much unacceptable to me and there was no way I was putting my retirement savings in these funds if these were my only choices.

Searching For Better Investment Options

After reviewing these options, I immediately scheduled a call with the financial guy to find out what the deal was with this 403(b) plan. My concerns were pretty straightforward – these fees were way too high and none of these funds interested me. All I wanted were passive, low-cost index funds.

“Oh, do you have investment experience?” he asked me.

“A little,” was my response.

He then went on a little spiel about how actively managed funds did better during downturns and that the market was looking a little “frothy.” Whatever.

When I asked him about the possibility of any Vanguard options, he basically gave me a run-around, telling me something about how Vanguard was too expensive for him to offer. I really didn’t understand it, but I guess it was clear, there were no Vanguard options in my 403(b) plan. He didn’t seem to be able to send me a list of all of the available fund options I had either.

After a little more discussion, I went straight to the point. I wasn’t interested in any actively managed fund and all I wanted was for him to send me whatever his lowest cost, passively managed index fund was. A few hours later, he came back with what he thought was a solution for me – a group of iShares funds from Blackrock. He assured me that it was the only fund he was aware of that had extensive index fund options with no upfront fees.

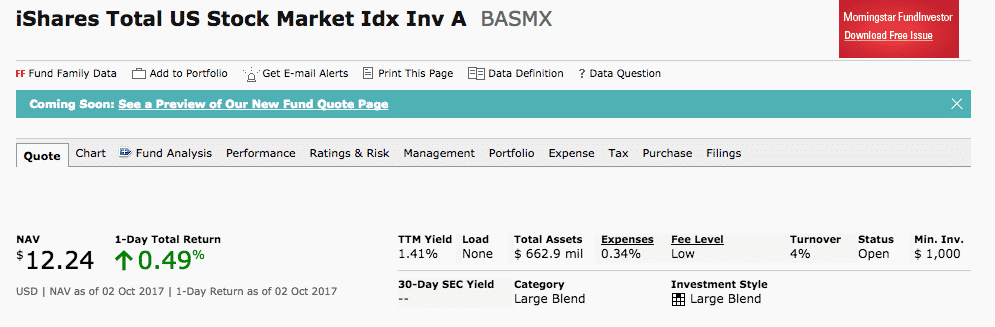

I looked up the Total Stock Market Fund that he sent me on Morningstar, ticker symbol BASMX:

Not amazing, but manageable. At a 0.34% expense ratio, it’s still nearly 10 times more expensive than the same Vanguard Total Stock Market Fund, but I won’t lose sleep over this. It’s at least doable. And as long as the other fees he told me are true (he said the only other fee was a $50 annual administrative fee), the 403(b) won’t kill me with fees.

So, was this guy trying to rip me off? I honestly have no idea. Maybe he got something from steering me towards those ridiculously expensive, actively managed funds. Or maybe he just seriously thought those were better options for me. I do know that the 403(b) agreement made it clear that he has no fiduciary duty to me.

One thing that I do think about is that, if I’ve spent hours of my life learning about this stuff, what happened to all of my coworkers who probably know nothing about investing? Are they all invested in these high-cost, actively managed funds? My guess is probably yes.

Make Sure To Analyze Your Retirement Plan

Depending on your employer, you’re going to have plans with varying levels of quality. The bigger your employer is, the more likely you’ll probably have a better retirement plan. If you’re employed by a small employer, make sure to pay careful attention to your plan and question what you see. You don’t want to get scammed.

It helps that I’ve learned enough about this stuff to know what to look for. If you’re new to investing, make sure to carefully examine the expense ratio of funds that you’re investing in. I’d say anything with an expense ratio of over 0.5% is pretty high. If it’s near 1%, it’s way too high.

Another piece of advice is to find out what your retirement plan costs in terms of administrative fees. It wouldn’t surprise me to see plans that charge some ridiculous percentage of assets under management on top of the expense ratio of the funds.

If you’re in a situation where you only have crappy funds, you need to figure out a way to get your employer to give you better options. I feel like there’s way too much info out there these days for employers to be getting suckered by these crappy plans.

I’ll be keeping a close watch on my 403(b) plan simply because I don’t really trust anything that this financial guy told me. I have no idea if he’s allowed to deliberately lie to me – I would hope not – but the fact that he initially tried to steer me towards these expensive funds didn’t leave me with a good feeling. I work way too hard for my money to lose it all in fees that I don’t need to pay.

I’d talk to HR and see what can be done as its entirely possible they are unaware of how crappy the options are. Given that this guy’s first reaction was “do you have investment experience,” I’d say its a safe bet no one realizes they are getting screwed. There may be a reason they have this guy/firm and the reason may be as simple, and irrelevant, as “his name was first on a google search.” That said, don’t be surprised if they give you the task to find a new administrator and/or explain to them why this is such a poor plan.

Also, I know a ton of companies and now universities have been sued over the last few years because their 401(k)/403(b) plans were so bad. You would think the bar association, which is filled with lawyers, would be aware of this. Obviously, this isn’t a tact to take but may help move the wheels, or at least get this guy to offer better funds.

My husband got his small company to switch from their crappy expensive plan to fidelity. Vanguard was too expensive for the company (though cheaper for employees). I think the next best option was schwab.

That’s pretty sweet. I’d love if my org would switch over to a real company instead of whatever they’re using.

Way to stay on top of this, FP… I’ve heard from a few podcasts that 403(b)’s have terrible and expensive investment options. Question – with not having a 401(k) through work, can you now save more into your solo 401(k)? I think you may be able to save north of $50k?

So I screwed myself now when it comes to my solo 401k. 401ks and 403bs are all in the same bucket – you can save 18k total between both of them. In contrast, the 401k or 403b contribution limits are counted separately from the 457, which is what I had when I was working in state government (I didn’t have a 401k with my state govt job).

So basically, my “employee” contribution to my solo 401k is going to be less now because any contributions I make to my 403b count towards my yearly contribution limit.

What I’ll probably do is try to figure out what my 1099 income will be each year and aim to fill up as much of my 401k/403b space as I can with my side hustle earnings, since my Solo 401k plan that I have with Fidelity is really good (total stock market fund, expense ratio of 9 basis points, and no admin fees either).

It’s just sad, man. Wall Street makes BILLIONS by fleecing everyday Americans with administrative fees that otherwise would compound into a more substantial retirement fund. Good job doing your homework, FP. It’s unfortunate you have to have essentially a PhD in investing to avoid getting ripped off.

It’s nuts. I really wonder how many of my coworkers are invested in these expensive, actively managed funds.