One thing that I absolutely HATE is when someone tells me that paying off debt is easy if you’re making a good salary. Maybe I take it too personally, but it feels like a knock on my accomplishment. After all, I paid off $87,000 worth of student loans, but I also had a good salary that allowed me to do it. Was it easier to do than if I had been making less? Of course. But it definitely wasn’t easy.

A recent headline I saw reminded me that a lot of people think paying off debt is just a walk in the park so long as you make a high enough income. Take a look:

I love reading stories about people who crushed their student loans quickly! But that first sentence made me cringe. Paying off debt is easy if you’re making $90,000 a year? I’m sorry, but that’s total crap. Paying off debt is never easy! I don’t care who you are, if you’re paying off debt quickly, you’re working your butt off to do it.

Sure, it’s easier to pay off debt if you’re making more money. It’s actually pretty much a requirement. You HAVE to make more money than you spend if you want to pay off your debt. I don’t care who you’re talking to, anyone who paid off their debt quickly did so by making much more money than they spent.

But paying off debt isn’t automatic. You won’t stumble into it by accident. It takes work. And if you’re not actively trying to pay off your debt, it’ll never happen.

Was It “Easy” For Me To Pay Off My Debt?

I’ll save you some reading. No, it wasn’t!

But I can see how it might have looked easy to someone looking in from the outside. My first job out of law school paid me a gross salary of $110,000 per year (the market rate for a big law attorney in Minneapolis at the time). Seems like you could pay off your debt in your sleep with that kind of money.

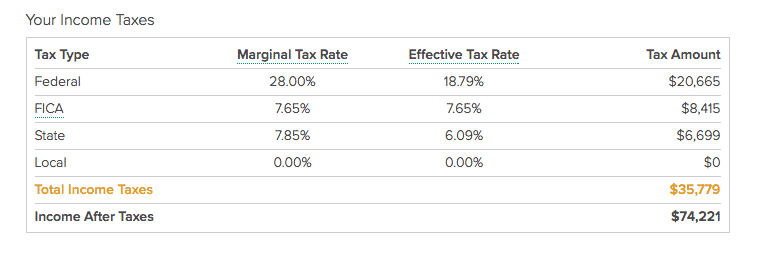

The thing is, even with that type of money, $87,000 in student loans didn’t just disappear without me doing something about it. Let’s take a look at what a $110,000 income looks like after taxes:

Is $30,000 per year to spend slumming it? Of course not. It’s still a ton of money for anyone. But I guarantee that there are a lot of people out there who spend more than that every year without even thinking twice about it. I’m sure that most lawyers in your typical big law firm spend more than that every year.

If I had just done nothing and lived like a normal lawyer, I wouldn’t be in this position today. But I didn’t do that. Instead, I did my best to live like a student. I didn’t act like I was a big shot lawyer. Paying off my debt took hard work and planning, even if I was making a good income. It didn’t just happen automatically.

Don’t Let Limiting Beliefs Hold You Back

Obviously, I couldn’t have pulled off my student loan success story without my income. But the secret is, NO ONE can do it without an income. The math tells you that if you want to pay off debt quickly, you need to put a ton of money into it. And putting a ton of money into debt requires a pretty decent base income. How else are you supposed to do it?

You can see the implicit belief in anyone who thinks that a student loan payoff is easy if you make a high enough income. It’s a belief that the only thing holding people back from paying off their debt is income.

But income isn’t the only answer. It’s required, for sure. But it means nothing if you aren’t using the income to actually pay off the debt. Go into any big law firm and most attorneys will probably still be sitting on a big pile of debt. Maybe they bought themselves a gigantic house or pay ridiculous rent for a luxury apartment. Whatever they’re doing, they’re living large because their paychecks say they can. If paying off debt were so easy, everyone would do it. But they don’t.

If you sit there and tell yourself you can’t do it, you’re necessarily holding yourself back. Don’t do that to yourself. If a high income is the answer and if you want to pay off your debt, then figure out a way to make more money so you can do that.

One of the first blogs I stumbled upon when I began my student loan payoff journey was the blog No More Harvard Debt. If you don’t know that blog, the guy was basically a finance guy who came out of school with $90,000 in student loans and made it a goal to pay it all back in a year. He ended up pulling the feat off in 7 months. At the time, his annual salary was somewhere around $90,000 per year or so. It’s a pretty extraordinary story that really inspired me on my student loan journey.

But the thing that really disappointed me was the haters. There were a ton of people who dismissed his story simply because he made a good salary and went out of his way to earn more money. To that, I always wonder, what else was he supposed to do? How else was he supposed to pay off his debt besides buckling down, making money, and using that money to pay off his loans? It wasn’t easy for No More Harvard Debt guy to pay his debt off. He hustled his butt off. Instead of saying you can’t do it, why not look at what he’s doing and figure out how to copy him?

Three Steps To Paying Off Debt

In the end, paying off debt can pretty much be boiled down into three steps. None of those steps are easy. They all require work on your end.

1. Earn Enough Money

I don’t care what you’re doing, if you don’t earn enough money, you’ll have a hard time paying off your debt. You need money in order to pay off all the money you borrowed before. There’s really no way around that. If you’ve got $100,000 in student loans and make $50,000 a year, then yeah, it’s going to take you a long time to get rid of your debt. It’s basic math. You’re going to either have to figure out a way to throw more money at the debt or be prepared for the long slog.

If you don’t have any debt yet but are thinking about getting into debt, my advice to you is to really think about it. Don’t take out a ton of debt for a degree that won’t pay you very much money. It doesn’t make sense to take out $100,000 or more in student loans if you’re entering a profession that only makes $50,000 per year. In fact, that kind of debt can cripple you.

A simple rule to follow is this. Keep your student loan debt below whatever you expect your first year salary to be. Ideally, you should take out no more than half of what your first year salary will be. I basically followed this rule and as a result, I was able to get out from under my student loans in a quarter of the time it takes most people to do it.

2. Spend Less Money

Earning enough money is necessary if you want to pay off debt, but it’s not enough. You also have to avoid spending all of it! It doesn’t matter what type of money you make if you’re spending it all.

That’s why paying off debt is hard no matter what income you make. It’s really easy to spend all of your money if you aren’t actively thinking about it. I saw so many lawyers around me fall into that trap. Instead of living like a student, they immediately upgraded to luxury apartments and spent all of their money on stuff they wanted. This necessarily left them with nothing to throw into their debt.

Remember to keep your perspective. There are a lot of people out there who make much less money than most of us. If they can spend less money out of necessity, you can probably do the same.

3. Pay Off The Debt!

Seems obvious, right? Yet this is just something most people don’t do. Instead, people spend their money on things that aren’t their debt.

Just take a look at the luxury apartment boom happening all over the country. This is happening even as student loan debt continues to rise. What this means is that, instead of paying off debt, a lot of people are choosing to pay more in rent. It’s fine, you can make that choice. But it means you’re picking luxury apartment living over your debt. You need to be aware of that choice.

Three steps. That’s all it really takes. But all three of these steps take work on your end. It’s definitely not easy.

Anyone Who Has Paid Off Debt Put In The Work

I don’t care whether you’re making $50,000 per year or six figures per year. Paying off debt is hard for anyone. It’s really easy to spend money. It’s much harder to spend that money paying off debt.

Ultimately, anyone who paid off debt fast did it by making an income that was much higher than their salary. They then took that income and actually used it on debt, instead of spending it on other stuff.

Don’t fall into that trap of thinking that paying off debt is ever easy. It’s not.

If you’re still in the middle of crushing your debt and you’re not trying to take advantage of any loan forgiveness programs, then you should consider refinancing with any of the student loan refinancing companies out there. When I refinanced, I cut my interest rate by more than half, which helped to accelerate my debt payoff.

SoFi is a terrific choice for refinancing your student loans. And the great thing is that once you join SoFi, they let you go to all of their fancy dinners and happy hours they hold every quarter. They even let you go after you’ve paid off all your debt! In the past two years, I’ve probably eaten $1,000 worth of food and drinks through SoFi.

Great tips. if you want to be debt free you must have discipline towards yourself that you need to pay for the debt first before anything else.

Great article! It’s so true … paying off debt requires serious dedication and commitment, regardless of income. It means sacrificing today so you have a better (more financially independent) tomorrow. Thanks for sharing your struggle and progress!

Thanks Ernest!

“Anyone who has paid off debt put in the work”. I love this line. There’s very little instant gratification going on for paying back debt. For most people it’s a process. And it’s a process that requires a plan.

I try not to get disappointed by the haters anymore because when they chime in, that means a nerve was struck.

Ooh, good way to think about it. Maybe I need to start thinking like that!

I loooooove this! One of my biggest pet peeves is the attitude that’s pretty prevalent on PF blogs that “All this stuff is easy and you’re an idiot if you don’t do what I did!” So thank you for acknowledging that this stuff is hard no matter what. Sure, it’s easier with a higher income, but it’s still not easy. And any change is hard, even if you have all the money in the world. Thank you for giving people permission to be human. 🙂

Thanks so much! It definitely isn’t easy! Sure, it might be easier for some people, but it’s never easy! Anyone who did anything financially great had to hustle to do it. Everyone’s got my permission to be human. 🙂

Totally agree! People want to hear how to pay off debt without doing anything different financially. Gravitating towards a high income job (at least in the short term) will help payoff debt.

Right! If you want to pay off debt, you gotta do something different. It it means hustling and making more money, then that’s fine. And if you’re already lucky enough to make enough money, it means actually using that money to pay off debt, which most people don’t do. It’s not easy though, no matter how much you make!

I hear what you’re saying, but at the end of the day it’s definitely “easier” for someone making more money to pay off debt faster. Each additional $10k/year I’ve earned, either through raises/promotions or side hustles has consistently made it easier to pay off debt. It may not ever be “easy”, but each person’s idea of easy is very subjective.

Very true. It’s definitely easier to pay off debt if you’re making more – in fact, it’s pretty much a requirement in my book. No matter what, if you’re not making enough money, it’s basically impossible to pay off debt. I guess my thinking is that it’s never actually easy, no matter how much you make. It’s way easier to spend all of your income than it is to use it on debt. It’s probably why so many high-income earners remain in debt even though many people would think it’s “easy” for them to pay off their debt.

It all comes down to savings rates. Sure having a 6 figure income should theoretically be better for paying off debt faster than someone who only has a 5 figure income (more $$ to work with), but there are plenty of people on 5 figure incomes who figure out how to reign in expenses and have high savings rates, and they’re the ones who will do better in the long run because they’re not giving in to lifestyle inflation.

As long as you can figure out ways to increase that positive “net income/net worth/” difference in the accounting equation (Assets – Liabilities = net worth), it doesn’t really matter how much money you make. And it’s certainly not easy for anyone…even a 50% savings rate means plenty of things are getting sacrificed in the process, regardless of the income bracket.

Very true man! That’s an interesting point about being better financially with less. It’s easy to lose track of your income when you’re making a ton of it.

You know for something that’s “easy” there sure are a lot of higher income people in debt. It’s also a bit of a chicken and the egg arguement. To pay off debt you need income. Getting that income is partially motivated by paying off the debt, or in the case of student loans is the cause of the debt in the first place.

Good point. It’s true that a lot of people who make the big bucks have to do take out a bunch of student loans in order to do it.

You’re right: It’s definitely “easier,” but there are still trade offs that need to be made. A qualm I have with the “paying off debt is easy with a good salary” statement is the built in “the other person’s got it easier than me” mentality that makes it easier to excuse poor financial choices.

Totally right! It does seem like an excuse! You see this all the time with the hater comments. It’s basically people saying they can’t do it, but really, it does feel a lot like an excuse.

Paying off debt is an accomplishment no matter what the size of your debt or your income. Ignore the haters who want to belittle your achievements.

That’s what I try to do! I think any lawyer, doc, dentist, etc gets that type of hate when they talk about paying off their loans. A lot of people basically have a “so what” attitude with those people pulling it off, since we’re all earning a good income anyway.

I’m with you. It’s common sense that isn’t so common. People’s expenses tend to magically match their income if they’re not paying attention, so you have to get focused on it and work hard at it. Nothing easy about it on any income.

Right! It’s really easy to spend money when you have it. No matter what, it takes work. Paying off debt isn’t easy, no matter what anyone thinks.

I totally agree. It might be easier, but not easy. And there are a whole other set of challenges. I often work with high earners in my money mentoring program who have debt and are struggling to pay it off. It’s tough to fight the lifestyle inflation. It’s tough to explain to family and friends why you can’t afford something when you are pulling in 6 figures. It’s tough to make frugal choices when you feel like that $100 is “just” another hour of work. It’s hard to go cheap on holiday gifts when you make $150k a year. Which is why they have stayed stuck, broke and in debt. Plus I think it’s embarrassing because people think it should be “easy” to pay that debt off. No one who makes 100k+ a year wants to admit they are broke.

The lifestyle inflation is crazy hard to fight. I saw it all the time with my coworkers. No one could just live in a regular apartment building. Instead, they all had to live in luxury apartments, even though we were all working all the time and didn’t even go home that much! The thing is, when everyone around you is living that way, you just sort of naturally assume that’s how you’re supposed to live.