If you’re delivering for Uber Eats, you might be wondering if your Uber Eats acceptance rate matters. The short answer is that your Uber Eats acceptance rate does not matter. While Uber Eats doesn’t make it clear in their documentation currently, in the past, they have explicitly made it clear that your acceptance rate doesn’t matter. It is also important to note that on their website, they don’t say a low acceptance rate can lead to deactivation. All they say is “[i]t is important to maintain a high acceptance rate to provide a reliable service to restaurants and customers.”

My own experience bears this out. I’ve been delivering for Uber Eats for over 5 years and have consistently maintained a low acceptance rate. Usually, I accept 25% or less of the delivery requests I receive. My acceptance rate often tips into the single digits even. Despite having such a low acceptance rate, I have never had issues receiving delivery requests and have never been told that my acceptance rate is too low

Indeed, Uber Eats could not require a high acceptance rate because doing so would blur the line of whether Uber Eats drivers are employees or independent contractors. Uber Eats wants their drivers to be classified as independent contractors, which means they can’t exercise too much control over their drivers.

With that being said, in this post, we’ll look at how the Uber Eats acceptance rate works and further explain why it doesn’t matter. We’ll also discuss another issue related to your Uber Eats acceptance rate – canceling orders and how you can do that without hurting your standing on Uber Eats.

Uber Eats Acceptance Rate – What Is It And How It Works

Your Uber Eats acceptance rate is based on the number of Uber Eats delivery requests you receive that you also accept. Every time you receive an Uber Eats delivery request on your phone, you have the choice of either accepting it or rejecting it.

When you reject an order, you lower your acceptance rate. By contrast, when you accept an order, you increase your acceptance rate. For example, if you’ve received 100 delivery requests and rejected 50 of them, your acceptance rate would be 50%.

One thing to note is that if you reject too many orders in a row or let a bunch of orders in a row lapse before you accept or reject them, Uber Eats may automatically log you out of the app. However, you can immediately log back in and keep getting delivery requests, so this is more of an annoyance than an actual issue you have to worry about.

How To Check Your Uber Eats Acceptance Rate

Uber Eats measures three metrics when it comes to your delivery performance:

- Satisfaction Rating

- Acceptance Rate

- Cancellation Rate

You can find these metrics in your Uber Driver app, under the profile section of the app. To find it, click the top left corner of the Driver app (where the three horizontal lines are), then click on your profile picture.

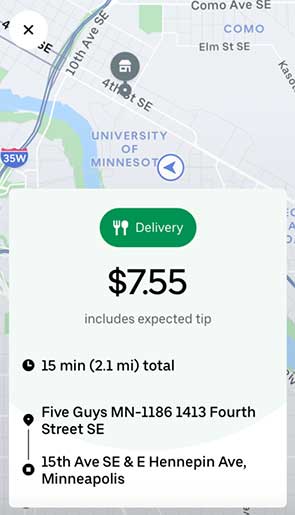

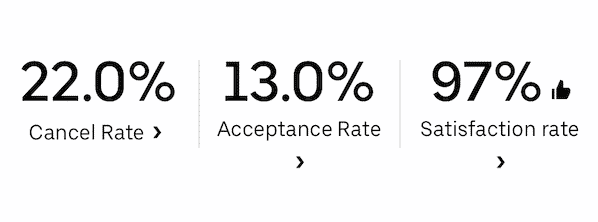

Here’s an example of my metrics in my Uber Driver app.

As you can see, I maintain a low acceptance rate because I only accept orders that are profitable and worthwhile to me. I reject far more orders than I ever accept (I also have a high cancel rate, which I wrote about here if you want more information about cancellation rate: Uber Eats Cancellation Rate – And Why It Doesn’t Impact You).

In the past when Uber Eats showed you your acceptance rate, people who didn’t understand the app were convinced that your acceptance rate mattered and could get you deactivated if it got too low. In reality, showing your acceptance rate is a scare tactic that Uber Eats uses to get less experienced drivers to accept more orders. I’ve been delivering for Uber Eats for over five years and have never had issues getting orders or working with Uber Eats. If the acceptance rate did matter, I’d have been deactivated long ago.

Your Uber Eats Acceptance Rate Doesn’t Matter

The definitive answer is that your Uber Eats acceptance rate does not matter. In the past, they made this explicitly clear on their website but they seem to have removed that language. However, this 2022 letter from Congress to Uber Eats CEO Dara Khosrowshahi quoted the language that used to be on the Uber Eats website, which stated: “As of August 21, 2017 Uber is no longer tracking acceptance rate or cancellation rate against Quest promotions.” The fact that Uber Eats once explicitly stated that they were not tracking acceptance rate in the app is a clear indication that it doesn’t matter.

That being said, Uber Eats isn’t afraid of using scare tactics to make it seem like your acceptance rate might matter. For example, on the Uber help page, they state this: “It is important to maintain a high acceptance rate to provide a reliable service to restaurants and customers.”

That might seem to imply that your acceptance rate matters, but it’s really empty language meant to scare new drivers into accepting more orders.

And again, I know that your acceptance rate doesn’t matter because I maintain a low acceptance rate, cherry-picking orders that make sense to me. Despite this, I’ve been consistently delivering for Uber Eats for over half a decade without any issue.

If you think about it, Uber Eats has a vested interest in avoiding anything that makes Uber Eats drivers look like employees. Requiring drivers to accept a certain percentage of orders would undermine the independent contractor relationship between Uber Eats and its drivers. So the best they can do is try to scare drivers into accepting more orders, but they can’t really do anything to punish drivers who are strategic about which orders they accept.

Canceling Uber Eats Orders – That’s Okay Too

Related to accepting orders is whether you can also cancel orders after you accept them. The answer here is that you can cancel orders without any issue so long as you do so before you pick up the order.

There are a lot of reasons why you might want to cancel an order after you accept it. First, it’s easy to accidentally accept a delivery request. The app makes it stupidly easy to click accept. I guarantee you’ll find yourself opening the app and accepting an order by accident.

The second reason you might want to cancel an order is if you arrive at the restaurant and find the order isn’t ready or there’s a long wait. Sometimes, you just need to cut your losses and move on.

Finally, you might also cancel an order because it’s not going in an ideal direction. If you’re multi-apping (which I recommend everyone does), you might get an order from Uber Eats, then realize that you have orders from DoorDash or Grubhub going in opposite directions. In those situations, it might make sense to cancel an Uber Eats order you already accepted to focus on other orders.

The most important thing is to never cancel an order after you’ve picked up the food and marked that you’re on your way to the customer. The reason you don’t want to do this is that Uber Eats or the restaurant loses money if you cancel an order after you’ve picked it up. When you cancel an order after you’ve picked it up, you keep the food and no one else can deliver the order. If you do this too many times, I’m positive that Uber Eats will eventually deactivate your account.

By contrast, if you cancel an order before you pick it up, there’s no harm to anyone. Uber Eats can send the order to someone else and they’ll still make their money.

Final Thoughts

So, if you’ve made it this far, you hopefully have learned why your Uber Eats acceptance rate doesn’t matter. When you’re delivering with Uber Eats, you’re working as an independent contractor, which means you are your own small business. As such, you need to act like one and be strategic about the assignments you accept. No business would ever accept an unprofitable bit of work. And the same should be true for you.

Now it does! Uber is punishing drivers by denying rides information (length, direction, fares estimation) when acceptance rates drop! I’m now receiving requests with only the time until pick up location.

Uber notified me that they was fraudulent activity with my account yesterday, and I could not continue delivery until the issue is resolved.

Today new day, I doticed that I have been deactivated, without any justification.

The only way to contact Uber is through their chat message portal

I I was told that my rating was to low.

I could file an appeal they validated.

I admitted that I declined about 3 of a few $3 offers where I had to drive about 25 min to deliver etc.

This is unreal, what Uber is doing.

Your car, your gas money, and milage that you are using and not theirs.

It seems like manipulation!

Fair is fair!

I’ve taken this advice and now since my acceptance rate is lower, would it prevent me from getting the benefits in the next tier? For example, I’m in the blue tier and UberEats is showing me if my acceptance rate doesn’t go up that I’ll not be able to use the Gold tier benefits.

It does matter. I tested a few times and my delivery offers slow down, sometimes alot.

You might think that, but I can counter and say I’ve never noticed any difference. Of course, how orders are assigned is a mystery, but I’d bet it’s probably more in your head than you think.