Your Uber Eats satisfaction rate is one of the most important ratings you receive in Uber Eats. It’s based on the last 100 people to rate your delivery services, either with a thumbs up or a thumbs down. If your satisfaction rate falls too low, you are subject to deactivation.

In this post, we’ll take a look at how the Uber Eats satisfaction rate works and what you can do to keep your rating high.

Uber Eats Satisfaction Rate – How It Works

As mentioned in the introduction of this post, Uber Eats calculates your satisfaction rate by looking at the last 100 delivery ratings you’ve received. Customers can rate their delivery with either a thumbs up or a thumbs down. This is a bit different from DoorDash (which allows customers to rate drivers from 1 to 5 starts) or Grubhub (which doesn’t have customer ratings at all).

Your satisfaction rate is calculated by looking at the last 100 delivery ratings you’ve received. Uber then takes the number of thumbs-down ratings you’ve received and the number of thumbs-up ratings you’ve received to determine your rating. For example, if you had 90 thumbs-up ratings, you’d have a 90% satisfaction rate.

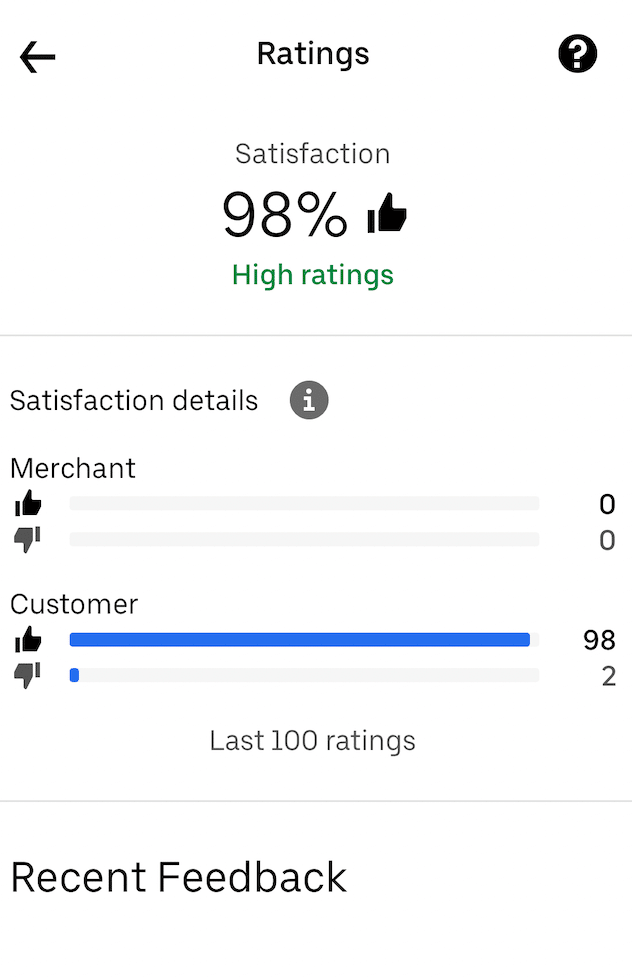

Below is a screenshot of my satisfaction rating. As you can see, of the last 100 delivery ratings I’ve received, 98 gave me a thumbs up and 2 gave me a thumbs up, giving me a satisfaction rating of 98%. For the most part, I tend to maintain a rating between 97% and 99%.

It’s important to note that your satisfaction rate will never be based on your last 100 deliveries since it’s calculated based on customers that rate their delivery. Most customers do not rate their delivery, so there’ll always be a lag between the number of deliveries you complete and your satisfaction rate. I’d estimate fewer than 50% of customers rate their delivery.

You’ll also notice that your satisfaction details include information about merchant ratings. Most merchants don’t rate Uber Eats drivers, so usually, you won’t have any ratings from merchants (or if you do, there’ll be very few of them). As far as I can tell, Uber Eats doesn’t do anything with your merchant ratings.

Why You Need To Maintain A High Satisfaction Rate

You need to maintain a high satisfaction rate to avoid potential deactivation. However, Uber Eats does not provide a specific rating that you have to maintain to avoid deactivation. Instead, they use vague language that “delivery accounts with consistently low ratings may be deactivated after receiving multiple notifications.” The exception is for drivers in California, where Uber Eats says that you have to maintain an 86% satisfaction rate.

The good news with this vague language is that you will receive several warnings from Uber Eats if your rating is low. If you get these warnings, you have to take them seriously and do what you can to raise your ratings (we’ll discuss this in the next sections).

Your best bet is to give yourself a good buffer. My general recommendation is to keep your satisfaction rating at 90% or higher. That way, you have to solid buffer so that if you have a few bad deliveries, you’ll still avoid potential deactivation.

I generally have my satisfaction rating close to 100%, which gives me a lot of cushion if I have a problem with a particular delivery. I find it doesn’t take much for me to maintain a high satisfaction rate.

How To Maintain A High Uber Eats Satisfaction Rate

So how do you maintain a high satisfaction rate? Here’s what you should focus on:

1. Deliver The Food On Time. The best thing you can do to maintain a high rating is to deliver food fast and on-time. This is expected by every customer. If you deliver food quickly, you’ll usually get good ratings. If you’re multi-apping, be mindful that you’re delivering your Uber Eats orders on time or else you risk getting a bad rating.

2. Follow Instructions. Customers will sometimes leave specific delivery instructions, which you need to follow if you want to maintain a high rating. If a customer tells you to leave their order at a specific place, make sure you do that. This can be frustrating when a customer wants you to bring the food to their hotel or apartment door, but if you don’t do that, you risk getting a bad rating. The few times I do get a bad rating are almost always related to this factor – where I don’t bring the food to their door and leave it in the lobby for them instead, even if they asked me to bring it to their door.

3. Check For Drinks. One of the most common things drivers fail to deliver is drinks. The most common scenario is where the restaurant forgets to give you the drink. You should always check the order details to see if a drink is included. Most restaurants simply miss this. The other situation is when you have the drink in your vehicle and forget to bring it out. It’s easy to leave the drink in a cupholder and forget about it. So, pay attention to the drinks (if any) in the order.

4. Avoid Spilling Or Damaging Their Order. Finally, you can maintain good satisfaction ratings by delivering food intact. I deliver food on my bike, so this is the second most common reason I’ll receive a bad rating. If I hit some bumps or just am not too careful, I can sometimes spill their drink or food, which leads to an unhappy customer. If you’re delivering with a bike, make sure you get a good bike delivery bag. With certain orders, you have to be more careful (soups, anything liquid, etc).

Final Thoughts

Maintaining a high Uber Eats satisfaction rate is very important. If you let it dip too low, you risk getting deactivated. Uber Eats will give you some warnings if your rating is falling too low, so you’ll at least be able to take steps to improve your rating.

Fortunately, maintaining a high rating isn’t difficult. Doing the basics is what matters – deliver food on time, avoid spilling orders, follow instructions, and don’t forget to deliver drinks or other items that are often missed by restaurants.

If you do all of these things, you’ll have no problem keeping your rating up.

And also, we don’t know what is inside the bag when it’s sealed. I agree we can verify the drink. But not everything.

As an Uber Eats delivery driver, I think the Uber Rating is a very floored system and sometimes completely unfair. You can be on time, polite, check for drinks, follow instructions and avoid spoilages or damages to their order. However if the restaurant doesn’t get the order correct inside the bag, or forgets certain food items. Sometimes we the driver gets the blame, when a customer will contact us shortly after finishing a delivery, asking where’s my fries or burger?

This is true..sometimes. But PLENTY delivery people are just lazy or inattentive and don’t even check tickets when the restaurant actually attaches them to the bag. You often can catch missing items that way as well.

Don’t use Apple Map, I had several order delivered to the wrong door. Thanks yo Apple it switched the address:/

I deliver by bike as well and I have never understood why most bikers Love to use those huge bulky backpacks that to me do not keep the food stable especially the drinks. You’re already carrying them at an angle for most of the ride and then getting on and off the bike is still juggling them around. A lot of people don’t even request the restaurants to cover the lids of drinks with stickers when they have them. And, a lot of bikers don’t even use bags which is actually against policy even though everyone wants to say it isn’t. I carry a bag but I keep it slung from my shoulder at my side and I have a lot more control over it that way. I can only imagine the shape that some customers food arrives in. Also, on a bike, in a major city, I would never carry branded bags or materials. This is a huge advertisement/target…look at me I got food! Come take it from me!