I recently picked up a new book from my local library called The Upstarts: How Uber, Airbnb, and the Killer Companies of the New Silicon Valley Are Changing the World. As you can probably guess, the book is about the growth of Airbnb and Uber, and it starts at the very beginning in the history of these companies, before they even existed. Something about this book really hit home for me and reminded me of an important lesson that I thought was worth reminding ourselves of again – we all have to start somewhere.

It’s an important thing to remember that I too often forget. One of the frustrating things about getting into the personal finance space is feeling like you’re so far behind all the time. I’m pretty much at the beginning of my financial journey and it’s sometimes disheartening to see people the same age as me who are already nearing or at financial independence.

The same is true with getting into the blogging world. I see all of these big blogs out there and sometimes get down on myself that my blog isn’t at that level yet. It sometimes makes you feel like giving up.

The thing that I always forget is that every one of these people had to have started out in about the same position as me today. Sure, our stories all differ a little bit. Some people started out a little bit ahead. Others started out a little bit behind. But ultimately, everyone had to start somewhere.

That’s why The Upstarts was a good thing for me to start reading this week. It’s a reminder to myself that nothing happens overnight and that building anything, whether it’s a big blog, a stable financial footing, or a billion-dollar company, takes time and work. There are no guarantees, of course. But if you find yourself lamenting that you’re not at the level of someone else, remember that even they had to be in your position once.

Even The Big Shots Had To Struggle Early On

The story of Airbnb’s CEO, Brian Chesky, is one that I find really remarkable. He’s obviously a smart guy, but he’s not a guy who was guaranteed to strike it big with his idea. Early on in his career, he basically toiled working the type of entry-level job a lot of us probably started out in.

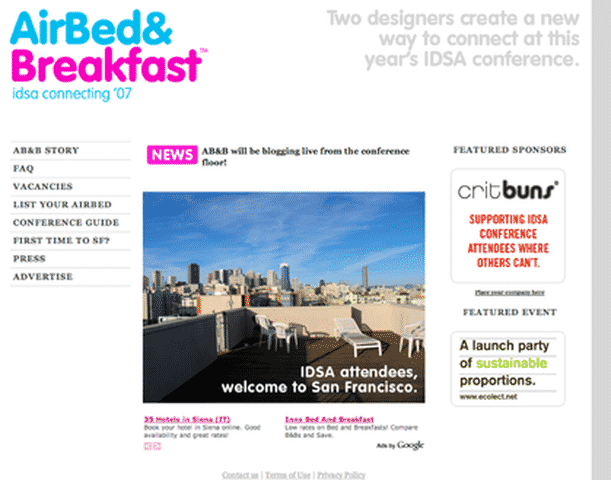

His Airbnb story starts off just like anyone else with an online business idea. Chesky and his co-founder, Job Gebbia got a domain name, set up a website, and started trying to get people to use the site. The first iteration of the site was even set up using WordPress.

That first week, Chesky and his co-founder managed to get a few people to stay at their house. And then the real struggle began – very few people took their site seriously.

They tried to set up the website at South by Southwest in Austin, but only two people ended up using Airbnb during that event – and one of them was Chesky himself. When they interviewed the person who hosted the future billionaire in Austin, he mentioned how Chesky would stand on the balcony and look off into downtown Austin, as if the action was somewhere else far away. As explained in the book, “he didn’t seem present.”

I totally get that feeling. It’s the feeling you get when you feel like you should be farther along than you are.

Needless to say, Chesky and his crew took a lot of hits early on. People didn’t believe in Airbnb and they weren’t making any money. To make ends meet, they picked up a side hustle selling funny presidential cereals for the 2008 election (they called them Obama Os and Cap’n McCains). That’s some hustle right there. Eventually, with a little bit of help (and remember, we all need help), they managed to get into Y-Combinator. And the rest is pretty much history.

The story itself is interesting, but what’s really interesting was how those early struggles seemed so relatable. Anyone who has tried to create something out of thin air has had to face this same struggle. You see these big shots now and you forget that one time, maybe not that long ago, they probably weren’t all that different from you and me.

It Takes Time

I know it’s a platitude, but it’s true. Succeeding at anything takes time. When we see those people who are so far ahead of us, it’s a good idea to remind ourselves that they didn’t just start out there. They had to begin somewhere.

I need to keep reminding myself about that fact. I just happen to be at the start of my own financial and blogging journey, and it’s easy to get down on myself. Sometimes I fall into the comparison trap and feel like I’m never going to make it. This is especially true if I forget that there was a road behind every single person I look up to.

My suspicion is that forgetting about that road is why many of us aren’t willing to let time run its course. We all want things to happen right away. It’s probably why so many of us come out of school and immediately start upgrading everything in our lives. We forget that a lot of the people we’re trying to emulate had a long road behind them.

Just Keep Hustling

I think in the end, we have to remember to keep hustling. It’s a tough road for anyone who’s reached any sort of success. Most of us only see people’s end results. We discover blogs when they’re already big. Or we learn about people who have already reached financial independence. We always see the destination. It makes it easy to forget that there was a road behind it.

This blog isn’t the biggest blog in the world. I appreciate every single person that comes to visit and I’m happy that it continues to grow. It’s okay that it isn’t the biggest blog in the world yet. I should also remember that I’m miles ahead of where I was just a little while ago.

The same is true with financial independence. I know I’m behind a lot of people. I know I’m also ahead of other people too. Anyone who’s already there didn’t get there overnight. They hustled, day-in and day-out, for years before they made it. And when they first started, they probably started somewhere around where I am too.

When Chesky and his crew got into Y-Combinator, they called themselves “cockroaches” because they just wouldn’t die. It’s not a bad compliment.

In hindsight, you look back at an idea like Airbnb and think it’s crazy that anyone didn’t think it could succeed. But we know that in life, nothing is guaranteed. It takes work – and a lot of it – if you want to make it.

If you’re ever feeling behind, don’t forget to remind yourself that everyone had to have been where you were once too.

Do you ever fall into this trap of forgetting that everyone had to start somewhere?

Great post FP, I often feel the same way about my own progress financial or otherwise, , it’s always nice to know you’re not the only one. It’s also an encouragement to keep going. One guarantee is that none of us will reach our goals if we give up! : )

True that! Gotta just keep that perspective!

This is an awesome read and the best part it will always be relevant. Anyone, at any point of their debt journey, career, or blogging journey can relate to this. I can relate to my own journey in paying off my student loans at an expedited rate, which can feel hopeless and at times like I’m doing everything wrong. Blogging, too. I’ve blogged for about a year now and still too often feel like my blog is one day going to “get there”, but if I just look back to where I was this time last year, it’s amazing. We accomplish so much more than we ever take the time to sit back and realize. So, thank you for writing this. Echoing the comment above, slow and steady wins the race.

Glad I found your blog and looking to coming back for more!

Best,

Leah

Thanks so much Leah! You make some great points and it really puts things in perspective when we sit back and realize that everyone had to have started at the same place.

So true – it’s easy to get frustrated when comparing our progress to others, especially if you started your FI journey later in life. “Comparison is the thief of joy”, but, indeed, we’ve all had to start somewhere and we’ll all face our own unique struggles. Keep up the great work!

Thanks Tabitha!

You mean there’s hope for my terrible website building skills? It’s unreal how basic their site was back in the day

I know, it’s crazy! It was basically just two guys with an idea. Not that much different from all of us.

Yes FP. This blog looks super nice and the content you put out is strong. Slow but steady wins the race.

I struggle with the same feelings, but in the end I tell myself that I am not doing this for the numbers. I want to reach out to people and ultimately value quality over quantity.

But agreed, sometimes the vanity metrics clog up our heads :-).

Thanks for the book tip. Added to my long to-read list.

Thanks for the compliment! I’m trying to remember slow and steady too, but yep it’s important to not let those vanity metrics get in the way!

I’m definitely going to check out this book. Thanks, FP!

Keep up the great work on this blog – I really enjoy your writing. Good things come to those that wait and are patient. The side hustle reports are awesome!!

Thanks, man! Appreciate it!

This is a brilliant post. We all need a reminder at times that we all start off at the beginning….! Nobody is an instant succcess or instantly popular or instantly anything else… besides alive!

Great post.

Thanks Katy! I definitely have to work to keep reminding myself that. It can be frustrating when you don’t get to the top instantly!

Great perspective, FP! I didn’t start my financial journey until the ripe old age of 36. Ha! It was tough reading about how people were already retired by their 30’s while my net worth was in the negative (six figures to be exact).

I personally thing your blog is excellent. I’m a frequent visitor and sometimes commenter. Plus you’re student loan debt free! That’s pretty darn awesome!

Docs start so much later it’s crazy! My fiance is looking at starting so late too. She won’t be done with her residency until she’s 32 years old. Some of these super savers are already retired for 2 years at that point!

Put it on my reading list. Thanks.

Cool! Get it at the library if you need to. So far, it’s pretty good.

We started climbing out of $100k worth of debt when I was 40, with a family in tow. There will always be others ahead and behind us, all about perspective. Keep hustling.

That’s definitely true. There will always be people ahead and behind us. I’ll definitely just keep hustling!

Interesting read! Discipline and persistence is important when pursuing any worthwhile goal.

As someone near your age, I can certainly relate. I’ve been investing for almost 13 years now and am seeing the wonders of compounding interest at work, so all the hard work has started bearing noticeable fruit.

I have a couple of other passive income streams that are in their infancy and I have to remind myself that the best time to plant a tree is now.

Thanks, DS! 13 years of investing is awesome! I feel like I’ve just barely started.

“I appreciate every single person that comes to visit.” Thanks. It’s nice to be appreciated 🙂

Yeah I fall into that problem sometimes. People (and the news, books, etc) always focus on the huge successes. So it’s easy to focus on that instead of focusing on the actual hard work that goes into success.

I don’t remember which book it was that I read, but the explanation was great: If people gave up on finding love as often and as easily as people give up on running a successful business, the human population would die off. (Failure is a necessary part of success.) So there you go.

Haha I’m glad you feel appreciated! And True that! Definitely a good quote.

I can ensure you that there are already bloggers out there (including myself) who already look up at your achievements. You have to start somewhere and you did a great start. Keep up the good work!

Thanks man! Appreciate the kind words!