When you’re married to a dentist, you tend to learn a lot about the world of dentistry. Turns out dentists love to talk about teeth and when you hear them talk about it all the time, you end up picking up a few pieces of information here and there.

In addition to learning about teeth, I’ve also been learning about the crazy amount of student loans that most new dentists graduate with these days. I’m definitely no stranger to student loans. Law school is notoriously expensive and in the legal world, student loans are pretty much a given. When it comes to student loans though, lawyers don’t even compare to the type of debt that dentists can graduate with.

Perhaps the craziest student loan story I’ve heard comes from one of my wife’s friends. This friend is currently a practicing dentist sitting on a mind-boggling $500,000 worth of student loans. You read that right. Half-a-million dollars. It’s an absurd amount of debt – and potentially financially crippling.

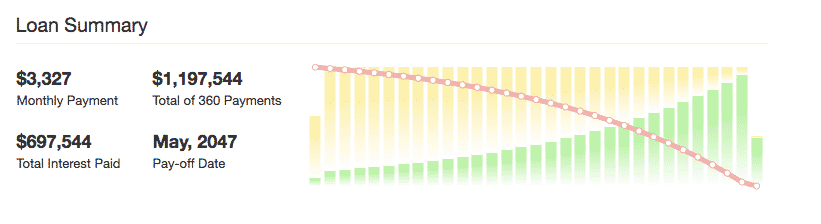

To understand the impact of that debt, it helps to actually see what it means on a month-to-month basis. Assuming an interest rate of about 7% (which is a pretty fair estimate), $500,000 in student loans comes out to a monthly payment of $3,327 over the next 30 years. On a standard 10-year repayment plan, my wife’s friend would be looking at a monthly payment of $5,805 per month.

A monthly fixed cost that high puts this young dentist in a problematic position. Just to meet her monthly payments, she’d have to earn a minimum of $39,924 in after-tax money. With that type of yearly outflow, it’ll be a long time before she’s financially independent. She’d need to have a portfolio of over a million dollars just to afford to pay the bare minimum on her student loans for the next 30 years.

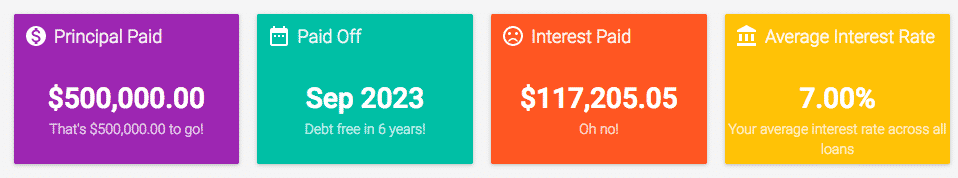

The amazing thing, though, is that with a bit of work and some significant sacrifice, it’d be possible for her to pay off all $500,000 of her student loans in just 5 or 6 years. It definitely wouldn’t be easy and I admit that not everyone will have the ability to do this – this dentist just happens to be in a position that makes it possible to achieve an outlandish goal.

Despite this possibility of being debt free so soon, there’s a 99.9% chance that she won’t do it. It’s just too far out of the ordinary. In this post, I’m going to discuss how it’s possible for a dentist with $500,000 worth of student loans to pay it all off in just a few years and what we can learn from this example.

How Does A Dentist End Up With $500,000 In Student Loans?

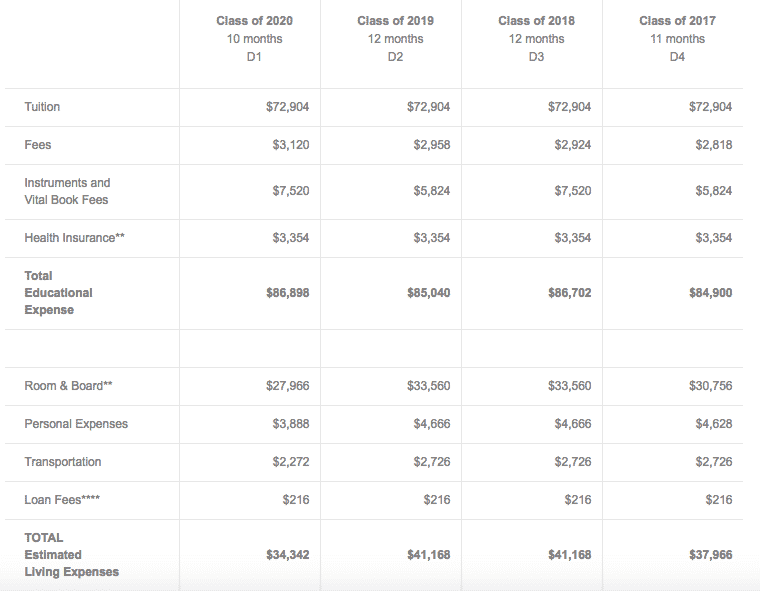

Before tackling how to handle this debt, I suppose the first question to ask is how does anyone even end up with this much debt in the first place? A half-million in student loans seems pretty nuts. Turns out it’s actually pretty easy for a dentist to end up in this position. Take a look at the expected yearly cost for a school like NYU Dental.

If you’re keeping score at home, we’re looking at the following yearly costs for those four years of dental school:

- D1 – $121,240

- D2 – $126,208

- D3 – $127,870

- D4 – $122,866

Total Cost: $498,184

NYU is pretty ridiculously expensive, but not all that out of the ordinary. Tufts Dental School – another comparable east coast school – has an estimated four-year cost of $450,412. Even an “affordable” state school like my own state of Minnesota has a four-year cost of $304,277 for in-state residents.

To make matters worse, not every state has a public dental school, making it even harder for many future dentists to reduce their school cost. My wife, for example, is originally from Wisconsin and the only options for her were to either attend an expensive private dental school in Milwaukee (Marquette University) or opt to pay out-of-state tuition for another state dental school. As a result, someone like her was going to end up with significant debt, no matter what she did.

Paying Off $500,000 Worth Of Student Loans In Five Or Six Years?

$500,000 worth of student loans probably seems like an insurmountable amount. Most people don’t even have mortgages that high, let alone student loan debt that isn’t tied to any asset and that can’t be discharged in bankruptcy. In a situation like this, the vast majority of people will just continue the status quo and resign themselves to the fact that they’ll be paying off their student loans well into their 50s and 60s.

I’ve never been one to accept the status quo like that. As I thought about it some more, I realized that if my wife’s friend were willing to think just a little bit outside the box, it’d actually be possible for her to pay off all of her debt by her early 30s. Even if she didn’t do that, she could make a significant dent and bring it down to a much more manageable level.

In order to pull this feat off, we’ll need to assume a few facts:

- She makes $200,000 per year. This might be high or low depending on where you live. My wife’s friend is currently a part owner of her group practice and I’d hope that would mean that she’s making somewhere in the $200,000 range. Personally, I don’t think this is an unreasonable assumption. You can make $200k as an associate in most areas, but the average income of a private practice dentist, regardless of amount of years practicing, is around $175,000.

- She chooses to live at home with her parents. The unique thing here is that my wife’s friend has the ability to live at home with her parents, but chooses not to take advantage of that fact. In fact, she even lived at home for a year after she graduated from dental school and didn’t have a problem with it. Moving out was just the natural process. Obviously, living at home isn’t the ideal situation, but in many other countries, living at home as an adult isn’t considered a particularly odd thing. I think it’s a uniquely American thing to choose to live on your own even when you’re not in the financial position to do so.

- She spends no more than $24,000 per year. Honestly, if you’re single and living at home with no rent or utility costs, spending $2,000 per month seems downright luxurious.

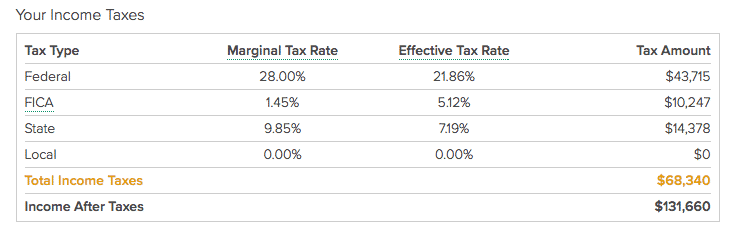

If we take the above assumptions as true, here’s what we’re looking at in terms of after-tax income.

On a $200k salary, this dentist is looking at $131,660 of post-tax income. So how does someone making $131,660 in post-tax income pay off $500,000 worth of student loans?

Let’s break it down some more. If we assume a spend of $24,000 per year, that leaves this dentist with a little over $107,000 remaining. Throw in some insurance costs and other miscellaneous spend and I don’t think it’s ridiculous to have $100,000 left over. Honestly, a single person living at home on $2,000 per month can live pretty darn well. How much can you really spend each month if your only expenses were food, clothes, and travel?

$100,000 per year thrown at student loans means that the debt is gone in 6 years. And by choosing to live at home so that she can aggressively pay off her debt, she ends up saving almost $600,000 in interest.

If she can figure out a way to bump that income up so that she can throw $10,000 per month towards student loans, the debt is gone within 5 years. Easier said than done obviously, but it’s not completely ridiculous.

What Can We Learn Here?

- Think Outside The Box. There are a ton of ways to reduce your expenses. Most people making a high income won’t even think about living at home – it feels shameful. But, when you consider how much debt she’s in, her salary really isn’t very much. She’s broke! And if you’re broke, you need to think about what else you can do besides the status quo.

- Live Weird While You Can/Pay Off Debt While You’re Young. Your 20s are the time you should be hustling to crush your debt. Most people don’t expect you to live like a baller when you’re just starting out your career. Use that to your advantage. My wife’s friend is currently 28 years old – she spent one year living at home and has since been living in a luxury apartment in a hip neighborhood. If she’d just been willing to keep living at home, she could have been done with her student loans by the time she hit 31 or 32 years old, then moved out on her own. Or she could have at least made a significant dent in her student loan balance. I personally think that’s much better than still being a half-million in debt.

- You Need To Keep Your Rent Low. A mistake that this dentist made was opting for a luxury apartment instead of finding a more affordable, normal apartment somewhere. Obviously, people want to live in a nice place, but you can do that perfectly fine by living in a normal apartment building with normal people. My sister-in-law is a terrific example of a high-income individual smart enough to keep her rent costs low while living in a solidly nice place. Instead of luxury, she opted for a top-floor unit in a normal apartment building located in a good neighborhood. By doing this, she pays half of what most people probably pay, which allows her to save a lot more money.

- Get That Interest Rate Lower. Interest is a killer when you have a student loan balance that high. On a $500,000 loan, this dentist is looking at $35,000 per year of interest or about $95 of interest per day. That amount of interest is going to destroy you. She might not be able to refinance that debt now, but once her debt to income ratio is a little better, she should seriously consider refinancing and trying to get that interest rate lower. (Related: My Student Loan Refinancing Experience)

- You Choose What’s Important To You. Ultimately, when it comes to debt, for the most part, you’re the one that chooses whether paying it off is important to you. If you opt to pay for something else, it means you’re choosing that thing over the debt. There’s nothing inherently wrong with that. Just make sure that you are aware of that fact. For my wife and I, we’re choosing to spend our money on paying off debt.

I know that this isn’t necessarily an ideal situation. Living at home as a young dentist while everyone else is living it up in their luxury apartments isn’t my idea of a great time. But if you’ve got that advantage, take it while it’s there.

A half-million worth of student loans is serious business. What’s really amazing is that one change – really, just one change – can be the difference between my wife’s friend paying off this debt in her 30s vs. paying it off in her 50s. Just imagine how much wealth she could build with that extra 20 years.

This is well written and takes the proper perspective:

How can I do this?

That’s so much better than listing out the reasons why you can’t.

The idea of a dentist out of school being $500k of student loan debt is becoming more and more normal by the year. If you consider housing costs + any carry-over debt from undergraduate degrees, it’s not too much of a stretch for someone to turn a $300k dental school tuition and leave school half a million in debt.

It’s difficult to see a path out on a starting salary of $120k. However, if you can make progress that first year, then there’s no reason you can’t make MORE progress as your income grows. By year 5 or 6 when your income has grown along with your skillset and experience, you can start making serious progress toward eliminating those loans provided you don’t allow your lifestyle to balloon too much.

Yeah, that’s sort of the point I was trying to make with this post. The idea isn’t that this is an exact roadmap to pay off such a massive amount of debt, but just to sort of think – how could it be done. Is it possible? I don’t know. But it’s worth thinking about rather than just throwing up our hands and giving up or telling ourselves we can’t do anything.

No wonder student loans are such a scary issue, I agree with your post and also feel that the other things I have cut down on to save money are eating out and drinking. Lastly, many non essential items such as books and electronics can be purchased used.

So, what would you advise a med school graduate with over $400,000 in debt, who has to do several years of . residency at $50,000 annual salary (set by Medicare) with compounding interest in order to be licensed? Or, a medical student how can’t practice because they didn’t match to a residency? Or, the many hundreds of US medical students who can’t get a residency because hospitals now give those slots to foreign students whose foreign medical schools circumvent the system by privately paying hospitals twice the amount that our government does? Sound fair? Sound like a situation from which a medical student may never be able to dig themselves out of? Wonder way the suicide rate for medical students is high?

Umm…I first advise this med student to stop being so xenophobic and blaming foreigners for taking their jobs?

$200K is a very, very, very generous salary for dentist fresh out of school with no experience. You’re looking around closer to $100K-120K pre-tax especially in non-rural areas. So your plan of paying that off in 5-6 years goes out the window with that salary.

You may be able to make 200K as an associate in a very rural area that also can afford dentistry, but the average income of a private practice dentist, regardless of amount of years practicing, is around $175,000. With corporate offices taking over, most aren’t making over 120,000 their first several years of practice as an associate.

In regards to owning your own practice, it would be great if every one of the 6000 students that graduate each year could own their own practice, but not every single dentist can own their own practice. Furthermore, not every person is cut out to own their own practice. I know it sounds great to just say own your own practice, but that entails a lot, and also a lot more debt.

I mean, really this post was more of a thought exercise that living at home when you have the option could result in a pretty big difference in student loan pay off.

Why can’t every dentist own their own practice though? Like I think anyone that has the smarts to get into and finish dental school has the smarts and drive to own a practice. Like I know not every dentist wants to own a practice, but I would disagree that some dentists literally cannot have the skills to own a practice. That’s a limiting belief that I cannot accept and I don’t think any of us would go up to some young dentist and say to their face, you literally do not have the skills to own a practice because you’re too stupid, don’t have the drive, or whatever. Now, whether a dentist wants to own a practice is another question, but every dentist can own a practice and do fine for themselves if they’re willing to go rural.

You run a financial site, you surely know about supply and demand. What do you think would really happen if everyone really did own their own office. As is, there are already a glut of offices in most places even in many areas people would consider rural. Just about 7 years ago the number of dental graduates each year was around 4000. What do you think a 50% increase in the workforce does to the field as well?

Yes, an increase in the workforce does lead to more competition and lower incomes – I can’t deny that. Solution is to obviously to not limit yourself and be one of those people that does something different. Let’s face it man, the vast majority of people will never actually take action on anything. If I told everyone who was struggling with their practices to pick up and go open up somewhere in Alaska where people actually need dentists and there are no dentists there, 99% of people would absolutely not do that. So all you have to do is be one of the 1% that actually does it.

Think about with anything in life. I can tell you all of the studies that say broad-based indexing is the way to go, and yet, the vast majority of people won’t do that. I can tell you how to be in good shape by going to the gym and lifting weights and exercising and eating well, and most people won’t do that.

The whole idea about “what would happen if everyone” did X thing is a ridiculous slippery slope argument that doesn’t take into account the fact that MOST PEOPLE do nothing!

So what would happen if everyone opened up their own office – probably wouldn’t work. But most people won’t open up their own office. So why not be one of the people that actually does something?

The argument of what would happen is no more ridiculous than your saying everyone should open their own office. But I don’t blame you though—it’s much easier to say that when you are an outsider looking rather than an insider with real experience in the field. Just like I don’t know just exactly how bad MDs have it for paperwork in their field, etc. But as a practicing dentist, and one who went through the entire student loans and practice loans, I can say that the situation is far direr than you can possibly imagine. I consider myself pretty fortunate in that I paid off all of my debt in just 31 months, but there are far more people i know who will be mired in debt for the foreseeable future of their careers or overpaying for a so-called ‘big office’ just for the ability to have a higher initial income to service debt. There is no other field right now more ridiculously priced than dentistry and so full of people who think they can be a savvy businessman when, in fact, most dental professionals are poor ones.

The smart choice for a truly savvy person is to avoid these situations all together. Would you pay 100k for a Honda Accord? Would you pay 1 million dollars for a modest 4 bedroom house in spur urban Texas? Everything financial is about value. Then why would we not call foolish on those people who insist, despite all contrary evidence, on joining a field with an unprecedented entry fee along with associated cost?

An outsider? What the heck are you talking about? My wife is a dentist that literally just bought a practice a year ago straight out of her residency (she specialized). She had 300k+ of student loans – same as you, and we’re aggressively paying it off with the expected cash flow. You paid off your student loans in 31 months, but are out here talking shit to other people trying to do the same?

Here’s the difference between me and you, man. You tell people, “you can’t.” I’m out here telling people, “why can’t you?”

I don’t make anywhere close to 200k as a dentist. I turned several low-ball offers. During my residency, my coresidents lived in nice apartments; I found the difference they paid was minimal to the run-down house I shared with my boyfriend, but I guess when you’re talking about pinching pennies, there might be a difference. However, I’m not that convinced. In the last five years, I’ve seen the cost of living sky rocket. The New York land(slime)lords mentality has spread to many cities and it’s harder to find affordable housing. Many of my friends who were able to afford these luxuy apartment still received financial support from their parents. When you don’t have that as an option, you look for cheaper housing which is disappearing. I think it comes down to policy and our politicians have let is down by letting education skyrocket and rentals to be unregulated.

Yeah, no complaint from me there – I think that the cost of getting a dental school education (along with vet and chiropractic) is crazy. Law, med, and pharmacy are ridiculous too, but not as crazy as those first ones.

For housing, I mean, I think there is a difference. Several thousand dollars per year in rent difference is not pinching pennies. If you’re paying 500 less per month, that 6k a year. With 500k of student loans, that’s probably around 30k of interest per years, so that one change has just covered 20% of your interest for the year. That’s significant.

I wrote this post while my wife was still in residency, but as I learn more about the dental game, it has become clear to me that most dentists simply cannot afford not to own their own practices. I think every dentist should become a practice owner, but I’m pretty biased towards ownership these days.

One of my colleagues is in even worse shape. 4 years of undergrad and 4 years of medical school at an Ivy League cost her almost 700k. She’s currently in fellowship right now so her interests are accumulating.

Back to your wife’s friend, she reminds me of many of my colleagues. When we started residency, they splurged on luxurious apartments (with doorman, pool, etc) costing more than half of their monthly paychecks while I paid several hundred dollars (all inclusive) living in a studio found on Craigslist. I didn’t know about FIRE but have always been frugal due to being a first generation immigrant. If my parents could raise two children on a combined salary of less than $40k annually then I can save a lot on a resident stipend and eventually an attending salary. I paid mine less than a year after residency while also helping my husband pay for our nice wedding. My husband and I basically did all that you recommended.

I feel like many people feel overwhelmed with the loan amount and try not to think about it. Unfortunately, the amount keeps growing regardless of whether they pay attention to it.

700k – holy crap! That’s probably 40k+ a year in interest alone – basically paying a decent salary for most people in interest alone!

The luxury apartments are just something everyone seems to do. I totally get wanting to live in a nice place, but it’s totally unnecessary! Sounds like you’ve got some good perspective.

Great post because this was me! I went to NYU for dental school in the early 2000s and then specialized in orthodontics for another 3 years after. Finished up with almost 600k in student loans. My wife (who is a school teacher) and I lived very frugally (although we had our own place) for the first 5 years and we paid everything off.

Note that I only made 200k a year for the first 3 years at my associate position but income did go up after I purchased (took a business loan) a small practice that grew. I consider myself very fortunate but I also had the discipline to live like a resident while other peers partied/spent like rockstars.

It sucked but it can be done.

I’m glad that this resonated with you and thank you so much for sharing your own student loan experience! I’m glad to hear that it can be done. That’s really amazing that you paid off all of that debt so fast. Most people (including pretty much all of my wife’s friends) are just planning to let their loans linger around for 30 years. There’s just no way I could accept that.

I think it would be very hard for someone to payoff this kinda loan in 5 or 6 years. It would require extreme discipline and planning to execute such a plan.

Besides, most new graduates want to live big after graduating from college and have their own place to live and a nice car to drive, eat out, travel, etc. Life inflation kicks-in pretty fast after graduation.

Well at least she picked a high income profession, so she has some options or paths to paying off her debt in some reasonable amount of time of her choosing.

No doubt, it’ll be definitely hard – maybe unrealistic even. I think it just shows what is possible if you’re willing to really work at it. Obviously, most people aren’t going to want to do this and maybe they shouldn’t, but it’s just a potential possibility. Really just depends on which things you value and which you don’t.

Haha I love the intro. I wonder what fun topics there are to talk about when it comes to teeth. Hmm.

This post is very well-written and packed with great information. I’ve seen a lot of people living in a luxurious place although they have a lot of debt. I think it’s partly because they feel like they should treat themselves after all those years of hard work. But I do agree with you that sometimes we need to make short-term sacrifices to reach our long-term goal faster!

Oh, trust me. Those dentists can talk about teeth all day.

And thanks for the kind words! I never understood living in a luxury apartment when you’re totally broke. My sister-in-law is a Physician’s Assistant and her and her husband live in a perfectly fine place. It’s just a regular apartment in a normal, old apartment building. They’re able to save so much more money because of that.

Wowza. I know dentists have a high earning potential and 500k is not unreasonable for the cost of the degree, but that amount of student loan debt would be really difficult for me to come to terms with!

You list great actions your wife’s friend can take, but honestly that is great advice for anyone who wants to get out of debt. Thinking outside the box, living below your means and choosing what’s important to you are all ways to approach paying off debt.

It’s pretty nuts what type of loans dentists start out with. And while dentistry is a good career, these student loan numbers don’t really add up. It’s crazy! And right – getting rid of debt like this is going to require getting real weird.