As you can probably tell from reading this blog, I’m pretty proud of how fast I paid off all of my student loans. It took me just 2.5 years to pay off all $87,000 worth of it. As a brief recap, I started my first job in the fall of 2013, started paying down my debt for real at the beginning of 2014, and paid off the last of my student loans in 2016. By the time I reached a $0 student loan balance, I hadn’t even been in the workforce for three years! In hindsight, that’s actually pretty astounding. There probably aren’t a ton of lawyers out there that are debt free three years out of law school.

With my recent marriage, however, it looks like I’m officially going right back into debt again in the form of my wife’s student loans. She graduated from dental school in 2014. Since then, she’s done a one-year hospital residency and is now currently in the middle of a three-year specialty residency. Needless to say, four years of dental school, four more years of post-dental school training, and no significant income since 2010 means that she’s sitting on a pretty high student loan balance. It’s a little bit over six figures at this point.

I haven’t talked about my wife’s debt all that much because, to be honest, I never really thought of it as my debt. Even though Mrs. FP and I have lived together for a while now, we’ve always kept our finances separate for the most part. That’s not to say that we didn’t know what the other was doing with their money. It’s just that we’ve always done our own thing.

Once you get married, however, your finances aren’t really separate anymore. Her debt is basically my debt now. The good thing for you is that you get to follow along from the beginning as we work towards crushing this debt.

Our Current Debt Situation

Let’s look at where we stand today in terms of our debt. Neither of us has any credit card debt or car loans and we don’t plan to acquire any of that anytime soon.

We do have a mortgage which we’ve been able to afford. Due to some fortunate circumstances, Mrs. FP was able to buy a house before she started dental school. She lived there for a few years with roommates (house hacking for the win!), then rented it out to a family member, and now we live there (with the occasional Airbnb guest). For now, I’m ignoring the mortgage debt simply because it’s not going to be our focus anytime soon.

Student loans are what we care about and we have a lot of it right now. I’m sitting on $0 of student loans, which is a good thing. Paying off all of that debt before we got married really gives our young family a lot more breathing room.

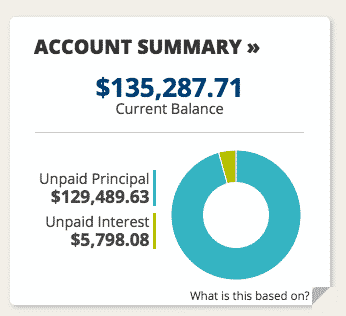

My wife is sitting on $129,489 worth of student loans, with nearly $6,000 sitting as unpaid interest at the moment. These loans are currently in deferment while she finishes out her residency. Apparently, putting her loans in deferment was a big mistake, but we’ll address that issue in the future. For now, what Mrs. FP has been doing is using her savings to pay the interest each year so that it doesn’t capitalize.

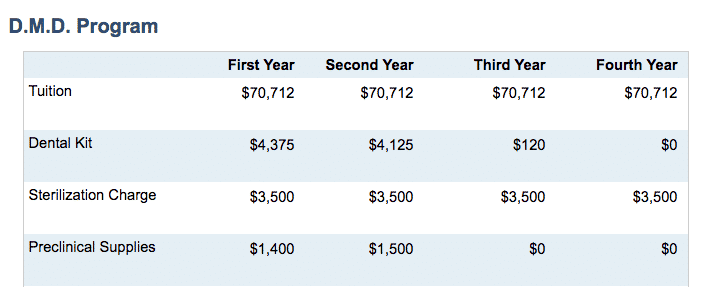

In the dental world, Mrs. FP’s student loan balance actually isn’t all that bad. Just take a look at how much tuition costs at a prominent east coast school like Tufts.

And that’s just tuition! It doesn’t even include things like room and board, which easily should add another $20,000 a year or so. At a minimum, your average dental student at a school like Tufts is going to come out with over $280,000 worth of student loans. Yikes.

Mrs. FP was fortunate enough to go to a slightly cheaper school – but not by much. In-state tuition and fees at her dental school are well over $60,000 per year, with out-of-state tuition and fees costing well over $80,000 per year. Due to some unique circumstances, Mrs. FP was able to come out of school with much less debt compared to your average dental student. It’s fortunate and makes things a lot easier for us. Still, remember that paying off debt is never easy, no matter what anyone thinks. It takes work to do it. That’s why we need a plan.

How We Plan To Pay This Off

Right now, our plan is to buckle down once Mrs. FP starts working next year and basically throw her entire paycheck at the student loans. Even though I’m currently working right now, we’ve made the decision to wait until she starts working before hitting her loans. I’m just not making enough right now and I think it’ll frustrate us to see so little progress if I start throwing my meager, state salary at her huge student loan debt. Plus, I’m still saving aggressively in hopes of playing some financial catch-up.

The good thing is, given her expected salary, I think we can get her loans paid off within two years. The key is to basically treat her income as a windfall. We’ve been used to living on my one salary for a few years now. Ideally, we can just keep doing the same thing. Avoiding lifestyle inflation will be key!

The other important thing will be to refinance her student loans as soon as we can. Since there’s absolutely no way we’re keeping this debt around or going for loan forgiveness of any sort, I don’t really see any downside with refinancing. I’ve talked about my own student loan refinancing experience with my law school loans, so the nice thing for Mrs. FP is that she doesn’t have to stumble her way through refinancing like I did.

In terms of how we’ll refinance her loans, we’ll probably initially use a search engine like LendEDU to see what the rates look like for her. It takes only a few minutes to search for rates and it doesn’t do a hard credit check, so there’s pretty much no downside to using it.

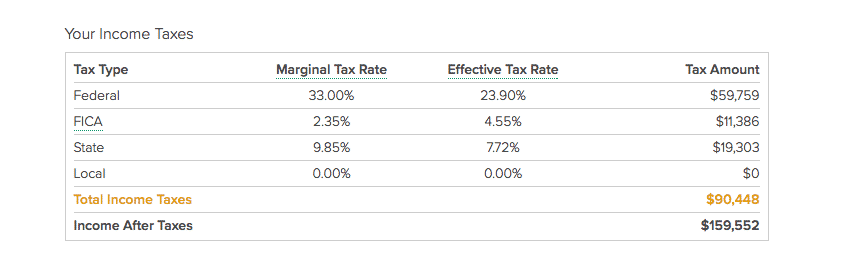

Actual numbers are obviously hard to pinpoint, but we can make some estimates. I think a household income for a lawyer and a dentist of around $250,000 seems reasonable.

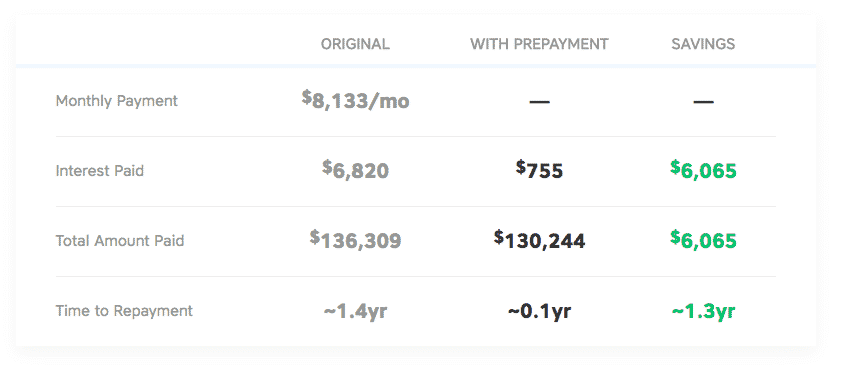

A $250,000 household income leaves us with an after-tax income of around $159,000. If we leave ourselves about $30,000 a year to live off of and save somewhere around $30,000 – which is around what I saved in 2016 by myself – we’re looking at just a little under $100,000 per year that we can throw towards loans.

Inputting that info into any loan payback calculator shows that, at that pace, we’d likely pay off all of her debt within 15 months or so – a little less than a year and a half.

Can We Do It?

Obviously, it’s hard to say whether this plan will work or not. By the time our household is making a significant income, I’ll be 31 years old and Mrs. FP will be 32 years old. We’re not old by any stretch, but obviously, things can change in the next few years.

Lifestyle inflation is the main thing we have to avoid if we have any hopes of succeeding in paying off this debt quickly. It’s easy for any new professional to come out of school and then immediately start spending that income. The key is to treat that high income as a blessing early on, not as a right. Doctors and dentists get stuck in a crappy position of having to take out a ton of student loans. But they’re also in a position where they can probably make the money to pay them back.

Hopefully, me getting married and now being in debt again means that I can help more of you. I’ve always regretted that I didn’t start this blog up back when I was in debt payoff mode. It would have been nice to have a journal tracking what I was doing and I think it would have been helpful for a lot of people to see exactly what was happening each month with my student loans.

For now, if you’re interested in following along with this debt payoff journey, make sure you sign up below to get all of the latest Financial Panther updates!

One of my closest friends graduated from Tufts so I am privy to the insane amount of student loans the graduates end up having. I think you two have a solid plan to tackle that debt. My husband and I started paying our loans separately but when we married last spring, we combined our finances. He helped mine first then once I finished, I returned the favor. Good luck.

Oh gosh – Tufts is nuts. Right up there with NYU dental for crazy student loan balances. I think it helps that I paid off my debt right away – gives us a little bit more cushion, although I keep going backwards in income, which doesn’t help us, haha.

I think will be totally fine even with lifestyle creep. I am a public health general dentist in South King County, Washington. Graduated UW here in Seattle on 2014 with about $220k. Now have about $96k remaining. Wife being a periodontist is much different than general dentistry, let alone pub health. We have two young kids, big mortgage, a old Honda Civic and a 2014 Highlander. The lifestyle creep is basically the kids organic food and our maybe ever other month date night. I’m sure you already know this, but never forget to “treat yo’self”

That’s awesome that you’ve crushed 100k of debt that fast. My wife graduated dental school in 2014 as well, but then did a 1 year GPR and a 3 year residency (unpaid residency, of course). Essentially 8 years of post-college schooling for her, so we’ll be in big catchup mode once she’s done next month.

You can do it! That seems like a crazy huge number but then you remember others have saved $500k-$1M in 7-8 years so they can retire early (at least that is what kept me going when I was paying off my debt!) You can definitely hit this first milestone. Also, dental school is crazy expensive!! $70k per year!! That is nuts!

It’s crazy how expensive dental school is. It’s not uncommon for folks to come out with half a million in debt. It’s a potential recipe for disaster.

I wondered if your wife’s debt would become “our debt” but figured you’d reveal it in time. I’m glad that you’ve mingled your finances as well as your lives.

I expected you to say she had over $200K in loans. It’s so weird to think $129K is not that bad but it just shows how relative things are. I think the strategy you came up with is excellent. Mr. G has a friend who’s a dentist with a thriving private practice and it took until her 40s to pay off her debt. No way is that going to be the case with you.

Yep, I was sort of holding it off on calling it “my debt” for a while – just wanted to be able to say I was debt free for a little bit of time at least! There’s a story as to why she’s got much less than she should have, but it’s a story that we may or may not reveal.

Congrats on getting married!!! While I’m sure it’s difficult to know that you’re jumping back into debt it’s got to make you feel good knowing that you know how to get out of debt in a timely manner. I have a feeling you won’t have any problem knocking this out in not time!!!

Thanks MSM!

I appreciate your blog presepctive from a law school debt point of view. 10 years out of law school (private school at that) I’m still drowning in student loans. A series of mishaps with jobs early on really slowed me down. I’ve been make great progress for the last 18 months (living on one income), but with such a big mountain to climb, staying motivated is tough. Thanks for your insight. Your journey is encouraging. I’m excited to follow this time around.

Appreciate you reading and thanks for following along! Good luck with your own student loan journey!

You got an excellent plan laid out, FP! Have you thought about taking your side hustle money and throwing it at the loans until Mrs. FP starts working full time? That may save you some money on interest.

Yeah, it’s something I’ve thought about because the income we earn in our side hustle could probably cover the interest. At the moment, my wife has enough saved up that she’s been able to hit the interest each year, and we sort of ear mark our side hustle income. The Airbnb income basically serves as our house maintenance/emergency fund (the housing experts always say you should save 1% per year of your home’s value for house maintenance, and Airbnb does that and more). The other income that I pay SE taxes on has been going into a Solo 401k. One thing (and now that I think about it, a good topic for a future post) is that taxes on side hustle income suck! That’s because you’re pretty much getting taxed at your highest marginal tax bracket plus you’re paying the SE taxes as well. That’s why I prefer to shelter as much of my side hustle income as I can.

Are you aggressively, while still appropriately, claiming as many expenses as you can against that side hustle income? I find that alot of that income can be offset with expenses. For example, talk to a CPA or tax accountant, but I’m sure that is much opportunity to offset that Air B&B income with pro-rata housing expenses necessary to generate that income. That’s not expense free income. I don’t Air B&B, but I’ve been a landlord for several years and cash flow a lot, but recognize very little taxable income. and I’m nowhere near as aggressive in claiming expenses as some landlords I know.

That’s a significant amount of debt, but you have a great plan for paying it off and your wife’s salary will help tremendously in paying it off quickly!

Without a doubt! Salary is definitely key. It’s pretty much impossible to pay off debt really quickly without a high salary.

I agree with Erik that you guys will crush that debt. It definitely helps that she’ll be earning a great income and you guys are already used to living on one income. I’m pretty sure keeping lifestyle inflation in check won’t be that big of an issue.

We hope not, but the lifestyle inflation is something that’s hard to avoid. Our house isn’t the fanciest house, and if we’re starting to bring in huge amounts every month, it’ll take some definite willpower to not blow it all on a giant house or something.

You’ll crush it without a doubt! Your frugal habits will catapult you to greater and greater heights after you are debt free!

Thanks Erik! That’s what we’re hoping for!

Good luck with paying down another round of student debt! I’m sure it will be easier the second time around, especially if you can commit one income solely to debt reduction. Congratulations to Mrs. FP on her studies and good luck to her as she starts to practice!

We’re definitely hoping that we can continue just living off one income. Considering that’s pretty much what we’re doing now, it seems like it should be possible to just keep the status quo and keep living on one income. Then when we’re done with that debt, maybe we’ll just bank my entire paycheck and live off her income.

Yes the single best advice when we were your age was to put every raise and bonus into savings, and act like you still make the same amount (which I now understand is called lifestyle creep). It was hard for us in NYC where there was constant pressure to travel, upgrade housing, etc. We have managed to keep our housing cost and spending at the same level for 10 years through 5 moves, 2 kids and quadrupling our salary. We managed to pay off a private undergrad education, a PhD and an MBA in 5 years this way so it is attainable as long as you don’t pay attention to your friends who say “don’t you have enough money by now to buy a nice big house?”!

That pressure is ridiculous when you’re two professionals who’ve never earned any income. You can see how it happens. My wife won’t earn her first paycheck until she’s 32 years old. By then, a lot of people are already in nice houses and living pretty well. It’s hard not to just immediately jump into all of that when you’ve been deprived of it for so long. The problem is, if you do that, you’re definitely setting yourself up for trouble or at least adding unnecessary stress.

Don’t worry, Panther. You’ve crushed this once, now you get to double-team her debt. Financial Panther Pack for the win!

Debt is certainly to be aboided and crushed but is a useful tactic. In your case you now have lawyering skills. She has a dental practice in exchange. I took out a loan when purchasing my car. (Financial Independence community gasp) In exchange for .9% interest I’m able to (and have been) dropping that money into savings accounts. Not Preferable emotionally, but I can’t argue with Math.

Yeah, I’ve had debates about the interest rate arbitrage game. For me, just getting rid of debt makes things so much simpler, but I can see the value of keeping the cash on hand in playing that spread.

Given the expected household salary I agree it shouldn’t be too difficult to repay it quickly. Congrats to Mrs. FP for keeping that debt relatively low compared to the average dental student.

Which dental specialty has she chosen?

She got lucky to keep that debt low and there are some personal circumstances that let her do that. She’s going into periodontics, which is basically gum surgery.