I’ve often lamented about getting a late start in the savings game. Unlike many of my peers that went into the workforce at 22 years old, I opted to head off to law school (and goofed off for a year before doing that). Choosing this path meant that I had to take out nearly six figures worth of student loans and made it so that I earned essentially no income for the majority of my twenties. By the time I started my first job, many of my friends had already been in the workforce for 4 or 5 years.

When it comes to late starts though, I don’t think anyone can beat my wife. She spent five years in college, another four years in dental school, did a one-year general practice hospital residency and is now currently in year two of a three-year specialty residency. For those of you keeping track at home, that’s 8 years of post-college training! And unlike medical residencies, most dental residencies pay nothing or offer their residents a tiny stipend (usually a few thousand bucks a year – my wife made about $4,000 total in 2016). By the time Mrs. FP earns her first real paycheck, she’ll be 32 years old. Oh, and she’s also got a healthy six figures of student loan debt to boot. Quite a position to be in at 32 years old.

Going a decade without an income isn’t great for anyone financially and it’s especially worse when you come out of it with a ton of debt. It’s why any medical professional or lawyer needs to be super aggressive with their savings and debt crushing plans. When you’re starting off your working career so late, saving 10 or 20 percent per year just isn’t going to cut it.

The good thing though is that if you opted for a professional degree, you’re hopefully going to be in a position where you can earn much more than an average income. You need to treat that income wisely. How you use it right off the bat and the way you think about that income is going to matter a ton.

So for us late starters out there, the options are pretty simple. We can give up and blow all of our money. Or we can roll up our sleeves and play some catch up.

The lucky thing is that given how compound interest works, playing catch up is pretty easy.

The Doubling Penny Example

My favorite way to demonstrate the power of compound interest is through the example of the doubling penny. Basically, this hypothetical asks you a question – would you rather have a million dollars right now or a penny doubled every day for 30 days?

Without much thinking, most people would opt to take the million dollars upfront. A penny is such a tiny amount that it doesn’t seem possible for it to turn into more than a million dollars, even if doubled every day.

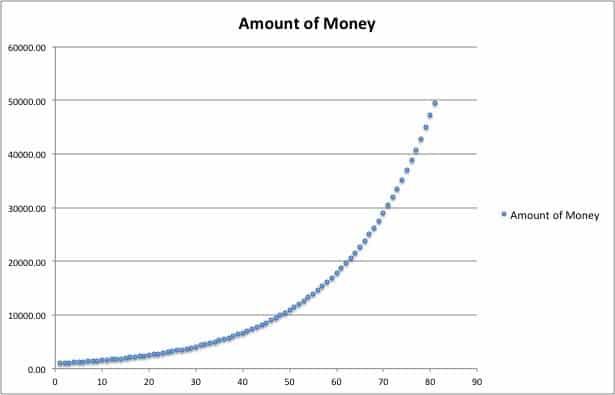

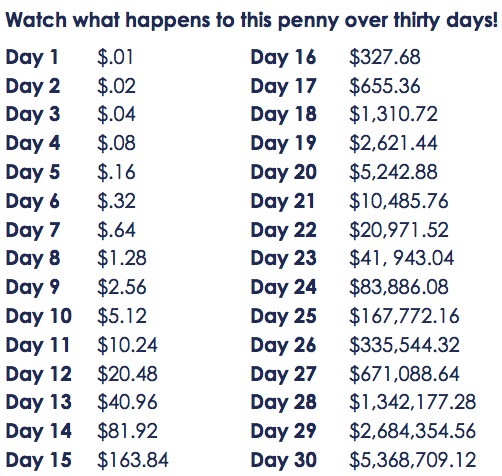

Of course, a question that simple must have a trick answer, and indeed it does. Just take a look at the doubling penny in action:

Turns out that the penny doubled every day for 30 days becomes well more than a million dollars. By day 28, your penny has already become more than a million dollars. By day 30, your penny has turned into $5,368,709.12. It really goes to show you just how valuable compound interest is.

So what does this mean for someone like me who is getting a late start in the savings game?

Compound Interest Doesn’t Matter Early On

The power of compound interest is an amazing thing. It can turn pretty regular sums of money into enormous sums of money. It’s how that penny can go from a single penny to over 5 million dollars.

The good thing for us late starters, though, is that compound interest doesn’t actually do all that much in the beginning It’s hard to think about it, but money doesn’t grow in a linear fashion. Instead, it’s exponential. If you let your money grow over a decent period of time, it’ll probably look like the graph below:

You can see that at the front at the beginning of the line, growth is slow. The amounts are just too small for compound interest to do a whole lot. Sure, your money is still growing, but not at huge clips like it’ll do later on in life. The exponential power of compound interest just hasn’t had the time to take hold yet.

This is good for us late starters though. It means that it’s possible for us to save aggressively and get ourselves right back into the same position as our peers that have been able to save for much longer.

It’s Easy To Catch Up

Let’s go back to the doubling penny. You can see that in those last few days, the penny is just too far ahead for most people. Anyone getting started at that point will have a hard time catching up to that penny.

But if you’re a late starter, it means you’ve got an incredible opportunity to get yourself right back on track early on. Five days in and the penny is worth just a few cents. By day ten, that penny is still worth only five bucks. That means playing catch up isn’t all that hard. If by day ten, you find yourself wanting to get in on that doubling penny action, all you need to do is save up five bucks as fast as you can.

That’s how my wife and I look at our savings plan – it’s a game of catch up. Sure, we’re starting out our savings journey late. I didn’t start aggressively saving until 2016. My wife hasn’t really been able to save anything since she’s never earned a real income. But the nice thing is, we’re only five to ten years behind most of our peers. Even someone who has maxed out their 401k since graduating college (which I think isn’t very likely for most people), would have put away about $180,000 over the last ten years. That’s a huge number, sure, but it’s not an insurmountable amount. All we have to do is put away $60,000 per year for 3 years to end up right at the same level as someone who’s been saving fairly aggressively for a decade. Save $100,000 per year and we’re potentially ahead of the person that’s been saving a good amount for their entire 20s. Considering that we should be earning well into six figures as a lawyer and dentist couple, that type of saving isn’t an impossible thing to do. And it’s not necessarily impossible for other folks either that are coming from similar backgrounds.

What You Need To Do

- Don’t succumb to lifestyle inflation. Without a doubt, falling into lifestyle inflation will destroy you. You see medical folks and big shot lawyers do this all the time. Instead of living like a student early on, new grads snag that first paycheck and then go to town with it. Some buy a huge house. Others get the luxury apartment or the nice cars. You cannot do this if you want to catch up to your peers financially. It’s much easier to keep the status quo then it is to downgrade your life. If you upgrade your life right away, you’re going to have a hard time cutting back in the future.

- Stay humble. Remember, even if you’re a big shot lawyer or doctor, you’re starting off way behind everyone else. Your friends have had years to build their careers and save money. You just got your first paycheck. Keep that perspective in mind. I think if you stay humble, it makes it much easier to avoid the problems of lifestyle inflation and to be happy with what you already have.

- Invest aggressively. No doubt about – you need to play catch up. And the only way to do that is to save as much money as you possibly can. This can include paying off debt aggressively as well. Remember that saving 10% or 15% of your income isn’t going to cut it when you just got your first paycheck in your late 20s and early 30s. If you’re trying to catch up, you need to be saving more like 30% or 40% of your income. If you can swing it, saving 50% or more of your income is ideal.

I’m still bummed that my wife and I are starting our savings journey so late. But the more I think about it, the more it doesn’t seem so bad. My wife and I are only 30 years old right now. The mighty power of compound interest probably hasn’t taken hold yet for most of our peers. It means that even though we’re behind, we should be able to catch up pretty quickly.

Interesting topic! I’m a late starter, too when it comes to career and personal finance. I was working for the government and traveling the world (a couple of years here and there). I didn’t come back to the states until 31 and started thinking about my career (and life) goals, while my peers had been practicing law for a few years. I then went to B school at 32 and got a finance MBA with close to six figure in debt. But a few years later now, I’m debt free and just got a promotion making decent income (I work in a large consultancy).

So my question is what to do with your extra savings. Say I want to save aggressively, like 30%- 40%, or even 50% of my income. Only 10%-15% can going into (401)K and IRA, given my income level. I have an account with E*Trade but am considering better options.

It seems like every high school kid in Canada who’s ambitious wants to be a doctor. Most family doctors don’t make that much money!

After years of school and residency, they graduate with hundreds of thousands in debt. Then Canada caps the family doctor’s pay at $200k.

If you have your own office and hire a secretary, prepare to shell out $80k a year. So really you’re only taking home $120k a year before taxes. Then you got to pay back all the student loans, equipment costs, and account for the years that you weren’t working.

It’s an interesting topic and something I may talk about in the future – basically, it seems like a lot of us are sort of pushed towards certain types of jobs. It’s why I became a lawyer – I didn’t really know of any other types of jobs. These jobs are obviously good careers, but there are so many more options out there than just doctor or lawyer.

I think we’re on the same page today. I also got a late start due to 3 years of goofing off (just posted a similar story) and did basically the same as you to catch up. The compounding factor is interesting, and not something I thought of immediately. But I think it’s true! For a long while, my money grew so so slowly because there wasn’t much to grow, but once you reach 100k it just kind of blazes past, which is super fun to watch.

With the salaries you and your wife will be making, you’re definitely gonna be alright.

Oh no doubt, we know we’ll be alright! Just gotta not let the lifestyle inflation happen.

Exponential growth is difficult to wrap your head around, but the Exponential Hydra is real. There’s a turning point somewhere in the exponential chart where, like a ballon filling with helium, gravity lets go and it floats off on its own. That’s the moment the FI community is saving for. You bring up a great point that the demon is getting to that point. Whether right away or over time, trip that switch and with low expenses your money army is marching on its own!

Nice way to think about it! I’m just waiting to hit that point one day.

Yeah. It really depends on what profession you enter. I have a friend who worked in the art industry until age 28, went back to school for 1.5 years for a post-bac, entered medical school (5 years), and neurosurgery residency (8 years) and is currently in fellowship. Doesn’t look that great.

Yup, the remuneration is pretty good but boy the lifestyle is also pretty rough.

Yeah, it’s crazy, BUT, at least they’re getting paid during residency. Sure, they’re only making 50k or whatever, but that’s still a respectable income (about median for the US). The dental world is rough for those that choose to specialize in non oral surgery fields because you have to go an extra 3 or 4 years and make literally no income. In fact, making matters worse, they actually make you pay tuition!

Great point, FP! Being able to throw gobs of money into investments can make a huge difference real fast! I’ve been on both sides of the penny myself. I started saving right away, but with a small salary it didn’t amount to much for quite a while. But with a couple promotions and fortunate advancement in my career I’ve been able to throw six figures into investments for the last four or five years. Couple that with a solid investment plan and the accounts can grow quite quickly.

You folks are definitely focused on the right aspects and will be catching up very quickly indeed! Keep up the great work!

Thanks GS! Hopefully, we’ll be following in your footsteps one day and throwing tons into our investments.

Your article is spot on and what many people struggle with. I’m just starting to see the space shift lift off the ground. Three years ago I was at $150,000 and now I’m pushing $400,000 and those dividends are really starting to move the needle on my investments. Outside of my 401k where I don’t actively track dividends I’m pulling in $500 a month where a few years ago it was only a $1300 for the entire year.

That’s amazing! That’s what’s nice about compound interest for us late starters. Even though a lot of my peers are so far ahead, it’s not that hard to just buckle down and catch up.