Whew! I just got back from a week at FinCon, so I am absolutely exhausted. Still, this blog doesn’t sleep, so I’m back today with another Financial Panther Side Hustle Report!

If you’re a new reader, the basic gist is that each month, I document exactly what I made side hustling using various sharing economy and gig economy apps.

I think there’s a lot of value in working in different gig economy apps into your life, but for me, the biggest thing is that it gives me a good base to work from while I continue building this blog and working on earning a living as a writer and content creator. It always amazes me how much I’m able to bring in each month from doing all of these different gigs.

With that background out of the way, let’s take a look at what I earned this month from side hustling in the sharing and gig economy.

Side Hustle Income for August 2019

- Airbnb: $905

- Rover: $510

- Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub: $432.07

- Wag: $119.70

- Bird/Lime: $764

- Shipt/Instacart: $273.29

- Selling Trash Finds/Flipping: $106.12

- TaskRabbit: $68

- Job Spotter: $21.53

- Gigwalk/EasyShift/Field Agent/Observa/Merchandiser: $91

- WeGoLook: $19

- ProductTube: $10

- VoxPopMe: $15

- Google Opinion Rewards/1Q/Surveys On The Go: $21.56

Total Side Hustle Income for August 2019 = $3,356.27

August ended up being a pretty good month on the side hustle front, especially when you consider that I took a week off to go traveling. My wife and I have found ourselves pretty cooped up this year, so we decided to head up to Alaska for a week to do some hiking and see some natural landscapes. The highlight of the trip was a long hike we did on the Harding Icefield Trail, which led to an amazing view of the Harding Ice Field in Kenai Fjords National Park.

Getting back to the side hustles, I ended up making over $3,300 from 14 different income sources in August. Income was split up pretty evenly between Airbnb, Rover, Lime scooter charging, and deliveries, with the remainder of my side hustle income coming from other miscellaneous gigs.

You’ll notice that this month I also added a new gig into my side hustle arsenal – grocery deliveries via Shipt. This is an app that I’ve been meaning to try out for a while but just never got around to actually doing. I have some experience with grocery deliveries from trying out Instacart back in the day, but that gig never really worked out very well for me. Shipt, on the other hand, fits in surprisingly well with my lifestyle and I find it oddly fun to do these grocery deliveries. I’ll go into more detail about my experience with Shipt later in this post.

With all that said, let’s take a more in-depth look at my earnings for the month.

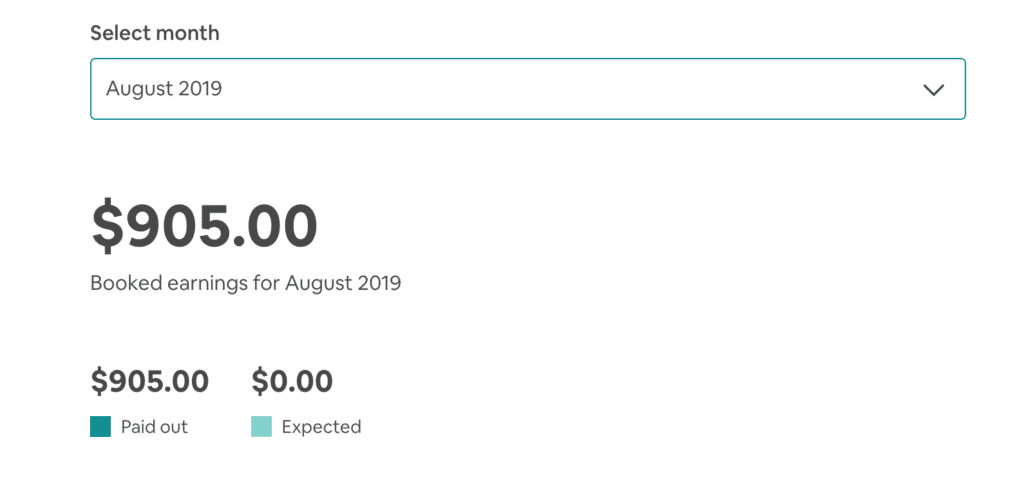

Airbnb Income: $905

I had a solid Airbnb month with over $900 of income from renting out a room in my house on Airbnb. This is actually a bit lower than what I’ve earned in past years. Typically, August ends up being a high earning month for me because my wife and I usually end up hosting a college kid that needs a place to stay for a week or two while they’re between leases. For whatever reason, that didn’t happen this year.

As noted earlier, my wife and I went on a week-long trip to Alaska towards the end of the month. One of the things I always try to do is to get my place rented out during those trips. It works out because then our house – which would otherwise sit empty – generates income for us while we’re gone.

I ended up getting a booking for the week that we’d be gone, but the guest ended up canceling their reservation a few weeks before their stay. Someone else then booked for a single night during that week we’d be away. This meant that I had to block off the other nights since I wouldn’t be around to clean the room for new guests. As a result, we ended up with our house sitting empty for almost the entire time that we were on vacation. Bummer.

All in all, August was a good month. The interesting thing is that the interest and principal on our mortgage payment adds up to a little over $10,000 in a year. This year on Airbnb, we’ve already earned more than $10,000 in bookings. That’s pretty incredible for what is ultimately just us renting out one room in our house to occasional guests.

- If you have extra space and want to earn extra income using your home, you can sign up to be an Airbnb host using my referral link.

- Airbnb is also one of the most affordable ways to travel. If you’ve never used Airbnb, sign up for Airbnb with my link and you’ll get $40 off your first stay.

Rover Income: $510

August was surprisingly lucrative on the dog sitting front. I ended up watching two dogs in August – both repeat clients. One was an old dog named Cooper that we’ve been watching regularly for the past two years. He’s 16 years old now and still in great health, but I always get a little nervous watching him given how old he is.

The other pup we watched was Watson, a Toy Poodle that we’ve also been watching for about two years now. He stayed with us for almost two weeks.

This was an easy Rover month, as we’ve watched both of these dogs for a really long time and they fit into our life pretty well. It’s really not much work for us to watch either of these guys.

I think of dogsitting as a pretty passive side gig, primarily because I already have a dog. This means that I don’t really have to change anything about my day-to-day life since I already have to walk my dog and do all of the other regular dog care tasks in my life.

If you’re in a similar situation, Rover is definitely something you should look into. You can sign up to be a dog sitter on Rover using my referral link.

Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub Income: $432.07

August was a pretty average month on the food delivery front. Here’s a breakdown of my food delivery earnings in August:

- Postmates: $100.74

- DoorDash: $190.29

- Uber Eats: $72.69

- Amazon Flex: $0

- Grubhub: $68.35

It was a pretty even breakdown between all of my delivery apps, which should come as no surprise given my strategy of using all of my delivery apps at the same time. The idea is that you want to get multiple deliveries all going in the same direction. If you do this, you’ll be able to drastically increase your earnings because you’re able to essentially double up on all of your deliveries.

My interesting delivery story for the month was how I ended with $100 of free food from Noodles & Company. I picked up this order that had a delivery address with a street name but no house number. The customer didn’t have a working phone number and so, after speaking with support, I was told to bring the delivery to the location on the map and mark the order as delivered. I went ahead and did that and then came home with multiple containers of pasta.

I don’t think anything tastes better than free food!

Wag Income: $119.70

I made more on Wag than I expected this past month since I really didn’t feel like I did many dog walks. I’ve mentioned this before, but I find dog walking worked better for me when I had a full-time job and walked dogs during my lunch hour. These days, since I have a much flexible schedule, I find that I can make more doing deliveries. Most of the time, I’m just doing Wag walks when I see an interesting dog that I want to walk or when I think it makes sense with my schedule.

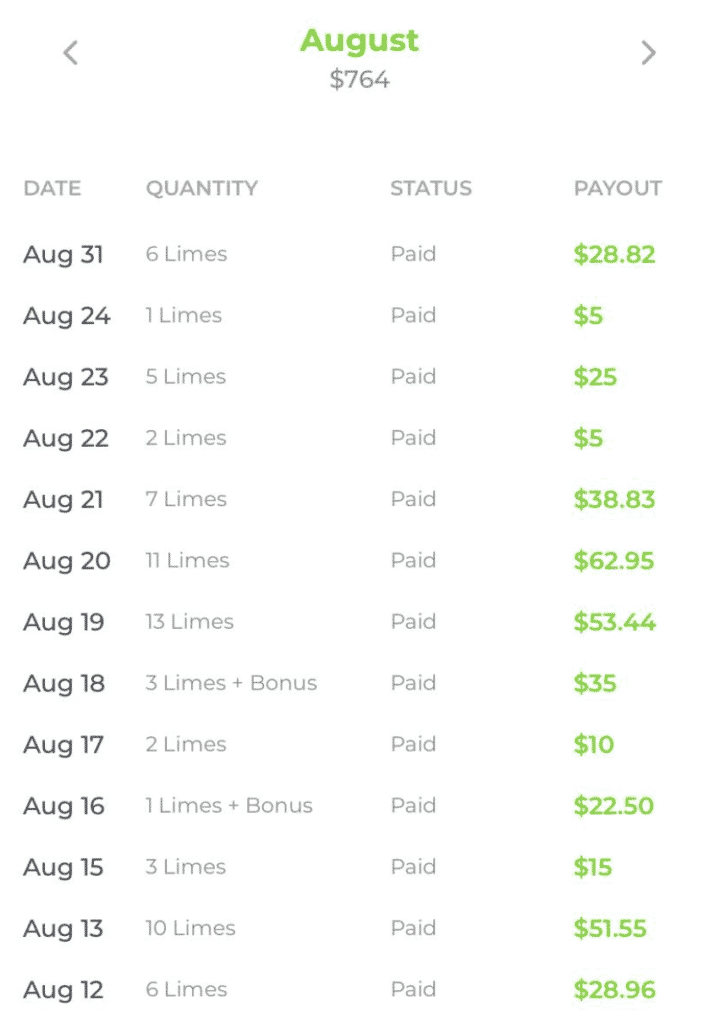

Bird/Lime Scooter Income: $764

The scooter game continues to be off the charts and it’s just crazy to me that I can make close to $1,000 per month just picking up scooters around my neighborhood.

I’m currently capped at charging 6 scooters at a time, so most evenings, I’ll just walk around my neighborhood, grab my 6 scooters, then drop them back off in the morning. It typically adds up to $30 per day and takes me 15-30 minutes to do. $30 per day might not sound like much, but when you do the math, it adds up to $900 per month, which I think is significant for most people.

I was also lucky enough to show off my nightly scooter routine to some of my online, money friends. I attended CampFI-Midwest over Labor Day Weekend and my friends, Leif from Physician on Fire, and Stephen Baughier from CampFI stayed at my house for an evening before the camp. We went to the Minnesota Golden Gophers football game and after the game, Stephen and I needed to hitch some rides home. Since it was nighttime, there were dozens of scooters that needed charging just sitting outside of the stadium. We ended up grabbing a few scooters to get us home, then grabbed a few more that were on my block – a quick $30 all while going home from a football game.

I wrote a post a while back that really goes into deep detail about how this scooter charging hustle works. Make sure to give that a read to learn more about it. Depending on where you live, this is something that you should consider doing too.

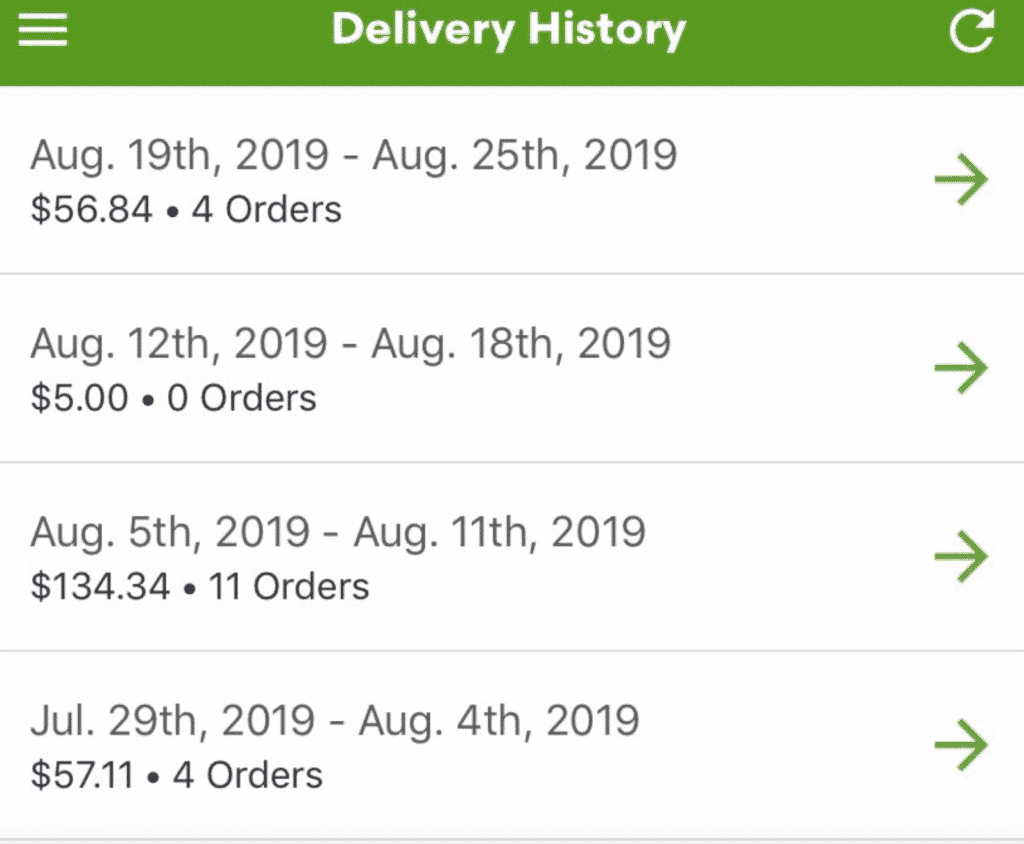

Shipt/Instacart Income: $273.29

I finally added a new gig into my side hustle arsenal – grocery delivery with Shipt. It’s been a while since I’ve added a new gig to my monthly routine. I’ve actually tried out grocery delivery in the past with Instacart, but I found that Instacart didn’t work out very well for my situation since it required me to sign up for shifts and I couldn’t just pick and choose what deliveries I wanted to do.

Shipt though has actually worked out very well for me and is something that I can see myself consistently doing. My coworking space is located downtown and it seems like there are a ton of deliveries at the downtown Target that I can do. Importantly, the delivery distances are short enough that I’ve been able to do all of my deliveries on my bike – it’s mainly doing deliveries to office buildings located just a few blocks away. I could actually do a lot of them on foot if I wanted to.

I’ll likely write up an entire post to explain how Shipt works and my thoughts on it, but right now, I find it strangely fun to pick up groceries for people. I’ve also noticed that I’m getting much faster at doing it since I’m starting to learn where everything is in the store.

Keep an eye out for a more in-depth post in the future about my experience with Shipt and who I think it might make sense for.

Trash/Flipping Income: $106.12

I’ve been getting weak in the trash and flipping game, but I still always seem to manage to sell a few things each month. On the trash front, my lone sale for the month was a dog kennel I found while I was on a walk with my nieces. Most people don’t realize it, but kennels are actually really expensive. I ended up selling this one for $30 within a few days of listing it up on Facebook Marketplace.

On the flipping front, I ended up making a few sales on eBay. One sale was a Columbia Winter Jacket I found earlier this year at the Goodwill Outlet. I picked this jacket up for about $3 and it ended up selling on eBay for $30. Not a bad return on my investment at all.

My other interesting sale for the month were these hats I got for free at the X-Games. I’ve mentioned SoFi Events before, but if you haven’t heard of it before, these are basically fancy events put on by SoFi for SoFi members. I’ve been getting tons of free stuff from them over the years, and in August, my wife and I ended up with free tickets to the X-Games, along with access to the VIP lounge (or XIP lounge, as the X-Games calls it). We also received these free, limited edition X-Games hats, which I ended up selling on eBay for about $25 each.

So, in the end, I got to go to the X-Games, eat free food, and I made money to boot. Not bad at all.

TaskRabbit Income: $68

I ended up doing two gigs on TaskRabbit in August. One of the gigs involved delivering a card and champagne to someone’s parents at a hotel downtown. That gig was easy enough to complete. I just went to the Target that I was doing Shipt deliveries at, bought the champagne and a card, then dropped it off at the nearby hotel. That earned me a solid $17.

I also did a gig for a startup that wanted to verify that the marketing materials they had sent out had been put up by the various businesses they sent them too. This gig required me to bike around downtown and check on a list of restaurants. It wasn’t the most fun task to do, but it wasn’t particularly hard to do either. It was really just more time consuming then I expected.

TaskRabbit is something I continue to keep active just to see if anything interesting comes out of it. I sort of like how you never know what might come up on it.

Job Spotter Income: $21.53

It’s business as usual for Job Spotter. I’ve read reports that some people are finding the payouts to be less than they were before, but I haven’t personally noticed that on my end. I continue to earn a consistent $20 or so each month without a lot of work. Read my review of Job Spotter if you’re looking for more info about how the app works and why you should use it.

Gigwalk/EasyShift/Field Agent/Observa/Merchandiser Income: $91

Below is a breakdown of my earnings on each of these picture taking apps in August:

- Gigwalk: $0

- EasyShift: $0

- Field Agent: $68

- Observa: $0

- Merchandiser: $23

Field Agent was very lucrative last month because they had a bunch of gigs where you took pictures of certain apartment buildings. Each one of those gigs paid at least $7 and only took me 5 minutes or so to complete, which made them very worthwhile to do.

I also did a number of Merchandiser audits this month. My strategy with Merchandiser is to only do gigs that do not require me to interact with anyone. Merchandiser worked out really well for me this past month because the available gigs were at the same Target that I was doing my Shipt orders at, so I was able to do them while I was doing my grocery deliveries.

These picture-taking apps have a bit of learning curve, but they can work out once you figure out which ones are worth doing and which ones to ignore. I’ve been doing them since 2016, so that’s how I’ve learned how to best use these apps.

WeGoLook Income: $19

WeGoLook was slower in August, but still pretty easy to do given the way I live right now. As tends to be the case, I completely forgot what gig I did, but I assume it was taking pictures of someone’s car and then sending it off to the insurance company (via the app). Whatever it was I did, it wasn’t memorable enough for me to even remember it.

ProductTube Income: $10

I seem to regularly make a few bucks per month from using ProductTube. This is a little known app that is definitely worth downloading on your phone. You make money from this app by doing video reviews of certain products while you are out shopping. Each video is only 5 minutes long at most and typically pays between $5 and $25. That adds up to a nice hourly rate when you do the math.

The only issue with this app is that you have to make these videos while you’re in public, which can often feel weird and uncomfortable. I find that no one notices me since I just wear headphones while I record my video and people just assume I’m talking on my phone. It’s really up to you and how comfortable you feel making videos in public, but to me, it’s not too big a deal.

VoxPopMe Income: $15

I cashed out $15 this past month from my VoxPopMe account. This app is another one of those market research type apps where you are asked to respond to a question and then record a short, 15-second video response on your phone. Each video earns you 50 cents, so that’s a very good return on your time. You can cash out after you hit $15 in your account, so this represents a couple of months of earnings.

Google Opinion Rewards/Surveys On The Go/1Q Income: $21.56

It was another pretty solid month from these little survey apps that I keep on my phone. Here’s the breakdown of my earnings on each survey app:

- Google Opinion Rewards: $8.79

- Surveys On The Go: $11.02

- 1Q: $1.75

What makes these survey apps different from your typical survey websites is that the surveys are really short, often 4 questions or less. Google Opinion Rewards is the best of the bunch, but Surveys On The Go is surprisingly easy and good as well. 1Q can be hit or miss, but they give you a quarter to answer one question, so I leave it on my phone and collect my couple of cents each month for basically a few seconds of work.

And that concludes the August 2019 Side Hustle Report!

August was a busy month with a lot of time where I really couldn’t hustle too much. I basically had the first three weeks of the month to do my thing and then spent the remainder of my month traveling and attending financial events.

Despite that, I still managed to make over $3,000 doing a bunch of different stuff. These gigs really provide a nice floor for me while I continue my transition to self-employment and work on building up this blog.

I hope this post was helpful to you. If you have any questions about how these gigs work or how you can do the same thing, feel free to let me know in the comments below. Have a great month everyone!

Great job! I’m getting ideas from this post, so I’ll have to try to implement some more side hustles. I get lazy about it, but it’s because I can make money just working extra hours at my regular job. I had been planning to try Rover, so I think I’ll check that out again.

Nice meeting you at FinCon!

Great to meet you too!

I kept thinking of you at FinCon as I walked around/tripped over the bazillion scooters 😀 Glad to see you’re still doing amazing things side hustling!

Thanks! Those scooters were all cash money!

Need a new side fun money gig for fall. A little 😢 to see the base rate in Minneapolis to go down from $5 to $3.80 so scooter. With a few $10 treasures thrown in so people aren’t so mad. It’s easier now to skip that hustle unless over $5- I am not tempted. Because it’s not fun. But have been keen to get the the $7-$10 scooters 🛴 when they pop up. Less work.

Have you ever looked into becoming a notary, or is this prohibited since you’re a lawyer?

I can become a notary. Don’t know how to make money doing that though.

You’ve talked about mystery shopping before. Why don’t you include it in your monthly reports?

Good question. Most of the mystery shops I do either only reimburse me for my meal or the reimburse me some amount and then “pay” me an amount that basically equals what my meal costs. So, I don’t really consider that income, since what I’m getting paid is just covering the cost of my meal.

The only time I do include my secret shopping income is when I’m reimbursed for my meal and the payment I receive is more than the cost of my meal. That only really happens at a select few fast food places, where I’m reimbursed like $10 for my meal and then they also pay me $8 or so as my fee.

If I did include secret shopping as side hustle income, then it’d be something like $200 to $500 of “income.” But again, since it’s just reimbursing my meal costs, I don’t think of it as income.

FP, you are doing well on the secret shopping side! I’m beginning to follow your lead and have now expanded into multiple platforms mostly with restaurants but have recently tried some retail secret shops and have found these very interesting. I do like doing ones I can repeat though as any secret shop on its own has some prep time involved with very specific report requirements.

In a way I agree that it’s not income per se (not talking from income tax perspective), esp on reimbursement only shops, but you are getting value – paid meals and other things. I think people would be interested in this like your normal sidegigs. Consider capturing as a separate category of value other than income, food for thought (ha, ha). Keep leading the way!

Retired Guy, I completely agree! I have begun doing mystery shops and am enjoying them too. They are very detailed but also fun.

And I agree, there is value to free food even at inflated prices.

I think that’s a good idea and I’m going to consider throwing this into my next side hustle report towards the end just so people know (and I can know) how much free food I ate.

Love reading our side hustle posts – and progress – for the hustles with a low income, are you expected to file taxes?

Yes, I just put everything onto a schedule C.

Do you pay quarterly taxes? Or pay when you file?

When I had a day job, I would just pay when I filed since I could cover most of my tax bill via my job withholdings. Now, I pay quarterly.

W.r.t. Airbnb, how do you make the decision the to rent for one night vs. turn that offer down and hope someone subsequently rents for a longer period of time? I don’t have any numbers to back up my statement but I think I would have rejected the “one night stand” hoping for a longer-term rental. You don’t say when you accepted the one-nighter’s reservation so if it was the day before you were leaving for vacation, I would probably have done the same thing. If the first guy cancelled “their reservation a few weeks before their stay” it would seem like that would be enough time to get a multi-night booking.

So, I have instant book set up which means that guests that have good reviews already can book instantly without having to request that I accept. I should have changed it to a minimum stay for those dates, but I forgot to do that. And I can’t cancel on a guest once they book without facing a penalty. So, it was just my mistake that cost me. Live and learn.