One of the mistakes a lot of people make when they first start side hustling is mixing their side hustle income and their day job income into their main checking account. Aside from the obvious administrative hassles that come with doing this, the biggest problem really has to do with the fact that your main checking account just really isn’t designed to handle things beyond your typical paychecks.

It bears repeating because I think a lot of people forget this, but the money you earn from your side hustle isn’t the same thing as a paycheck. No matter what it is you’re doing – even if it’s just the simple gigs I do like dog walking and delivering food – you need to think of your side hustle earnings as business income. You can’t just treat your side hustle income like it’s a paycheck. Rather, your paycheck is ultimately what you decide to pay yourself after you’ve taken care of expenses and taxes.

Because of how side hustle income works, it’s important to create systems so that the money we earn from our side hustles can flow to the appropriate places.

I tend to think of side hustle income as flowing into three places:

- Business Expenses

- Taxes

- The Money You Pay Yourself As Your “Paycheck”

So, if you make $100 side hustling, you need to divide that up. Some of it needs to go to taxes. Some of it goes to business expenses. And once those two things are taken care of, the rest can be paid out to you like it’s your paycheck. Most people forget about those first two things and instead, skip right to the paycheck part, treating the entire amount they earn from side hustling as their own money. And this can lead to issues later down the line.

For a long time, I had a really simple system in place since I didn’t actually spend any of my side hustle income. In my simple system, all of my side hustle income simply went into a sub-savings account that I created with Capital One 360. At the end of each year, I paid my taxes using that account, then put the rest of it into a Solo 401k that I opened with Fidelity.

Things have recently changed however since I quit my job to go all-in on this blog. Instead of being bonus money, my side hustle income is now money that I might actually need to use in order to cover my living expenses. As a result, I’ve had to create a new system to appropriately handle this flow of money.

In today’s post, I want to go over the system I’ve set up to handle my side hustle income and explain how it works. If you’re a side hustler, I highly recommend that you either use my system or set up a system similar to this. The important thing is you need something in place to manage your side hustle income and make sure it’s all going to the appropriate places.

How To Manage Your Side Hustle Income

At the outset, there are three main things you need in order to properly manage your side hustle income.

The first is a bank account dedicated solely for your side hustle income. All of the money that you make from side hustling should go directly into this bank account first. Think of this bank account as your side hustle inbox. All of your side hustle money goes in there and then you need to figure out what to do with it. Does it stay in there? Does it move somewhere else? That’s up to you to decide. This bank account should only be used to pay for business expenses (you’ll pay your personal expenses from your normal, personal checking account, discussed below).

The second thing you’ll need is a separate bank account for your taxes. A lot of people that start side hustling forget this, but in general, when you’re side hustling, you are your own business and you are the one responsible for paying taxes. The big mistake a lot of people make is spending all of the money they make, then finding out that they owe a bunch of taxes at the end of the year with no way to pay for it. Don’t let that happen to you. Whenever any money goes into your side hustle bank account, some of it needs to go into your tax bank account.

The final thing you need – and this is probably obvious – is a checking account that you use for your personal expenses. This is basically your primary personal bank account and the one that your paychecks go into and that you pay your personal bills from (rent, mortgage, utilities, food, etc). When you “pay” yourself from your side hustle, you should be paying yourself into this bank account, just as if you were paying yourself a paycheck.

A bonus thing that isn’t required, but that you should consider utilizing, is the Solo 401k. This is essentially a retirement account that you create for yourself. I’ve written about this “side hustler’s bonus retirement account” before and I’ve also walked through how to set up a Solo 401k with Fidelity in this post.

An example might help to clarify the above:

- If you make $100 from side hustling, it should first go directly into your side hustle bank account (i.e. your side hustle inbox). Any business expenses should be paid directly from that bank account.

- At least 1/3 of that $100 should then go into a separate bank account designated just for your taxes. You’ll use this bank account to pay taxes either quarterly or at the end of the year.

- Finally, whatever is left over can then be transferred to your personal checking account as a sort of paycheck to yourself. From that paycheck, some percentage of it should be set aside to fund your Solo 401k.

With all that said, there are two primary apps that I use in my money system that I want to share with you today:

- Chime: A free checking account that I use for my side hustle income.

- Catch: A free savings and benefits app for independent contractors that I use to automate my taxes.

Below is an explanation of what these apps are and how I utilize them.

Chime: My Primary Side Hustle Checking Account

My current primary checking account that all of my gig economy stuff goes into is Chime. I initially opened this account purely because it offered a $50 account opening bonus, and initially, I had no plans to actually use this account for anything. (As a side note, just like with credit cards, banks will often offer signup bonuses if you open a new account with them and meet certain requirements. You can make a good chunk of money by taking advantage of these offers, as I’ve written about in my ultimate guide to bank account bonuses.)

Of course, this is why bank accounts offer these signup bonuses, because their hope is that you’ll like their stuff enough that you end up becoming a customer. That’s exactly what happened with me – I ended up liking Chime’s interface, and since I needed a dedicated checking account for my side hustle income, I decided to give them a shot. Chime had a couple of things that appealed to me:

- No fees of any sort;

- A very good app and web interface; and

- Money posts into the account 2 days early, making it so that when I got paid, the money would often be there by the next day or even the same day I was paid.

As explained previously, all of the side hustle income I make goes directly into this bank account. The money then either stays in that account, gets sent to my tax account, or is sent to my personal checking account as a paycheck to myself.

You don’t have to use Chime, of course. I just wanted to share the system I use, but you can use any checking account you want so long as it makes sense for you. The important thing is to use a separate bank account for your side hustle income and to make sure that it’s totally free with no account minimums (in fact, I think the free part is basically non-negotiable).

If you don’t like Chime, there are other options you can use. I’ve listed a few below that I think are also good options for a side hustle bank account. They’re all 100% free with no fees and no account minimums.

- Varo (offers a $75 signup bonus if you do a direct deposit of $200 – this can typically be met by doing an ACH transfer from any other bank)

- SoFi Money (offers a $25-$50 signup bonus if you fund the account with $100)

- Lili (a new bank I just found that is created for freelancers and gig workers)

- Ally (probably the best overall bank out there)

- Discover (a good bank account that I use for my Airbnb income)

- Simple (the bank account I use for my personal checking account, but you could use for side hustle income too)

There are way more banks out there that you can use – far too many for me to list them all here. Just pick what works for you so long as it’s a free bank account that does what you need it to do. (Chime is still offering a $50 bonus if you open an account and do a direct deposit of $200 or more. This requirement can be met by doing an ACH transfer from pretty much any bank.)

Catch: The App I Use To Save For Taxes

The secret weapon in this money system is Catch, which is definitely one of the best new fintech apps I’ve found in the past year. I’m not even sure how I found this app, but without a doubt, if you are side hustling, this is something you definitely need to use.

Here’s how Catch works. One of the things you have to remember is that unlike a paycheck, your side hustle income comes to you with no taxes taken out of it. Generally, you need to take at least 1/3 of the side hustle income you make and set it aside so you can pay taxes later down the line.

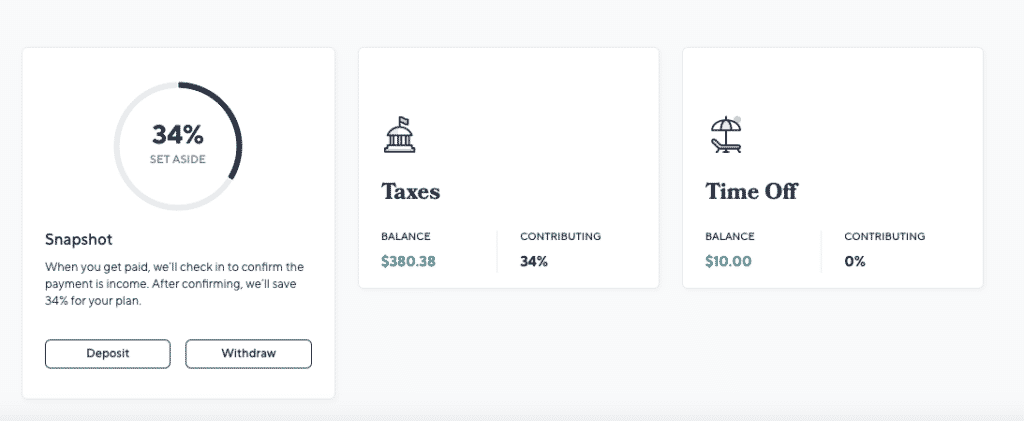

Catch does this automatically for you. To do this, you give Catch some info about how much money you make annually. Catch will then suggest how much it should save for taxes (you can adjust this number as needed). You then link Catch to your checking account and the app will monitor your transactions for you. Every time Catch sees new money come into your bank account, it’ll ask you to confirm if that was or wasn’t income. If you confirm that it was income, Catch automatically pulls money from your checking account and puts it into a separate FDIC insured bank account.

Here’s what it looks like when you get a new transaction into your bank account. As you can see, I recently received payment for one of my gigs and Catch is asking me if this is income.

The big thing is that Catch is free, which is why I started using it (regular readers of this blog know that I’m not a big fan of paying for any fintech products and especially paying for any product that is designed to help you save money). This app is seriously worth using and it makes it much easier for me to save for taxes since I no longer have to manually remember to set aside money for taxes each month.

Putting It All Together To Make The Perfect Side Hustle Money System

I’ve been side hustling for a while now, and this current system of combining Chime and Catch has worked out perfectly for me. All of my side hustle income goes into my Chime account. From there money goes to where it needs to go each day. Catch monitors my income and saves money for my taxes. I pay myself a paycheck from my Chime account to my personal bank account. And then I save as much as I can to a Solo 401k that I’ve created for my side hustle income.

One thing to remember is that the money Catch sets aside for taxes is saved in a saving account that doesn’t earn you any interest. This might not be that big a deal depending on how often you pay your taxes and how much you are setting aside.

My solution to this problem is each month, I simply withdraw all of the money in my Catch savings account, then move it to a separate, high-yield savings account that I set up with Ally. That way, I get the tax automation with Catch, but also earn interest on the money I’m saving for taxes. It takes me only a few minutes to do this each month.

Note that this is the system I’m currently using for all of my sharing economy/gig economy stuff. I use a free business checking account for this blog from Azlo (which I can probably talk about in a future post) and that has its own system.

The key takeaway here is to have a system in place for your side hustle income. Money should be flowing without you having to think about it too much. Take some time to set this up once and it’ll all start working like clockwork.

Interesting, but I feel this is only better for people who need the spending money everyday/week otherwise it’s a lot more work/clicks. Currently I just have all my side hustle income go into an Ally account, and then at the end of the month I check my Mint for how much I made that month from Side Hustles and then transfer the appropriate amount to my Side Hustle Taxes account and the rest to a different account(currently Student Loans)

Yep, it’s definitely more important if you’re actually using the income (which I will soon need to do). It sounds like you have your system in place already, which is very key – most people don’t have any system at all.

With that said, I think Catch is still pretty valuable just because of the automation aspect of it. It takes a few clicks, but you basically just get a notification whenever you’ve been paid, then click 1 button. So basically keeping up with everything as it goes, rather than having to remember each month.

Can you make some comments about being paid in Amazon Gift Card. Both my side hustle of Product Tube and Job Seeker pay in this fashion. Are there any tax implications. What about your general thoughts?

Thank you

Matt

Hey Matt. General rule is that any income – regardless of source – is taxable income. As a result, yes, being paid in gift cards is technically taxable income. You won’t get a 1099 from these apps though.

I had not heard of Chime or Catch so this is very useful. I came to entrepreeurship after a longtime corporate career and my husband was still in corporate when I started (he’s now a consultant like me). So we also kept our traditional brick and mortar bank accounts, and I used our HELOC to smooth out our monthly expenses and then funneled all my consulting income into repaying the HELOC. I paid quarterly estimated taxes so I would catch up on taxes on a regular basis, and before the last quarter I reconciled with my accountant what the actual tax number would be so there wouldn’t be a big surprise. That said, you can only use your HELOC if you have discipline not to overspend.

I’ve read about the HELOC strategy, but haven’t had the guts to try it. Definitely requires discipline, which most of us reading this probably have, but I’m still too much of a newb to understand how HELOCs work exactly. Might be something I need to research.

Hey MPLS downtown friend.

Started the Chime today $50 for you and me . Thank u.

Started Lime charge because I can walk to snd from drop offs as fun exercise game- and adds up. Teaches me the value of $4.50… I won’t buy items now because I know how many limes I have to charge. Good training.

My question is… can I use the Lime daily payment as a direct deposit to meet the $200 requirement and then change where Lime deposits every month??

Thanks!

Hey Pat. My wife seriously laughed out loud when she read your comment about the value of $4.50. Spoken like a true Lime scooter juicer, haha.

So don’t use Lime to meet the direct deposit requirement, because you need to deposit $200 in one transaction, which there’s no way to do that with Lime.

To meet the Chime requirement, just do an ACH transfer from your regular bank account. So whatever bank you use, go to their website and link it to Chime. Then transfer $200 to your Chime account from your bank account’s website. If it triggered as a direct deposit, then it’ll post your $50 immediately. If not, try again with a different bank.

I used Discover and that triggered it. My brother and my wife both used Ally and it triggered for them. The datapoints I’ve seen show that basically any bank transfer will trigger as a direct deposit. Hope that helps. Hit me up if you have questions. My bank account bonus post does a good job of explaining how these work if you need more info.

Yes. Will try again with my TCF and if that doesn’t work – will start the ally account now.

I thought the $200 could be multiple transactions that add up to $200.🤦🏼♀️

Glad your wife appreciates. It is how I explain it to my husband— it not about the $$ – it more about the good habits and having fun.

I look at lime as a game that pays. Saving in chime now so I can spend on gifts and one long term goal. Requires strategy. Keeps me from over spend at Target. It is fun way to see a scooter, reserve it, turn on my Apple Watch to track my walk. Gets me walking to a destination instead of to Trader Jose or Whole Foods… my previous destination walks.

Thx for response.

TCF should work – I think they finally added the ability to link external accounts!

The reserve feature is really big, especially for the casual charger like us. Last year, I basically had to go run to a scooter if I saw it. Now, if I see one nearby, I can just reserve it, then walk over there with my dog.