Happy New Year everyone! No doubt, 2020 was a tough year for everyone and I think we’re all looking forward to a (hopefully) better 2021. But before we get into the new year, we still need to finish one last bit of housekeeping and take a look at what I was able to earn side hustling in the final month of 2020.

For new readers, each month, I document exactly what I earned from side hustling using various sharing economy and gig economy apps (think apps like DoorDash, Uber Eats, etc). Over the years, I’ve figured out ways to incorporate these various apps into my day-to-day life. With the right strategy, I think these apps can be lucrative.

December always tends to be a slower month for me when it comes to these apps, mainly because of the weather and the holidays. The weather slows me down because most of my side hustles are based around me biking outside. I consider myself pretty hardy, but even I’m a little slower and lazier when it’s cold and snowy outside. And on the holiday front, I tend to take a bit of a break from working during Christmas and New Years’.

Still, even with a slower month, I brought in some solid side hustle income. Let’s take a look at what I was able to earn in December 2020.

Side Hustle Income for December 2020

- Airbnb: $0

- Rover: $216.75

- Postmates/DoorDash/Uber Eats/Grubhub: $685.80

- Shipt/Instacart: $9

- Selling Trash Finds/Flipping: $163.82

- WeGoLook: $23

- ProductTube: $160

- TaskRabbit: $17

- Gigwalk/EasyShift/Field Agent/Merchandiser/Observa/IVueIt: $25

- Google Opinion Rewards/Surveys On The Go/1Q: $18.10

- Secret Shopping: $67

- PrestoShopper: $155

- ProductLab: $2

- User Interviews/L&E Research/Respondent.io: $40

Total Side Hustle Income for December 2020 = $1,582.47

In December, I ended up making a little over $1,500 from 13 different categories of side hustles. About a third of that came from food deliveries, with the remainder coming from a mix of my other side hustles.

The surprisingly lucrative side hustles this month outside of food deliveries were ProductTube and PrestoShopper. Both of these side hustles are ones I often mix into my food deliveries, as I’m typically able to do them while I’m out delivering food.

Here’s a more in-depth look into how I made my side hustle income this past month.

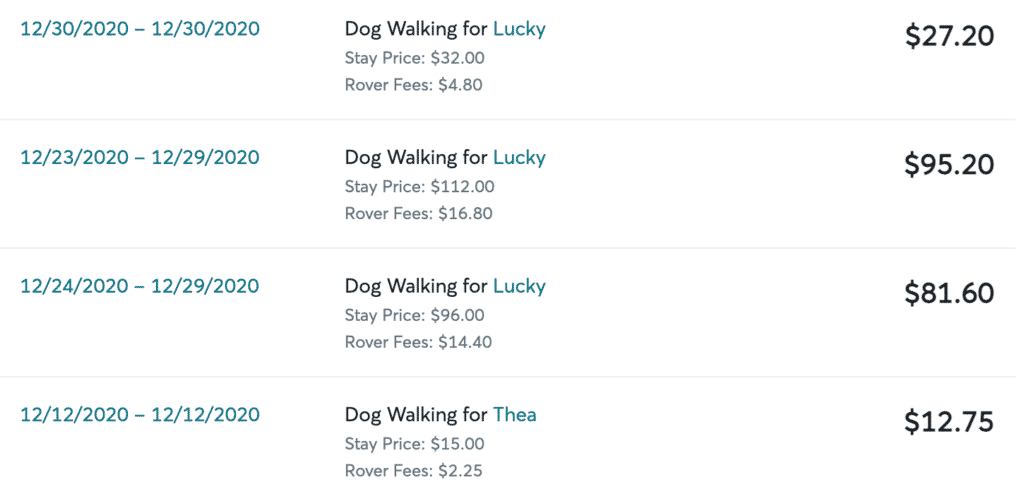

Rover Income: $216.75

I had a busy month with Rover, hosting two pups over the Christmas and New Year’s holidays. However, because those stays went into January, I’m not including them in this month’s side hustle report. You’ll see them in the January report instead.

My Rover earnings this month came from dog walking that scheduled via the Rover app. I had two neighbors ask me to walk their dogs. One neighbor lives about 5 blocks from my house and I ended up walking her dog once. She was looking for a daily dog walker, but I couldn’t commit to doing that (plus I don’t think it would be worth it).

The other walk was for a neighbor that lives down the street from my house. I ended up walking her dog twice a day for about a week – once in the morning and once in the evening.

Dog walking is something that I’m fine doing every once in a while, but I often find isn’t as good a use of my time because of the capped income potential that comes with dog walking. That is to say, with dog walking, I charge a fixed amount for a fixed length of time, which means I can’t improve my earnings by being more efficient with my work. My only option to increase my earnings is to charge more, which isn’t always possible when you look at the market rates around you.

If you look at the above, you can see that my dog walking rate is $15 on non-holidays and $16 during holidays. Rover takes a 15% cut of my earnings, which means that after fees, I’m only making $12.70 or $13.60 for a 30-minute walk (note, I’m grandfathered into the 15% commission rate because I signed up for Rover before 2016). That translates to $25 or more per hour, which isn’t bad. The issue is that I can’t increase my hourly earnings. This is in contrast to task-based gigs like DoorDash or Uber Eats, where I’m able to earn more by multi-apping, being more efficient, and completing more deliveries in a shorter amount of time.

That said, I can think of worse ways to earn extra income. Of all of my side hustles, Rover is the one that I anticipate doing forever. It generally fits in well with my lifestyle and I don’t anticipate that changing anytime soon. If you’re interested in Rover, you can sign up to be a Rover sitter with this link.

Postmates/DoorDash/Uber Eats/Grubhub Income: $685.80

Deliveries were way down in December. This is pretty typical during the winter months because I do fewer deliveries when it’s really cold outside. Remember, I use my bike to do deliveries, so weather plays a big factor when it comes to this side hustle. The college students are also gone for the holidays, so things are much slower in my neighborhood compared to what they usually are.

Here’s the breakdown of my food delivery earnings in December by platform:

For the month, I did approximately 22 hours of deliveries, which comes out to an hourly rate of about $31 per hour. This is lower than what I’ve averaged in prior months but still very good considering how quiet things have been in my area (in prior months, I’ve been able to earn $40 or more per hour delivering food – and all while doing deliveries on my bike).

One good thing that happened this past month was that I was finally able to get my Uber Eats account reactivated. I mentioned this in last month’s report, but I haven’t been able to log into Uber Eats for weeks because of a glitch in their app. Each year, Uber Eats conducts a background check but for some reason, my background check consent form wouldn’t go through. I ended up calling Uber several times per week, tweeted at them, and even went into the Uber Greenlight Hub in order to get help.

After 5 weeks of being unable to log onto Uber Eats and getting very little help, I finally managed to reach an Uber support person that was able to help me. I essentially had to beg her for help, and thankfully, she went out of her way to make sure that my background check got processed. I was up and running a few days later.

Uber Eats is the second busiest food delivery app in my city, so not having it active definitely impacts my earnings. Now that I’m back on Uber Eats, I’ve been able to multi-app better and I’ve noticed my earnings are back in the $40 per hour range.

If you want to deliver for any of these apps, feel free to sign up using the links below.

- DoorDash: Sign up for DoorDash here.

- Postmates: Sign up for Postmates here.

- UberEats: Sign up for Uber Eats here.

- Grubhub: No referral link, but you can sign up for it here.

I also track all of my delivery earnings using Gridwise, which is a free tracking app that I highly recommend you use. This app tracks where you go and how long you’re working, and you’ll get some great data from this app that you can use to improve your delivery efficiency.

Shipt/Instacart Income: $9

I didn’t do any Shipt deliveries in December but I did do one Instacart delivery. This was on a slow delivery day, so I grabbed this Instacart order that was right where one of my DoorDash deliveries took me. It was a small order – only a few items – and I was able to shop and deliver it fairly quickly. The order paid $7 and I received a $2 tip, so it wasn’t bad for the amount of time it took me.

If you’re interested, you can sign up to be a Shipt shopper with this link. And you can sign up to be an Instacart shopper using this link.

Trash/Flipping Income: $163.82

I flipped one small item this month – a pair of shoes that I bought at Goodwill Outlet. I spent about $1 on these shoes and sold them on eBay for $11, so after fees, I made a solid $9 or so.

My other sales for the month were old electronics that I sold. I’ve been trying to do a better job of getting things out of my house and my strategy for the past year has been to list up anything I find on eBay that looks like it could sell. While I was doing this last cleaning round, I found an old iPhone 6 and an old iPod that had been sitting in a drawer collecting dust for years.

I sold the iPhone 6 for $59 on eBay. The more surprising thing to me was how much the iPod sold for. I ended up selling it for $105, which I find very surprising for a completely outdated piece of technology. I suppose some people like to collect iPods or have some strange use for them.

In any event, selling these two old electronics brought in some decent cash that I wasn’t expecting. I suspect that many of you reading this probably also have an old electronics drawer that you may want to clear out too.

WeGoLook Income: $23

I did one automobile inspection gig through WeGoLook. The gig paid $23 and took me about 5 minutes to complete (all I had to do was snap a few pictures of a car). I did this gig while I was doing a secret shop in the area, so it fit in well with what I was already doing.

WeGoLook isn’t a consistent app, but the gigs are easy enough to do that I always try to grab them if they’re nearby or I plan to be in the area.

ProductTube Income: $160

Like in November, ProductTube was again very lucrative in December. Most people have never heard of ProductTube. As a bit of background, it’s a market research app where you film videos of yourself shopping and answer questions about your experience. The videos generally take 5 minutes or less to complete and pay between $5 and $25.

There normally aren’t that many available ProductTube gigs, but it seems like this app got really busy at the end of the year. It really amazes me how much you can make with this app. All of the videos I made in December were 5 minutes max. Even better, a lot of them were ones that I could complete while I was at home.

I expect that ProductTube will slow down again as companies start with a new market research budget in the new year, but it was good to take advantage of it while I could. For those of you that haven’t used this app, I highly recommend downloading it.

TaskRabbit Income: $17

The same person from November hired me again in December to complete a market research gig. The assignment required me to go to a specific gas station and evaluate certain chocolate products.

The funny thing is that this was an assignment that I had previously completed with ProductTube, so I was able to essentially get paid for the same assignment twice. I invoiced the client for an hour, which earned me $17 (it took me only a few minutes to complete the assignment, but I also had to bike to the gas station, which was about 5 miles from my house).

Gigwalk/EasyShift/Field Agent/Merchandiser/Observa/IVueIt Income: $25

I made some money in December from two of these picture taking/auditing apps. Below is the breakdown of my earnings for each of these apps.

- Gigwalk: $0

- EasyShift: $0

- Field Agent: $10

- Merchandiser: $0

- Observa: $15

- IVueIt: $0

My earnings from Field Agent came from two “buy and try” gigs. I typically accept these sort of gigs because I can get free food. In this case, one of the gigs required me to buy some eggs and the other required me to buy a frozen pizza product. Both of these gigs reimbursed me for my purchase and paid me $5 as well.

The other picture-taking/audit gigs I did in December were via Observa. These gigs required me to take pictures of the spice aisle at some local co-ops. I did these gigs while I was biking and running errands.

In my opinion, none of these apps are worth going out of your way for, but if you happen to be in the area and see one of these gigs, they can be worth doing for some easy extra cash.

Google Opinion Rewards/Surveys On The Go/1Q Income: $18.10

The short survey apps I use made me a few extra dollars in December. Here’s what I made with each of these apps.

- Google Opinion Rewards: $6.58

- Surveys On The Go: $11.27

- 1Q: $0.25

I continue to hit the $10+ mark each month with Surveys On The Go (that’s important because you have to hit $10 before you can cash out your earnings in that app). Google Opinion Rewards and 1Q were both pretty standard with respect to what I made from them.

Secret Shopping Income: $67

Secret shopping did well this past month. All of my secret shops were done via Marketforce and were for a national fast-casual restaurant chain. Note that Marketforce pays you for the shops you completed in the previous month, so the payments and reimbursements I got in December were for secret shops that I completed in November.

All told, I ended up getting 7 free meals for the month. Getting paid while also getting free food is not a bad deal at all. Secret shopping is obviously very different given the pandemic, but I’m hoping it can pick up again in this coming year if things can start to return to normal. For more information about secret shopping, you can check out my post: Restaurant Secret Shopper Jobs: A Strategy To Eat For Free And Hack Your Food Expenses.

PrestoShopper Income: $155

Presto Shopper was very lucrative again thanks to all of these Covid safety check assignments around my city. I typically complete them while I’m biking around running other errands. I’ll often also mix them in while I’m delivering food since I can complete these tasks very quickly.

Note that Presto Shopper is a poorly developed app and not at all intuitive. When you sign up, be prepared for a learning curve. Once you understand how it works, however, there’s some decent opportunity out there.

ProductLab Income: $2

I only made $2 this past month from ProductLab. This is an app where I submit a screenshot of my weekly earnings and get paid $2 or $3 for the information. I continue to make $2 or $3 each week for literally 5 seconds of work thanks to this app. This past month, ProductLab changed things around to make it so you can only cash your earnings once you hit $10 of earnings. This is a bit annoying, but it ultimately shouldn’t be a problem. I should be able to cash out my earnings every 4 weeks or so.

User Interviews/L&E Research/Respondent.io Income: $40

I made $30 completing a market research study where I had to eat some chocolates that I bought at the gas station. These were the same chocolates that I completed that other market research survey for via TaskRabbit. This video took 5 minutes to complete, which made this a very worthwhile assignment.

I also earned $10 by completing a survey from QualNow. This is another market research site that I sometimes receive surveys for.

And that concludes the December 2020 Side Hustle Report!

December was a down month on the side hustle front. That said, I’m still happy with what I was able to bring in.

With December in the books, my final side hustle earnings for 2020 equals $25,896.65! That is not bad at all considering that I did my side hustles on a part-time basis while writing on this blog and working on other projects.

What you can take away from this is that, with some strategy, it’s very possible to make these gig economy and sharing economy apps work for you. You don’t have to hustle as much as I did either. Even just a few hours a week can add up to an extra $500 or $1,000 per month. For some, that might not seem like much. For others, it can make a dramatic difference in your financial life.

Don’t forget, it doesn’t take much to become a millionaire with enough time and consistency. Indeed, just $30 a day is enough to get you there. Depending on how much you can make from your side hustle, $30 a day of extra income could take you an hour. Maybe less even.

I hope you found this side hustle report helpful. If you’re interested in seeing what I did in prior months, be sure to check out my past side hustle reports.

Thank you for recommending ProductTube. I signed up and will be completing my first video later today

Awesome! Hope it works out!

I gave old I pods to my Kids when they where 3 or 4 with selected Audio books. And my elderly mother instantly wanted one too. Especially the old ones with Display are wanted by the elderly, because you see where you are navigating to. This is closer to what they know from their time 😁

I don’t think they are collectables, but really used.

Hmm, didn’t think about that. But yeah, fact that it doesn’t connect to the internet could be useful for giving to kids.

I’m not a fan of the ebay shoes. If you sell for $11, you pay $2 fees, $4 shipping, and $1 goodwill. That leaves $4 profit. Buying, listing, and shipping the shoes has to take an hour. $4/hour isn’t hot.

Also, it takes away an affordable pair of shoes that someone in need could have bought. Goodwill only charges a dollar so that someone without means can get a decent pair of shoes for a dollar, not to maximize profit. I’d skip buying and reselling from thrift stores all together.

Hey John,

I understand what you’re getting at, but it comes from a fundamental misunderstanding of what Goodwill is about. Goodwill’s charitable mission is not to sell used items to poor people. Rather, its mission is to provide job training and employment services to people who would generally have trouble finding jobs.

The Goodwill stores you see are the retail arm that almost entirely fund this mission. They take donations and sell them in order to generate revenue for their charitable mission. If the items do not sell, they then get sent to a landfill.

Of course, they can sell used items for cheaper than other places because they get their inventory for free. But the Goodwill store is not like a soup kitchen where the store is made for poor people. Anyone can shop at Goodwill and if you are purchasing from Goodwill, you are supporting their charitable mission.

I buy used clothing at Goodwill for my son (and for myself, for that matter), even though I’m not poor by any means. I buy used games there because they are cheaper than buying them new. I buy used books there for the same reason as well. I do this because it’s cheaper and more environmentally friendly to buy used vs. new. I doubt you’d say that buying things for myself at Goodwill, even though I’m someone with means, is immoral or unethical (or maybe you would if you didn’t understand what Goodwill is about).

If buying to resell vs. buying for myself is the distinction that matters, then I’d have to ask why the purchase intent would matter. If I bought those shoes for myself, I’m still, in theory, taking it away from someone who definitely needs it more.

Anyway, that’s just my thoughts on the matter. I’ve heard this argument a lot from folks who I don’t think understand that Goodwill’s mission isn’t to sell clothes to poor people.

(And my tone isn’t meant to come off as combative. I’m just trying to share what I know and give some additional info).

Thanks for the thoughtful response. I like the environmental angle of shopping at thrift shops even at higher incomes, but flipping just seems opportunistic to me. I suppose it’s not a big deal if you (and others) aren’t doing this so often it is preventing quality used items from going to those in need. I would assume that thrift stores have a surplus of inventory right now and most people won’t go through the trouble of what you’re doing. Maybe Goodwill should sell select items online and train people in this area as well. My guess is that that’ve already considered this and decided it’s not worth the effort 😉

I charge the buyer shipping, so that’s covered. I agree I wouldn’t go out of my way to do this. That’s why I don’t go thrifting solely to find things to flip. In this case, this was something I bought while I was looking for baby clothes. I like buying baby clothes from Goodwill because the clothes are only $1 or $2. Indeed, all of the baby clothes we have are either hand me downs from friends and family or purchased used at Goodwill. Adding on something to flip while I’m there just works out for me. Part of the whole monetizing the things I’m already doing.

Other times I go to Goodwill are when I want to check out if there are any good books and to see if there are any good board games. My wife goes to Goodwill outlet to find clothing that she can use for craft projects. I rarely go to Goodwill solely to find things to flip.

I average listing and sending items between 10 and 15 minutes in average. So the hourly rate seems ok for me in this care.

I really like reading These ,

Thanks!

Thank you for posting this, I always find a new app to try reading each month. I signed up to ProductTube in July and I haven’t gotten any gig offers, so I’m curious how you fare so much better. Do you get more offers by being nearby stores or do most show up at home? Could the gigs be more regional? I live in Los Angeles so I thought there would be plenty of businesses to try but nothing has come up.

You know, I don’t really know why ProductTube worked out so well the past two months. It’s usually not that lucrative – I usually only get a handful of gigs per month. Most of my gigs are ones where I review something at Target and that works out very well for me because there’s a Target down the street from my house.

Great work, and I’m sure these are helpful for side hustlers, but it seems like the next step is to start focusing/grading these for both you and your readers. I’d imagine assigning the following scores 1) total profit 2) time spent per dollar, 3) effort 4) enjoyment, and 5) availability and calculate a score or grade for each source depending on how much you value each metric. The first few winners should be the primary focus, drop at least the bottom few, and then spend at least a portion of the time saved testing out and reviewing new sources. You probably do this to a certain extent already informally, but showing your calculations and reasoning in each report would be a huge help to true side hustlers and allow them to more efficiently work a side hustle plan into their schedule.

Hey John,

Good ideas. Totally makes sense and I’ll try to do that. I try to explain my reasoning behind the different apps I use, but I think it would make sense to have more definitive thoughts about each app I use.

Yes, this process can be optimized. Marcus Lemonis would give advice like this.

I’ve also noticed that the Panther’s market probably is very different than many readers. For example, I tried to sign up for Door dash by bike, but was denied based on my location. However, things like Field Agent seem to have a constant flow of things that could net $20/ day if I tried.

Your details are awesome. I have loved this side hustle series, picked up a few myself, and can picture your model of slow retirement so easily. Between this and your bank rewards, you could add another $50,000 job to those MMM lists of where college is not needed to earn a manageable wage. I’m curious what you would estimate your weekly hours to be, knowing that it probably varies, but in general.

Thanks Greg! Glad you enjoy these posts. It’s been 5 years of them, which is crazy now that I think about it!

I always calculate how many hours I spend doing deliveries. And those numbers are pretty accurate. I worked 22 hours doing deliveries in December, so about 5 hours a week.

Some of my other apps are a little harder to calculate. Take Rover for example. When I dog sit, how do I calculate my time worked? It never really feels like work and I already have a dog. So I’d say I work zero hours for those dollars.

Most of the other apps are done while I’m doing something else, so it’s very rare for me to go out of my way to do any of these gigs.

So this is a bit of a winding way to say it’s hard to calculate the hours I work on these side hustles outside of food deliveries, since I’m always incorporating most of these side hustles into things I’m already doing anyway (i.e. running errands, eating lunch, etc).