There’s a little-known fact about investing that most people don’t appreciate until they really think about it. That fact is this: if you give yourself enough time, the amount you have to save in order to end up with a large sum of money is actually very reasonable.

Perhaps nothing can open your eyes to how much you really need to save than to look at a concept like the Latte Factor. This thought experiment says that if we forego small, daily expenses and instead save and invest that money, we’ll end up with a large sum of money given enough time to let it grow and let compound interest do its thing. It’s basically a lesson in opportunity cost – if we choose to use our money one way, we lose what we could have gained from using our money in another way.

But another thing that I think the Latte Factor teaches us is that small sums matter – and especially so when combined with time and consistency.

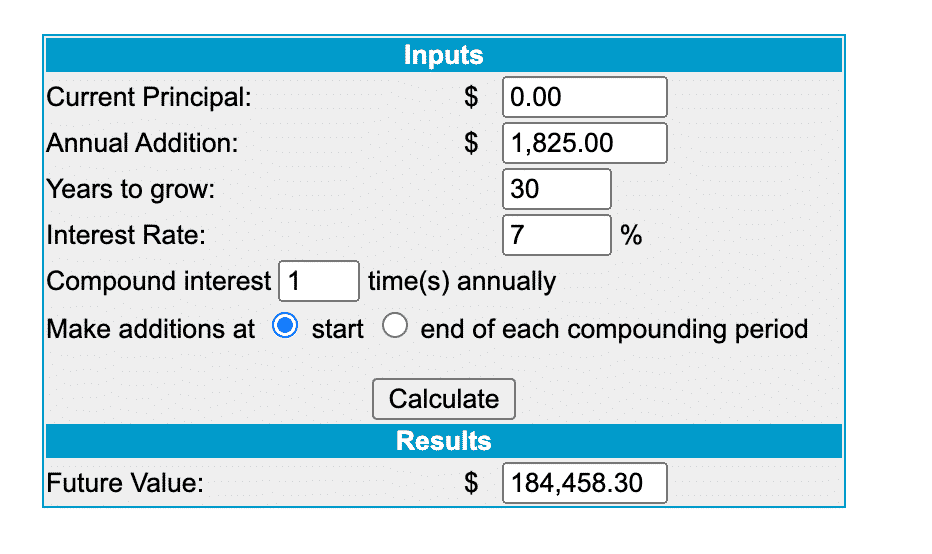

For example, if you can save just $5 per day for 30 years, you’ll end up with over $180,000. To be sure, 30 years is a long time, but $5 per day over 30 years isn’t an unreasonable goal. Most of us probably can do this if we try.

When you do the math, it looks like this:

- Saving $5 per day means that in one year, you’ll have $1,825 ($5 x 365 days).

- Invest $1,825 per year for 30 years in low-cost index funds and you’ll end up with $184,458, assuming a reasonable long-term rate of return of 7%.

It gets even more eye-opening if you can start earlier and give yourself more time to let your money grow and compound. Start saving $5 per day at age 20 and at age 60, you’d have over $389,000. That’s a lot of money from doing something that’s very reasonable.

The $30 A Day Retirement Strategy

Knowing what $5 per day adds up to over the long term means we can extrapolate with even larger sums and with different lengths of time.

Here’s a chart with how much you can have if you start saving pretty reasonable sums of money per day from age 30 until age 60.

| Amount Saved Per Day | Total In 30 Years |

|---|---|

| $5 | $184,458.30 |

| $10 | $368,916.60 |

| $15 | $553,374.90 |

| $20 | $737,833.20 |

| $25 | $922,291.50 |

| $30 | $1,106,749.80 |

If you can do the same thing, but start doing it at 20 years old instead of 30 years old, you end up with what I think are pretty ridiculous sums of money.

| Amount Saved Per Day | Total In 40 Years |

|---|---|

| $5 | $389,837.46 |

| $10 | $779,674.93 |

| $15 | $1,169,512.39 |

| $20 | $1,559,349.86 |

| $25 | $1,949,187.32 |

| $30 | $2,339,024.79 |

To me, the magic number I recommend people aim for is $30 per day. That’s $10,950 per year or $912.50 per month. If you can start aiming for this goal in your early 30s and keep doing this for 30 years, you’ll comfortably be a millionaire in your 60s, all just from saving what seems like not that much money (and start doing this in your 20s and you’ll end up a multi-millionaire).

This isn’t to say that saving these amounts – even as little as $5 per day – is going to be easy. Doing anything for 30 or 40 years is a long time. It’s going to take an amazing amount of consistency to hit any of these long-term goals.

But any amount can make a huge difference to your future self. And importantly, the amounts I’m asking you to save here aren’t unreasonable. I think that’s the most important thing.

Saving $1 million or $2 million might seem impossible. But saving a few dollars per day, every day – that’s totally doable.

How To Implement The $30 A Day Retirement Strategy

When it comes to implementing the $30 a day retirement strategy, you have two mains options: (1) save $30 a day or (2) earn $30 a day.

Saving $30 per day is what most people naturally gravitate towards. I think it’s because most people find it easier to conceptualize saving $30 by cutting something in their budget.

But to me, the better option is to figure out ways to earn an extra $30 per day. The power in this is that any extra money you earn is money that you otherwise wouldn’t have had. That means you can save all of it.

Years ago, bringing in extra income was more difficult, but with phones, the internet, and the gig economy, bringing in an extra $30 per day is entirely possible for most people, even if you have a full-time job. Indeed, if you can figure out how to earn an extra $30 in an hour (which is very feasible for many people), you only have to dedicate 1 hour per day in order to hit this goal.

The beauty of the gig economy is that you can combine money-making opportunities with things you’re already doing (or should be doing). I call this strategy monetizing your life.

An easy example of this is with my favorite side hustle – on-demand food delivery. Over the years, I’ve regularly earned extra income by delivering food using my bike with apps like Postmates, DoorDash, Uber Eats, and Grubhub. Through a combination of experience and good strategies, I’m able to average around $40 per hour most weeks. At the same time, by doing these food deliveries with my bike, I’m earning extra income while exercising, which is something that I always try to dedicate time to do.

Spending an hour a day exercising is not an unreasonable thing to do. Getting paid while I do it can literally make me a millionaire.

Where To Invest Your $30 Per Day

Once you figure out where you’ll get your extra $30 per day, the next thing you need to do is figure out where you’ll put this money so that it can grow over the long-term. Years ago, it was much more difficult to invest small sums of money given fees, commissions, and account minimums. But today, we have a variety of options for low-cost investing even with small sums of money. It makes the $30 per day retirement strategy very possible.

One very good option is to invest our extra daily earnings using a robo-advisor like M1 Finance. Here’s why M1 Finance works for this strategy:

- No management fees.

- You can buy partial shares of low-cost, well-diversified ETFs.

- The minimum balance to get started is $100 for taxable accounts or $500 for retirement accounts, which means it has a low barrier to entry.

- You can automate your savings, which makes it easy to set and forget.

In order to give us the best chance at good long-term returns, we’ll want to create a portfolio that’s low cost and well-diversified. There are three ways you can do this with M1 Finance:

- Create your own low-cost, diversified portfolio. You’ll only want to do this if you know what you are doing. Investing isn’t difficult, but if you want to end up a millionaire with this strategy, you have to invest correctly for the long-term.

- Use M1 Finance’s “expert pies.” These are well-diversified, low-cost portfolios that are created and vetted by M1 Finance. Pick an aggressive pie that you can use for long-term investing. The retirement pies, for example, are great options. A 90% stock/10% bond portfolio is also a great choice.

- Invest everything into VTI. The Vanguard Total Stock Market Index Fund ETF (VTI) is an excellent choice. You could invest all of your daily earnings into this one ETF and do great over the long-term. This is what I personally do.

The important thing is consistency. If you take the $30 you earn each day and invest it with any of the above strategies, you’re very likely going to end up a millionaire. It really can be that easy.

Final Thoughts

Saving a million dollars or more can seem daunting, if not downright impossible. But saving small amounts on a regular and consistent basis is very possible. It makes becoming a millionaire seem very achievable.

If you can start while you’re in your 20s, it’s amazing how little you need in order to end up with a million dollars or more. $15 per day starting at 20 years old gets you to a million dollars by the time you’re 60. That’s really not a lot of money to save (or earn) each day.

Even starting at 30 years old and saving until age 60 doesn’t require much. $30 per day isn’t nothing. But it’s not that much money to save each day either.

You can cut things out of your budget to reach these savings goals – and that’s what most people do. But if you can think about what you can do to earn an extra $15 to $30 per day, then you can essentially have your cake and eat it too.

It takes work to earn that extra income. But it’s not that much work. We just have to be willing to make some time for it. If an hour a day and $30 per day can make you a millionaire, I think that’s well worth it.

I love it when someone can communicate fairly sophisticated mathematical concepts with simple to understand language. Great job! Something amazing will happen to young people who adopt this plan. They will start out saving $30 a day but then over time they’ll start saving a portion of their raises and bonuses as well and they’ll probably end up with twice as much as in the examples because the savings behavior should compound too, when something is working you just tend to turn it up a notch.

That is true. I know that I save much more than that per day now and will continue to do so.

This is a fantastically simple approach – in a way, if you could save an hour’s pay everyday – that’s not asking for much, is it? That’s actually 12.5% savings rate (1 hour / 8 hours).

And if you saved 2-3 hours pay, that’s a savings rate of 25% – 37.5%.

Inversely, saving an hours paycheck implies spending the remaining 7 hours paycheck. Sometimes that can’t be helped, its difficult to save when your income isn’t very high to begin with. But for those who make a decent income, if you’re only saving an hours pay, that maybe is something to dig into.

This is lovely stuff FP.

Thanks! The way I see it, even if you aren’t making much, instead of 8 hours, add in another hour somewhere else in your day, make $30, then put it away. That’s 7 hours a week of side hustling, which isn’t a crazy thing to do. An hour a day can literally make you a millionaire!