The DoorDash heat map is the system DoorDash uses to show drivers the busiest places in the city. Each time you open the Dasher app, you’ll see a map of your city. When you start dashing, the DoorDash map will show a heat map of the busiest areas in your city.

The DoorDash heat map can be a useful starting point when figuring out the best places to work in your city. It shouldn’t be the end-all, be-all though either. While the heat map can be useful, it’s not always accurate either. Figuring out the best places to work in your city will usually come down to experience – with enough practice, you’ll understand where to work in your city.

With that said, this post takes a closer look at the DoorDash heat map and explains how it works and how you should use it.

The DoorDash Heat Map

As noted in the introduction to this post, the DoorDash heat map shows Dashers the busiest areas in their respective cities.

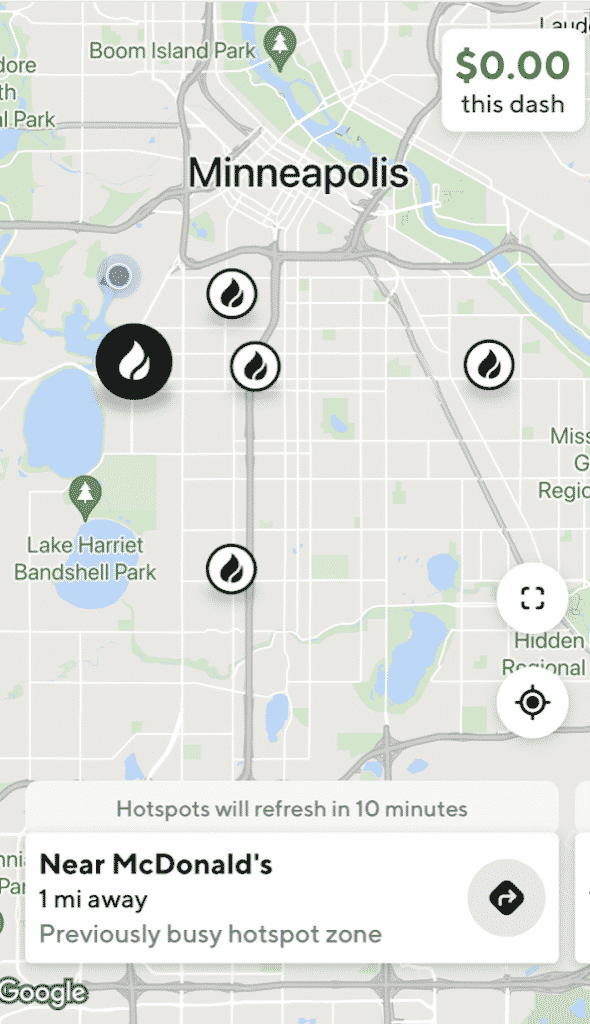

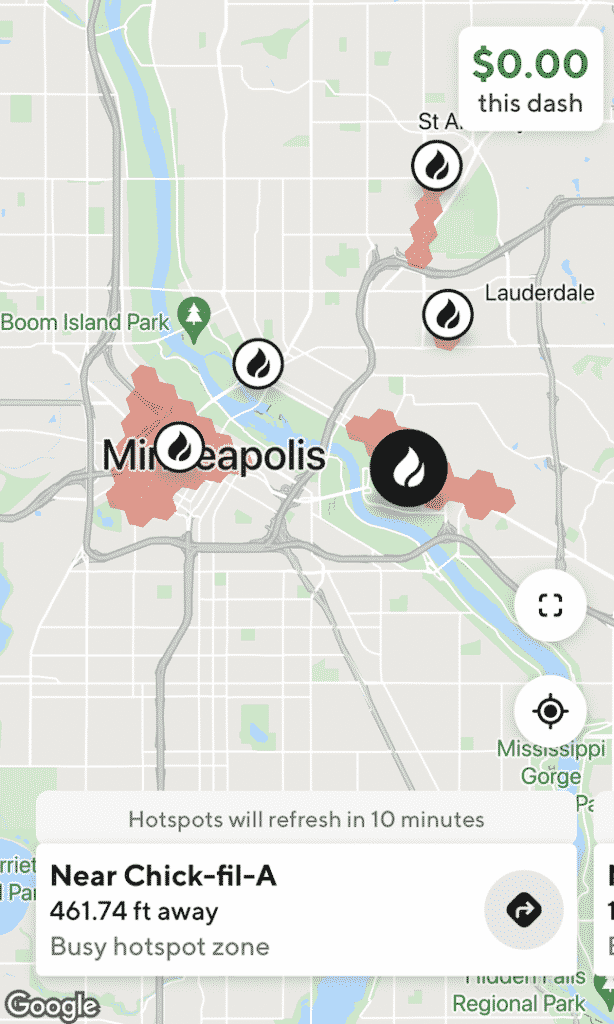

When you log into the DoorDash app, you’ll see flames in certain areas. These flames indicate areas of the city where customers are placing a lot of orders.

In the above screenshot, you can see there are several hotspots in my city. Theoretically, if I’m looking for DoorDash orders, most of them will come from restaurants in those areas.

It’s important to note that these flames don’t represent where the order is going (i.e. where the customers live). It’s just providing information about areas that have restaurants that people are ordering from. Accordingly, when you’re in a hotspot, you may get order requests that take you outside of the busy area.

How The DoorDash Heat Map Works

The DoorDash heat map provides information on two types of hotspots. These include dynamic hotspots and historical hotspots.

Dynamic hotspots show areas that are currently busy. When you see a dynamic hotspot on your DoorDash heat map, the area around it will be shaded in red. This shows you areas where customers have placed DoorDash orders. You’ll typically see dynamic hotspots during peak hours (i.e. lunch and dinner hours).

Historical hotspots, on the other hand, show areas that are historically busy, but might not be busy right now. A historical hotspot is represented by a flame but without the red heat map around it. You’ll mainly see historical hotspots during times when it’s not busy. The idea is that during slow times, you’ll want to go to areas where customers have historically placed orders. That way, when orders do start heating up, you’ll get more orders if you’re in those busy areas.

The DoorDash heat map updates every 10 minutes, so you may see slight changes in where the hot areas are located based on the ordering patterns in your city.

Why I Don’t Worry About The DoorDash Heat Map Much

You’ll get a lot of opinions about how important the DoorDash heat map is. To me, I don’t think they’re a very big deal. Rather than chasing the heat map, it’s best to work at the correct times. If you’re working peak hours, it won’t matter much where you are – you’ll get delivery requests. But if you work during off-hours, things will likely be slow no matter where you are on the map.

Besides working at the right times, you also want to have a good understanding of where you should be working in your city. Certain places will always be busier than others, regardless of the heat map. You have to understand where restaurants are located in your city and you need to understand the ordering patterns in your city. You also want to know where people live in your city. Areas that have restaurants and housing nearby are great since you can pick up a lot of orders and avoid traveling long distances.

I’ve been doing DoorDash for a long time, so I know exactly where people order from in my city. In Minneapolis, where I live, the best places to do deliveries are in Downtown Minneapolis during the day, around the University of Minnesota campus, and in Uptown Minneapolis. I’m fortunate to live and work in all of those areas, so I don’t have to go out of my way to be in a busy area and as a result, I don’t really have to look at the heat map.

It’ll take some practice, but you’ll eventually get a good understanding of which areas in your market are busy. Stay in those areas when you want to get orders. Most likely, they’ll be the busy areas on the heat map anyway.

Final Thoughts

The DoorDash heat map shows you the busiest areas in your city. It can provide a good starting point for Dashers trying to figure out the best places to work.

But don’t base all of your decisions on the heat map. You’ll want to use your own experience to figure out the best places to work for your situation. And more important than the heat map is making sure you’re working efficiently and working at the right hours (i.e. during prime hours like lunch and dinner),

The more you work on DoorDash, the better a feel you’ll get of your city.

Leave a Reply