DoorDash uses a bit of a hybrid system when it comes to the DoorDash schedule. You can always log into the Dasher app and click “Dash Now” if there’s room for more Dashers. The other option is to schedule your Dash in advance. If you do this, you’ll reserve your Dash slot and when the time comes, you’ll be able to log in and start Dashing, even if you wouldn’t be able to Dash because there are too many Dashers on the road.

This puts us in a bit of a conundrum. On the one hand, becoming a Dasher is great because of the flexibility of the gig – you can turn on the Dasher app and start Dashing whenever it works for you. On the other hand, if you have to schedule in advance to be able to work, you lose flexibility and Dashing starts to feel more like a job where you have set working hours.

So what should you do? Do you need to worry about the DoorDash schedule or not?

In this post, we’ll take a look at how the DoorDash schedule works and whether it’s something you need to think about when you’re doing DoorDash. The short answer is that, in some markets, the DoorDash schedule may very well matter. In other markets, you’ll never have to think about the schedule.

How Does The DoorDash Schedule Work?

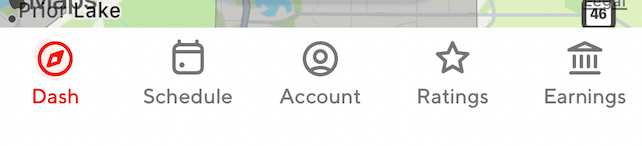

You can find the DoorDash schedule in your Dasher app, located in the bottom row where it says “Schedule.”

DoorDash lets you schedule a Dash up to a week in advance. There aren’t specific time slots in the schedule. You can instead pick any start and ending time that you’d like in 30-minute increments. For example, if you wanted to Dash from 4 pm to 9:30 pm, you would log into your Dasher app, go to the schedule, and then select those times for the day that you want.

Once you’re scheduled, you’ll be able to log in and start Dashing during those assigned times. One thing to note is that while you don’t need to log into your scheduled Dash time exactly at the start time, you do have to log in eventually or else DoorDash will drop your schedule for that time. The grace period is generally 30 minutes, so you’ll need to log into your Dash within 30 minutes of the start time.

Another thing to note is that there isn’t really a penalty if you schedule yourself but don’t log into your Dash. I probably would try to avoid doing this too often, but if it happens, don’t sweat it. Also, you can log out of your scheduled Dash whenever you want, so don’t worry about the end time you set for yourself. If you want to stop Dashing, just log out.

Early Access Scheduling (i.e. Priority Scheduling)

DoorDash also has a system that gives priority access to the DoorDash schedule for Dashers who meet certain criteria. If you meet the following criteria, you’ll gain access to priority scheduling (more info is available here on the DoorDash website):

- You qualify if you have a Customer Rating of at least 4.6, a Completion Rate of at least 95%, and have accepted and completed at least 5 deliveries on the DoorDash platform between 12am the previous Friday and 11:59pm the previous Thursday; OR

- You qualify if you have a Customer Rating of at least 4.6, a Completion Rate of at least 95%, and have accepted and completed at least 500 lifetime deliveries on the DoorDash platform.

If you meet these criteria, you’ll gain access to the schedule 6 days in advance starting at 3 pm each day. By contrast, if you don’t qualify for early access scheduling, you’ll only be able to access the DoorDash schedule 5 days in advance. It’s a 1-day difference, which might or might not matter depending on your market and where you live.

Qualifying for early access scheduling usually shouldn’t be too difficult for the most part other than maintaining the completion rate. Keeping a customer rating of 4.6 or higher is something you should be able to do as long as you provide solid customer service (i.e. picking up food on time, handling the food properly, following directions, etc). Meeting the delivery requirements shouldn’t be a problem either. Completing 500 lifetime deliveries isn’t very much. And completing 5 deliveries in a week also isn’t difficult.

The main issue is maintaining a completion rate of 95% or higher. While your completion rate does matter and you should ideally aim to complete every order you accept, there are reasons you might opt to cancel an order you accepted. If the wait is long or you’re multi-apping and receive a better order from another app, it can make sense to drop your DoorDash order in favor of another order. I usually aim to keep my completion rate at 90% or higher, but I don’t often stay above 95%.

Remember, your acceptance rate does not matter. But your completion rate does matter because if it drops below 80%, you risk deactivation. Keeping your acceptance rate above 95% so you can have access to priority scheduling can also make sense and isn’t too difficult so long as you’re strategic about the orders you accept.

DoorDash Schedule Vs. Dash Now

You might be wondering whether the DoorDash schedule matters or whether you can simply rely on the Dash Now feature, which lets you Dash whenever you want.

Whether you need to schedule in advance depends on your market. I’ve found that in most markets, scheduling in advance isn’t something you need to do. For instance, in my market, I never schedule myself in advance and I’ve found that, except in rare circumstances, I’m always able to click Dash Now and start working (I live in Minneapolis).

If you’re in a market where you can Dash whenever you want, I would ignore the DoorDash schedule and not worry about it. However, if you’re in one of the few markets that are saturated with Dashers, then you’ll probably have to schedule yourself in advance to be able to work.

In that situation, I recommend scheduling yourself for wide swaths of time. That way, you can cancel your Dash early if you want to do something else. Remember that DoorDash doesn’t appear to penalize you for scheduling yourself, but then canceling your Dash early.

Do You Get Better Orders If You Schedule Yourself In Advance?

Whether you get better orders if you schedule yourself in advance is a question subject to speculation. The DoorDash algorithm is not public and no one really knows how orders are assigned. That being said, many people claim that DoorDash prioritizes Dashers that schedule in advance or that have Top Dasher status over those that choose the “Dash Now” option. This is often claimed without any evidence, so whether it’s true or not is unclear (if anyone has a source directly from DoorDash that says this is the case, please let me know).

I’ve never had issues receiving consistent orders so long as I’m working during prime hours (i.e. during lunch or dinner). The only exception is if there’s a large peak pay bonus in effect, which is when I find I receive few orders because so many Dashers are logged into the app.

In short, no one outside of DoorDash knows how the assignment algorithm works and you’ll likely have to try things out to see if you notice any difference.

Final Thoughts

The DoorDash schedule is fairly straightforward. You can schedule yourself in advance up to 5 or 6 days in advance depending on if you’ve qualified for early access scheduling. This differs from Uber Eats, which doesn’t have advanced scheduling and allows drivers to log in whenever they want.

I’ve never had to schedule myself in advance with DoorDash and don’t plan to do so, but that might be specific to my market. That being said, I’ve delivered for DoorDash in other major cities (Washington DC and Chicago are the two cities I deliver in the most outside of Minneapolis) and I’ve never had an issue Dashing whenever I want. My advice – try things out and see what works best for you.

*If you’re getting an error message that says, “Dasher must be active to schedule Dashes,” then check out this post: Dasher Must Be Active To Schedule Dashes – What It Means And Why It Happens.

So new days become available who knows when so you have to randomly check all the time to see if you can get a shift consisting of times they make up most of the time there are no shifts available even if you’re tryn a week in advance then if you’re more than 15 minutes late to logging in for that shift the entire shift is gone and you cannot get it back leaving you unable to work then when you do get a shift and you log in on time it randomly signs you out and you can’t get back in and finish your shift not allowing you to work anymore then if it randomly gets busy and you get in they’ll let you schedule for an entire hour it’s just funny cuz I’m not an employee I don’t need a schedule and the whole point of this job is to make your own schedule it says it right in the first line of your ad then there’s acceptance rate if you’re not above 70 which is absolutely impossible unless you’re taking two and $3 orders half the day you get punished by lower quality deliveries it’s a black hole with no way to win Uber eats has none of this and the app flows perfectly to people who do this full-time this is cruel and unnecessary complicated crap think of the resources you use to handle the schedule calls about the schedule complaints acceptance rates all unnecessary

I am a bit confused on if I will be able to use the earn by time option with a scheduled dash. It often seems to pop up with the Dash Now option, but if I’m already in a scheduled dash, it doesn’t. If I end the dash and it isn’t available, then try to go back to my scheduled dash, it will have been deleted. So, that’s the conundrum!