Welcome to another edition of the Financial Panther side hustle report! Over the last few years, I’ve sort of become known as the dude that does a lot of weird sharing economy and gig economy side hustles – so much so that I was even featured in an article on Marketwatch. I haven’t read the comments to that article because, well, I’m sure I know what they say (I’m stupid, I should be working to build my skills at my job instead of wasting my time doing these gigs, etc).

To that, I say, sure, that makes sense if you love what you’re doing and are trying to stay and advance in that field. I’m not about that life though and honestly, these side hustles are about more than just the money to me. I suspect that a lot of you pursuing the whole financial independence thing are in the same position, looking to get out of what you’re doing and try something different.

Anyway, if you’re new here, each month I document exactly what I made side hustling using various sharing economy and gig economy apps (I’ve been tracking all of this income since 2016). Today, we’ll be taking a look at what I was able to make side hustling in February 2019

Side Hustle Income for February 2019

- Airbnb: $669.33

- Rover: $226.10

- Postmates/DoorDash/Uber Eats/Amazon Flex: $506.76

- Wag: $325.30

- Selling Trash Finds/Flipping: $181.64

- Job Spotter: $17.53

- Gigwalk/EasyShift/Field Agent/Merchandiser: $12

- WeGoLook: $19

- Roadie: $36

- ProductTube: $55

- VoxPopMe: $23

- Google Opinion Rewards/Dabbl/1Q: $14.40

- Rideshare Survey: $160

Total Side Hustle Income for February 2019 = $2,246.06

February ended up being a huge side hustle month, as I brought in over $2,200 from 13 different sources. I’m always happy when I put up big side hustle numbers in the winter, especially when you consider the fact that I don’t use a car for any of my side hustles and most of my side hustles are outdoors related.

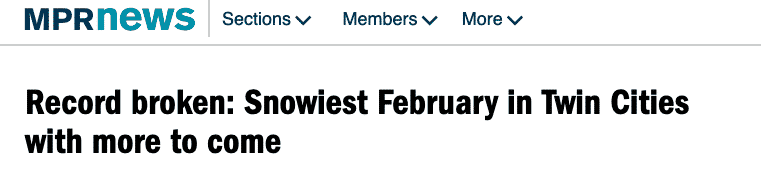

February was an especially tough month because of the weather here in Minnesota. We had the polar vortex hit us for part of the month, which led to some ridiculously cold days. Then we had a record amount of snow – I believe the most in recorded history for February in Minnesota. Despite this, I still trudged on with my side hustles.

What I do find interesting about February was how evenly split my side hustles were. Usually, Airbnb tends to dominate my income reports, but this month, I had a very even split between all of my primary side hustles. Airbnb accounted for 29% of my income. Deliveries accounted for 22% of my income. And dog related stuff (Wag and Rover) accounted for 24% of my income.

We’ll take a closer look at how I earned this income in the remainder of this post.

Airbnb Income: $669.33

February was a pretty slow month for Airbnb, but we still ended up making more than what we’d make if we had a traditional roommate. At the same time, by opting for Airbnb over a traditional roommate, we get the added benefit of less wear and tear on our home (due to people being in our house for shorter periods of time) and the ability to have the house for ourselves when we want it.

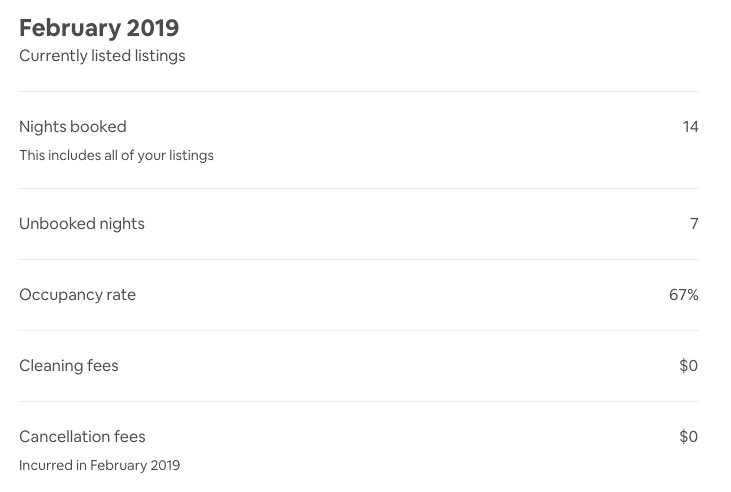

We ended up with 14 nights booked in February, which comes out to an average nightly rate of about $47 per night. For the first time in a long while, we also ended up with available nights that ended up going unbooked. Most of the time, I block off days just to give me and my wife a break from hosting and I’m fairly confident I could regularly book 30 nights per month if I wanted to.

One negative we had in February was a long-term guest that was in town to visit his girlfriend. It was a profitable stay – the guest paid over $300 for that week-long booking. But it wasn’t a booking that we particularly enjoyed, primarily because these two guests pretty much never left our house. It wasn’t unbearable, but I was happy when they left. Our other guests were terrific as usual.

House hacking with Airbnb has really proven to be a valuable way to generate some income out of our primary residence and offset our housing costs. It’s something that I think a lot of people could do if they’re willing to at least give it a shot. I’ve written a post about my general setup for Airbnb, so be sure to read that post to see exactly how my wife and I have been house hacking our home with Airbnb.

- If you have extra space and want to earn extra income from your home, you can sign up to be an Airbnb host using my referral link. It helps to support this blog.

- Airbnb is also one of the most affordable ways to travel. If you’ve never used Airbnb, sign up for Airbnb with my link and you’ll get $40 off your first stay.

Rover Income: $226.10

We had another terrific month on Rover, allowing us to earn extra income without really having to do anything beyond the regular dog care tasks we already have to do with our dog. We’re basically using the fact that we have a dog to allow us to earn income from dogsitting other dogs. I don’t have a name for this, but it’s like we’re “dog hacking” maybe?

This month saw a repeat of one of our favorite pups, a Coonhound mix that my wife and I have watched multiple times. Since Financial Pup is a beagle, we’re pretty partial to hound dogs.

The other interesting development this month was a week-long boarding I did with one of my regular Wag dog walking clients. I’ve been walking this dog for about a year through Wag and his owner reached out to me to see if I happened to offer dog sitting services. I’ve had a lot of Wag walks I’ve done where I’ve secretly hoped I could turn the pup into a boarding client, so I’m happy this actually happened. It shows that a lot of these apps, even though they’re separate, can work together too. Dog walking clients can turn into dogsitting clients, and vice versa.

Dogsitting is something that is very easy to incorporate into your life, especially if you already have a dog. You’re already doing dog care tasks, so adding another dog into your home is a fairly low effort way to bring in some extra income. I also see it as a nice entryway into entrepreneurship, basically allowing you to start up your own dog sitting business with very little costs or risks.

If dogsitting make sense for you and you feel like supporting this blog, you can sign up to be a dogsitter on Rover using my referral link.

Postmates/DoorDash/Uber Eats/Amazon Flex Income: $506.76

Wow! I don’t really keep track of my delivery app earnings until I tally them all up at the end of the month, so I was super surprised to see I brought in over $500 doing deliveries in February. What makes this even more remarkable is that in February, we had headlines like this:

The snow and cold temperatures are actually what made this such a lucrative month for deliveries. I still bike to work, even in the winter, and since Minnesota does a pretty good job clearing the main roads, it’s not too hard for me to still get around by bike. Since most people don’t like to go out when there’s snow on the ground, it means the delivery bonuses can be sky high. For most of the month, I could pretty much make $30 to $35 per hour doing deliveries on my way home from work. That’s more than my hourly rate is at my day job.

Below is a breakdown of my earnings on each platform in February:

- Postmates: $109.07

- DoorDash: $354.69

- Uber Eats: $0

- Amazon Flex: $43

DoorDash continues to be my favorite delivery app, primarily because the bonuses tend to be so high in my market. They’ve had a lot of negative press lately with the fact that they essentially subsidize delivery wages with customer tips, but when the bonuses are so high, that doesn’t matter too much to me (when you tip though, please don’t tip in the DoorDash app – always tip in cash so that your delivery person is actually getting your tip). Of course, these bonuses won’t last forever, but while they are there, DoorDash is very lucrative, at least in my market.

Postmates and Amazon Flex were pretty standard for the month. I tend to use both apps as filler apps in between orders, with DoorDash as the primary app I use. I tend to avoid Uber Eats during the winter since they’re the only delivery app I have that doesn’t tell me where the delivery is going before I accept it. Since I’m not trying to bike around for hours when it’s cold outside, I need to be able to see where the delivery is going so I can make sure it fits well with my route home from work. Uber Eats also hasn’t been offering much lately in terms of bonuses, and very few people tip on Uber Eats.

A lot of people think there isn’t money to be made in deliveries, but my experience is totally different. Obviously, different markets can vary, but based on my own experience, there is money to be made with doing deliveries, especially if you’re only doing deliveries during lunch and dinner hours. If you’re doing it on a bike the way I do it, you’re literally getting paid to exercise. My friend in Madison, Wisconsin has been really killing it lately with deliveries, averaging somewhere around $30 or $40 per hour when bonuses are factored in (unlike me, however, he drives to do his deliveries, which cuts into his earnings a little bit).

Wag Income: $325.30

I had a big month on Wag, pretty much having a dog walk lined up every single day in February. Most of my walks were my usual regulars and were done during my lunch break. I also had a few walks I did when I was downtown for a few days.

Wag walking was a little bit more difficult this month because of the temperatures. But, when temperatures are cold, it also means higher bonuses. As an example, I had one 60 minute walk I did that paid me $36 after tip. That’s worth my time.

I have a lot of fun with Wag and I think it’s a really good side hustle for anyone that likes dogs and lives in a city. Depending on where you live, you can make a good amount of money just walking dogs in your neighborhood (and you get the added benefit of getting some exercise). It’s also a good app to use in conjunction with delivery apps since you can usually fill in some of your low-demand hours with Wag walks.

I’ve got a more in-depth post about Wag, so be sure to check that post out if you’re looking for more info about how Wag works and why I do it.

Trash/Flipping Income: $181.64

The natural progression from selling trash finds is to start sourcing things from stores and selling them for a profit online. I’ve been doing that over the past few months on a pretty sporadic basis, just to test the waters out and see if this is something that I can do to generate income. I know that there’s money to be made in the trash flipping game. I’m now also convinced that there’s money to be made in the regular flipping game.

An important note is that this number is higher than what I actually made in profit for the month, but I think it’s easier for purposes of this post to just list my monthly gross revenue from selling stuff, then break down my cost of goods within this post. This revenue number also includes random stuff I sold in my house. I’m trying to clear out old clothes that I no longer wear, and an easy way to practice selling stuff online is to just sell old stuff from your closet. And trust me, you have a lot of clothes in your closet that you probably never wear and that people will buy.

Breaking it down a little further, the gross revenue looks like this:

- Income from Flipping: $128.79

- Income from Selling My Old Clothes: $80

Of that gross revenue, eBay essentially takes 13% of the sale as a fee, so I calculated my revenue by calculating 87% of that gross sale price, which comes out to $181.64.

A lot of the stuff I’ve been flipping is stuff I buy from the Goodwill Outlet. I never knew these places existed before, but they are awesome. Goodwill Outlets are where clothes that couldn’t sell at a regular Goodwill store go. They put everything into bins and you buy things by the pound. It’s around $1.50 or less per pound, so you can buy tons of stuff for basically a few bucks. I think you could seriously make $100 or more per day if you put in some time at these places.

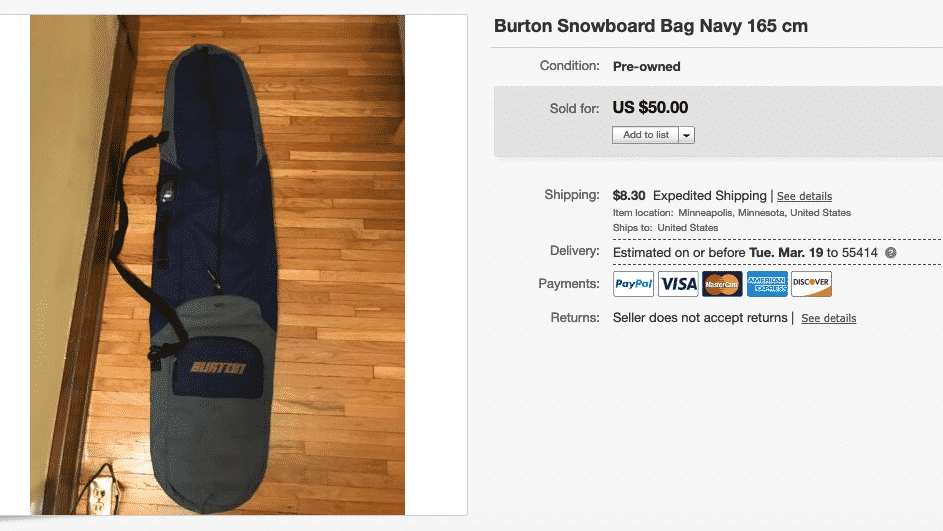

A few of the interesting things I sold in February include this Burton Snowboard Bag, seen in the below screenshot. I had no idea this was valuable, but my wife spotted it at the Goodwill bins and recognized the brand as one that the snowboarders used at the Winter Olympics. This thing essentially cost us $1.50 to buy and I ended up selling it on eBay for $50. You won’t get huge scores like this all of the time, but it just helps to show that there is money to be made out there if you’re willing to at least try.

Overall, in February I spent $42.94 at the Goodwill Outlet, so it’s pretty low risk to try my hand at flipping. I’ve definitely covered my cost of goods at this point, and now all of the stuff I currently have in my house can be sold at a pure profit. It might take a while, but it’s sort of interesting to have a bunch of stuff that’s ready to sell in the background – a little dividend-generating machine in a way (Millionaire Dojo mentioned this concept to me in a comment last month).

Of all of my side hustles, this is the one that my wife likes the most and actually does with me. Yes, she’s a specialist dentist with 8 years of dental education…and one of the things she likes to do is to dig through stuff at thrift stores to see what might sell for profit. We get down and dirty here in the Financial Panther household.

Job Spotter Income: $17.53

Job Spotter did better than last month because my wife and I went to the mall to return some stuff. The mall always has a ton of hiring signs, so it’s not hard to make 5 or 10 bucks while you’re doing your normal walking in the mall.

Job Spotter is still my no-brainer app that I think everyone should use. Read my in-depth review on Job Spotter if you’re looking for more info about how the app works and why you should have it.

Gigwalk/EasyShift/Field Agent/Merchandiser Income: $12

These picture taking apps are a nice way to earn a few bucks when you’re already in a store or passing right by a store. You sometimes have to choose your gigs wisely, especially for EasyShift and Merchandiser gigs. Like anything, you eventually get better at these gigs just by doing them. And the more you do them, the more you’ll understand which gigs are worth doing, and which ones are way too much work or too hard to do.

This month, I earned $6 taking pictures of the pet food section at a grocery store my wife and I were in. This gig took me about 5 minutes to complete.

My Merchandiser gig involved taking pictures of a haircare aisle at a Walgreens. I was already passing by this Walgreens on my way home from work, so it was easy enough for me to just stop in there and take some quick photos. This paid me $6 and also took me about 5 minutes to complete.

I’ll also note that I did a secret shop gig through Bestmark. That one reimbursed me $35 to eat at a fairly well-known family restaurant. The food was awful, so I kind of regret doing that secret shop. Still, it was a free dinner. I’m not including those earnings in this side hustle report just because the meal cost us $35 and we got reimbursed for the cost of the meal, with no additional pay.

WeGoLook Income: $19

If you’ve read other side hustle reports, you know that WeGoLook is an app I’ve been using where I get contracted to take pictures of vehicles and buildings for insurance companies. Peerless Money Mentor has a good blog post about how this app works.

I only accept gigs that are near me and easy, and as a result, I often forget what the gig was. I think my February WeGoLook gig was a vehicle damage report. Basically, I call up the vehicle owner, swing by their house, and take pictures of their car. I only do them when they’re near my house and in easy biking distance (or on the way to somewhere I’m already going). It usually takes me no more than 15 minutes to complete a gig, so the $19 is pretty good.

Roadie Income: $36

Roadie is a funny app that I sometimes do if I happen to be near the airport. They have a partnership with Delta to deliver lost bags to people and sometimes the pay is high enough that I think it’s worth doing.

In this case, my wife and I were pretty close to the airport, so we swung by and grabbed a bunch of lost bags. This actually took a lot of work though, as I had to grab 7 total bags and stuff them into my car (we have a Toyota Prius Hatchback). Still, for 36 bucks, I think it was worth it.

I don’t do Roadie a ton since I don’t live near the airport, but it can make sense if you’re someone that’s doing Uber or already near the airport.

ProductTube Income: $55

ProductTube is an app I’ve been using that I’ve had a lot of success with. The gigs here basically require you to go into stores and film yourself answering a bunch of questions about how you decide to purchase specific products. They use these videos for market research purposes.

What makes ProductTube valuable is that the pay is really good for how little time it takes to complete each gig. Each video takes no more than 5 minutes to complete, and I’ve been paid as much as $30 to do a short video. The drawback is that’s awkward to film yourself answering these questions in public, but if you’re like me and just don’t care what other people think, it’s not a big deal. And to be real, no one pays attention to what other people are doing anyway.

Note that ProductTube pays via Amazon gift cards, so it’s not straight cash. For most people though, Amazon gift cards are pretty much as good as cash.

VoxPopMe Income: $23

VoxPopMe is another one of these video survey apps that I do in my spare time. This one typically pays you between 50 cents and 1 dollar to film a 15-second video answering some survey questions. It’s worth doing simply because of how little time it takes to do the video survey.

You can cash out to PayPal once you have $15 worth of earnings. That usually takes me a month or two to do that. Obviously, you won’t get rich using this app, but it’s worth having on your phone. From an hourly wage perspective, this is actually really high paying (50 cents to record a 15-second video equals $120 an hour).

If you sign up for VoxPopMe using my link, you’ll get $1 to start off you account.

Google Opinion Rewards/Dabbl/1Q Income: $14.40

Google Opinion Rewards continues to be a no-brainer app to use. Obviously, it’s not a lot of money, but you should make a few bucks every month for a few seconds of survey questions each month. I ended up making $4.15 in February from Google Opinion Rewards.

1Q is a little less useful, but I keep it just because I get a few questions each month. It’s only a few quarters, but it only takes me 2 seconds to answer a question. I made 25 cents from 1Q in February.

Dabbl totally sucks and I’m probably going to delete this app from my phone. They used to pay a quarter or so for each survey, but lately, they’ve cut down their pay to 1 cent for a multi-question survey. That’s basically an insult. I cashed out $10 from Dabbl that I’d been building up to over the past few months, and I’m now done with this app unless things change with it.

Rideshare Survey: $160

This was a really random side hustle in February. I’m in a lot of food delivery courier Facebook groups and some company posted up these surveys seeking data about driver compensation. The surveys only took a few minutes to complete and required me to include screenshots of my delivery earnings. They ended up paying me $100 for my surveys, then $10 for referring someone, then another $50 when they realized that they forgot to ask for additional screenshots that they needed. A very unique situation, but dang, that was big money for very little work.

And that concludes the February 2019 Side Hustle Report!

I’m very happy with what I brought in for the month of February. What’s so incredible about this is that I could pretty much survive with my side hustles alone (and I bet a lot of people in the financial independence community could be pretty comfortable on $2,000 or so per month).

The important thing to take away from this post is that there’s money out there. You just have to be willing to try different things. Don’t dismiss stuff just because it seems “beneath” you.

If you want to look over my other side hustle reports, be sure to check out my side hustle report page, where I keep a list of all of my side hustle reports since I started this blog in 2016. I also maintain a list of all of the side hustle apps I use on my Side Hustle List page, so check that post out if you want some more ideas about what you can do to earn extra income in the sharing and gig economy.

Hey Kevin,

I hope all is well with you, Bro! It’s been a while since I read your reports.

Yesterday, I saw you included Product Tube in your latest side hustle report, so I decided to check it out.

It did feel a little awkward filming myself while trying to decide which brand of chewing gum to buy, but it was easy money!

Also, thanks a lot for linking to my WeGoLook article. I got a notification for a delivery of confidential documents assignment a few miles away, and I initially accepted it.

Then, since I had second thoughts about it, I decided to let someone else do it. While it would have been an easy $12, I didn’t feel comfortable delivering the bad news lol

-Jerry

Hey Jerry! Haha, yeah, ProductTube is weird, but like, the way I see it, you put on some headphones, and then it basically just looks like you’re talking to someone on the phone. 5 or 10 years ago, talking to yourself in public would have looked weird. Today, I don’t even look twice when someone’s talking to themselves – I just assume they’re on the phone. And that’s what everyone else assumes as well, I guarantee it.

So yeah, I do those debt-collector gigs sometimes when they’re close. It’s weird for sure, but its like, all I’m doing is just giving them a letter. They can still ignore the letter and I’m not harassing them either like those debt collector people that call on the phone

Sorry if I missed this, but is this gross earnings or net earnings? Do you have an estimate of this income after taxes and overhead costs (gas, vehicle maintenance, etc.)? I’ve seen videos that indicate that after taxes and overhead costs, ride sharing apps do not provide much net income. Just wondering about your take on this.

Question about Wag/Rover dog boarding. How does it work for someone who works full-time and can’t be home during the day to watch the dogs?

I work full-time and am not home during the day. My dog stays home alone during the day for 8-10 hours, and most people’s dogs do the same thing. After all, how would anyone work if their dog couldn’t stay home alone?

I just make it clear in my profile and whenever I do a meet and greet that I am not home during the work day and that I can only accept dogs that can stay home alone during the day. It’s never been a problem.

Hey Kevin!

I thought I asked that question in a previous post but I couldn’t find it when I went back and looked. Sorry about that. You should interview the guy who has 14 cars on Turo. That would be really interesting!

I’m looking to purchase a new(er) car and the consumer in me wonders if renting out my future car would justify spending a little more on the car. Of course, the realist in me thinks that’s a horrible idea.

Hmm…tough decision. If you can afford the car, then go for it, but I always like to think about any sort of house hack/car hacking thing as, can I afford it even if I don’t do any form of hacking. So, if I bought a house, I wouldn’t buy one that I couldn’t afford without house hacking. Same goes with cars. You never know – Turo or GetAround could suck and/or not be worth it, and then you’re stuck with a car you can’t afford, right?

Kevin, I’m sorry if you already answered this but what do you think of car sharing apps like GetAround? Have you ever considered renting out your car using GetAround? I’m living in San Francisco and considering giving it a shot.

Hey Greg. I answered this before in another post you asked about it, but basically, I’ve only used carsharing apps from the customer side. I rented a car once from Turo and the dude I rented from had like 14 cars on the platform. I personally don’t quite understand how you make that much money with cars given all the mileage people must put on them, but there must be some money out there when you consider that companies like Enterprise and Hertz are multi-million dollar companies.

I’d love to try it myself, but I don’t have a car and my wife won’t let me rent out her car.

Found this link on Facebook. Great breakdown, a lot of info here. I’m reading your student loan payoff strategy next. I have a full time job that doesn’t quite cover what I need it to (unlike most of my co-workers, I consider savings and investing plus paying down debt to be just as important as any other “bills.”) and I’m very open to gigs. Most of the comments on the Marketwatch were OK, BTW. Just a few snobby people and those a little too inhibited to do anything out of their comfort zone but no legit criticism of your choices.

Thanks Greg! Hope it was helpful and appreciate you stopping by. Hit me up if you have any questions.

Nice going with the Burton Bag! It’s fun to learn what brands and items will go for a lot. The longer you do it, the easier it gets to find those $1.50 items that sell for $50. I’ve been getting into the hat game recently. Certain ones like vintage John Deere can go for a couple hundred.

Interesting about the hat thing. The great thing is that there’s so much stuff out there. I feel like a lot of people get into a scarcity mindset of thinking that the flipping game is saturated. I think positive and realize that there’s more stuff out there than any single person can ever find.

Yeah, there’s a lot of that scarcity mindset going around. I’ve found that even when I go to a crowded estate sale I still don’t have a hard time filling up my car with stuff though. Most people seem to be buying for themselves so they just get a couple things and I’m the weird guy with a big pile of stuff.

I think there’s still a ton of room for new people to sell on eBay even with people like Gary Vee telling everyone to do it. Like you said, there’s more stuff out there than anyone can find. I bet millions, if not billions of dollars worth of stuff is being thrown away every single day. Just the stuff the guy at garbagefinds.com finds in the trash blows my mind.

Do you find that the Merchandiser app has a lot of gigs that require speaking to managers and working to manage inventory at the store? I’m always looking for gigs that are quick and easy and a lot of the Merchandiser gigs require a lot of steps. Not that that’s a bad thing, but in looking to monetize my time, I want apps that allow me to do things quickly and efficiently. Where do you typically find the quick gigs on Merchandiser??

Yeah, I avoid any gig that requires me to talk to anyone. The gigs I do on Merchandiser are the ones that are just me taking pictures of stuff. Gigwalk, EasyShift, and Field Agent also have these quick, easy to do picture taking gigs. EasyShift you gotta be a little careful though because sometimes they ask for ridiculous amounts of work for a few bucks.

HI—-Just wondering, do you have an estimate of how many hours it took to make February’s side hustle money ?

Good and important question that’s a little bit hard to answer since a lot of these gigs are not time for money jobs. For example, Airbnb and Rover are both fairly passive. Airbnb has more direct time used in the sense that I have to clean up the room for guests, but even this is pretty minimal now that I have my system down. Rover is almost negligible on the time simply because I’m walking my dog and doing my regular dog care tasks at the same time. Wag is done during my lunch hour, so those typically take me 30 minutes to an hour depending on if I get lunch also. Deliveries average about $30 an hour these days given the recent bonuses.

So short answer, I don’t know how many hours I spend. In February, I worked a full-time day job and I also worked on this blog. And then I sleep 6-8 hours per day and watch a lot of TV and youtube videos. I do spend time on these hustles, but it’s time fit within the hours of my day. A lot of us have 2 or more hours per day that we lose doing random stuff – imagine if you earned income during those hours.