For many people, figuring out how to save $5,000 in 6 months can seem like a daunting task. Most people simply don’t have that kind of money in their budget to save.

Here’s the interesting thing though. While saving $5,000 in 6 months isn’t an easy task, it’s also not that difficult of a task either. I’m thoroughly convinced that most people reading this can do it (indeed, if you’re reading a post like this, you’re probably already doing more than most people).

Saving $5,000 in 6 months might not seem like that much, but it can be a life-changing amount of money. To be sure, $5,000 by itself probably isn’t going to change your life. But if you start early enough, stay consistent, and let time and compound interest work for you, your future can look very different.

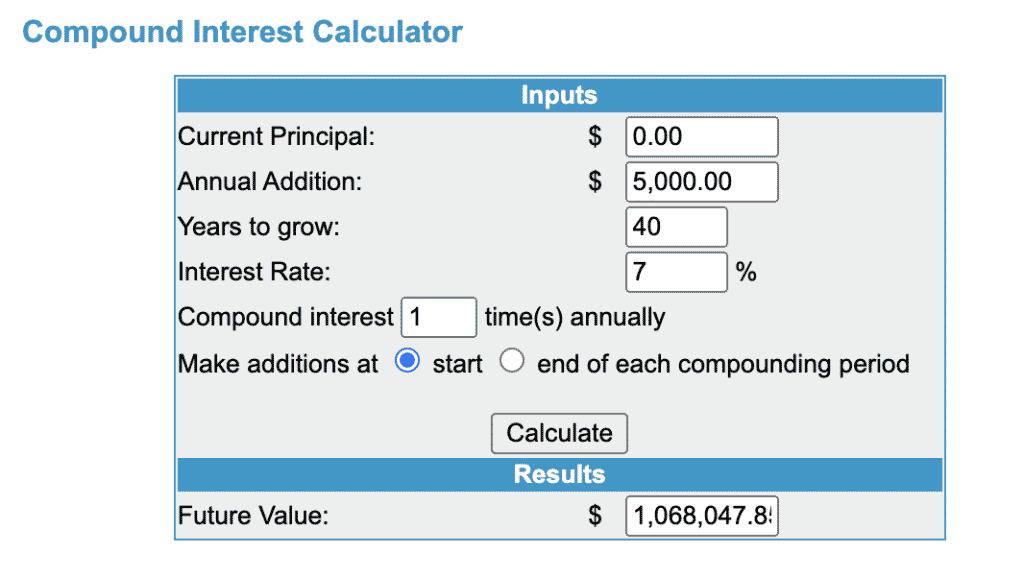

It’s hard to understand how much $5,000 can become until you do the math and see the numbers. For example, if you save $5,000 each year for 30 years, you’d end up with $500,000 (assuming a 7% rate of return). If you could do this for 40 years, you’d end up with over a million dollars.

That means if you’re reading this and are pretty young, you can become a millionaire with just $5,000 a year (do this from age 22 to age 62, for example). That’s the power of time, consistency, and patience. If you combine all of these three traits, you almost can’t lose.

Since we now know just how valuable $5,000 can be, let’s take a look at what you need to do to save $5,000 in 6 months.

How To Save $5,000 In 6 Months

If you want to save $5,000 in 6 months, you basically have two options. The first (and what most people try to do) is to save your way to $5,000. To do this, you need to monitor what you spend and figure out what you can cut from your budget. What’s leftover is yours to save.

Saving your way to $5,000 isn’t a bad thing to do. Indeed, probably the most important principle of personal finance is to spend less than you earn. It’s a necessity if you ever want to achieve financial freedom.

But budgeting and saving isn’t much fun either. And the problem with constantly finding things to cut in our budget is that it can’t scale. There’s only so much you can really leave out.

I also think this constant emphasis on finding things to cut in our budget gives money a negative connotation – something that I’m not a fan of. It makes money into something that limits us. Money becomes about depriving ourselves and limiting what we can do, rather than figuring out how money can be used for us.

So while saving your way to $5,000 in 6 months is by no means a bad thing to do, I prefer the second option – earning my way to $5,000. Instead of figuring out how to cut your budget by $5,000, why not figure out how you can earn an extra $5,000. When you think about it, there’s a limit to how much you can save, but there’s no limit to what you can earn, especially if you’re willing to hustle.

Breaking Down What It Takes To Save $5,000 In 6 Months

It can be daunting when you have a big number to reach, but the great thing about earning and saving money is that you don’t have to do it all at once. Instead, you can break things down into smaller, more manageable chunks.

Saving $5,000 might seem like a lot. But consider what it takes to save $5,000 in 6 months. To do that, you need to do the following:

- Save $833 per month; or

- Save $192 per week; or

- Save $27 per day.

That’s all it takes. That isn’t to say it’s easy. But it is doable.

Even saving $833 in a month might seem difficult. I agree with you there too, so why not break things down more. Saving $192 in a week seems more in reach. Saving $27 in a day seems even more manageable. Make things smaller and suddenly large numbers seem much more in reach.

It’s Easier To Earn Than It Is To Save

One thing I recommend is rather than thinking in terms of what you can do to save more money, think instead in terms of what you can do to earn more money.

You can cut back on some things and find more money in your budget. But cutting back on the things you have isn’t pleasant and it isn’t easy. And, unless you have a huge amount you spend on something each month, it’s not easy to find big sums in your budget. Many of us don’t have $27 per day in our budgets that we can easily cut.

When you flip it around though and think in terms of what you need to earn each day, the equation changes. It can be difficult (or near impossible) to cut $27 per day from your budget. But almost anyone these days can do something to earn $27 in a day.

The fact is, for most of us, it’s simply easier to earn more money than it is to save it.

Some Things You Can Do To Save $5,000 In 6 Months

So what can you do to save $5,000 in 6 months? If you’ve ever read this blog, you know that I’m going to tell you to pick up a side hustle, specifically looking at the gig economy since it’s flexible and gives you a way to earn money fast and consistently.

Think about some of the things you can do to reach that $27 per day of extra income. It doesn’t take much.

- You can deliver food with your bike (or ebike) with DoorDash, Uber Eats, and Grubhub. If you work 1 hour per day during the lunch or dinner rush, you can easily earn $27 or more, especially if you play it smart and multi-app. I regularly earn $30 or more per hour by only doing deliveries during peak hours.

- If you’re in a city that lets you charge electric scooters, you can earn $25 to $30 in a night charging 5 or 6 scooters. In the early days of Bird and Lime, I was easily able to hit this mark by grabbing a few scooters each night around my house. Unfortunately, a lot of scooter companies have moved towards an employee model, so earning money charging scooters isn’t as good as it used to be.

- Dog sit or walk dogs on Rover or Wag and earn $25 to $30 per day. The nice thing about dog sitting, in particular, is that it can almost be a passive activity. If you already have a dog, your schedule barely has to change.

There are a lot of other things you can do to earn extra income – and you don’t have to do each side hustle by itself either. Indeed, the best thing you can do is to combine your various side hustles in a way that best fits your life (I call it monetizing your life). Back when I had a regular, full-time job, I used to walk dogs during my lunch hour, deliver food on my way home from work, and charge scooters in the evening before I went to bed.

Find what works best for you. I’ve tracked my side hustle earnings for years in my monthly side hustle reports. Check those out and see if you get any ideas from there that can work for you.

And side hustling isn’t the only way to earn extra income either. You can earn a significant amount of money each year by taking advantage of bank account bonuses. Indeed, in most years, my wife and I earn $10,000 or more in bank account bonuses between the two of us. If you want to learn more about bank account bonuses and how they work, check out my post, The Ultimate Guide to Bank Account Bonuses.

The main takeaway here is that earning $27 per day can be a life-changing amount if you try to do it. In 6 months, you’ll hit your $5,000 savings goal. And it really isn’t that difficult if you think about what you need to do to earn $27 per day, $192 in a week, or $833 in a month.

Final Thoughts

If you want to save $5,000 in 6 months, you can do it. It’s not going to happen by accident though – you need to take action to get there.

Consider approaching saving money from both angles. Figure out how if there’s anything you can cut from your budget. You might find there’s some category you spend money on that you don’t really need to spend as much as you do.

Try to automate your savings too. I’ve been writing about money for years and one thing I’ve learned is that saving money isn’t about self-control. It’s about getting the money out of your hands before you can spend it. So set up a separate bank account and save the money away.

Then, figure out what you can do to earn more money. It doesn’t take much – just $27 per day is enough to get you there. Most people can earn that much in an hour by taking advantage of the various gig economy apps out there (you can check out a full list of all the gig economy apps I use here). If you have other strategies or skills you can use to earn more, implement those.

You can do it!

Leave a Reply