Not too long ago, I discovered a Twitter account that looks at some of the cringy financial Tik Tok advice out there. It’s a lot of the things you would have seen (and still see) on YouTube and Instagram. Young, mostly white, mostly male influencers peddling crypto, NFTs, options trading, and various other get-rich-quick schemes. They have extremely high-risk tolerances and look down on everyone for not doing the same things they’re doing. They get “it.” And if you don’t get it, well, then you’re just stupid.

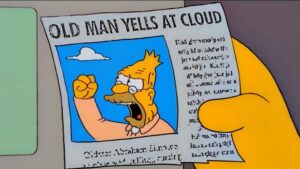

I have a pretty large dislike for these types of influencers. To be fair, I am getting older, so it’s possible I’m just a crotchety old guy now, but I also don’t think I’ve reached that “get off my lawn” phase of life yet. Even if I was still in my 20s, I’d still get probably get annoyed at a lot of these people.

I think my beef really comes from their lack of humility. I know, they have a shtick they have to put out there. Maybe they aren’t like that in real life. But that type of persona – the I’ve discovered the secret and you’re stupid if you don’t follow me – just rubs me the wrong way.

Of course, there are people out there who are giving good, financial advice – telling people to do things like increase their income, save more money, invest wisely, and do all of these things over the long haul. I don’t have a beef with any of those Tik Tokers. That’s the right way to do things. Slow and steady. Building a habit. Enjoying the journey along the way.

The thing I’ve noticed with these cringy get-rich-quick Tik Tok influencers is that they’re all about making big bets. Go all-in on crypto. Or put it all on NFTs. Or go big on something else. Desperate people are looking for ways out. So when someone with so much confidence tells them there is a way out -and a way to get out quickly – they jump on it. Some will make it too. Some won’t. Whether or not it works out, I think is beyond the point.

Here’s my philosophy on pretty much anything in life. Everything takes time. Things don’t usually move fast. But if you can give yourself enough time, you’re almost assured to see good things start to happen.

And – I think this is important – if you’re going to make big bets (which is all fine and good), at least bet on yourself first before you bet on someone else.

I’m Not Against Big Bets

I’m not against making big bets. Of course, I don’t have the ludicrous, hyper-risk tolerance of these Tik Tok influencers (putting their life savings into the latest crypto or meme stock or NFT is not for me). But I’ve made big bets in my life too.

Perhaps the biggest bet I ever made from a money perspective was quitting my job 3 years ago to see what I could do with this whole blogging and writing thing. It’s had its ups and downs. I’m probably never going to make as much as I could have made if I stuck it out as a lawyer.

But here’s the thing. While I didn’t necessarily know what I was doing when I made this bet on myself, I at least went into it knowing that I wasn’t doing anything that was going to make me rich overnight (or make me rich ever).

It took time. I’m never going to write a post telling you how you can start a blog and make tons of money on it starting tomorrow. Things just don’t work that way. I bet big on myself, but I gave myself years before I was even in a position to try to make a real go of it.

We All Bet On Ourselves Already

The interesting thing about big bets is that we all do it. When you get married or have kids or go to school, you’re making a huge bet that you’ve found the right partner or that you can handle kids or that you’re studying something that you want to do. These are all-in decisions we make. Some of them let you take back your decision, but it’s going to cost you. Some you can’t take back at all

Education and career choices are probably where we make our most obvious financial bets. I spent $87,000 and three years of my life to go to law school. It gave me a five-year career and I earned enough to save a good amount of money and pay off my loans. But ultimately, this big bet didn’t go the way I thought it would. It was a mistake, a sunk cost for me to learn who I was and what drove me.

My wife made an even bigger bet on her education. When you add up her tuition and the opportunity costs of her education, she ended up spending over $800,000 and 8 years of her life to get into her career. Not to mention she bought a practice after she graduated.

These are big bets we made. Huge, risky bets even. But if we were going to bet big, we at least bet on ourselves. Isn’t that what we should be doing?

We Need To Be Patient – And Have Some Humility Too

The get-rich-quick influencers might have real things they’re peddling. Maybe they truly believe that they’re helping people by giving them this secret information that they know (all you have to do is buy their course or join their premium membership Discord channel).

But most of the time, these influencers are looking for views and attention. And to do that, they need to tell you that what they’re doing is easy, that you can do it quickly, and that they know for sure they are right and everyone else who tells you otherwise is wrong. You’re not going to get a lot of attention telling people to save money, invest slowly, and be patient. And you’re definitely not going to get a lot of attention if you tell people that you don’t know what’s going to happen in the future.

I don’t know how you can get rich overnight. I know nothing about crypto or NFTs or meme stocks or options trading or whatever other fancy finance things some Tik Toker makes a video about. Maybe I’m just one of those people that don’t get it. But that’s the truth. I don’t know everything.

The only thing I do know is that if you give yourself time, most of the time, you’ll probably do okay. And yes, you should make huge, crazy bets. But bet on yourself first.

Why does it Matter that they’re mostly white?

Well said!

Ughhh I refuse to get on Tiktok. It is scary from what I can see, what’s circulating around there, in terms of news/advice.

I’m 60+ and appreciate all of your articles, particularly the ones that offer life-lessons and guidance for the younger crowd. Many have no appreciation of the opportunities they have at this point in time, nor do they recognize it isn’t guaranteed to continue.

Big Fake it till you make it energy out of those accounts. I’ve stopped looking at Finance twitter for that reason. Insufferable at best, dangerous at worst.