When I was in college, I picked up a copy of The Automatic Millionaire by David Bach. His book is still one of my favorite money books and probably the first book I recommend to anyone beginning to learn about personal finance.

When I first read Bach’s book, I too, wanted to become an Automatic Millionaire! One chapter in his book talked about setting up an IRA or a Roth IRA. I was a 19-year-old kid at the time, so I didn’t have a clue what that meant. All I knew was that it was something good! After reading The Automatic Millionaire, I hopped onto E*Trade, opened up a Roth IRA, and transferred $100 into my Roth IRA account.

And then, I was stuck. I remember The Automatic Millionaire talking about investing in mutual funds, but I didn’t really know what that meant or how to put my money into that type of investment.

After tinkering around on E*Trade and trying to figure out how to put my 100 bucks to work, I ended up finding a cheap stock for a bookstore company you might remember called Borders. Back then, Border’s share price was around $3 per share. I thought for sure that Borders was too big to fail! Well, we all know what happened there.

I never did figure out the Roth IRA thing while I was in college. Eventually, I even forgot that I had opened one. And I didn’t put another dime into any sort of investment vehicle until I was around 27 years old.

When I tried my hand at opening a retirement account, I thought it would be like opening a bank account. The way I visualized it, you put money into your retirement account and then left it to grow over time.

But that’s not at all what it was like! You couldn’t just put money into a retirement account. You also had to know where to put your money once it was in the account.

This is where robo advisors come into play. I’m a huge fan of robo advisors because of how easy they are to set up and how much they open up the world of investing to your average joe who knows nothing about investing.

For those of you that don’t know, robo advisors are automated investment platforms that invest your money for you in an appropriate allocation based on your age and risk tolerance. Examples of popular robo advisors include services like Betterment, Wealthfront, or M1 Finance.

All of these services are great and do one thing very well. They take away the biggest problem facing any new investor – simply getting started.

Not Everyone Is Into Money

I know, I find it hard to believe! But it’s true. Not everyone is a money nerd.

If you’re into personal finance, then investing seems really simple. Open up a retirement account, pick a Total Stock Market Index Fund with low expense ratios, and consistently invest money over time.

But the actual process of getting started isn’t all that simple if you have no idea what you’re doing! Tell a regular person to do the above and they’ll have no idea what you’re talking about or how to go about doing that.

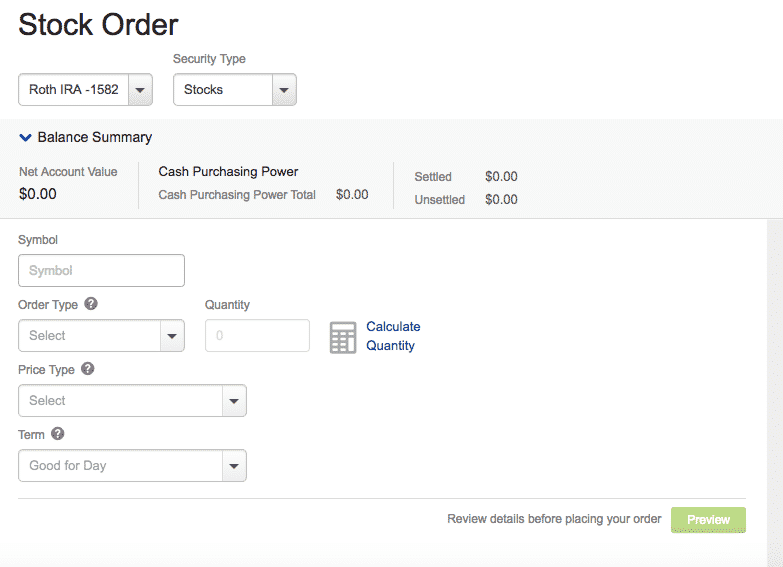

Here’s what I mean. Let’s look at your typical E*Trade brokerage order screen:

This entire thing looks pretty intimidating if you have no background in investing. Look at all the drop-down boxes! And I have to enter in all sorts of weird information that I don’t understand. To a newbie starting out – and we were all newbies once – this might as well be a different language.

If you make something too complicated, many people will quit before they get started. That’s exactly what happened to me when I was in college and trying to start up my first retirement account. I never got started because the entire process was too complicated.

The Impact Of Friction

The main thing stopping most people from doing any particular task is the amount of friction between doing nothing vs. getting started. The more perceived work it takes to do something, the less likely we are to start doing it, and the more likely we’ll look for easier alternatives.

An example I always use to demonstrate the problem of “friction” is the ridership of city bus systems vs. train or subway systems. Compare the two modes of mass transit. A train is much easier for a regular person to use when compared to a bus. Trains have easily recognizable stations. Their schedules are more obvious. You can pay for the ride before you board. Most importantly, trains are on tracks. You know exactly where you’re going when you hop on a train. These are all things that are comforting to a new rider.

In contrast, look at your average bus system. Buses take a bit more work to figure out. Stops sometimes appear to be randomly placed (often just a pole at an intersection). You don’t always know the bus schedule. And unless you have a bus pass, you need to plan on how you’ll pay for the ride before you hop on the bus. But the most frightening thing is not knowing where a particular bus is going. Buses aren’t on tracks. To a new bus rider, hopping on a bus can be a scary experience.

I’d wager that every person who rides a bus is also willing to ride a train or subway. But not everyone that rides a train is willing to use a bus. A train will attract more people simply because it’s easier to use. There’s less friction for your average joe to overcome.

Robo Advisors Remove A Ton Of Friction From The Investing Process

The biggest benefit of a robo advisor is their ability to remove friction from the investing process. You don’t have to know what you’re doing. All you need to do is open up an account and put money in.

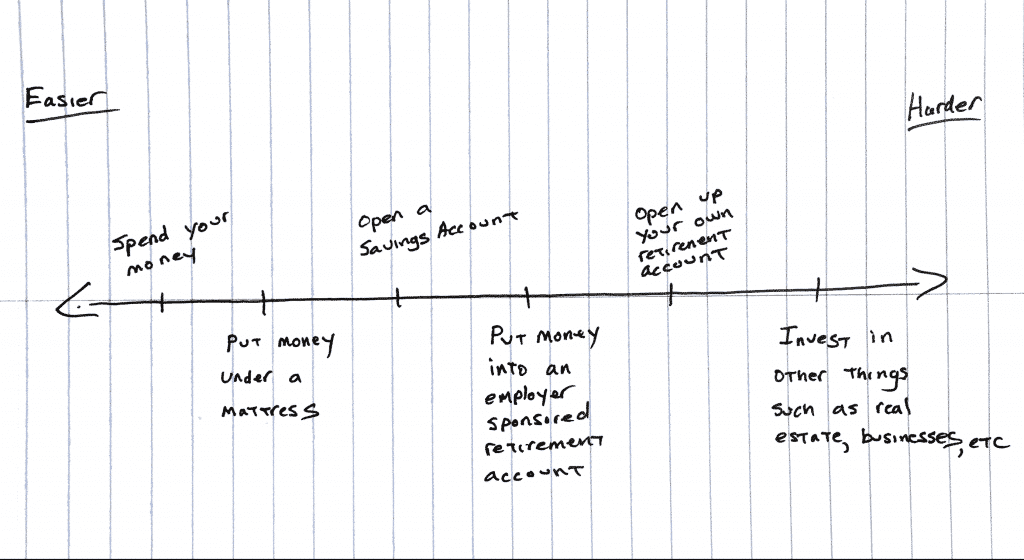

If we had a spectrum of the easiest ways to use your money, it’d probably look something like this:

Some takeaways:

- Spending your money falls to the left of the spectrum and is the easiest way to use your money. The friction in using your money in this manner is low. Anyone can do it!

- Putting money away takes a little bit more work. But opening up a savings account isn’t particularly difficult. All you need to do is set one up at basically any bank and throw some money into it. You don’t have to do much thinking beyond that.

- Putting money into an employer-sponsored retirement plan, such as a 401(k), also isn’t too difficult. A lot of employers automatically take a certain percentage of your paycheck and invest it into a default investment option unless you opt-out. This is exactly what happened to me in my first year of work.

Investing outside of work is when the friction really ramps up. You can see how confusing investing can look if you know absolutely nothing about it. Robo advisors remove this friction.

And this is the ultimate benefit that makes robo advisors worthwhile. For the person who knows nothing about investing, it suddenly becomes as easy as putting money into a savings account. Investing suddenly slides to the left of the difficulty spectrum. It’s the equivalent of taking a train versus taking a bus. Fewer barriers to entry mean more people take that initial first step of investing their money. That’s worthwhile in my book.

Great post. I have been using Betterment for about a year and love their interface and ease of use. It’s been a great way to get my Wife comfortable with investing as well. For the less financially savvy, staying at the robo-advisor level will serve them just fine. For those who want to eventually be more hands-on, robo-advisors may still have their place, if for no other reason than to have something to compare their own ETF or Index fund picking performance against once they’re comfortable with more “friction” (Great example!). I’ll be taking that next step myself within the next year. We’ll see if my own hand selected portfolio can outperform robo-advisors over the next 10+ years.

Part of the reason I started an account with Betterment was because I wasn’t too savvy about how to invest. Now that I’m a bit better with it, I might just move it all to Vanguard, but for now, the small fee isn’t too bad for me. At 0.25% management fee, plus 0.05% expense ratios (give or take), I’m basically paying 30 basis points for the ease and knowing that I have a fiduciary giving me a nice, diversified portfolio.

I think robo advising is probably the wave of the future and I’m sure some of the bread and butter financial advisors are going to get swept up. I’m pretty sure that high net worth people will always try to beat the market with a financial advisor that may or may not earn their keep.

But I do think they’ll continue to take massive market share.

Thanks for sharing!!!

I agree that Robo-Advisors will continue to grow over the years. They just make it so much easier to start investing. Getting over that initial start phase is really key.

Great points about friction, and how a little bit of resistance can delay you taking action for years. And as you rightly know, in personal finance time really is money.

So I totally agree with you that robo-advisors are a very effective way to get started i the stock (and bond) markets. It’s a wonderful tool for people who just want to set it and forget it.

Exactly right! Friction is what stops most people from taking that first step. I know it did that for me. I had an idea of what a Roth IRA was back in 2006 or 2007, yet I did nothing because I couldn’t figure out what I was doing and did’t really have anyone to teach me.

I think Robo Advisors are great because they make it so easy and a lot of them have great user experiences. I was a Betterment user for 2 years, but eventually decided to manage my own finances once I learned more about investing. But while I was using it for 2 years I loved it and still recommend it to new investors who want to take a hands off approach. Investing is not easy and it’s really easy to make bad decisions unless you read a lot and pay attention. Robo advisors simply mitigate that risk for often very low fees. The ONE thing that I thought that Betterment was missing was the ability to select your own funds – they only let you select your % allocation between stocks and bonds. If I could have selected more investments then I might have stay just for the UX experience and re-balancing. The whole Tax Loss Harvesting didn’t really add up when I ran my own numbers, but for some investors it will save you at least the amount of money that Betterment charges. FYI I don’t work for Betterment – just a previous user. I do not currently use a robo adviors but really think they are great for newer or hands off investors. Thanks for sharing FP.

Thanks Millennial Money! That’s really the main benefit with them, it just makes it much easier for your regular person to figure out investing. There’s no doubt, you can easily just recreate the asset allocations yourself, if you understand it. But if you have no idea what the word asset even means – like I was like not so long ago – then it’s just a completely foreign language. Tell someone to go invest in VTSMX or something and 99% of people won’t know what any of those words mean or how to do it. But tell someone to go open up an account at Betterment, Wealthfront, or Wisebanyan, and it’s basically as easy as opening up a bank account. If it costs a few basis points to do that, I think it’s worthwhile. I know it would have helped me out 10 years ago if something like Betterment had been around.

What!? Not everyone’s into money? We have a small taxable account open with a robo adviser – it’s so simple and easy to set up and forget. For those who are new to investing, or just don’t want to deal with it, this is a great option.

I know, I’m shocked too, but we are in a totally weird subculture that is really into this stuff. Most people don’t care at all about this stuff. I’d say 99% of the population can open up a bank account pretty easily. But that same percentage of people won’t know how to open up an investment account. That’s the big benefit of robos. Get people out there opening up investment accounts!

This is so great to go over. When we studied investing in school we would look at specific stocks, study their history, chart them, etc. In my classes, index funds never came up! I didn’t discover them until years later. Not just is this type of research and analysis not practical for most busy people, but there are so many stocks to choose from that it can be overwhelming. I agree that robos are a great option, not just because they tend to be low cost and easy, but are perfect for people that prefer not to interact with others or feel intimidated when having to ask for help on getting going with investing.

The fact that you studied investing in school is really out of the ordinary! I didn’t learn anything about investing during any of my time in school – and I was an econ major in undergrad…

Intimidating is a good word. Think about going to the gym. A lot people – myself included – hate going to the gym because it’s an intimidating place to be. You’ve got some big guy next to you who knows all the exercise moves lifting tons of weight. Then I’m there looking like a weakling. So rather than go to the gym, I’d just stay home.

It’s the same thing with investing. As easy as we make it sound, it really isn’t if you have no background in it, just like doing a bunch of exercises at the gym isn’t that easy if you have no background in lifting. It’s all about reducing those barriers to entry. The easier and less intimidating it is, the more likely people will do it!

Great post- I think robo’s are definitely great especially for people who are just starting to invest. Loved the spectrum chart!

Thanks Amber! That’s why I’m a big fan of robos. I think we forget that investing is easy for some of us because this is just what we think about all the time. It’s like someone else who’s good at cooking or running or anything else. They’re good at it because they do it alot.

But for some people, investing just isn’t all that easy. Anything we can do to make things easier and as simple as possible is a big benefit for anyone just starting out.

Glad you liked that chart. I had to hand write it, so my apologies for the crappy handwriting!

The Automatic Millionaire is one of my favorites as well! It was given to me right after I graduated college and set me off on the right foot financially.

I’m a big fan of robo advisors. I currently use Wealthfront, and have been really happy with it thus far. Even if you have some personal finance and investing knowledge, I don’t want to spend a lot of time researching the best funds, and coming up with the proper asset allocation between all the funds. Wealthfront does all that for me. Plus, I was intrigued by tax loss harvesting.

For me, robo advisors are the easiest and most efficient way to put my money to work for me. The ability to automate deposits into my account and have them automatically deployed according to my investment plan is a huge plus.

It sounds like you like the robo-advisor for the time saving aspect, and that’s great! I also have a small SEP IRA set up with Wealthfront. I chose that just because it was really easy to set up and I was trying to save a couple bucks in taxes last year, so needed to set one up right away before the tax deadline. Again, reduced friction is what made me set that up. If I had to call in or fill out a bunch of forms, I might have opted to just forget trying to save on taxes. Making things easy is what makes more people do something, and that’s awesome in my book.

I do like the robo – investing. The logic seems simple. Computers are smarter than I am. Use the “computer machine” and “them internets” to make money more better than I can! Go team!

The downside of this theory is that then it should be true for Predictive Policing software too. I feel like an idiot standing inside a 10 meter box for 30 minutes at a precise time of day because the computer told me to…yet crime went down. Sigh.

Our robot overlords will soon control all our aspects of our lives! But seriously, technology has really made financial stuff so much more accessible. You’d be surprised at just how confusing it is to set up a retirement or investment account on your own. Even if you tell someone to set up a Roth IRA with Vanguard, they won’t know what that means or how to do it without some help and background information. But something like Betterment, Wealthfront, or Wisebanyan just makes it so much easier (fyi – Wisebanyan is literally a free Robo-Advisor. No management fee at all).

I can see why the robo’s are successful, but I continue to be a shamelessly no-robo guy – I think most people would be better off with the old fashioned balanced fund which essentially does the same thing with less complicated Tax forms. 😀

I know you’re a no robo-guy and that’s totally cool! The reason I’m a big fan of robos is just in its ability to help people get started investing. I know that my entire financial life might have been different if I had a robo to show me the way back in 2007. I think we’re just so into this personal finance world that we forget that 99% of people don’t know anything about this stuff and don’t want to spend their time trying to learn.

As an example, my buddy started up a Roth IRA a few years ago using Vanguard based on my recommendation. But he couldn’t figure out how to set it up. Putting money into a Vanguard Total Stock Market fund is second nature to us. But to a regular person, it doesn’t mean anything. This is the person that benefits from a robo. It makes it as easy as setting up a bank account basically.