A few days ago, I made my yearly contribution to my Solo 401k. It’s something that I’ve done every year without fail since I first discovered that side hustling made me eligible for this extra tax-advantaged account. I have my Solo 401k with Fidelity because it charges no fees and has good investment options, and as in past years, I invested all of my contributions into Fidelity’s Total Market Index Fund, otherwise known as FSKAX.

There are a lot of ways to invest correctly and no one can know what the best investing strategy is without knowing the future. I’ve opted to go with the Simple Path to Wealth strategy outlined by JL Collins – that is, pick a single, low-cost, passively managed index fund that aims to mirror the performance of the entire US stock market. It’s a strategy that has historically worked out well and is likely to continue to work out into the future (albeit, it definitely won’t be a smooth ride along the way).

In this post, I want to go over what FSKAX is and why I’ve opted to use this fund as my primary – and indeed, my only – investment option in my Solo 401k.

What is FSKAX?

FSKAX is Fidelity’s Total Market Index Fund. It’s a mutual fund that is passively managed, which means that the fund managers do not attempt to pick and choose stocks. Instead, the fund aims to mirror the performance of the Dow Jones US Total Stock Market Index, which is an index that consists of over 3,500 stocks that represent about 95% of the US stock market.

Like the index that it mirrors, FSKAX holds over 3,500 stocks making up almost all of the US stock market. Also like the index that it mirrors, FSKAX is cap-weighted, which means that the stocks that make up the fund are held in proportion to the market capitalization of each company. Thus, the larger the company, the more that company’s stocks make up the fund.

In practical terms, what this means is that the largest 500 publicly traded companies in the US make up the vast majority of FSKAX. Indeed, the top 10 holdings in FSKAX, which consists of large stocks that you likely know (i.e. Facebook, Google, Apple, Microsoft, Amazon, etc), make up about 22% of the fund’s holdings.

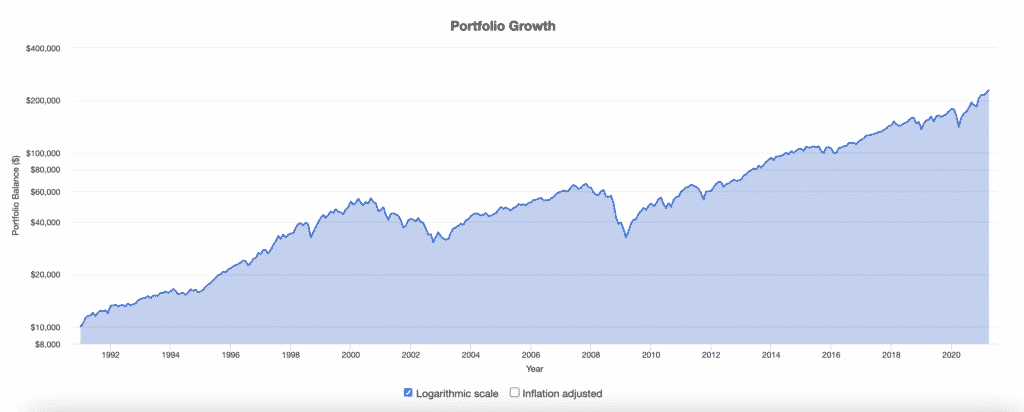

Because FSKAX mirrors the total US stock market, we can get an idea of its long-term growth by looking at the return of the total US stock market during the past 30 years or so. Here’s what that growth has looked like since the early 90s:

You can see that it’s not a smooth ride by any means, but over the long term, the market does march relentlessly upwards, as someone like JL Collins has put it. This makes logical sense – every company is striving to succeed in the marketplace, and as companies continue to innovate and grow, they also grow in value. The ones that don’t make it fall out of the index, replaced with new companies that hope to do grow and generate more profits. When you’re betting on the total stock market, you’re betting on the future of these large companies (and maybe betting on the future of capitalism in general).

Why Invest With FSKAX?

So what is it about FSKAX that makes it my go-to investment in my Solo 401k? Here are a few of those reasons:

1. Well Diversified. FSKAX holds over 3,500 individual stocks. That means when I invest in this fund, my money is divvied up into over 3,500 different stocks. Some are huge companies that we all know. Others are smaller companies that few of us know about. Some of these stocks will be huge home runs. Others are going to be terrible busts. What’s important is that by investing in this fund, I’m getting exposure to every one of these stocks, both winners and losers. And over the long term, the winners will likely outpace the losers.

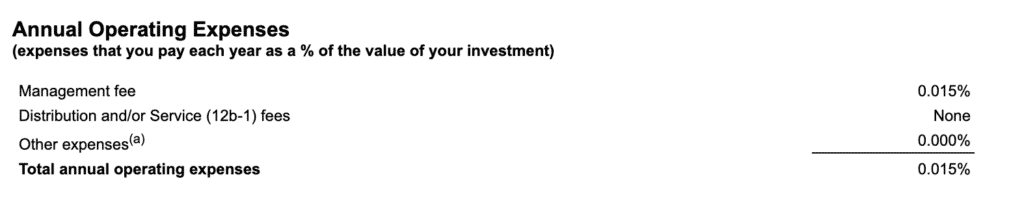

2. Extremely Low Cost. Investing always comes with a cost. What makes FSKAX very appealing is just how low cost it is. Indeed, it currently has an expense ratio of just 0.015%, which is one of the lowest expense ratios out of all mutual funds currently in existence. Over the years, they’ve actually continued to drop the expense ratio on this fund, so I think there’s a good chance the expense ratio could drop even more over the years.

Indeed, even Vanguard’s Total Stock Market Index Fund has an expense ratio of 0.04% as of the time I write this. This isn’t significant enough to make a huge difference between these two funds, but it’s at least worth pointing out. That’s one of the benefits of competition between these large companies – they’re all fighting for our business and lowering costs in order to try to win our business.

Of course, there are also no frontload fees or transaction fees associated with FSKAX, which also makes it a good option for me to use in my Fidelity Solo 401k.

3. Very Simple. Finally, going with FSKAX as the sole investment in my Solo 401k comes with the benefit of simplicity. I don’t need to worry about different asset classes or rebalancing or doing anything else to manage my investments other than putting money into my account and buying this one fund. It also removes me having to decide how much I want to invest in each fund I have.

In fact, I only check on my Solo 401k once per year when I make my yearly contribution. The benefit of this simplicity is that it helps me avoid getting into the habit of tinkering with my investments. I’m only investing in one fund and so long as I don’t get spooked or second guess myself, there’s really nothing else I have to do.

One question you might have is why I don’t go with Fidelity’s Zero Total Market Index Fund (FZROX). It’s actually the same fund as FSKAX but has no management fee at all (it literally has a 0% management fee). I’d actually invest in FZROX if I could, but for some reason, Fidelity doesn’t give you access to this fund in your Solo 401k. I don’t know why this is the case. That said, the expense ratio difference (0% vs. 0.015%) isn’t enough to actually matter, so I’m not stressing too much about that.

Is FSKAX Enough?

The two biggest criticisms with investing only in FSKAX is that it doesn’t give you exposure to international markets and because it’s cap-weighted, the vast majority of the fund is invested in large-cap stocks, which means you have less diversification than you think. These are all valid criticisms and I can’t say definitively whether this strategy is right or not. What I can say is that using only FSKAX is likely good enough. And unless you can see into the future, the best we can do when it comes to investing is good enough (perfect isn’t possible).

That said, here the some of the reasons why these concerns, valid as they may be, might not be as big of a deal as some might think:

1. Lack of International Exposure. One issue with investing only with FSKAX is that it only invests in the US stock market. Of course, we know that the world is much more than just US companies. As a result, this lack of international exposure carries a risk that US stocks underperform over the next several decades, leading to below-average returns over the long term.

One reason why I’m comfortable with this lack of international exposure is that FSKAX gets indirect international exposure. By that, I mean that almost every company in the total US stock market has significant international operations. Think of a company like Facebook or Google, which has huge overseas operations and is used by almost billions of people. Or companies like McDonald’s or Coke, which while headquartered in the US, generate around half of their revenue from overseas operations.

In short, FSKAX might not directly invest in international stock markets. But it gets access to the international market purely by how connected and global our world is today.

2. Not Diversified Enough. Besides the lack of direct international exposure, another potential problem with only investing in FSKAX is that most of the fund is made up of large-cap stocks. Another issue is that many large-cap stocks tend to cluster in the technology sector, which means that much of FSKAX is made up of large-cap and tech-based stocks. A better option, some would argue, is to tilt your portfolio by adding in more of the underrepresented types of stocks into your portfolio.

These are valid concerns and there are good arguments that tilting your investments towards small-cap stocks or value-oriented stocks is likely to lead to higher returns. The one thing to consider is that tilting your portfolio in any direction is a bet that those portions of the market are going to perform better. It also adds a layer of complexity that might not be for everyone. I’ve personally decided that keeping things really simple works best for me.

In any event, a fund like FSKAX does have mid-cap, small-cap, and value stocks within it. It just doesn’t tilt in those directions. Instead, it keeps things entirely passive by investing in the market as the market currently stands.

Final Thoughts – Is FSKAX A Good Investment?

This brings me to my final thoughts. Is FSKAX a good investment?

The answer is that it’s absolutely a good investment and one I’m perfectly comfortable recommending assuming (1) you have a long investment time horizon, (2) you believe that US companies will continue to grow and innovate over the long term, and (3) you have the stomach to ride the ups and downs of the market.

FSKAX works for me because it keeps my portfolio simple and I’m comfortable with what I know will be a bumpy ride over the decades, but likely a relentless climb upwards.

There’s no one right way to invest. And there isn’t one right investment either. But there are correct ways to invest (or at least ways that are more correct than others). Using only FSKAX might not be the best way to invest. And it’s certainly not the only way to invest. But it’s at least not an incorrect way to invest. And that’s the most important thing for me. Good enough is what I’m aiming for.

One advantage of FSKAX over FZROX is that it hold 1,249, or 47% more stocks. FSKAX holds 3,854 stocks while FZROX holds 2,635. I would get more peace of mind paying the .015 expense ratio to be even more diversified.

Good breakdown of FSKAX, and I’m glad you mentioned FZROX. I never really see anyone talking about it but that’s my fund of choice for my IRA. Sure, it’s negligibly less of a fee than .015% but to me it’s some extra peace of mind.

Hey Kevin, I do follow a similar strategy on my tax-deferred accounts using both FSKAX and VTSAX. That said, I’ve made some adjustments to get exposure to small-cap value per Paul Merriman’s buy&hold. I think that strategy makes my portfolio more aggressive while balancing risk. No right or wrong and time will tell. Take Care.

Sounds like you did a good amount of research. With a huge workaholic culture such as the United States, there’s no way that the US will fail at delivering positive returns over the next decades to come. Maybe I’ll add this to my portfolio? Hmm..

I admittedly have no clue what will happen in the future. All we can do is make the best decisions with the information we have. That’s what I’m doing.