We’re heading towards Thanksgiving, so it’s time for me to provide a recap of what I earned from side hustling in the sharing and gig economy in October 2019.

As a quick recap, each month, I document exactly what I made from various sharing economy and gig economy apps. Before I quit my job to do this blog full-time, these reports served more as side hustle reports, showing readers what a regular person could make by fitting these various apps into their day-to-day life.

Today, I have a lot more flexibility with when and where I work, which has made it much easier for me to bring in extra income via these different apps. I still call these posts my side hustle reports because that’s how I treat these gigs. The nice thing about these gigs is that they provide me a sort of income floor while I continue to pursue this whole full-time blogger thing.

With that introduction out of the way, let’s take a look at what I made from the sharing and gig economy in October 2019. Below is a breakdown of my earnings for the month.

Side Hustle Income for October 2019

- Airbnb: $1,477

- Rover: $164.05

- Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub: $211.75

- Wag: $29.40

- Bird/Lime: $858.58

- Shipt/Instacart: $81.95

- Selling Trash Finds/Flipping: $130.55

- TaskRabbit: $54.35

- Job Spotter: $27.88

- WeGoLook: $28

- Google Opinion Rewards/1Q/Surveys On The Go: $31.09

- Secret Shopping: $20

Total Side Hustle Income for October 2019 = $3,114.60

October was yet another solid month, made possible by a few things doing very well. Airbnb was a big earner in October, and I’ll go into more detail about what I did on Airbnb to make that possible. In addition, I also made a very good amount from charging Lime scooters.

My other gigs were down this month, mainly because I found myself traveling a bunch in October and not having as much time to do gigs as compared to other months. The weather hasn’t been too much of a factor for me yet. October in Minnesota is still pretty warm to me, but things will start taking a dip once the cold weather really kicks in.

The rest of this post contains a more in-depth look at my earnings for October 2019.

Airbnb Income: $1,477

Airbnb income was strong in October, made possible because my wife and I rented out our whole house on Airbnb for three weekends. In total, we ended up with 9 nights booked for the month. 6 of those booked nights were for the whole house and 3 were just for the guest room that we rent out.

Renting out the entire house while we’re traveling is a strategy that we’ve utilized a lot this year to really increase our revenue and help cover our travel costs. Since we have some flexibility in our schedules and a lot of points and miles saved up, we’ve been able to turn our traveling into essentially a profitable activity. All we have to do is get our place booked, then figure out where we want to go.

I did two trips last month using this strategy of renting out the house and then hitting the road. The first was a trip to New York at the beginning of the month to visit a friend of mine. The second was a trip to Colorado that my wife and I did in order to do some hiking in Rocky Mountain National Park. I made about $450 of revenue during each of these trips. And since I paid for my flights with points and miles, I essentially got paid to vacation.

We have a few more trips planned in November which will also bring in significant income, including a trip during Thanksgiving where we’ll make a little over $1,000 from our house while we’re celebrating the holiday.

This Airbnb house hacking strategy is something that almost anyone can do. Even if you’re not comfortable renting out a room in your house while you’re living there, it’s possible to at least rent out a room in your house while you’re traveling. If your house is going to sit empty, you might as well figure out a way to use it to bring in some extra income.

- If you have extra space and want to earn extra income using your home, you can sign up to be an Airbnb host using my referral link.

- Airbnb is also one of the most affordable ways to travel. If you’ve never used Airbnb, sign up for Airbnb with my link and you’ll get $40 off your first stay.

Rover Income: $164.05

Rover was a little down this month, but still solid given the fact that I was doing a lot of traveling during the month. I’m currently on pace to make about $3,000 this year from Rover, which means I’m averaging about $250 per month. It’s not a crazy amount of income, but it’s not bad either.

At this point, Rover has become an almost passive activity for me. I own a dog, so I’m already doing things like walking and feeding my dog. And since I’ve been doing Rover for so long, I have a pretty good stable of repeat clients that I know fit in well with my day-to-day life. This might be a weird thing to say, but it’s almost like my dog acts as a sort of income-generating asset for me, helping me bring in $2,000 to $3,000 per year since the primary reason I have this Rover business is due to the fact that I already own a dog.

If you’re in a similar situation or think that Rover might make sense for you, then you can sign up to be a dog sitter on Rover using my referral link.

Postmates/DoorDash/Uber Eats/Amazon Flex/Grubhub Income: $211.75

October was a little bit slow on the delivery front. I ended up making about $50 per week doing random deliveries here and there. Below is what I earned from each delivery app in October.

- Postmates: $13.04

- DoorDash: $113.36

- Uber Eats: $16.92

- Amazon Flex: $0

- Grubhub: $68.43

As usual, I did all of my deliveries using a bike or electric scooter. One of the interesting things I did this month was to do a delivery while I was traveling in Colorado for a weekend. I had some time to kill on a Sunday morning before catching my flight, so while I was out exploring, I grabbed a delivery that was nearby that I was easily able to complete on foot. I only made about $5, which obviously isn’t much, but it was something I was already doing anyway. Plus I found it fun to do.

Over the coming months, my delivery income is likely going to take a dip. I do all of my deliveries on a bike or electric scooter, and even though I like to be tough, even I have some trouble doing deliveries in the elements when it’s really cold out.

Wag Income: $29.40

Wag was very slow this month, not because there weren’t opportunities to earn income, but just that I didn’t really prioritize Wag walks in October. I’ve mentioned it in previous side hustle reports, but Wag worked out a lot better for me when I had a normal day job since I could usually walk a dog during my lunch hour. This allowed me to get away from my desk and meant that I could go back to the office without being all sweaty.

These days, I find myself prioritizing other gigs mainly because I find them more profitable and I have enough flexibility that I don’t have to worry about getting back to my computer at a certain time or coming back sweaty. There are still a lot of dogs that I like to walk, but it really just depends on where I am and how I’m feeling.

I think Wag still has some value depending on your situation. It’s especially good if you’re someone that just loves dogs. Be sure to check out my in-depth Wag post if you want to learn more about how Wag works.

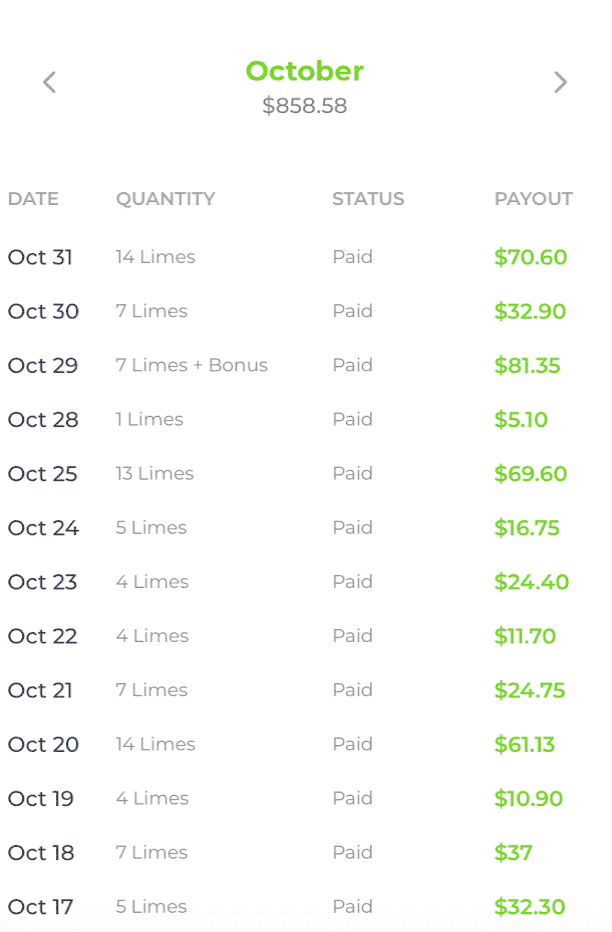

Bird/Lime Scooter Income: $858.58

Lime was very profitable in October. Last month, I made over $1,000 charging scooters, and while I didn’t hit that mark this month, I was very close. From an hourly wage perspective, Lime is definitely up there. I live in an area with a ton of scooters, so it’s really easy for me to grab my scooters for the night in 15 minutes or less. I always aim to get 6 scooters each night, which typically adds up to about $30. While I haven’t tracked my hourly earnings, I’d guess it’s somewhere close to $50 per hour just given my location and how many scooters are around me.

One question a lot of people ask me is whether charging scooters has an impact on my electricity bill. The answer to that is, no, I haven’t noticed any noticeable change to my electricity bill since I’ve started charging scooters. I think a lot of people have a pretty deep misunderstanding of how much electricity a scooter or other small vehicles use. The fact is, the batteries on these vehicles are not very large and are pretty similar to charging up any other large electronic device, such as a laptop. The typical electricity cost is going to be somewhere between 3 and 5 cents, and that’s assuming you’re charging a scooter from 0% battery. Even if you charge a ton of scooters, you’re looking at $10 or less in electricity costs for an entire month. For most people, the electricity cost will not even be noticeable.

It’s starting to get cold now and the scooters are likely going to get pulled off the streets soon, which means this income source will disappear. Until then, I’ll keep getting as many scooters as I can.

Shipt/Instacart Income: $81.95

I ended up doing 4 Shipt deliveries in October and also got paid for a Shipt delivery I did in the last week of September. Shipt is something that I continue to find weirdly satisfying. For whatever reason, I find the game-like aspect of it fun. It’s like I’m getting paid to go on a little mission.

As a side hustle, I find that Shipt works out pretty well when I’m looking to fill odd hours in my schedule. Since Shipt deliveries are also scheduled in advance and I can pick them up from a pool of available deliveries, it provides a little more predictability compared to my other gigs, which are often on-demand and can be unpredictable.

My main concern with Shipt is with how heavily tip-reliant it seems to be. If I’m grabbing an order that isn’t on promo, it basically only seems worth my time if I actually get a tip. And at the moment, based on my experience, it seems like more often then not, people don’t tip, which can be frustrating.

I’ll still probably keep working Shipt into my side hustle repertoire, mainly because I find it fun. Shipt might also be a good thing to do in the winter since it allows me to get inside and avoid the cold a little bit. If you’re interested in learning more about Shipt and how it works, be sure to read my in-depth post about what it’s been like to work as a Shipt Shopper.

Trash/Flipping Income: $130.55

Trash and flipping income stayed solid in October. The sales for this month were a mixture of selling old stuff that I had in my garage and selling some new stuff that I found recently. Here’s a breakdown of the things I sold in October:

- Sold a bookshelf that was at my wife’s office. We ended up taking it apart and got it sold for $40. It’s a gigantic bookshelf, so it was nice to get that huge piece of furniture out of our garage.

- Sold a desk that I had sitting in my garage since last year. I ended up selling this desk for $10.

- I sold some old clothes that had been collecting dust. These were sold on eBay for varying prices.

- Sold some clothes that I found at the Goodwill Outlet store. These were also sold on eBay for varying prices.

Goodwill Outlet is still a place that my wife and I like to check out every once in a while. It’s like a treasure hunt and the stuff is so cheap that you really can’t lose money on your finds. As an example, I sold this University of Minnesota sweater for $20. You buy things at Goodwill Outlet by the pound, so that means this sweater cost me about $1 or less to buy.

I’ve still got a ton of stuff in my garage that I need to start moving, so my plan this month is probably going to be to get some more stuff listed up since my garage is looking pretty cluttered these days.

TaskRabbit Income: $54.35

October was a funny month on TaskRabbit. I ended up doing two gigs which generated some decent income. One of my gigs required me to go to the law school library and scan all of the pages of a book that was in the library. It was the first time I’d been to my law school in a while, so I actually found that pretty fun to do. The actual process of scanning the book wasn’t too bad either. I used an app on my phone called Scannable that lets you scan papers just using your phone, so I didn’t have to worry about dealing with an actual scanner machine.

The other TaskRabbit gig required me to go to the store and find a laptop plug for some guy in a hotel downtown. I ended up combining this gig with a Shipt grocery delivery, which allowed me to double up my income in one trip.

TaskRabbit gigs seem to be hit or miss for me, but I sometimes like them when they add a little variety to my day. It’s kind of fun to be able to bike around and do small, random tasks for people. It’s not consistent by any means, but it’s worthwhile to have on your phone just to see if anything interesting comes in.

Job Spotter Income: $27.88

Job Spotter was the same as usual. I’ve averaged about $20 to $30 per month taking pictures of hiring signs and even with recent changes to the Job Spotter algorithm, it hasn’t seemed to change my earnings. This is the no-brainer app I tell everyone to use simply because of how easy it is to fit into your day-to-day life. Read my review of Job Spotter if you’re looking for more info about how the app works.

WeGoLook Income: $28

WeGoLook income was fairly normal for October. I ended up doing two WeGoLook gigs – one was a car inspection which required me to take pictures of a damaged car and the other was a debt collector letter that I had to leave on someone’s door. I only do WeGoLook gigs that are close to me, so my time commitment here was very low.

Google Opinion Rewards/1Q/Surveys On The Go Income: $31.09

These survey apps did very well for me in October. What I like about these apps is how little time they take. Even though it’s not a ton of money, it’s actually a good amount when you consider how little time these apps take – usually seconds to complete.

- Google Opinion Rewards: $6.62

- Surveys On The Go: $23.97

- 1Q: $0.50

Surveys On The Go was my big earner this month. I’m able to cash it out once I hit $10 of earnings, so October represents my earnings in both September and October, since I didn’t earn enough in September to cash out. Google Opinion Rewards remained consistent – I typically earn about $6 to $10 each month from it. 1Q I just keep on my phone because it literally takes a second or less to answer any questions they send your way.

Secret Shopping Income: $20 (plus $376 of free food)

In October, I made $20 from doing secret shops, as well as received $376 worth of reimbursed meals (I ended up getting 10 meals for free).

I’ve written about this in prior posts, but one strategy I’ve been using to dramatically reduce my food expenses is to pick up restaurant secret shopper gigs. One of my best friends has also started doing these secret shops as well, which has provided me with even more opportunities to eat for free. I wrote an entire post a few months back explaining exactly how I’ve been able to hack my food expenses with restaurant secret shops, which you can read here.

I also did a few random secret shops as well this month. One of my more interesting gigs was a secret shop where I had to go to a shoe store and evaluate the store’s customer service. I received a $15 payout, as well as reimbursement for $15 worth of clothes. I ended up buying a bunch of cool socks that cost $10, so in the end, I made a $10 profit and received $20 of free socks.

And that concludes the October 2019 Side Hustle Report!

October was a really good side hustle month. When you combine my side hustle income with my blog income, I ended up making more in October than I would have made at my normal job. It’s pretty incredible that even without a steady income anymore, I’m still able to bring in the same amount of money as I made as in my traditional, “stable” day job. Obviously, some months will be better than others, but it goes to show that there’s still a lot of possibilities out there.

You don’t need to go and make a full-time income doing these things though. Just taking a few steps to bring in some extra income can make a big difference. And it doesn’t require you to work a ton or do something you hate. If you want to max out your Roth IRA, for example, all you have to do is make $6,000 in a year. That’s $500 a month.

If you look at these side hustle reports, you can see that it’s very possible to do that.

Really enjoyed the details of your earnings! I will be definitely checking out some of the apps. I sell on Poshmark by app and eBay. I have also found TopCashback which I have made almost $300 since October to be awesome too. Receipt Hog is a simple app that you just take pictures of your daily receipts and you earn gift cards or cash. Not huge amounts but the app is fun and interactive too. Once again, thanks for sharing!

Thanks Angela!

Yeah, I use Receipt Hog, Receipt Pal, Fetch, and Coin Out just to make some money on my receipts. It’s not a lot, but it takes me a few seconds and I make like 50 bucks a year just from snapping photos of my receipts.

I’m curious for Job Spotter if you could share more about what stores you’re spotting – are you doing any repeats or chains? I seem to only get 5 cents per store nowadays which is definitely not worth my time.

Jennifer, in the Job Spotter app, carefully review the section called “The Field Guide” – this gives very important info on how they reward for hiring signs. After you do that, take a very close look at the Map shown at the bottom of the app. The map will give you important clues on job signs that will pay more on repeat – look for the dark green dots. In short though, they pay more for hiring signs of small independent business and much less at big box stores (i.e., your nickel example). What I do is before I go out and go where I’m going, I take a look at the map and try to pick up the dark greens along the way on the way there and on the way back (and just on the side I’m driving on a significant highway). Wherever I stop, if there are adjacent businesses I’ll check those out and submit them. Lastly, I’m always looking for “new” (not on the map) hiring signs as they’ll pay more than repeat hiring signs. These rules changed maybe 3-4 months ago and I’m actually making more now (last month was a high of $164) and this very part-time activity which I combine with other gig activity like Obe1 (i.e. FP). The only downside is I used Job Spotter to get paid to walk good strip malls but the rule changes makes this less valuable but I do some of this anyway for the exercise even if a bunch of nickel apiece stores. The rules are subject to change so anyone reading this should reference the current guidance in the app first. Hope this helps – good luck!

You should use the map feature in Job Spotter to see if there are any high-value stores near you. I’ve still been making about $20 to $30 per month just doing this as I’m out and about, so there’s still money to be made out there. If you hit up a new sign, it’s good for $2 or more, which is big money!

Thanks for posing these, I’m doing a few of these and earning extra money if fun, even if it’s small amounts compared to my day job. I’m always checking back to see when the next months will be up.

Sweet! Glad you’re out there making a little extra. It adds up over time!