My brother recently asked me to help him figure out how much he can contribute to his Solo 401k. He has a pretty successful business in which he’s a sole proprietor – last year, he made well over six-figures in net revenue. When you have a business that makes that much, it’s really important to take advantage of whatever tax-advantaged savings you can get.

Luckily, as a sole proprietor, the government gives people like him a ton of ways to save compared to your average W-2 employee. Indeed, unlike most people who can only put away $18,500 in their employer-sponsored 401k (as of 2018), someone like my brother can put away as much as $55,000 in a self-employed retirement plan like a Solo 401k. That’s a massive difference that can obviously make a huge impact when it comes to reaching your financial independence goals.

For the most part, I think the mechanics of a Solo 401k are pretty straightforward. The part that I always have trouble with is calculating how much you can contribute in a given year. Unlike your normal employer-sponsored retirement plan, where it’s just a matter of putting away the salary from your paycheck until you hit your yearly contribution limit, a Solo 401k requires a little bit more thought – you can’t just take whatever you make in your business and put it away. Instead, there’s a calculation that you have to follow to figure out exactly how much you can contribute to it. Personally, I don’t think it’s a very intuitive calculation (and it’s not really one you can just do in your head either).

As I tried to explain this calculation to my brother, I thought it might be helpful to share this info with you in what I hope is a simple and easy to understand read. What follows is a post explaining exactly how to calculate how much you can contribute to your Solo 401k, and importantly, why the numbers are what they are.

A Brief Introduction To A Solo 401k

As a brief bit of background, a Solo 401k is what is known as a self-employed retirement plan. When you think of retirement accounts, the first ones that probably come to mind are those that you get by virtue of your employment – a 401k, a 403b, maybe even a 457. These are all retirement plans that you do not create – your employer creates them and you are eligible to contribute to them only because you work for your employer.

Self-employed retirement plans, like a Solo 401k, are different. They’re a creation of you, made for people who have their own businesses and that do not get paid by an employer for that particular stream of income. To be eligible to contribute to a Solo 401k, you need two things:

- Earn self-employed income. Self-employed income is essentially any income that you earn outside of normal employment that is subject to social security and Medicare taxes.

- Have no employees. In other words, you have to be the owner of your business and the only employee for that business.

You’re eligible to contribute to a Solo 401k even if you have a normal, 9-5 job, which means that if you’re doing any side hustling as an independent contractor, you basically get access to a bonus retirement account.

I think the easiest way to conceptualise a Solo 401k is to imagine yourself as your own little company where you’re both the owner and the only employee. Any money you earn in your business can be contributed in one of two ways – as an employer contribution (i.e. essentially, like you’re giving yourself an employer match) or as an employee contribution (i.e. just a normal salary deferral like you would with your regular paycheck).

Think of a Solo 401k as looking like the diagram below:

How much you can contribute to each part will depend on what your net revenue is and whether you’ve made employee contributions to any other 401k plans. I’ve written in the past about Solo 401ks, so be sure to check out the following posts for more in-depth explanations about what a Solo 401k is and how you can easily set yours up:

- The Solo 401k: The Side Hustler’s Bonus Retirement Account

- Fidelity Solo 401k: A Step By Step Guide To Setting Up Your Self-Employed Retirement Plan

How To Calculate Your Solo 401k Contribution

As of 2018, the maximum amount that you can contribute to a Solo 401k is $55,000. That sounds simple enough, but like anything having to do with taxes, there’s more that goes into it than that. There are five main numbers we need to think about if we want to calculate our Solo 401k contribution:

- Net revenue (this is your revenue after taking all of your expenses into account)

- Net revenue subject to self-employment taxes (this is the amount of your net revenue that you have to pay self-employment taxes on)

- Total self-employment taxes

- 1/2 of self-employment taxes

- Self-employment income

The number we ultimately need to figure out is your self-employment income (this will be the most important number for you to calculate). You might think that your self-employment income should be the same as your net revenue, but in fact, it’s not.

The reason for this has to do with the fact that all working income is taxed at 15.3% to cover social security and Medicare taxes (otherwise known as FICA taxes). When you’re a regular employee, you pay 7.65% of your income towards FICA taxes. Your employer pays the other 7.65% out of their pocket, which they can then deduct from their net profits. On the other hand, when you’re self-employed, you’re both the employer and the employee for your own little business. As a result, you are responsible for paying both the employer and the employee portion of your FICA taxes (called SE taxes when it’s self-employed income).

It’s having to pay both portions of your SE taxes that’s important to your net-profit calculation. The amount of your net revenue subject to SE taxes isn’t 100%. The IRS takes into account that you’re paying the employer portion too at 7.65%. As a result, the IRS actually only taxes you on 92.35% of your net revenue (100% minus 7.65% = 92.35%).

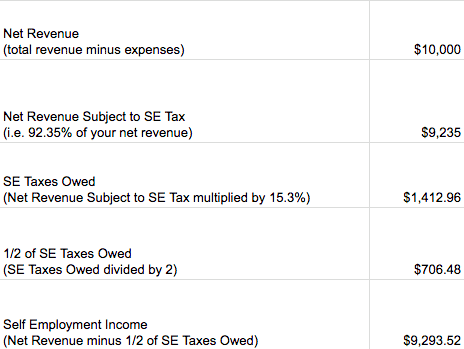

Let’s run through the following example:

- You earn $10,000 in net revenue. First, the IRS will only tax you on 92.35% of that. So, your net revenue subject to SE taxes will actually be $9,235, not $10,000 like you’d initially think.

- From there, we have to calculate the total SE taxes owed. We take the $9,235 that is subject to SE taxes and multiply that by 15.3%. That will give us total SE taxes due of $1,412.955, which we can round up to $1,412.96.

- We then take the total SE taxes due and divide that by 2, which gives us 1/2 of our SE taxes. This is the employer portion of our SE taxes that we can deduct from our net revenue. Thus, our final self-employed income in this case, after every deduction is taken into account, will come out to $9,293.52.

- Once we have our self-employed income number, we can work from there.

Are you confused? I don’t blame you if you are – I was also super confused trying to understand this. Below is a breakdown that I think will help show this calculation a little easier. Just follow this step-by-step, from top to bottom.

If you’re really confused and don’t care about this whole step by step process, then just remember this simple formula. Take your net revenue, then multiply that number by 92.35% x 15.3% x 50%. Then subtract that number from your net revenue. That will give you your total self-employment income, from which you can then calculate your Solo 401k contribution amounts.

Solo 401k Employee Contribution Limits

Again, as previously noted, the Solo 401k has two parts: the employer contribution part and the employee contribution part.

The employee contribution portion of a Solo 401k is pretty much like a normal 401k. You’re limited to the same amount that you’re allowed to contribute to other 401k plans, $18,500 as of 2018. This limit applies across all of your 401k accounts, which means that the total amount of your employee contribution is limited to $18,500 total between any 401k accounts that you might have. If you contribute $18,500 to your 401k at work, for example, you cannot make an employee contribution into your Solo 401k.

That’s pretty simple and easy to understand. Let’s look at the example where we have $10,000 in net revenue (which comes out to $9,293.52 of self-employment income). There are basically three situations possible:

- If we have no employee contributions in any 401k plans, we’d be able to contribute the entire $9,293.52 as an employee contribution to our Solo 401k.

- If we already maxed out our 401k at work, we would not be eligible to make any employee contribution to our Solo 401k.

- If we put some money into our work 401k plan, then we’d have a smaller employee contribution limit in our Solo 401k. For example, if we had contributed $17,500 to our work 401k plan, we’d only be able to contribute $1,000 as an employee contribution in our Solo 401k.

Solo 401k Employer Contribution Limits

Your employer contribution is limited to 20% of your self-employment income. Just follow the steps above to figure out your self-employment income, then multiply that number by 20% to get your employer contribution limit.

Using the $10,000 of net revenue example, with a self-employment income of $9,293.52, you’d be able to contribute 20% of that as an employer contribution, or $1,858.70. You’re allowed to contribute this amount regardless of what your employee contributions have been in your other 401k plans. In other words, even if you’ve already maxed out your 401k contributions in your regular, W-2 job, you’re still allowed to contribute 20% of your self-employment income as an employer contribution in your Solo 401k.

Perhaps what is most interesting about a Solo 401k is that the employer contribution amount is not affected by employee or employer contributions made in other 401k plans that you do not own.

Here’s what I mean. If you have a Solo 401k and contribute $18,500 to your Solo 401k as an employee contribution, you would only be able to contribute, at most, $36,500 as an employer contribution. Remember, the max you can contribute to a Solo 401k is $55,000.

But, if you max out your employee contribution in a 401k plan that you do not own (i.e. your 401k plan at work), you can technically still put as much as $55,000 into your Solo 401k as an employer contribution.

This makes logical sense when you think about it – your employer can’t see what your employer contributions are in other 401k plans, so the contributions that your employer puts into your 401k plans are all counted separately from any other plan that it doesn’t own. In theory, if you had multiple employers that were all willing to contribute $55,000 to your 401k, that would be totally fine.

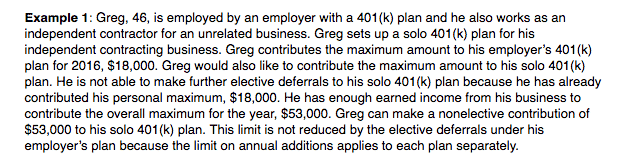

See the IRS example below if you are looking for more info about how this works:

Obviously, since you’re limited to contributing 20% of your self-employed income as an employer contribution, that would require a huge amount of self-employed income to hit the $55,000 contribution mark. It’s an amount few of us will reach, but it’s still an interesting thing to know (and maybe something that the really ambitious among us can strive for).

Important Things To Remember

It takes a little bit of time to understand how much you can contribute to a Solo 401k. The first step is to always figure out your self-employment income. This number will dictate what you can contribute to your Solo 401k.

After you’ve done that, just remember these important things about Solo 401k contributions:

- You cannot contribute more than whatever your self-employment income is. Duh, you obviously cannot save what you didn’t make.

- You need to calculate your self-employment income, not your net revenue, in order to make accurate calculations for your contribution limits.

- Your employee contributions are limited to the statutory maximum across all of your 401k accounts. In other words, for 2018, you cannot contribute more than $18,500 as an employee contribution across all of your 401k accounts.

- Your employer contributions are limited to 20% of your self-employment income and are counted completely separately between all 401k plans that you do not own. If you contribute $18,500 into your employer’s 401k plan, you can also contribute all the way up to $55,000 as an employer contribution in your own Solo 401k. Obviously, though, in order to do this, you have to make a ton of self-employed income.

If you earn any income yourself, you need to be taking advantage of a self-employed retirement plan, like a Solo 401k. It’s an extra retirement account that even your highest paid employee doesn’t get to have. You’ll reach your financial goals faster if you take advantage of every tax-advantaged retirement account at your disposal.

When it comes to tracking your accounts, I recommend using tools like Mint or Personal Capital. The best thing to do is just sign up for both of them and link all of your financial accounts. That way, you can see them all in one place and keep up to date with everything going on in your financial life.

Note that I am not an accountant or CPA, so make sure to double check everything with a licensed professional to make sure that you do things right.

great article.

My wife has a part time job and contributes the max to her work 401K.

She also started a side consulting business and started an i401K. I used your info above to make employER contributions to her account. (Thanks!)

She was just notified that her 401K at work failed the Highly compensated to non-highly compensated test and so it looks like she would not be able to max out the contribution at work in the future. So… we would like to contribute to her i401K as an employee. How does this affect her net revenue line? if she makes 20K net in 2022 and contributes 2K to her i401K as an employEE does this bring her new net revenue number down to 18K? Hopefully the question makes sense.

As an employee, she can contribute up to whatever the yearly 401k contribution limit is. But she needs to earn enough in her business to max out her employee contribution if that’s what you’re trying to do.

So in 2022, the max you can contribute to a 401k as an employEE is $20,500. So if she makes 20k in 2022 and contributes 2k, then it reduces her taxable income by the amount she contributed. But remember, she will still be paying self-employment taxes. There’s no way to avoid that.

If you will max out your SS tax payments at work, how does that impact the FICA calculations for the Solo 401k?

OMG, thanks for the clarification. I was really confused about this!

Shouldn’t your net self employment income be $8528.52?

That would equate to your net revenue of $9235 – 1/2 of SE taxes, right?

Shouldn’t that be $9235 – $706.48 = $8528.52 instead of $9293.52?

Let me know!

No, your net self-employment income is your net revenue minus 1/2 of SE taxes. So you’re subtracting from $10,000 in my example, not from the net revenue subject to SE taxes.

The net revenue subject to SE taxes is the number we’re using to figure out our SE taxes. That’s all that number is used for.

Do you make your contribution in one lump sum at tax time? If so, where to you keep that money in the mean time? Or what might you recommend?

Thank you, FP, for the most thorough and clear article on solo 401K’s that I have ever read.

I am in a business partnership, and am maxing out the 401K at the $55,000 employer and employee limit. I freelance on the side and make some additional income. Could I set up a solo 401K for the freelancing and still contribute 20% of the self employed income from freelancing even though I have maxed out my primary 401K at $55,000?

Yes, absolutely that is my understanding Ali. That will be en employER contribution. You cannot contribute more on the employEE side. Can do this with any traditional brokerage house or open a checkbook IRA with more complication and contribute after-tax amounts above the 20% I believe, but will defer to more experts.

Hey Ali. I’m not a tax professional, so be sure to check with your accountant. For Solo 401ks, each one is separate so you can contribute the maximum amount you can into each solo 401k as a separate plan. Note that there are rules however with “control groups” which basically says if the businesses you have are related, you can’t double-dip. You’ll need to check with your tax person to make sure you’re okay to do this

That was a great explanation I could find . The only question I have is I have a full time job where I am going to meet the social security tax obligations. So do I have have to only pay Medicare tax ( 1.45+ 1.45 employee and employer portion) + 0.9% additional Medicare tax ( Employee portion only) when calculating my tax requirement on side income.

If you earn more than the social security tax limit, then yeah, you can ignore the social security taxes. When you make more money, side hustling is even more advantageous.

Hi FP, your posts are always so helpful. I have not found a clearer explanation for how to calculate solo 401k contributions anywhere!

Here’s my question: For one fo the projects I worked on last year as a freelancer, the company used a staffing firm to pay me, and I was paid via W-2 instead of the normal 1099 route that usually happens with my other clients. I had taxes taken out from the 4 checks that were paid out to me already.

Last year I also had a bit of rental income from an investment property plus an accidental Roth IRA conversion (lol long story).

My question is: How do I know how much $ I can contribute to the Solo 401K since I basically l have income from one W-2, several 1099s, some rental income, and a Roth IRA Conversion? Is the Solo 401K contribution amount based purely on 1099s?

Thanks!

So the only money that’s eligible to go into a Solo 401k is income that goes on a Schedule C and is subject to self-employment taxes. Anything on a W-2 is employee income, so that’s not eligible. Your rental income is also likely not eligible because you probably put that on a Schedule E and it’s not subject to self-employment tax. The IRS thinks of rental income as “passive” income rather than active income. Roth IRA conversion is also not eligible because that’s not self-employment income.

Of course, I’m not a tax advisor, so this is all purely my thoughts. Check with your tax person to confirm.

Thanks so much for your response! Yes, I’ll definitely consult my accountant but it’s always good to get an understanding of what’s really happening. Have you done a post about MAGI, AGI, and what they mean vs self employment income? Tried but couldn’t really wrap my head around all these terms.

I haven’t but maybe I’ll look into it and see if there’s anything I can write about it.

Hi Kevin, thank you very much for what you do. I’m lucky to have found your blog.

Question, if my single owner S-corp (I’m the only owner/employee) received $300,000 per year and of that

$200,000 is given to me (employee) as salary with the mandatory self employment taxes and

$100,000 is given to me (owner) as distribution with NO self employment taxes,

What do I use to calculate my employer contribution limit? 200K or 300k? my employee portion (19k) is already maxed out somewhere else.

Thanks you very much

So disclaimer: I’m not a tax person, so this is just for entertainment purposes only, but your solo 401k contribution for an s-corp is based on your W-2 wages, so it’s based on your $200k employee salary, not on your distribution to yourself.

If you have two separate side gigs, can and should you open two different i401Ks?

If they’re both sole props, then you can just use the same solo 401k. It’s all the same money.

This is the clearest and easy to understand article on solo 401(k) I’ve read. The others left me with more questions than answers. Thank you for taking the time to write such a fantastic article.

I appreciate this thorough post. There is nothing like a great example to explain something.

I wish you had done an example in which you had some left over after you maxed out your employee contribution.

For example what happens if you made $21,000 in a year?

This is fantastic!! Thank you! I am looking into creating a business for side hustle ideas I have and people keep saying “it’s ideal to get a solo 401K instead of an IRA….if you qualify” – but then no one I know qualifies so they can’t actually tell me what is ideal about it. I do know of some specific, significant advantages to investing of the funds in a Solo401K when in a self-directed account so I’m glad to find more specifics on the tax side. I also know that you can employ your children and still qualify – Example: if we sell the kid’s toys, I can pay them to clean items and enter data on sales and so on.

My first question – If we pay our kids, then does that get subtracted from our net income?

Next question – Do you have articles written yet on if you can get a ROTH Solo 401K? And if you can, who provides them? (and then put the link here so we can go read that info too!)

I have my Individual 401K through Vanguard, and they offer a Roth 401k option. I contribute to both as an employee, and as an employer I only contribute to the Non-Roth portion of the Individual 401k. I don’t know if other brokerages have this option, I just chose it because I had already had my Roth IRA with Vanguard. Hope this helps!

Thank you Kevin for a very clear layout of how to calculate your contribution! I’m hovering in six figure Net Revenue, so I really need this info!

Hello!

This was incredibly clear and helpful. Thanks very much. I was wondering if you could explain how the tax deductions would work in the example you provided above, and what the ultimate tax obligation would be for the year?

Best,

Nicole

Hi Nicole,

Glad it helped. Anything you contribute to your Solo 401k would lower your taxable income for that year. I’m not sure what your tax obligation would be, as it would vary based on a lot of factors.

Hi Kevin,

Great blog! I’m wondering if you max out the employer option to contribute the maximum (20% of self employment income) if you’re then obligated, if you end up hiring employees, to contribute the same to their accounts? In other words, do you have to be careful about any precedents you set here? Thanks!

If you have employees, then you can’t use the solo 401k anymore (Solo 401k is only for businesses with no employees). So you don’t need to worry about any precedent setting!

I see elsewhere that the employer contribution limit is 25% not 20%, can you help me understand that?

The reason it’s really 20% and not 25% is because employer contributions are limited to the amount you make that’s subject to self-employment income. I know, super confusing, but that’s why it’s actually 20% and not 25%.

I believe if you’re an S-corp it is 25% of earnings (compensations)

How is the amount you can put into a solo 401k affected if you have to pay the additional (0.9%) tax for high earners? Does this vary whether your self employed “side hustle” income is over the high earner (250k married) limit or if it the combination of you w-2 and 1099 income that is over the limit?

Also, if you are earning at that level won’t your income no longer be subject to social security taxes? How does that affect the calculation?

Can/should you just do the calculation as if the self employment dollars are the first dollars you make so that they are subject to social security but not the additional Medicare tax.

OR

Can/should you do the calculation at your marginal rate where you are not subject to social security (12.4%!) but are subject to the additional Medicare tax (0.9%).

Thanks!

You know, I actually never thought about that because you’re right, once you make over a certain amount, you won’t be paying social security taxes on those amounts above it. I’m admittedly not a tax expert, so you’d definitely want to talk to a professional. I’d probably just calculate it the normally though, so I guess you’d end up slightly under-contributing if it did make a difference. I honestly am not sure how the calculation changes for high-income earners that are subject to that 0.9% additional tax. If you find out how that works, let me know! Would be good for my own knowledge.

Great post, thanks for writing!

I am trying to help my Dad boost his retirement savings, he is a self-employed Veterinarian operating his own hospital with about 6 employees (S Corp) but no 401k available to himself or the employees. Would it be permissible under IRS rules for him to establish a new entity (in which he was the sole proprietor) and pay himself “Consulting Income” from the hospital to the sole proprietor entity and then use that entity to establish a solo 401k? I understand this is might be a more complex scenario then can be addressed here but was just curios if you had heard of anyone doing something similar to this. I appreciate your time!

Hey Connor, I’m not a tax professional, so honestly, I don’t know the answer to that. I think it’s definitely worth talking to someone to see if that is possible. My gut tells me that it could be in the grey area.

Wow. I’ve heard of the Solo 401(k), and knew it was advantageous. But I had no idea how advantageous. Damn it, I got to start monetizing my blog. Thanks for the tutorial, Kevin. It was really informative.

Thanks for writing this post! My wife recently quit her full time job and does some tutoring and part-time teaching on the side. She has an SEP-IRA from previous self-employment stints, but it seems like she can put away more with a Solo 401(k), so we will definitely have to check it out!

In her case, she should definitely be going with the Solo 401k – it’ll make it much easier for her to put in more money due to the ability to go with the employee contribution. I almost always recommend going the Solo 401k route over a SEP-IRA. I think I need to write a post on that some time!

Thanks for the affirmation. Glad I could help with a potential future article 🙂