Editors Note: Some offers mentioned below are no longer available. View the current offers here.

Ever since I began travel hacking, I’ve kept hearing about the Southwest Companion Pass and how beneficial it is to have. Many people consider it one of the best travel hacking perks you can earn, allowing you and a partner to travel for free for up to two years (if timed correctly). If Southwest flies out of your primary airport and you plan to travel domestically with two people, there’s incredible value you can get out of it.

Over the past few years, this is exactly how my wife and I have been able to travel domestically for free. We first got the Southwest Companion Pass in 2017 when my wife earned it by opening two Southwest credit cards and getting the signup bonus on both of them. We’ve continued to do this every two years, switching off which one of us gets it.

If you’re able to fly on Southwest, getting the Southwest Companion Pass is something you should definitely consider. Here’s how it works.

What Is The Southwest Companion Pass?

The Southwest Companion Pass is a Southwest travel perk that allows you to get buy-one, get-one-free tickets on every Southwest flight you take. To get it, you need to earn 135,000 Southwest Rapid Rewards points in one calendar year. If you reach 135,000 Southwest Rapid Rewards points in a calendar year, you earn the pass for the remainder of the year that you earned it, plus the entirety of the next year. So, for example, if you earn the Southwest Companion Pass in 2023, you’ll have it for the remainder of 2023 plus the entirety of 2024.

With this in mind, the optimal way to earn the Southwest Companion Pass is to earn it as close to the beginning of the calendar year as possible. If you time it right, you can get the Southwest Companion Pass for almost two years.

As far as how it works, it’s pretty straightforward. Once you’ve earned it, you can designate a companion on your account that will fly with you for free. Then, each time you book a flight, your companion flies for free with you. In other words, you buy one plane ticket and you get a second plane ticket for your companion for free. All you have to do is pay the taxes and fees on your companion’s flight.

The great thing about the Southwest Companion Pass is that your companion flies for free even if you use Southwest points to book your flight. That’s a big deal because it effectively makes it so your Southwest points go twice as far since you can buy your ticket using points and then book your companion to fly for free.

How To Get The Southwest Companion Pass

To get the Southwest Companion Pass, you’ll need to earn 135,000 Southwest Rapid Rewards points in one calendar year. The easiest way to do this is to open two Southwest Credit Cards and earn the signup bonus on each one. If the signup bonuses are high enough, you’ll be able to earn your 135,000 Southwest points just from the signup bonuses.

Southwest credit card holders get their Companion Pass qualifications reduced by 10,000 points. So, if you are a Southwest credit card holder, you only need 125,000 Southwest points to qualify for the Companion Pass. Since the best way to earn the Southwest Companion Pass is via credit card signup bonuses, effectively, you’ll only need 125,000 Southwest points to earn the Companion Pass.

As a bit of background, Southwest has five Chase co-branded credit cards. Three of these cards are personal credit cards and two of them are business credit cards. Below are the five cards with their associated annual fees. Note that each card comes with different benefits, so simply going by the annual fee is not the best way to think about these cards. Rather, you’ll want to consider the benefits each card offers and whether they make sense for you.

The process of opening the cards is pretty simple – just apply for the cards like any other card. You can apply for the Southwest cards using my referral links if you feel like supporting this website. For the Southwest business cards, you’ll need to have a business, but almost everything can qualify as a business (basically, if you earn any amount of money or have some way to earn money outside of a W-2 job, you have a business that qualifies you for a business credit card). For more information about business credit cards, check out this post: Business Credit Cards: The Ultimate Tool For Travel Hackers

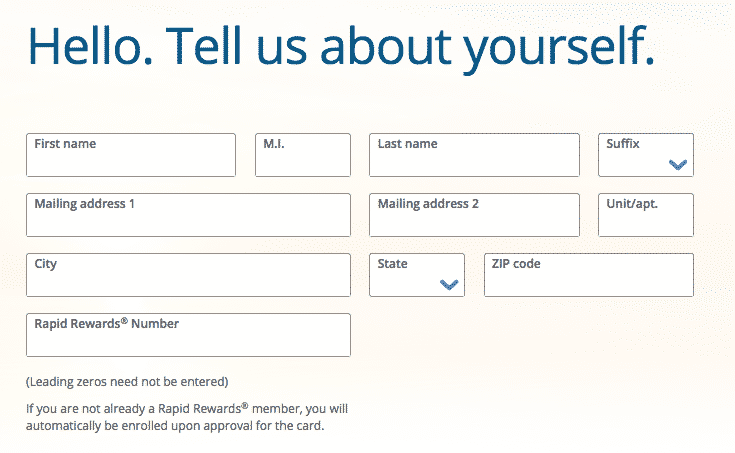

You should also create your Southwest Rapids Rewards Account in advance so that your signup bonus can be properly credited to your frequent flyer account (when you apply for the cards, you’ll enter your Southwest Rapid Rewards Account number so that your points can be tied to your account).

Once you’ve been approved for the cards, I’d recommend sending a secure message to Chase to confirm when you need to meet your minimum spend. Then, put that information into your calendar so that you don’t forget.

Southwest cards are subject to the Chase 5/24 Rule, so you’ll need to know your 5/24 status to see if you’re going to be eligible to open two Southwest cards. (Read the following post if you need more background about the Chase 5/24 Rule).

Who Should Get The Southwest Companion Pass?

So who should get the Companion Pass? There are three things to consider.

First, you need a companion to fly with. If you don’t have one, then you’re not going to get much value from the Companion Pass. Instead, I’d recommend going for other cards like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve, or Ink Business Preferred Credit Card.

Second, you need to live somewhere that has Southwest flights. People who live near Southwest hubs would particularly benefit from the Southwest Companion Pass. If you live somewhere that doesn’t have Southwest flights, your Southwest points won’t be very helpful to you.

Finally, you need to be planning to do a decent amount of domestic travel in the next year or two. Southwest does fly to the Caribbean, Mexico, and parts of Central America, but otherwise, its main routes are domestic. They also have flights to Hawaii which can be very useful for Companion Pass holders. If you don’t fly domestic flights much, then I wouldn’t recommend going for the Companion Pass.

As one last comment, the annual fees for cards like these are something that I used to worry about, but in reality, they shouldn’t worry you too much. That’s because these cards all offer yearly anniversary points for each year that you have the card open. These points help to offset the annual fee, making the effective cost of the card lower. In addition, if you consider how much value you’ll get from the Southwest Companion Pass, any initial annual fees you pay are well worth it. If you travel and use your Southwest Companion Pass, you’re likely going to come out ahead.

When Is The Best Time To Apply For The Southwest Companion Pass?

The best time to go for the Southwest Companion Pass is towards the end of the calendar year or as close to the beginning of the calendar year as possible so that your points post early in the year. In a best-case scenario, you want to time it so your signup bonus posts in January or February, which means you’d want to apply for your Southwest cards in late October through December, with the goal of having your points post to your account in January. That means you’ll want to make sure you hit the minimum spend at the beginning of the year.

For example, if you sign up for the cards in November, you’ll want to make sure you hit the minimum spend on January 1st or later. That way, your points will be credited to the current calendar year you’re in, which makes it possible for you to have the companion pass for close to two years. In other words, your ideal timeline would look something like this:

- Late October to November: Sign up for two Southwest credit cards that will enable you to earn 125,000 Southwest Rapid Rewards points.

- January 1st: Hit the minimum spend requirement on this date or later. Once you reach 125,000 Southwest Rapid points, you’ll have the Companion Pass for the remainder of the current calendar year and the entirety of the next calendar year.

You’ll also ideally want to wait until Southwest is offering elevated signup bonuses. Since you need 125,000 Southwest Rapid Rewards points, you’ll need an average of 62,500 Southwest points per card to earn the Companion Pass. Do the math to make sure it makes sense to get the card.

Also, remember the most important thing. You need to earn all 125,000 Southwest Points in one calendar year to qualify for the Southwest Companion Pass (in other words, you can’t earn half the points in one year, then half the points in another year – all 125,000 points need to be earned in the same year). A huge mistake some people make is hitting the bonus too quickly on one card, making it so that the signup bonuses post in separate calendar years. My general recommendation to avoid making this mistake is to time it so you don’t hit the minimum spend until after the New Year. If you do this, you’ll for sure never mess this part up.

Southwest Credit Card Choices And Limitations

Since we need two Southwest credit cards to earn the Companion Pass, we need to do a little strategizing to determine which cards to get. One major limitation is that you are (technically) only allowed to have one Southwest Personal Credit Card open at a time. As a result, to get the Southwest Companion Pass, we’ll have two choices:

- Get one Southwest personal credit card and one Southwest business credit card; or

- Get two Southwest business credit cards.

I personally think it’s better to get two Southwest business credit cards since business cards don’t count toward your 5/24 status, but which option you pick will depend on your personal situation and what the signup bonuses are at the time you apply. There are also ways to get two Southwest Personal Cards by taking advantage of some application timing things, but that’s a more advanced play that isn’t necessary for most people (if you really want to know how that works, feel free to send me an email).

Note that Chase does have a rule in which you are only allowed to get one business card every 30 days, so as a result, if you are applying for two business cards, you’ll have to wait at least 30 days between your applications. In my experience, it’s usually a good idea to space out your applications anyway when applying for Chase cards.

Final Thoughts

If you’re under 5/24, have a companion to fly with, and plan to do a decent amount of domestic travel in the next two years, then you should definitely aim to earn the Southwest Companion Pass. It’s one of the most valuable travel perks in the travel hacking game and something that I plan to utilize for as long as I can.

So, as a quick recap, to earn the Southwest Companion Pass, you’ll want to do the following:

- Sign up for the Southwest Rapids Rewards Program on the Southwest Airlines website. You need to do this so that you can have the points credited to your Southwest frequent flier account.

- Get two Southwest credit cards (ideally when they have elevated signup bonuses). You can either get one Southwest personal card and one Southwest business card or get two Southwest business cards.

- Once approved for the cards, send a secure message to Chase to confirm your minimum spend date. This isn’t required but I like confirming this information just in case.

- If you’re trying to optimize the Southwest Companion Pass, then aim to apply for the cards sometime in late-October and hit the minimum spend after January 1st. That way, your signup bonus will post in the next calendar year, allowing you to earn the Southwest Companion Pass for the maximum amount of time possible.

Any questions? Feel free to hit me up.

*Addendum: One thing to remember is that you need to earn all 125,000 Southwest points under one person’s name. You can’t combine points between two different people.

Financial Panther has partnered with CardRatings for our coverage of credit card products. Financial Panther and CardRatings may receive a commission from card issuers.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Can you get the companion fare by just applying for one credit card and not two? Please outline the steps and timing. Thank you.

Thanks for the breakdown. One thing im unclear on. I opened a Business Premier card, and my wife opened a Premier. We entered the same Rapid Rewards number (mine) when signing up. Do you know if we can get both sign-up bonuses applied to the same Rrapid Rewards account if we opened separate cards under our own names, or do you definitely need both cards under the same person‘s name to get both bonuses?

Thanks again!

You need to have both cards opened under the same person’s name. So one of you will need to open up a second Southwest Card to get the companion pass.

So I just successfully did this but I have a question-I wasnt approved right away(I applied a few days ago and just got approval over the phone, Im guessing because Im hitting my 5 card limit with them?), but I noticed the promo is over, so will I still get the bonus offer since thats when I applied? Or does it only matter when I was approved because if thats the case Ill be pissed! Because there was virtually no reason for them to delay approval.

Did you apply when the bonus was 60k? If so, you should still get the bonus, since that’s what you applied for. Once you’re approved, make sure to secure message them and make sure that you’re getting the 60k bonus and find out what your minimum spend date is.

Yes- I basically did it as soon as I read your article and the offer was definitely valid- thanks for your quick reply!

Your plan is my plan exactly. I’m so glad I heard about the bonus because my friends know I love sign up bonuses and one friend was looking into the cards before I even knew about it!

I applied on Saturday, and didn’t get instant approved which worried me, though I applied through 2 separate browsers (I was rejected earlier last month for the Preferred because I already had the Reserve). I was VERY happy to see the cards show up in my account this morning…it was better than Christmas morning. Now I just have to make sure I spend the last portion in January. Great tip on sending the secure message I’ll do that just in case too!

Awesome that you got the card! Next two years will be pretty sweet!

Awesome post. Very thorough – thanks. There was a discussion of the SW Companion Pass on the one of the actuary forums, so I left a link for people there.

Thanks AoF! I never even knew about actuary forums, so that’s new for me!

We’ve had the Southwest Companion fare this year and loved it! It sometimes require routing a flight with a stop, but if it saves $100 bucks to lose an hour or so, I think it’s worth it. I think of my hourly pay rate and if it’s less than that, then it’s worth it.

Makes sense! The nice thing for a midwest person like myself is that, being in the center of the country makes it much easier for us to do our domestic travel. We can pretty much go east or west in the same amount of time.

Very genius and thorough steps . I’ve never been on a southwest flight (we’re not in a SW hub) but they are consistently the top performers. Wish we could but travel hacking is always a fun read!

There are a lot of other ways to travel hack as well! The Southwest one is just what I’ve been wanting to get for a while!

Nice hack! Too bad we’re both past the 5/24 rule. I did end up getting the Merrill Lynch card though. Now to book some free flights 🙂

Ah, I’m still at 4/24 myself, although I’ve opened up 6 cards in the past year (two business cards which don’t count for 5/24 purposes!). My wife’s at 3/24 now after opening up these two Southwest Cards.

I snagged the Merrill Lynch myself back in February. We put some wedding spend on it, then booked our honeymoon flights using the signup bonus. It was perfect because each flight was almost exactly $500, so we basically got maximum value on the M+ signup bonus.

Can you help connect the dots a little for me. So you each end up with 60,000 points, then do you have to transfer all the points to one account? Can you redeem the 120,000 points on flights in addition to getting the companion pass?

This sounds like an awesome deal, I am definitely thinking about doing it.

Good question! Sometimes I get so caught up in this stuff that I maybe don’t make things as clear as I could.

So to get the Companion Pass, you open up two cards under one person’s name. The 110,000 points need to be earned all by one person, in one calendar year. You can’t split them up between two people.

So, easiest way to think about it:

-You personally open up the Southwest Plus and the Southwest Premier card this week. Both cards are in your name, using your credit score and credit information.(make sure you apply for each card in separate browsers in incognito mode)

-From now until December 31, 2017, you spend about $1,500 or so on each card (so $3,000 in total spend in about 3 months). You do this because you don’t want the bonus points to hit until 2018.

-After January 1, 2018 until sometime in mid-January, you spend the remaining $500 or so on each card (about $1,000 in total spend) (make sure to confirm with Chase when you need to hit your minimum spend by – it should be sometime in mid-January)

-Since you’ve now hit the minimum spend, your bonus points will post on your next statement date – probably sometime in January or February depending on when you hit the spend. You now automatically earn the companion pass, which is good for the rest of 2018 and all of 2019,

-You now have 120,000 Southwest Points to use, plus every time you buy a ticket with those points, you get a free flight with it.

Does that make sense?

If you’re new to the world of travel hacking, this is a great one to get started with, assuming you’ve got a good enough credit score to be able to get approved for both cards.

Awesome, that really helps clarify! Definitely going to give this a try!

That pesky 5/24 rule gets me every time with Chase these days. GRRR!!

I’ve had the SW card before and love flying with them. Any liner beats Delta and especially United. Nice post, FP!

Ah bummer! For someone with two little ones, Companion Pass could be pretty good – one for you, one for your spouse, and then both kids fly free! Hopefully you can get your hands on the Companion Pass next time around.

It might be time for our household to get these credit cards! We just hit the MS on the last one we signed up for, but I was looking forward to having a break from churning 🙂

Does the companion pass work for both purchased flights and points paid for with points, buy one get one free either way? Do you need to have 110,000 credited points for a certain amount of time to earn the companion pass?

Yep, you can use the Companion Pass for both flights that you pay for and flights that you get using your points.

Once you hit 110,000 points in a calendar year, you automatically get the companion pass when your next statement hits. Just remember that you need to hit the minimum spend on both cards after January 1st. That way, the 60k points will post on each card in January, 2018, and you’ll earn the companion pass for all of 2018 and all of 2019.