This is a bit of a different post compared to what I usually write, but I think there’s a subset of readers that might find this post interesting. Financial independence has always been about getting back more control of our lives. And when you think about it, bikes might be one of the first things we get that give us some semblance of control, allowing us to get from place to place without relying on someone else. When you think of it like that, it makes sense then that bikes have become such an important part of my life.

When I look at my own biking activity, I’m comfortable saying that I probably bike more than 99.9% of the US population. Biking is the main way I get around. And indeed, since our family is a one-car household, it’s often the only way I can get around.

My story of how I got into bike commuting and using bikes as my primary mode of transportation started almost a decade ago. I wasn’t a life-long bike commuter. For most of my life, I got around by taking mass transit or walking. It wasn’t until I signed up for my first bikeshare membership that I realized how useful bikes were for getting around. I went from never biking to biking every day.

What makes me different from many hardcore cyclists is that I’m not a bike expert. I can barely change a flat tire (I’ve done it a handful of times and hated it). When I do need to do something with my bike, I bring it to a bike shop. In many ways, I’m the model of what a bike commuter should be – someone who uses bikes to get around but isn’t invested in the hardcore cycling world that seems to gatekeep many out of biking. It’s like how most of us drive cars, but don’t know how cars work. That’s how I am with bikes for the most part.

The way I’ve biked and thought about biking has changed as I’ve moved into different stages of my life and discovered new ways of biking. Perhaps most noticeable is what biking means to me. For most of my life, biking was about getting myself from one place to another. But now that I have a kid and need to get him around from place to place, biking means something very different.

In this post, I want to share my biking story over the years, from when I first started bike commuting to what my biking style is like today. My hope is that this story shows you that anyone can bike. You can do it even if you have kids too.

Here’s my story and the evolution of my biking journey to where I am now.

My Biking Story Began With Bikeshare

Up until 2015 or so, I commuted almost entirely by bus or train. I didn’t own a car, so I purposefully lived in neighborhoods where I could get around without one.

Things changed big time when I discovered my city’s bikeshare system. These systems are ubiquitous now in most large cities, but back in 2015, they were still fairly new.

In Minneapolis, we had a bikeshare system called Nice Ride that gave you unlimited 60-minute rides for $60 (it has since evolved, but still has the same yearly membership and unlimited rides). I signed up for a membership and suddenly had access to thousands of bikes throughout the city. Instead of taking the bus to work, I started biking every day. There was a docking station right outside my apartment. And my office had a docking station right outside of it, making it an easy commute to work – about a 15-minute bike ride.

And that’s how I got around for the most part. To me, bikeshare was an even better, more affordable form of mass transit (it was about 26 cents per ride if I only counted my commute to and from work each day). My wife had her own bike, but I preferred using the Nice Ride bikes since I didn’t have to worry about locking them up or having my bike stolen. And with the Nice Ride system, I had the entire city open to me.

Incorporating Multi-Modal Transit Into My Biking

In 2016, I ended up getting a new job in downtown St. Paul. I lived in Minneapolis and was previously commuting to downtown Minneapolis, so commuting to a different downtown meant my bike commute had to change.

It was during this stretch that I started taking advantage of multi-modal transit. This is when you combine multiple forms of commuting, In this case, to get to work, I would grab a Nice Ride bike and bike to the light rail station near me (about a 10-minute bike ride), then hop on the light rail to downtown St. Paul. From there, it was an easy walk to my office.

To get home, I would usually grab a Nice Ride and bike back the entire way – an 8-mile ride that took me about 40-45 minutes. I did this because I didn’t have to worry about getting home sweaty (in contrast to going to work, where I wanted to avoid sweating).

Nice Ride shuts down during the winter, so I got a cheap bike that I used in the winter to get to the train station. To get a sense of how crappy this bike was, I once left it on the train by accident and no one stole it. The bike wasn’t fancy, but it got me to where I needed to go.

Converting To Ebikes And Electric Scooters

In 2018, two things dramatically changed the way I viewed bikes as a commuting tool. First, I discovered electric scooters thanks to shared scooter companies like Bird and Lime. I had never used any form of electric micromobility before and I was stunned when I first tried these vehicles. I couldn’t believe how well I could around with an electric scooter. And they were unbelievably fun to use. I became an electric micromobility convert right there and was convinced that this was the way people needed to get around.

The second thing that changed me was when I visited Dallas for a work trip and tried out an ebike for the first time. Like with the electric scooters, riding an ebike was a life-changing experience. My wife and I rode 10+ miles the first time we used an ebike and didn’t break a sweat. As soon as I got back to Minneapolis, I immediately bought an ebike for myself (the first ebike I got was a RadCity, which has over 6,000 miles on it and is still going strong). I still think it’s the best thing I’ve ever bought.

Most people seem to have two objections when it comes to using a bike as a primary mode of transportation. One of them has to do with poor infrastructure. I think that there are ways around this and there are very few places where it’s simply impossible to bike, but I get it. I’m fortunate to live in a city that’s done a pretty good job of prioritizing pedestrian and bike-friendly infrastructure.

The second objection has to do with not wanting to sweat. I’ve always thought this was more of an excuse than a real objection, but the beauty of ebikes and scooters is that they completely remove this objection. You aren’t going to sweat on an ebike or scooter – at least not any more than you would from walking or standing outside.

These days, I almost exclusively use ebikes to get around. It’s opened up so much of the world to me. And I love how I can get around without breaking a sweat. The ebikes I use go around 20 mph, which is fast enough to get me to most places in the city within 30 minutes or so.

In addition to commuting with ebikes, ebikes have also turned into an investment for me in a way. That’s because I use my ebikes to do food deliveries with apps like DoorDash, Uber Eats, and Grubhub (in addition to all of the other gig economy side hustles I do). It’s not difficult to cover the cost of an ebike by using it to do deliveries. It can even be a business expense.

Beyond ebikes, I also use electric scooters to get around. I think scooters are probably more fun to ride than bikes and I find that in the summer, I’ll often opt to use the scooter to get around. Ebikes have more utility though, mainly because these days, I have to get around with two people now (more on that in the next section).

The Future – Biking With Kids

For most of my biking life, I only had to think about myself. Biking was generally a solo activity – a way to get myself from one place to another. But once my son was born, the way I thought about biking had to change. It wasn’t just about moving myself around anymore. I also had to move my son too. It’s a big shift in thinking when you have to start thinking about bikes as vehicles to move multiple people around.

Ebikes make getting my son around so easy. Pedaling with kids can be difficult, but with an ebike, I really do feel like I have a full-fledged car replacement.

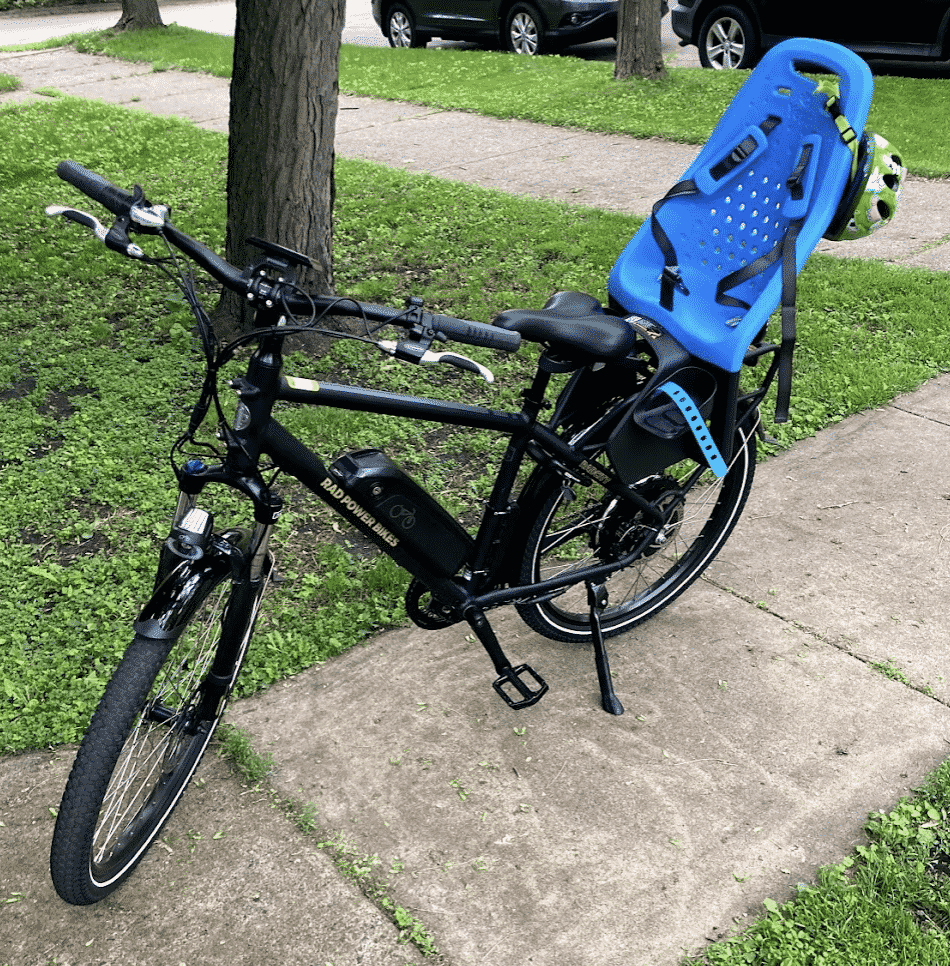

To get my son around, I use a bike seat that goes on the rear rack of one of my ebikes. It’s rated to fit children up to 6 years old and 40 pounds, so I should be able to use the bike seat for a long time.

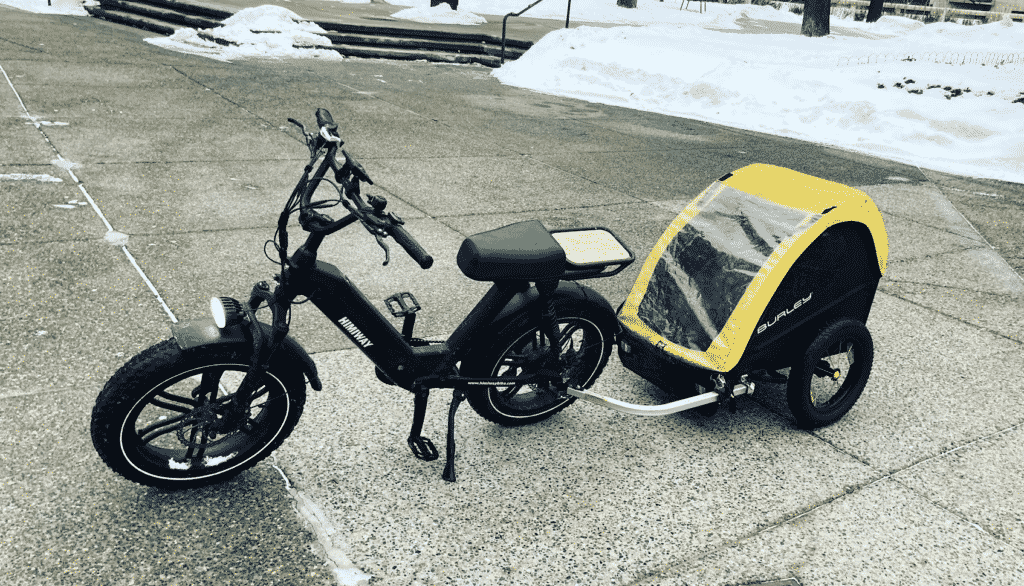

During the winter or when it’s raining, I use a bike trailer. This comes with the advantage of allowing my son to be in an enclosed space, shielded from the elements.

My son and I bike 4-5 miles each day to get to daycare. Most people, even hardcore cyclists, might have given up at this point and gone with a car. But I’m committed to sticking it out with a bike. Even in the winter, we still bike every day. I simply bundle my son up and place him in the trailer. He stays nice and warm in the trailer (I’m really the one that has to brave the elements).

As our family gets bigger and my son gets older, I’ll probably convert to an electric cargo bike, which is essentially like the SUV of the bike world. I’d love to get a cargo bike like the Urban Arrow, which can carry 4 passengers, but it does come with a steep price tag. More likely, I’ll end up getting a cargo bike like the RadWagon.

Anyway, that’s my biking story. I’ve gone from regular bikes to ebikes and scooters to using ebikes to transport my son. It’ll be interesting to see how my biking story changes over the next 10 years.

I think with growing family you’ll need an electric vehicle next 😉

Yeah, that Tesla is calling me. The thing is, while I like electric cars, there is an inherent inefficiency with them. All the battery power is being spent to move the car, not the person. That’s very different than an electric bike or scooter, where the battery power is spent primarily moving the person.

I envy you. Moved in with my (now) husband and live in the suburbs. Even to get to public transit I have to drive, it takes longer actually just to get to the train than just to drive to the city. It’s infuriating since it’s only 10 flat miles to work from our house (15-20 minutes by car), but it would involve biking on busy roads/highways (this avoids interstates which is most direct route) through the former murder capital of the US during dark on the way home and getting off the bike to walk it over an interstate bridge (biking is not allowed). Starting prices in houses in the city at a minimum are 3-6 times (depends on neighborhood) what my husband paid for his place, and his place has a yard and such. I miss living in my tiny apartment in the city pre-marriage sometimes but what can you do? Love is cool…

That’s a bummer. You can do 10 miles on an ebike really easily. It’s a shame when places make it so you can only use cars to get around. I’m not against cars, but I am against design that takes away choices and elevates the car above everything else.