I bike to work five days a week, and every once in a while, I like to reflect on how fortunate I am to be able to do that. It’s a wonderful situation that I find myself in. I live close enough to my office that biking to work isn’t a particularly difficult thing for me to do. And, by biking to work, I get to avoid all of the costs of car ownership, while at the same time collecting all of the cost and health benefits that come with biking. It’s a great choice that I’ve made – one that will make me wealthier over the course of my life.

That first paragraph tells you the story that I’ve told myself – that biking to work is my choice, an active decision I made. As I’ve always thought about it, it’s up to the individual to make the decisions that make biking possible – things like living close to where you work, staying in shape so that biking is a possibility, and just having the sheer willpower to bike instead of drive, even on crappy days. Anyone who doesn’t do that is just being lazy (or so I say). The hustlers bike, while the lazy drive.

In some ways, that could be true. But in other ways, that’s not really true at all. Sure, biking to work is partly a choice that I made. I’m able to bike to work because I made certain decisions that make biking possible. At the same time, there’s much more to it than that, factors that came into play long before I ever started biking.

And that’s probably why I choose to bike to work more than anything. I’ve been blessed with a lot of advantages in life, and the fact that biking to work is so easy for me is a product of those advantages.

I have the privilege to be able to bike to work. To me, it’s a shame to waste it.

What Biking To Work Says About Me

The mere fact that I’m able to bike to work tells you a lot about who I am and the advantages I had and still have today. Some of those advantages are and were my own doing – I made my own choices to put myself in the position I’m in today. Others, I had no choice in the matter and was just lucky enough to be born with those advantages.

For example, the fact that I can ride my bike to work says at least the following about me:

I Know How To Ride A Bike. Learning to bike is a skill – albeit one that you can learn as a kid. I can’t remember when I learned how to ride a bike, but it must have been sometime when I was in the first or second grade. This is a big deal. It meant my mom (who was the person that taught me how to ride a bike) was not only able to afford to buy me a bike but could also take the time to teach me how to ride it.

Perhaps most importantly, it means my mom had the foresight to know that this was a skill worth having. I didn’t choose to ride a bike, just as a lot of us don’t choose the skills we were given that still benefit us today. It was a skill that was given to me, solely because I was born in the right place.

I’m Wealthy Enough That I Can Afford To Live Near Where I Work. The most important factor on whether you’ll bike to work is, without a doubt, how far away you live from your office. As you start moving farther away from work, the speed difference between a car versus a bike gets bigger and bigger, which makes using your car more and more advantageous. Thus, quite obviously the farther away you live, the less likely you’ll bike to work.

In some ways, where you live is a choice. It’s why I opt to live in dense, urban, college neighborhood, instead of in a large house in a subdivision surrounded by highways. By choosing to live here, I’m able to forego using a car and make the easy bike ride to my office every day.

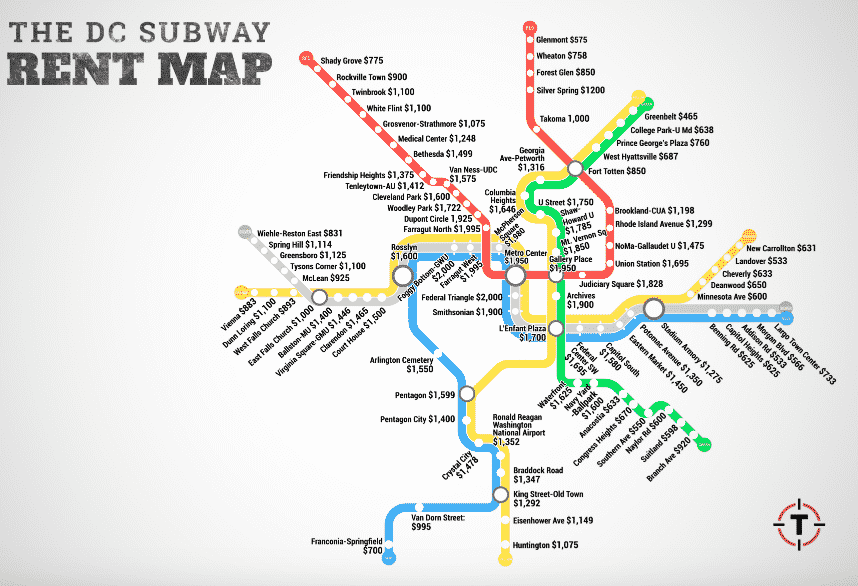

But at the same time, I’m able to live where I live because of my income. Housing will always cost more as you get closer to the city center. And it’s city centers where our jobs are located. Paradoxically, it’s the people that are already making a good income that are in the best position to use the cheapest and most efficient form of transit.

I’m In Good Enough Shape Where I Can Physically Bike To Work. It goes without saying, but riding a bike requires some level of physical fitness. I’m lucky enough that I have no major physical barriers or disabilities stopping me from riding my bike. I can ride to work in the morning without even breaking a sweat.

For some people, biking isn’t an option, whether that’s due to lack of fitness, or due to physical barriers that are out of their control. I have a friend of mine who suffers from a lung issue, which makes biking difficult for him. He’s forced to drive places, not because he doesn’t want to bike, but because he literally can’t.

I Have Access To A Bike. Access to bikes is something that a lot of us overlook. Bikes don’t have to be expensive, but that doesn’t mean they’re cheap either. A lot of people just aren’t in the position to drop a few hundred bucks to buy a bike.

One positive development is that access to bikes is getting much easier with the rise of bikeshare systems. I’m an avid bikeshare user myself, using exclusively bikeshare bikes from April through October (since it snows in Minneapolis, they close up the bikeshare system during the winter). At just $72 per year for my membership, it costs me just $10 per month, or about 25 cents each time I ride to work. That’s a price that most people can afford.

At the same time, my ability to access bikeshare is a product of my income and ability to live in wealthier and denser neighborhoods that can support bikeshare systems. Those living in poorer neighborhoods or in less dense neighborhoods farther away from the city center won’t have the same access to bikes as I do.

If You’re Privileged Enough To Bike To Work, Don’t Waste It

One of the reasons that I bike to work – even on the hottest and coldest days – is that, in a way, I feel like I have a duty to do so. I was born into a privileged position, one that gave me a leg up on others in a ton of areas.

When you think about it, biking is a great example of the rich getting richer. By biking to work, I get to stay healthier (which saves me money and makes me wealthier), and I don’t have to use a car to commute to work (which also saves me money, makes me healthier, and again, makes me wealthier). For people without the same advantages as me, a car might be the only mode of transportation they can use. And that mode of transportation will cost them.

The fact that I can bike to work so easily is a product of my choices, but it’s also a product of external factors that I had no control over. It’s never seemed right to me to waste this privilege, especially when biking not only benefits me, but also benefits the world (less pollution, less cars on the road, etc). To me, the biggest shame is seeing someone who can bike to work choose not to do so.

So, if you’re in the position to bike to work, take a second to recognize what a privilege you’ve been given. It’ll really put the whole biking to work thing into perspective.

Good!

The post reminded me of my youth (in NYC) where I would walk to work. Whats a joy! No transit hassles. And in those days it was much more affordable, and with a high enough turnover it was not difficult to find a new apartment every time I got a new job!

That of course all changed once I paired up with a woman, we wanted more space for a family, etc. Years later (now in California) I have a house in a not expensive area (believe me there are such things). No bike, but I live where I was able to drive to work for 20+ years by taking local roads–no highways! Another joy!

If you can walk to work, you’re in a really awesome position. Very few are in that position I find! California has always seemed like a tough biking state – maybe not San Fran, but LA for sure just seems like its built to make it as hard as possible for people to bike.

Love this! I’ve been biking to work this summer and found that it saves me about $6 per day– super helpful since I’m paying off about $650k in student loan debt. I’ve never really thought of it as a privilege, but that’s exactly what it is for the reasons you described!

Glad you’re taking advantage of biking! And awesome savings! Just think about what it says about you that you can do that – you’re healthy, you live close to where you work, and you know how to ride a bike. That’s privilege, and something that we shouldn’t waste, if given that opportunity.

“A lot of people just aren’t in the position to drop a few hundred bucks to buy a bike.”

Neither was I. But neither was I in a position to spend 60€ on a monthly bus pass, or even think of buying a car.

But I had access to the internet – to local sites where I was able to buy a used bike for 50€.

That’s great! Hows the bikeshare system where you are? I’ve done some calculations and honestly, it seems like bikeshare can be cheaper even then owning a bike, when you consider the yearly maintenance and other costs that go into owning a bike.

Great post. Ive been trying to shift my mindset in the past months to actively practice gratitude, which includes acknowledging privilege. As it’s been more of a buzzword, I have learned all the more that I am truly privileged. I’m an RN in Seattle and I’ve been walking to work for years. My fiancé and I live in a studio so it costs less but we can take advantage of the location. I’m roughly a mile from the farthest hospital that I work at, so biking actually seems cumbersome! On occasion, if I’m too lazy to pack a lunch, I walk quickly and grab something at home. I’m in a good union, have great coworkers, and almost always get a solid 45 minute, uninterrupted break. Privilege on privilege. Though I never fancied myself a “city person,” this ends up being a MUCH less stressful life for me. My intent is for all this to add up so I can be more generous with money, time, even smiles. As you’re saying, this does require me to keep checking myself and to appreciate all that I have, and all that’s lead up to what I have.

Cheers FP!

Last night my boss caught me as I was unlocking my bike to ride home. “Oh you bike to work!” she exclaimed. I’ve been biking to work on and off since 1995 (and I haven’t driven to work since 1995) so biking to work doesn’t feel like a huge privilege, it feels like a way to save $5/day on train fare. But your points are valid. Had I read your post the day before that encounter, my reaction would have been much more positive and much less nonchalant.

I’ll keep my many transportation privileges in mind during my commute. Another is that I haven’t driven to work since the 90s because I’ve lived in towns who believe in putting money into good public transportation, so when I don’t want to ride, I have an affordable way to get to work.

Great perspective. I don’t waste my opportunity as I have cycle commuted year-round in the twin cities for the past 19 years. I’ve received all the benefits you outlined along with the pure joy of riding in the fresh air every day. However, you have opened my eyes to the fact that I have taken too much credit for my excellent choices. I now see that I owe a great deal of debt to those built in advantages I’ve had due in no part to my choices. I am privileged to have learned to ride a bike early and to have always had a bike and safe neighborhood to cycle through. I am privileged to be healthy and able to ride a bike and to be able to afford to live close to my work. All of which, as you outline, has improved my health and wealth. Amazing. I haven’t done all this myself….I’ve got to go call my parents now to thank them (again).

Glad to see a fellow Minnesotan bike commuter! It’s definitely something for us all to keep in mind – and why I think if you can bike commute, you need to do it. Biking is seen by a lot of people as just a smart choice we’ve made (which, of course, is true in part), especially in the FI world, but I think it’s also important for us to see that its a product of our environment, education, and all of that stuff we take for granted. That’s why it’s just so important for us to take advantage of it when we can – the biggest waste is getting privilege, something that not only benefit you, but also benefit others, and not take advantage of it.

Interesting, I never thought about biking as a privilege, but it makes sense. Having the leisure time to research bikes, think about and afford where you want to live, make healthy lifestyle choices, etc. The other side of the spectrum is where people are forced to bike because there is no other alternative or they can’t afford a car. I don’t think I feel strongly obligated to bike every day (most days I do, but sometimes I’m lazy!), but definitely will appreciate it more from now on.

The amazing thing is that I think there are very few people who are “forced” to bike. When you think about it, it’s probably easier to buy a car then it is to buy a bike. Think about all those scummy car places that say we finance everyone. People will go into crippling debt to get the car. I bet its harder to find 200 bucks to buy a bike then it is to finance a few grand for a car.

Great post! Super important perspective to keep in our minds. Thanks for writing this!

Thanks K!