Something that often gets forgotten in the side hustling discussion is the impact of taxes. If you’re like most people, taxes are probably a thing that you don’t think about all that much. You get your paycheck, you file your taxes at the end of the year, and you probably end up with a tax refund most of the time.

In its base form, income that you earn from normal employment (W-2 income as its called) is pretty simple. You’re taxed on that income in essentially three ways:

- Federal Income Tax

- State Income Tax

- FICA Taxes (employee portion)

These taxes get taken directly out of your paycheck, which is helpful for you since it means that you don’t really have to do anything. You just get your money from your employer and you’re good to go.

Obviously, you’ll pay more or less in taxes depending on where you live. Some places have local taxes (I’m looking at you New York). Other places have no state income tax at all. But in general, federal, state, and the employee portion of FICA taxes are the three taxes that you’re going to be paying on your regular, W-2 income.

The landscape looks a bit different when you’re earning income from your side hustle, whether that’s from creating a business (like a blog) or working on a sharing economy/gig economy platform like Uber, Lyft, Postmates, Uber Eats, Rover, etc.

In this post, we’re going to take a closer look at the taxes you need to think about when you’re earning money from your side hustle. We’re also going to look at how these taxes can impact your earnings and what you can do to keep more of your side hustle earnings in your pocket.

How Independent Contractors Work

When you’re earning income on the side, you’re most likely going to be earning it in the form of 1099 income. Unlike W-2 income (where your employer takes out your taxes for you), 1099 income flows to you with no taxes taken out at all. That means you’re going to have to pay your taxes yourself.

I think the easiest way to think about your side hustle taxes is to imagine yourself as a little company. You’re both the CEO and the sole employee of your little business empire.

So, for example, my various side hustles look like this from an organizational standpoint:

- Owner/CEO/Boss = Financial Panther

- Employee/Minion/Janitor = Financial Panther

On the one hand, I’m the upper management in my little side hustle business – the C Suite executive, if you will. And I’m also the lowest rung worker in my business of me.

Take my Postmates gig as an example. When I’m out doing my lowly delivery man duties on Postmates, I’m both the CEO of my own little delivery business and the only employee of that same business. It’s kind of weird to think about it that way, but that’s basically how being an independent contractor works.

The Different Taxes You Pay When You’re Side Hustling

Now we come to the dreaded thing that everyone hates – taxes. When you’re side hustling on top of your day job, the taxes you pay on your side hustle income matter A LOT. That’s because your side hustle income will be your highest taxed income.

Let’s look at why that is. Below is a list of the different taxes you’ll pay on your typical side hustle income:

- Federal Income Tax (at your highest, marginal tax rate)

- State Income Tax (at your highest, marginal tax rate)

- FICA Taxes (employer portion)

- FICA Taxes (employee portion)

You might wonder why I say that your side hustle earnings are taxed at your highest marginal tax rate. The reason has to do with the fact that, if it’s a side hustle, then by definition, it should be money that you are earning outside of your day job and, importantly, that you don’t need in order to survive (hence, why it’s called a side hustle). If you actually need your side hustle income in order to survive, it’s not really a side hustle – it’s basically just a second job.

If we make the assumption that your side hustle income is money that you don’t actually need to live, that means we can consider it bonus money and can think of it as the last dollars you earn in any given year. Remember, if you don’t need that money to survive, you could have opted not to earn it and paid no taxes at all.

The other thing you’ll probably notice is the employer portion of your FICA taxes. Like I pointed out before, when you’re running your own little business, you’re both the CEO and the only employee of your little company. Since you’re playing both roles, you’re responsible for paying the other half of FICA that your employer normally pays for you.

How Much In Taxes Are You Paying?

With that background out of the way, let’s go through an example to help you understand how much tax you’re paying on your side hustle income.

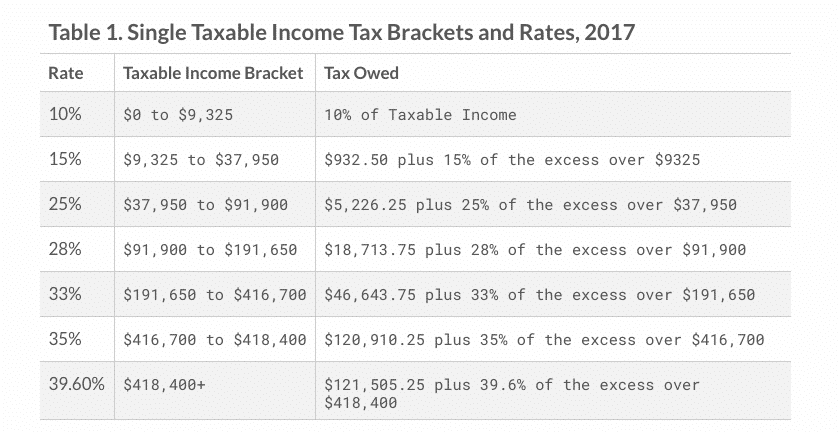

Let’s say you make a nice round, $100,000 in your day job. Here’s what the federal tax brackets look like as of 2017 for a single person:

Assuming you take a standard deduction, you’ll be firmly in the 28% tax bracket. That means that for every $100 you earn on the side, you’ll be paying 28% federal income tax on that money, along with your state income tax, and both portions of FICA.

Here in Minnesota, the $100 that you earned might look something like this:

- $28 goes to federal income tax (28% tax rate)

- $7.85 goes to state income tax (7.85% tax rate)

- $7.65 goes to the employer portion of FICA tax (7.65% tax rate)

- $7.65 goes to the employee portion of FICA tax (7.65% tax rate)

So for someone making $100,000 in Minnesota, that extra $100 of side hustle income comes out to $48.85 after you’ve finished paying taxes on all of it.

That’s a really big hit. And it’s why it’s so important to reduce your tax liability as much as possible.

Ways To Reduce Your Tax Liability On Your Side Hustle Income

Since we know that taxes are problematic for side hustlers, what can we do about it?

Thankfully, when you’re side hustling as an independent contractor, you’ve got a lot of ways to reduce your tax liability. Here are just a few ideas:

(1) Use A Solo 401k. The amazing thing about side hustling is that you get access to extra retirement accounts that normal people don’t get to have. In essence, you’re giving yourself a bonus retirement account.

Depending on your work retirement plan situation, it’s possible that you can save almost the entirety of your side hustle earnings. That’s what I was able to do in 2016 since my government job offered a pension and 457 plan, but no 401k.

At a minimum, you’ll be able to put away about 20% of your side hustle earnings (after deducting expenses), which can be big. And setting up a Solo 401k is really easy and costs nothing if you use a company like Fidelity.

(2) Deduct Expenses. The other unique factor with side hustling is the ability to deduct expenses. Remember that when you pay for anything normally, you’re using post-tax income. Buying a coffee doesn’t really cost 2 bucks. It costs more than that because you need to earn $2 of post-tax income.

Your side hustle earnings, on the other hand, give you the ability to pay for expenses related to your side hustle with completely untaxed money.

Take, for example, my upcoming trip to FinCon – probably the nerdiest, gathering around. It’s basically a bunch of personal finance bloggers hanging out and talking about money and blogging. This was a trip I was already going to take, but by paying for it with my blog earnings, I’m able to deduct those costs from my blog revenue, and essentially, every dollar I spend on my FinCon trip is spent, completely tax-free.

(3) Get Some Of Your Side Hustle Income On Schedule E.

Most of the income you earn from your side hustles will end up on Schedule C. This is the tax form that you use to report income from a business where you were a sole proprietor. When your income is on Schedule C, you also have to pay the employer and employee portion of FICA (i.e. an extra 15.3% in taxes).

However, not all side hustle income has to end up on Schedule C. The other big form is Schedule E, which is what you use to report income from real estate and partnerships. If you rent out a room in your house, for example, and don’t provide any “substantial services” as the IRS calls it, then it’s just regular, old, real estate income. That’s how my Airbnb income is treated. All I do is provide a room for people and that’s pretty much it.

What makes Schedule E income good is that you don’t have to pay FICA taxes on it. That’s a 15.3% savings if you can put your side hustle income on Schedule E.

Takeaways

There’s a lot that goes into the world of side hustle taxes and it’s definitely something that can surprise you if you go into it without realizing the tax burden. In the old days, people working for themselves tended to be more sophisticated actors that had access to lots of tax advice. Today, with the rise of the sharing economy, anyone of us can go out there and earn money for ourselves. It can be overwhelming if you don’t know what you’re doing.

What’s important to remember here is that your side hustle earnings will be taxed at your highest tax rates since it’s all money you’re earning on top of your day job. Your goal, then, is to reduce that income as much as possible in order to keep as much of your money as possible.

What do you think? How do you go about reducing your tax liability on your side hustle income?

I know this lost is a few years old, just recently found your blog and started doing side hustles like Field Agent etc. I know you are not an accountant, but I have two questions. If my total income from any one source (ie Field Agent, WeGoLook, or EasyShift) is less than $600, do I still have to claim on taxes? What if the cumulative is above $600 And second question–can I claim mileage as a deduction for those type of jobs? Thanks, love the site!

Hey David,

The technical rule is that all income is taxable. With that said, once you make over $600 from any one app, by law, the company is required to send you and the IRS a 1099. If it’s under $600, then they are not required to send you a 1099.

Yes, you can claim mileage deductions from those gigs. That’s a 100% legitimate business expense.

Thanks for the follow-up! Would you treat each completed job starting from home? Or if you were at point A and had to get to a job, would you use that starting point? I need to buy a mileage book!

I’m not sure of the rules off the top of my head, so you’ll need to check when you can start deducting your mileage. You can use Everlance to keep track of your miles. That’s a free mileage tracking app that works well.

You said that if it’s under $600, they’re not required to send you a 1099. Would they still send a 1099 to the IRS though?

Sorry to bother you again. You’re the most helpful blogger I notice. I get most of my self-employment money from online survey sites and some from Rover/Wag. I hope to apply to online teaching one day. I just want to confirm I’m clicking the right options.

While completing the EIN application, I chose myself as a “Sole Proprietor” and that I “Started a new business”.

The part where I’m stuck is when it asks “What does your business or organization do?” There’s options such as construction, food service, insurance, etc. Since none of those are what I’m doing, I selected “Other”. After clicking that, it gives me choices such as service, consulting, etc and a final option where I can type in what my primary business activity is. Since dog-sitting is so different from online survey sites or online teaching, what do you recommend I do? For you I know you have a lot of different side hustles. What did you put down as your business? Thanks!!

Hey Dan, just pick anything you want. That part really doesn’t matter, so what you picked is fine. Ultimately, you’re just a business of you. As Jay-Z would say, you’re not a businessman. You’re a business, man!

I’ve been making money off of survey sites, Wag, and Rover. Do I need an EIN for each side hustle if I want to contribute to a solo 401k?

No, you can have one EIN for yourself and all of that income can go into the same Solo 401k. You’re a sole prop and your business is just your full name.

Thanks! So I put my full name as the d.b.a. on the EIN application? Do I have to also register for a d.b.a. separately?

Nope, you don’t need to register for anything. It’s just your name.

This was a very helpful post! Have you tried using the Savant app? It’s currently in beta mode but it supposedly helps track earnings, taxes, etc., as well as help manage all of your side hustles in one place. I am curious if anyone has had experience with it.

I’ve never tried that app but I might take a look.

This was a great breakdown! I’ll be sharing this on my social media.

Right now side hustle income isn’t a tax issue for me because I stick to AirBnB for 14 nights a year or less. I do some mystery shopping but most of it is reimbursements which are non taxable. I have enough deductions where the taxes on the $200 of income I’ve brought in are negligible. But this will come in handy in 2018 (depending on how the tax code changes and when) when I expand my side hustling to replace the income I lost when laid off.

Thanks! That’s awesome that you do Airbnb for 14 days or less – seems like everyone should do that since it’s literally one of the only ways to get legitimate, tax-free income.

Taxes are theft. It’s one of the nightmares we all have.

Thanks for this guide. A very helpful post.

Happy to help James. I don’t necessarily think taxes are theft, but it’s definitely important to do what you can to lower your own tax liability.

Thanks for the detailed guide! Taxes are one of my least favorite things to do in the world. I usually just use TurboTax to file my taxes. I currently don’t generate any side hustle income, but I’ve thought about whether I should even hire a CPA to help me pay less taxes (legally) when I do have a side business/hustle >_<

My side hustle is Uber, and this is my 3rd year running it at a “loss” when it comes to my tax filings. Miles driven x $0.535 per mile = a substantial tax deduction that exceeds my Uber income (and tips, if I’m being honest). But luckily my actual cost of operating is significantly less than 53.5cents per mile, so I do OK with Ubering. Definitely not getting rich at it, but it’s a nice little secondary income of $10k-ish per year.

Wow nice, Uber is perfect for tax deduction.

Do you file yourself? do you dont need to tax estimate tax or income tax , cause its technically a loss?

Sounds like the perfect side hustle

But i dont really like driving

How long do you drive a month doing uber?

The big monkey wrench, imho, are estimated taxes. Depending on your hustle income you have to calculate your estimated taxes ahead of April if you don’t want a penalty.

So, this is an interesting thing. Last year, I didn’t pay any quarterly taxes and owed a penalty. My penalty? A whopping $8. The penalty is apparently half a percent of whatever underpayment of taxes you owe. So, unless your side hustle is huge, for a lot of people, I think it seems like you’ll pay enough taxes in your day job to avoid any big penalty when you file.

My first year doing side hustle, not paying quarterly taxes right now either.

So you cant pay the full amount at the end of the year? You get charged the penalty for sure then right?

My side hustle is pretty huge.

How do you file online? using the etfps or something like that?

You file a 1040 with schedule c or you only need to pay some taxes?

Awesome! I was curious about how the side hustles taxes worked with me having a full-time job. I wasn’t sure if I would have to estimate my quarterly taxes.

Thanks for putting this together, FP. I booked marked this so I can come back when I hopefully get my side hustles going…

Thanks man!

Wow this is the information i needed. Great article, well written

You should do some more articles on filing taxes. Like schedule C , 1040, bank interest , deductions

Do you file yourself or you have an accountant?

I just started my own side hustle too, but the taxation is very scary.

Technically not a side hustle as its my main income, as im a full time student, but it gets taxed as a side hustle 🙁

Thanks Kevin. It’s a good idea – I’ll probably be writing more about this stuff as I do taxes.

I file myself for now, although we’ll have to use an accountant once my wife buys a dental practice. That’ll just be way too much stuff to do by ourselves.

Thank you so much for this! I’ve been waiting for it for a bit now. In the beginning I think you meant that if you make $100k and take the standard deduction you would be in the 28% bracket not 25%, since your AGI would be about ~$94k.

Have you found that Postmates / Field Agent / other apps send you 1099’s super late in the year?

Also AirBnB income cannot be put into a solo 401k correct?

Good catch! Will revise the post to say that!

Postmates, Field Agent, and the like won’t send you a 1099 unless you make over $600 in a year.

Correct, you can’t put Airbnb income into a Solo 401k IF you’re putting that income on Schedule E. If you’re providing substantial services, then it would fit under Schedule C. There’s some debate out there in the Airbnb world – some people say it’s schedule C, other people say it’s schedule E. I’d say it probably depends on how much like a hotel you really are.