If you’re involved in the financial independence community, you’re probably someone that’s willing to think outside the box. You have to be willing to do this when you think about it. After all, we’re trying to do something that most people don’t even think is possible – reach financial independence and make work optional decades before most people would even think about it.

To do this, most of us think about controlling our expenses, particularly our biggest expenses. Housing is the one that I often see emphasized the most, which makes sense since it’s often our largest monthly expense. The strategies to reduce your housing expenses range from simple ones – things like buying a smaller house than you might want or living in a low-cost-of-living area – to more extreme strategies like house hacking (particularly buying duplexes or other multi-unit housing) or even moving overseas to low-cost countries.

This is fine and I’m all for reducing your housing costs if you can. But for all the emphasis I see on housing costs, it seems as if the same thought often isn’t placed on transportation costs. The suggestions here are usually the same, fairly simplistic strategies. Buy cheap, reliable used cars. Live closer to work. Drive less if you can. But all of this centers around the same general worldview – that transportation means using a car. Even the most hardcore financial independence advocates often seem to forget that cars aren’t the only solution.

I’m a biking advocate. I’ve been using a bike as my primary mode of transportation for a decade. But even more than being a biking advocate, I’m an ebike advocate. And pound for pound, I think the best investment I’ve ever made is my ebike.

For many of you reading this, I’m convinced that an ebike can be the best investment you ever make too. Here’s why.

How Much Does A Car Really Cost?

Cars have become so ingrained in our way of life that most of us don’t consider how much our cars really cost. Besides the high upfront costs, cars also come with a lot of recurring expenses. Here are some of the costs you might not think about when you’re calculating how much you pay for your car:

- Car payments

- Gas

- Maintenance

- Insurance

- Registration and Licenses

- Parking

- Depreciation

If you ask your average person what they think they spend per year on their car, they’ll likely give you a number far lower than what they actually spend. Studies show that most of us underestimate our car costs by as much as 50%. Considering how important it is to understand our expenses, it’s surprising how few people, even in the financial independence community, know how much they really spend on their cars.

There are varied numbers when it comes to how much it costs to operate a car per year, but the general consensus seems to be that a car will cost you between $7,000 to $10,000 per year. That comes out to $583 to $833 per month, which isn’t that crazy, especially when you consider the average car payment for most Americans is around $500 to $600 per month.

Anecdotally, a friend of mine leases an affordable car for $210 per month and when we factored in his insurance, parking, and registration, his monthly costs came out to around $400 per month just for the privilege of having his car parked. If we factored in gas and maintenance, his yearly outlay for his car came in right around that $7,000 mark.

It’s important to note that the yearly cost of a car only considers your own costs. It doesn’t even consider external costs borne by society. These include things like pollution, car deaths, reduced health, the cost to build and maintain roads, and inefficient land use as a result of building infrastructure around cars (i.e. we use up tons of prime space for parking, rather than something more beneficial). If you factor in these costs, cars become even more expensive.

In short, whatever you think your car costs, it probably costs more than that. And no matter how you slice it, it isn’t cheap. If you have a car or multiple cars, you’re spending a lot to keep them going.

The Cost Of An Ebike

Contrast the cost of a car with an ebike. Beyond the initial purchase, the costs that go with an ebike are fairly minimal. You don’t have to pay for insurance, licenses, or parking. And unlike car repairs, which typically cost hundreds, if not thousands of dollars, most ebike repair costs are fairly minimal. Things like annual tune-ups, replacing worn parts, and repairing flat tires will cost you a few hundred dollars per year. That’s far less than the thousands per year that your average car will cost.

Electricity costs are also almost non-existent. I’m not great at doing the math on electricity, but everyone who’s done the math has shown that it costs just a few cents to charge an ebike battery each day (for example, this site did the math and found the cost to charge an ebike battery for an entire year was about $29). And in theory, you could reduce the cost even more if you were to charge your ebike using someone else’s electricity (like at work or at a coffee shop).

The biggest cost you’ll face with an ebike is the upfront cost. Just like with cars, there are different levels of ebikes you can choose from, but you can expect that most entry-level ebikes will cost between $1,500 and $2,000. The RadCity, which is the main ebike I tend to use, comes in at about $1,500.

This might seem expensive if you think of an ebike as a toy or solely as a recreational vehicle. But if you think of it as a real mode of transportation – something that can replace most of the car trips you take – $1,500 for an ebike becomes a massive bargain. Even the crappiest used car will cost more than that – and it’ll come with all the costs associated with a car.

An Ebike Can Be Worth Millions

Things get really interesting when you think about how much an ebike can be worth beyond just what you save over having a car.

At the outset, for those of you in the financial independence community, consider how much you need to save to cover the cost of a car. Using the standard 4% rule, which says that you can withdraw 4% of your portfolio each year, you’d need to save $175,000 to $250,000 to afford the yearly cost of a car. That really puts things into perspective. Just to afford the cost of your car, you might need to save a quarter of a million dollars.

| Yearly Operating Cost | Portfolio Amount |

|---|---|

| $7,000 | $175,000 |

| $8,000 | $200,000 |

| $9,000 | $225,000 |

| $10,000 | $250,000 |

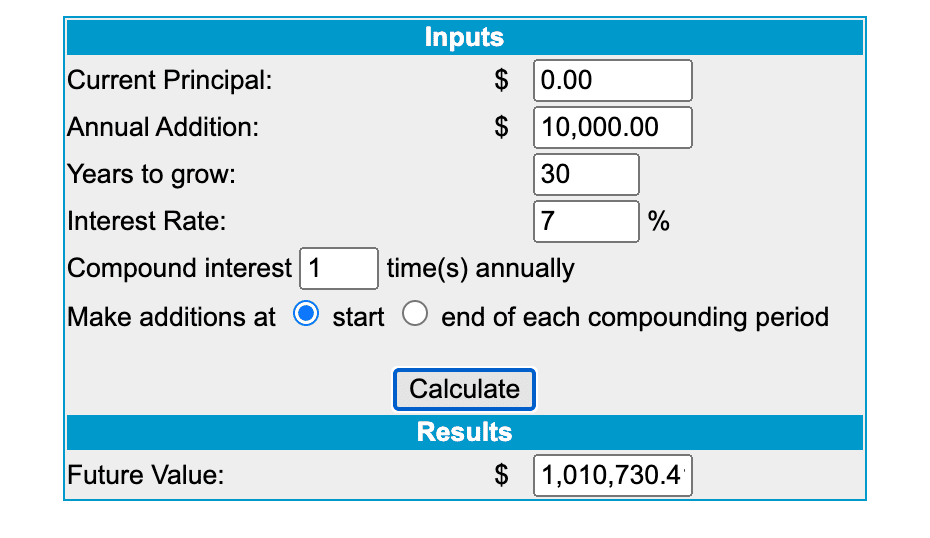

Next, consider the opportunity cost of a car. If you can save the $7,000 to $10,000 per year you’d spend on a car and invest that money, you’re looking at potentially having over $1 million saved up if you invest that money over 30 years. When you consider that most of us have cars for much longer than that (50 years or more), the amount of money you could be giving up is even more. Invest that $7,000 to $10,000 each year for 50 years and you’re looking at having over $4 million.

Finally, beyond the increased savings from using an ebike over a car, ebikes are also interesting because you can use them to make money. Regular readers of this blog know that I’ve long done all of the gig economy stuff I do each month using a bike. Over the past 6 years, I’ve been able to earn over $150,000 from all of my various side hustles. It doesn’t seem like I earn much each day, but the money adds up over time.

There’s a concept I like to talk about called the Reverse Latte Factor, where small amounts of income earned each day can lead to huge amounts if saved and invested over the long term. If the Latte Factor says you can save hundreds of thousands of dollars just by cutting back on small purchases, then the Reverse Latte Factor says you can do the same thing by taking the time to earn small amounts each day.

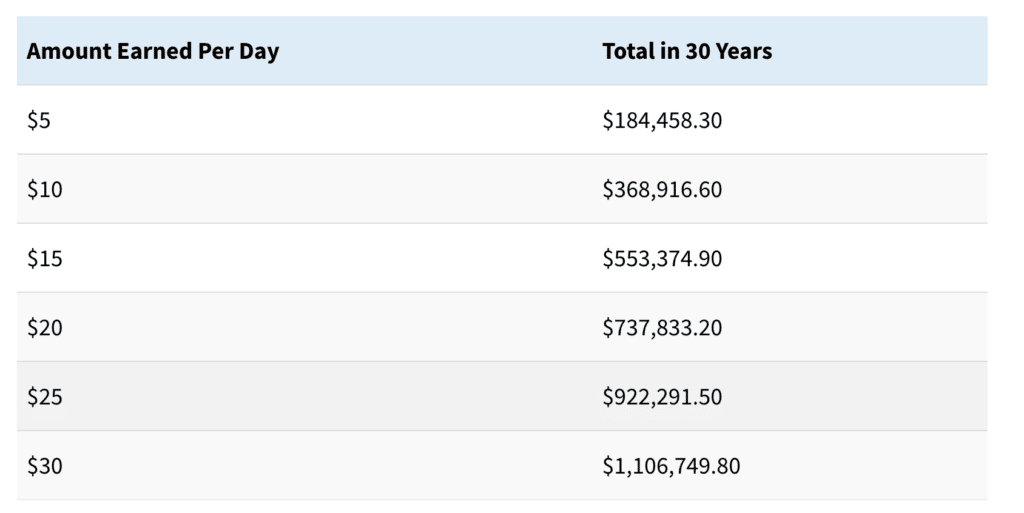

Consider how much these small amounts can add up to if regularly earned and saved over the long term. Here’s a chart showing how much you can have if you earn these small amounts each day and save the earnings:

Earning just $30 per day can potentially lead to over a million dollars in savings. Even $15 per day can add up to over $500,000. I’m confident that almost anyone can earn $15 per day biking around doing a few deliveries with apps like DoorDash, Uber Eats, and Grubhub. And there are a lot of other apps you can use to earn money with too using an ebike.

The point is that my ebike not only saves me money but it also gives me a vehicle I can use to earn extra money too. And that extra money can add up to a lot. Put it all together, and an ebike can be worth more than $2 million dollars in opportunity cost and $250,000 you don’t have to save to be financially independent. That’s incredible.

*As a side note, a recent study found that the lifetime cost of a small car came out to $689,000, with $275,000 of that cost being subsidized by society. Larger cars will cost even more over your lifetime.

Can An Ebike Really Replace A Car?

Years ago, I wrote a post entitled, Yes, You Can Bike To Work. The thesis of that post was pretty simple. Biking is good, you can do it, and if you can’t, you should quit being a baby and tough it out.

Admittedly, as a transportation solution, telling people they need to tough it out isn’t really a satisfying answer. I always knew that as much as I like to advocate for bikes, it could never be a complete transportation solution since there are so many excuses and barriers in the way that make them difficult for most people to use. However, when I wrote that post back in 2017, I’d never even heard of an ebike, let alone thought about what they could do for the biking landscape.

Ebikes completely change the game when it comes to biking. Most of the excuses you can use with regular bikes – I don’t want to get sweaty, I’m not fit enough to ride, it’s too far to bike, etc – don’t apply to ebikes. The fact is, with an ebike, you won’t get sweaty, you are definitely fit enough to use an ebike, and distances on ebikes aren’t very far. Having an ebike turns what could be a difficult ride into a pleasant cruise. You don’t even need to pedal if you don’t want to.

I think addressing distances is important as well, as most people who’ve never used a bike to get around overestimate how far it takes to go places on an ebike and how far they usually travel to go places. It turns out a lot of trips we make by car are between 1-3 miles. These are distances that are incredibly easy to replace with an ebike.

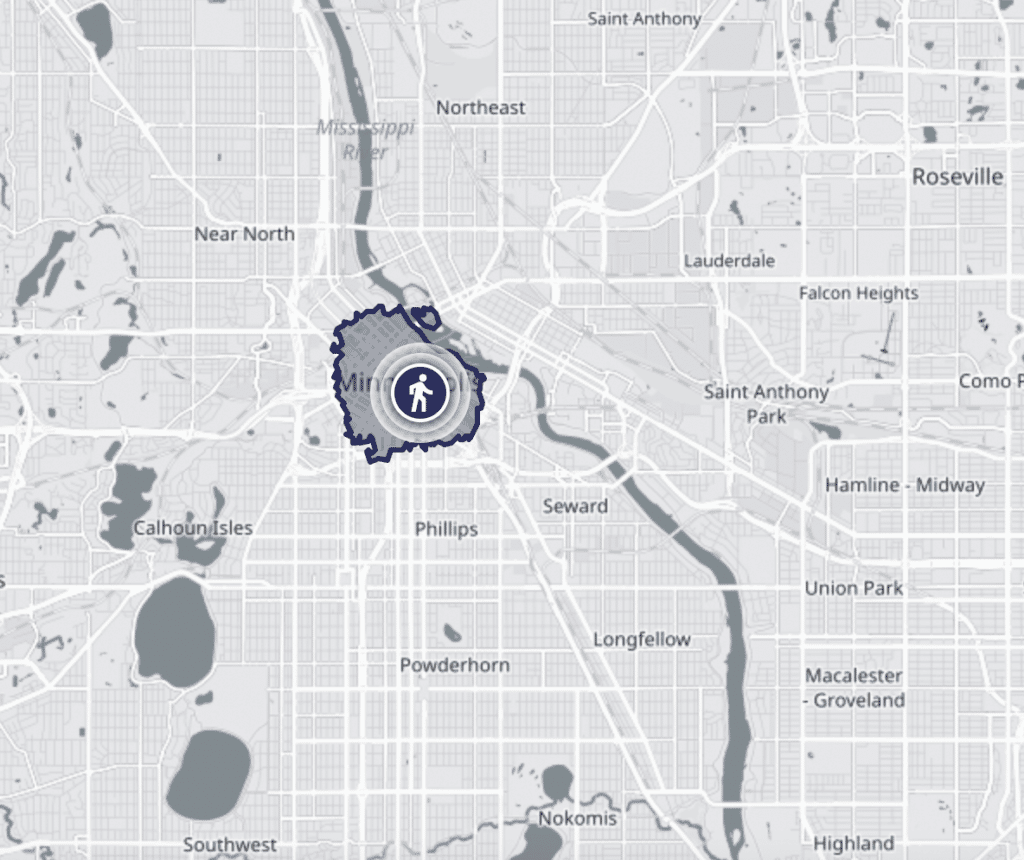

When I think about distances, I often think about how far I can travel in 20 minutes. On foot, 20 minutes doesn’t cover a ton of distance, mainly just areas in my neighborhood. Below is a map showing how far you can cover in 20 minutes on foot. It’s a decent area depending on where you live, but it still keeps you confined primarily to a single neighborhood.

On a regular bike, the distance you can cover in 20 minutes dramatically increases. Here’s how far you can cover in 20 minutes using a regular bike. As you can see, it’s a massively larger area than what you can cover on foot.

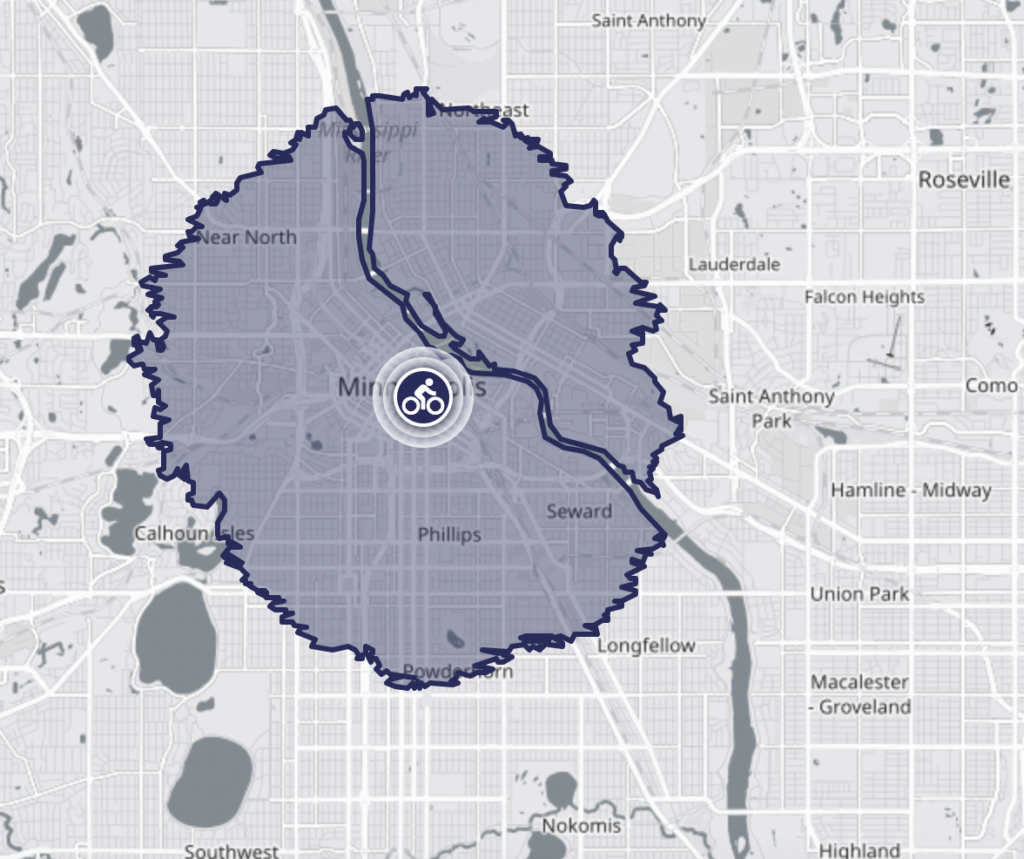

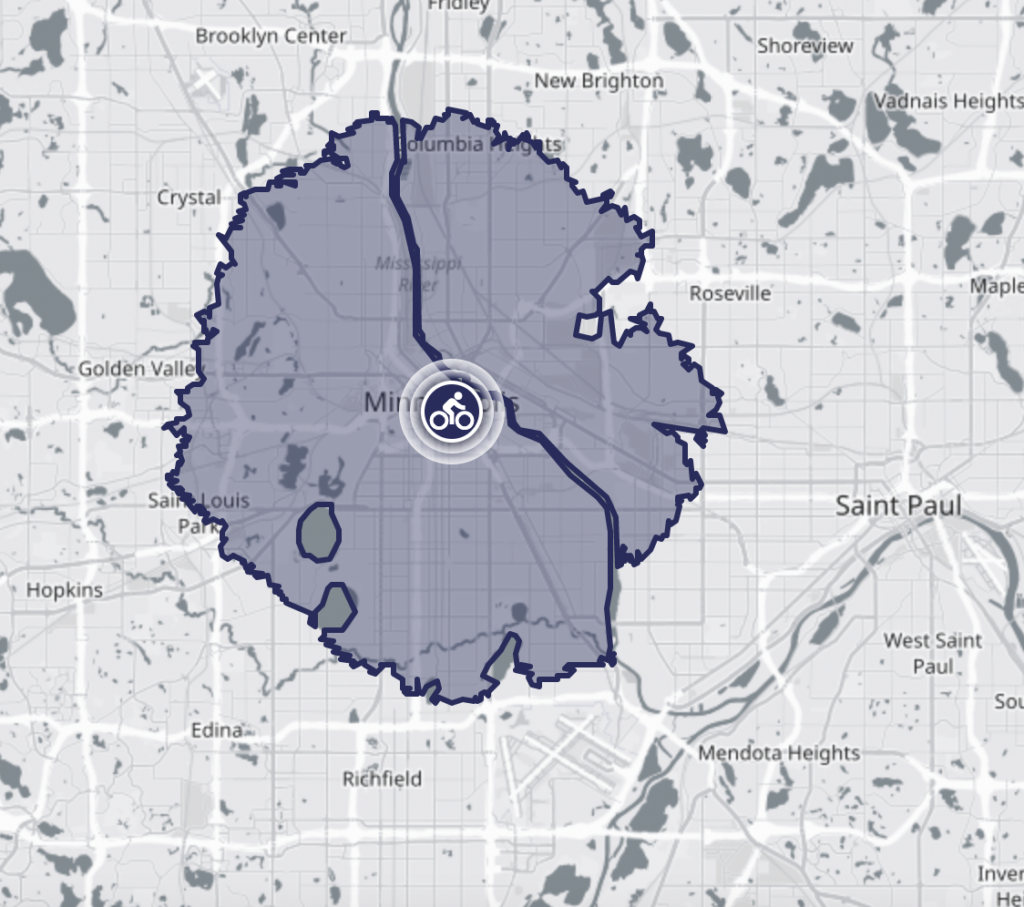

If you add an electric bike into a mix where you can pedal at 18-20 mph without breaking a sweat, the distances you can cover in 20 minutes become huge. Looking at the below map, it’s possible to cover my entire city limits and much of the suburbs in just 20 minutes or so.

When you factor in traffic and parking, in many cases, you can get to your destination on an ebike as fast, or even faster, than a car.

Ebikes Are For Families Too

One of the biggest shifts I had to make with bike commuting was when I had my first kid. As an individual bike commuter, I only had to think about myself. But once I had to commute with kids, I had to think about how my bike could be turned into a commuting vehicle for multiple people.

Most people think of bikes as a solitary activity, but bikes are incredibly powerful if you think about how you can use them. To get my kid around, I opted to go with the Thule Yepp Maxi bike seat. It attaches to the rear rack of my ebike and allows me to carry both me and my son on a single bike.

Once we have multiple kids, we’ll opt for a cargo bike like the RadWagon, which can hold multiple kids on the back, or I may splurge on an Urban Arrow so my kids can ride in a seat in the front of the bike.

The YouTube Channel Not Just Bikes has an excellent video on these box cargo bikes (called Bakfiets in Dutch). It’s definitely worth checking out, as it goes into far more detail on them than I can address in this post.

I also wrote a post called The Ultimate Guide To Biking With Kids, where I walk through all the ways you can use to get around a city with kids on a bike. It’s definitely worth checking out if you want to understand how a bike can become a kid-shuttling vehicle.

You Can’t Lose With An Ebike

One interesting thing about an ebike is that you basically can’t lose when you compare the cost of an ebike with a car. Yes, they seem expensive when you compare them to regular bikes and most people can’t imagine how they can be worth the cost. But if you treat them as a vehicle and not solely as a toy, they’re actually cheap.

Think about an ebike like the RadCity, which costs around $1,500. If a car costs $7,000 to $10,000 per year to operate, that means I could literally buy a new ebike every year and throw away my old one and I’d still be vastly ahead of what it costs to have a car. Even incredibly expensive ebikes like the Urban Arrow are so cost-effective that you could buy a new one each year for less than it would cost you to operate your car.

And of course, in practice, your ebike should be able to last you for many years. Ebikes are ultimately regular bikes with a few electrical components added to them. Like regular bikes, just about every part of it can be affordably replaced. You can’t say the same about most cars.

There’s some fear that ebikes are becoming consumable goods, meant to be replaced every few years like a phone or computer. I disagree with that sentiment, but even if true, you’d still always come out ahead, even if you had to replace your ebike every few years.

Final Thoughts

A lot of the trips we make by car can be made with an ebike. Even families can use ebikes to get around.

You don’t have to use an ebike all the time for every trip, but you should consider using an ebike for some of your trips. If you think about the trips you take with your car, you might be surprised at how many of them can be replaced with an ebike, especially when you add things like cargo capacity and kid-carrying capacity to them.

Ultimately, I want people to think outside of the box when it comes to their transportation. If you’re a two-car household, can you make the move to a single car and replace the other car with an ebike? Do you really need a car to get your kids around? Even for those of you that live in the suburbs, can those trips to the shopping center be replaced with an ebike? If you’re willing to think critically and creatively, you might find that many of your trips can indeed be replaced with an ebike.

My family is a one-car household. It’s a conscious decision we made to not only improve our finances but to also improve our lives in general. We’re healthier and happier. And I think my kid is happier and healthier too.

The first ebike I got was the best investment I’ve ever made. I’ve easily made my money back hundreds of times at this point. You can do the same too. Your $1,500 to $2,000 ebike, if used as a car replacement vehicle, can be worth more than $2 million. I can’t think of any investment with that kind of return.

Hey Kevin,

Great talk at Econme this year! Fun to find the article that started it all. Really enjoyed chatting ebike and bike commuting with you while commiserating about Law.

Here’s to a great spring of riding! The flowers are out in Philadelphia and it smells awesome!

Jon

Great to meet you too! Glad the flowers are out for you. We still have several inches of snow on the ground as I write this (March 2023). Top 10 snowfall of all time for us this winter, but can definitely feel spring is on the way!

I love my Ebikes. I don’t use commuter bikes, but have performance bikes: One for the road and one for the mountains trails. They are a game changer for us old bike racers who can’t keep up with the young riders anymore. I wrote about my experience in:

https://financialsuccessmd.com/why-i-bought-an-electric-bicycle-and-you-should-too/

I love your take on the financial impact of trading in one car for an Ebike. I have included this article in my Fawcett’s Favorites for next Monday. You got me thinking about whether I should also own a commuter bike for trips to the store.

Thanks

Dr. Cory S. Fawcett

Financial Success MD

I wonder if you could talk a bit more about safety; in particular with having a kid onboard as well. I’m a religious “CitiBike” bike-share user, and we’re in an urban core that allows us to be car free right now. As my wife and I look towards perhaps moving a bit further out, and thinking about family life, I think my biggest questions orbit around safety, and how to account for the risk-factor of injury.

Yes, cars get into accidents all the time too. But in most urban or suburban settings, surely the average risk/”cost” per mile is higher on an eBike than in a car?

Yes, safety is an important factor to consider. Unfortunately, danger to bikes and peds is all due to poor infrastructure and public policy decisions we’ve made in the US. A lot of cities are doing work to fix this, but the risk is still going to be there. The way I see it, if you aren’t able to get around safely by bike (or walking), it means your city has failed you and you should be steaming mad about it. It’s not the bikes that are dangerous. It’s the 2 ton cars that are killing people.

Ultimately, the decision of how you want to get around with your family is going to have to be based on your comfort level. I’m not going to tell anyone to bike with their kids if they don’t feel safe about it (but I will tell everyone you should be mad at your city for creating a place like this, where you’ve been forced to get around with only one mode of transportation).

There are things you can do to make it safer. Opting for the safest routes you can find, even if it takes you a bit longer, is one thing we can all do (the nice thing on an ebike is that even adding some more distance to your route isn’t that big of a deal). I’m a confident biker and will go into the road and do some vehicular cycling when needed. But when I’m with my son, I opt for off-street and protected paths, even if it increases the distance.

I think we all want to keep our kids safe, but let’s face it, we don’t live in a bubble either. When you drive with your kids, you’re taking a risk. When you walk down the street with your kids, you’re taking a risk. We do what we can to reduce the risks and weigh whether the risks are too much for us to take them.

That all makes sense! Yeah, life in NYC / DC is…well, not too many off-road protected paths, even if the bike lanes are slowly but steadily improving. Food for thought!

Thanks.

Hey Financial Panther!

Greetings from a neighbor in St Louis Park, MN! I bought a RadCity bike last summer and it’s honestly the best purchase I ever made. I ride it everywhere: to work (6 miles, 20 minutes with huge hills!), to the gym, grocery shopping, Target…even out to Lake Minnetonka to get frozen custard at Adele’s! People are so curious about it! I’m always getting questions about the range. 😆I say “it has unlimited range because when the battery runs out… you can use your legs!”

Anyway, I’m curious if you ride your ebike in the infamous Minnesota winter? I’ve never tried winter biking because I’m terrified of ice (valid excuse?), I have no idea how to dress (do I need to buy fancy clothes?) and I’ve heard the salt can really ruin the mechanics on a bike. Any tips?

Thanks, and I’ve always enjoyed reading your blog!

Hey Dan,

Yep, I ride year-round, including with kids. The only thing that really stops me from biking is if there’s a recent snowfall and my bike simply can’t handle it.

For clothes, it’s exactly what you’d expect for any cold weather. Big coat. Big gloves. Snow pants. Etc. Getting a balaclava ski mask thing to cover your face is a game changer also. I rode for years in the winter without any face covering and then when finally bought a balaclava and it made it so much more comfortable to bike in the cold.

Yes, you do have to do more maintenance in the winter. I admittedly am not the best at doing it, but in general, you should try to wipe down your bike when you get home and spray some degreaser. The Finish Line 1-Step Cleaner and Lubricant is good for making this process simple. Basically, wipe the snow and salt off your bike with a rag. Then spray your chains and gears with this stuff. It’ll keep things clean and avoid rusting.

I didn’t have any falls last year. Most years, I have a fall or two in the winter, but the nice thing is that falling in the winter doesn’t hurt because you’re bundled up in so much gear. I’ve never even had a scratch on myself when I fell in the winter. Like with any bad weather, take it slow and don’t drive like a maniac.

I have a Trek Road bike and definitely use it for trips less then 5-6 miles, unless it’s triple digits in the summer or raining.

Hope this isn’t a dumb question, but do you lock your ebike like a regular bike? Park it on a bike rack?

We definitely need to adopt them as you say you don’t have to break a sweat going up hills anymore. The issue is bike infrastructure is still lacking in much of the US, especially suburbs. You can’t ride an e-bike on the sidewalk, and the way some people drive deter most from riding on the road.

Yeah, I lock my ebike up just like a regular bike. I use a kryptonite chain lock. It’s a huge heavy lock.

Infrastructure is definitely a problem and that’s a failing of the cities we live in. If you live in a city that doesn’t have a place for bikes or other modes of transport other than a car, it means your city has failed you and removed your ability to choose, instead forcing you to adopt the most expensive mode of transport, with infrastructure paid for by us. It’s amazing how much power the car companies had and still have over our cities.