When I paid off my student loans back in 2016, I found myself with a lot of cash that I could suddenly start investing with.

Paying off debt is hard, but for the most part, the actual act of paying off debt doesn’t require a lot of knowledge. There’s no secret to paying off debt quickly. The only thing you can do is just make more money, spend less than you earn, and use as much of your free money as you can to pay towards your debt. The more money you can put towards your debt, the faster you’ll pay it off.

Once you’ve paid off your debt, you’re probably going to wonder what else to do with your money. The natural step is to invest it. And while investing is something that should be simple, the fact is, even in its simplest form, it still requires some basic knowledge, research, and understanding. You can figure out how to pay off debt without really having to learn anything. But you probably won’t figure out how to invest without someone teaching you how to do it or without you taking the initiative to learn it (perhaps by reading some good personal finance books).

In today’s post, I want to provide a basic framework that’ll show you where you can invest and how to do it. This is definitely not an exhaustive post since that would require me to write way more words than can fit into a blog post. But, I think this should at least provide a good starting point for anyone asking themselves, “how do you invest?”

Before we begin, I do want to go over a few assumptions that I always make when I talk about investing.

- Low-Cost Options. The only thing we can absolutely control is our costs. The more we pay to invest our money, the less we’ll have later. Knowing this, we generally want to pick the lowest cost investments that we can.

- Passively Managed Index Funds. We work under the general assumption that the future is unknowable and that we are likely not going to beat the market over the long term, especially when you add in costs. There’s a lot of research to back this up. And common sense tells us that this is true as well because if we could consistently beat the market, then we’d be super-rich and wouldn’t waste our time telling other people how to do that. If we work under this assumption, then our best bet is to pick index funds that seek to match the market. This also helps to keep our costs down.

Where And How To Invest

Let’s take a look at all of the common places you can invest your money. I’m looking mainly at mainstream options and not thinking about weird stuff that you honestly probably don’t need to use. Remember one thing when it comes to investing. You don’t need to hit home runs in order to win. Just doing average is going to get you to the finish line.

With that said, below are the places you should look to invest your money.

1. 401k Plan – Look For Low-Cost Options In Your Plan

The most obvious place to start investing is in your workplace retirement plan. This will typically be a 401k if you’re at a private employer or a 403b if you’re working for a public entity or a non-profit. Depending on your employer, you’ll either be automatically enrolled in your plan or you’ll have to take proactive steps to enroll yourself in the plan. At two of my jobs, I was automatically enrolled in my employer’s retirement plan. In my non-profit job, I had to proactively sign up for it.

Once enrolled in your workplace retirement plan, your next step is to figure out how much you want to invest and what to invest in. How much to invest is up to you, but the likely best thing you can do is to put in as much as you can afford to.

What to invest in is more complicated. Unfortunately, I can’t give any specific examples of what to invest in because everyone’s workplace plan is going to be different. Your main goal is to find low-cost, passively managed fund options that make things really easy for you.

If you want to make things really easy, you can pick a target-date fund that matches the year you think you’ll retire, generally some time way in the future. Assuming you’re young like I am, this fund will likely have around 80% to 90% invested in equities and around 10% to 20% invested in bonds. Be sure to check the expense ratios for your fund to make sure they are not too crazy. You can usually find this information by clicking on the prospectus or searching for the ticker symbol on a website like Morningstar. Ideally, you want expense ratios that are 0.5% or less. Anything close to 1% is robbery.

If you’re a bit more comfortable or your plan doesn’t have target-date funds, you can also make your own portfolio. It’s usually enough to invest in something like an S&P 500 Index Fund or a Total Market Index Fund. If you want to be a little more advanced, you can also create a simple three-fund portfolio and add some Total International Index Funds and some Total Bond Market Index Funds. The Bogleheads Guide to Investing recommends no more than 20% in international funds. For bond funds, a very general rule is to have your age in bonds, although I think that’s more conservative than needed and would recommend having much less than that (a decent rule of thumb is your age in bonds minus ten).

The most important thing is to keep your costs low! And, if you have a 403b plan, make sure you aren’t getting scammed!

2. Roth IRA: Use Vanguard or A Free Robo Advisor Like M1 Finance

The Roth IRA is the next place that you’ll want to look at when you start investing. A Roth IRA is a tax-advantaged retirement account that you create yourself. It is not tied to any employer, so you get to choose where you open one.

In the ideal scenario, you’ll be able to max out both your workplace retirement plan and your Roth IRA. If you can’t do that, you’ll need to decide how to break it up. Typically, you’ll want to invest in your workplace retirement plan first at least up to the employer match, if you have one. Then it’s up to you to decide whether to use the Roth IRA or stick with your own plan. But again, the goal should probably be to max out both at some point.

When people ask me where they should open their Roth IRA, I typically have a few recommendations.

If You Feel Comfortable Doing Things Yourself, Open Your Roth IRA Directly With Vanguard. The likely best thing you can do is to open your Roth IRA directly with Vanguard. Note that this is not what I did when I first started investing, mainly because I didn’t understand how investing worked and I wasn’t super confident trying to pick my own investments. Instead, I wanted someone (or something, i.e. a computer) to do it for me so that I knew I was doing things right.

It’s not actually difficult to do your Roth IRA directly with Vanguard, but it can be confusing if you’re brand new to investing because the interface is not that intuitive and there are a lot of choices you have to make that can be confusing if you don’t know what you’re doing.

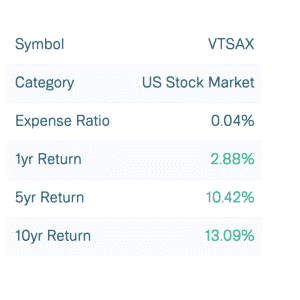

If you’re going to do your Roth IRA directly with Vanguard, you’ll want to pick low-cost, total market index funds. I typically recommend following the strategy laid out in J.L. Collin’s book, The Simple Path to Wealth and invest everything in VTSAX. If you need a bond allocation, you can also invest in VBTLX. If you want to follow the three-fund portfolio strategy from the Bogleheads Guide to Investing, you can also add in some international allocation with VTIAX. The percentages you’ll want to invest in each fund will vary based on your age. Here’s a good resource if you need more info.

If You’re Uncomfortable Doing The Investing Yourself, Then Go With A Free Or Low-Cost Robo Advisor. If you’re new to investing and just need someone to walk you through it, then I recommend going with the robo advisor route. My brother took this exact route because he really isn’t very interested in learning how to do this stuff himself and the option he originally took was to pay a high-priced financial guy to invest for him. As much as some of us might think investing is easy and something that everyone can do, the truth is, most of us reading this have spent a lot more time learning about this investing stuff compared to your average person.

I like the robo advisor route because it makes investing really simple – basically as easy as opening a bank account. The hard part of investing is actually doing the investing part, and it can be scary not knowing if you’re doing it right, not to mention the fact that most of the traditional brokerages do not have very intuitive platforms.

The benefit of using a robo advisor for a Roth IRA is that since it’s tax-advantaged if you later decide you’d rather invest directly with Vanguard, you can do so without having to worry about any tax consequences.

There are a few 100% free robo advisors that I recommend to people. Since they’re free and are in tax-advantaged accounts, they really have no downside for the investor that isn’t comfortable picking their own investments and wants to make sure that they’re investing correctly. Below is what I recommend:

- M1 Finance. This is the robo advisor I currently recommend because it’s completely free and will put you in a properly diversified portfolio. They call their portfolios “pies” and there are a number of “expert pies” which you can pick that will properly diversify your portfolio for you. The nice thing about M1 Finance is that if you do get more comfortable and decide that you want to pick your own investments, you can do that as well using M1 Finance and create your own investment pies.

- Axos Invest. Before M1 Finance came along, the only 100% free robo advisor that I knew of was WiseBanyan, which changed its name to Axos Invest after it was recently bought out by Axos. It’s still 100% free and you can also open up a Roth IRA using their app. You then answer a few questions and they’ll create an appropriate portfolio for you based on your risk tolerance.

I think M1 Finance is the more interesting robo advisor mainly because you can create your own portfolio if you want, which makes it very good for using as your Roth IRA forever, even if you’re comfortable with investing on your own.

One thing to note is that if your income is above a certain threshold, you won’t be able to directly contribute to a Roth IRA. However, you can do a Backdoor Roth IRA, which basically means that anyone, regardless of income, is able to contribute to a Roth IRA. My friend Physician On Fire has written the definitive post about how to do a Backdoor Roth IRA with Vanguard. This same general idea could be used for a robo advisor like M1 Finance as well.

3. HSA – Use It If You Have It

A health savings account – i.e. an HSA – is a tax-advantaged account that most people don’t realize is also a secret retirement account. While it’s typically used to save for medical expenses, the better way to use it is as an extra, tax-advantaged account. Depending on which HSA company you use, you can usually invest in low-cost index funds in the exact same way as you would in your employer retirement plans.

To be eligible to contribute to an HSA, you need to have a high-deductible health plan (HDHP). This is a specific type of health insurance that will be labeled as such. If you’re not sure if your plan is an HDHP, you’ll want to confirm with your employer or wherever you’re getting your health insurance from.

HSAs can be a little annoying because they’re sort of confusing and can sometimes come with high fees and bad investment options. It’s also sort of weird because you have two options with HSAs – you can use the one that your employer offers you or you can go and open your own HSA with any company that you want.

If you use your employer’s HSA, anything that you put into your HSA via payroll deduction goes in without FICA taxes taken out. This is literally the only way that you can avoid paying FICA taxes on earned employee income, which is why I typically tell people to contribute to their HSA using payroll deductions. If your employer uses a bad HSA, you can always roll over those HSA funds into your own HSA later.

If you create your own HSA, I recommend using a company like Lively. They have good investment options and low fees, so it’s a good HSA company that I can recommend.

4. 457 Plan – Use It If You Have It

A sort of secret retirement plan is the 457 plan. This is typically available only to people that work for government organizations or for certain non-profits. If you work for a hospital, you very likely have access to a 457 plan without even realizing it. My brother-in-law and sister-in-law both work for a hospital and never knew they had access to a 457 until I told them about it.

457 plans are extremely useful because of two things:

- The contribution limits are calculated separately from your 401k or 403b. What this means is that you can max out both a 401k and a 457 if you have access to both. You can put away some serious cash in tax-advantaged accounts if you have both a 401k and a 457.

- 457 plans are tax-advantaged but also come with the advantage of allowing you to take money out of the account without any penalty once you leave your employer. This basically means it’s a tax-advantaged account that you can access as soon as you quit your job, which makes it extremely beneficial for anyone pursuing financial independence. It’s like having the flexibility of a taxable account with the tax-advantaged benefits of a retirement account.

Your employer picks the options in your 457 plan, so you’ll want to follow the same strategies that you would use for a 401k. Keep things cheap!

One thing to note is the potential creditor risk of a 457 plan. A 457 plan is considered deferred compensation. This technically means the money in the plan can be subject to your employer’s creditors if your employer goes bankrupt. In contrast, money in a 401k is yours and cannot be touched by anyone. If you work for a government agency that offers a 457 plan, then you’ll have a governmental 457 which means that it’s not subject to creditor risk and is subject to the same protections as a 401k.

If you work for a big hospital or a big company that offers a 457, most likely you won’t have to worry about any creditor risk, but you’ll need to calculate this risk on your own to determine if using a 457 makes sense for you.

5. Solo 401k – Use This If You Earn Any 1099 Income

A Solo 401k is a 401k plan that you basically create for yourself. You’re eligible to contribute to a Solo 401k if you earn 1099 income and have no employees. One big advantage of a Solo 401k is that since you create it for yourself, you have much more ability to set it up so that you have good investment options.

A while back, I set up my Solo 401k with Fidelity, which I’ve had a very good experience with. My Fidelity Solo 401k is totally free, has good, low-cost investment options, and accepts rollovers from other pre-tax accounts. This makes it a nice tax-advantaged account to have in my tax-advantaged arsenal.

There are a few changes however that need to be considered in light of new tax laws. As I write this, there is currently a 20% pass-through deduction for 1099 income. What this basically means is that for 1099 income, it isn’t as advantageous to put money into pre-tax accounts and it often is more advantageous to put 1099 income into post-tax, Roth accounts. As a result, if you’re self-employed or earning money side hustling, it might make more sense to put your money into a Roth Solo 401k, rather than a traditional Solo 401k.

Unfortunately, Fidelity does not have a Roth Solo 401k option. Vanguard does have a Roth Solo 401k option and they charge a $20 per year fee for each investment that you have in that account. If you open a Vanguard Roth Solo 401k, it would make sense to invest in a total market index fund like VTSAX in order to minimize your administrative fees.

Be sure to also understand how to calculate how much you can contribute to a Solo 401k. There’s a fairly complicated calculation, but there are also a lot of online calculators that will show you exactly how much you can contribute.

6. Taxable Accounts – Use These After You’ve Maxed Out Your Tax-Advantaged Accounts

If you’ve used your tax-advantaged accounts and still have money left over, then you’ll want to start looking at investing in taxable accounts. The reason why you generally want to go for tax-advantaged accounts first is that you’ll save a lot of money in the long run by having your investments grow tax-sheltered.

I think there are two ways to go with taxable accounts. It’s basically the same way I recommend you set up your Roth IRA – either (1) open your taxable investing accounts with Vanguard if you’re comfortable doing it yourself, or (2) use a free robo advisor like M1 Finance if you’re not confident and want to make sure you’re doing it right.

The strategy for investing in taxable accounts is the same as with your tax-advantaged accounts. You want to stick with low-cost index funds. Since these are taxable accounts, however, you also want to use tax-efficient investments. This means you want investments that are not spitting out a lot of cash on a regular basis and that are not buying and selling a lot. A Vanguard Total Market Index Fund is a good example of a tax-efficient investment.

Final Thoughts

My goal with this post was to give you a general framework you can use when you’re starting out with investing. Of course, there is a lot more that goes into investing, but I think this post can do a good job of at least showing you the options that you have and what you should do when you invest.

For the TL/DR version of this post, you can basically follow these general principles:

- Keep costs low and don’t try to time the market.

- Vanguard is usually the best for everything when it comes to investing. When in doubt, you probably won’t go wrong using anything Vanguard.

- M1 Finance is, in my opinion, the best robo advisor and you can use that if you’re not confident in what you’re doing.

What do you think about all these discount discount traders like TD and Schwab who took out the trading fees?

They’re fine. But really, you should never pay trading fees ever. It’s been possible to invest for a long time without having to pay fees like that thanks to Vanguard, Fidelity, and a lot of other companies.

My employer provides both 401(k) and Roth 401(k). I only make contributions to Roth 401(k) because I believe I will be in a higher tax bracket when I retire. I invest up to the employer match and a bit more. Would you still suggest to open a Vanguard Roth IRA?

Yeah, you should still open up a Roth IRA.

Between dividend stock, vtsax, and rental, which one you should you recommend. I like passive income so i could spend time with my families.

I know that dividend stock is the most hands off investment, however the yield is only 4%. But it provide cash flow quarterly.

Thanks for your input

I’m much more about throwing money into index funds. If you like running a business, then rental is fine too, but remember that you’re basically running a business when you do that.