One popular fintech app that I’ve never really promoted on this blog is an app called Acorns. It’s what you’d call a micro-investing or micro-savings app. Here’s how it works. You link your credit and debit cards to Acorns. The app then monitors all of your transactions on those cards. Whenever you make a transaction, Acorns rounds the purchase to the nearest dollar, then saves that extra amount for you and invests it in a diversified investment portfolio.

Say, for example, you buy a cup of coffee for $1.50. Acorns will round up that purchase to $2, pull $0.50 out of your bank account, then invest that $0.50 for you. It’s like a digital version of your spare change jar, with the added benefit of investing your spare change, rather than having it sit there doing nothing.

I love microsaving apps – in fact, they’re an integral part of my money system. I think these apps solve a major problem that comes with saving, mainly that it’s often really hard to get started. A microsavings or micro-investing app like Acorns solves this problem by making the saving process pretty painless. Indeed, when you save small amounts like this, most of the time, you won’t even notice that you’re saving money. The public and investors seem to have noticed that this is a good idea too. Acorns is currently valued at $860 million and manages over $1 billion in assets. In other words, it’s a big player in the world of fintech apps.

There’s just one big problem with Acorns that makes me shy away from recommending it. I think it’s simply too expensive for what it does. In exchange for their service, Acorns charges users a small fee – currently, $1 per month for the Acorns Lite plan, $3 per month for the regular Acorns account (which includes IRAs and a checking account), and $5 per month for the Acorns family plan (which adds a kid’s investment account).

$1 to $5 per month doesn’t seem like much, but consider that most people using spare change investing apps likely aren’t going to be investing with large balances. The vast majority are probably going to have accounts with a few hundred dollars to a few thousand dollars at most. Many will probably have accounts with less than $1,000 (a simple Google search suggests that the average Acorns account size is somewhere in the $200 to $300 range).

The more financially savvy of us will recognize that this isn’t a good deal – an account with $1,000 will pay 1.2% in fees each year; a $200 account is looking at 6% in fees each year. But Acorns doesn’t market itself towards the financially savvy – it’s marketed toward the new investor who likely doesn’t understand how much a seemingly small, $1 per month fee can be when you’re investing small amounts.

Luckily, there is a way to make your own version free version of Acorns simply by using two Fintech apps that both cost nothing. In today’s post, I’ll walk you through my version of Acorns and how I get the same results without paying any fees.

Step 1: Download Peak And Use It To Roundup Your Transactions

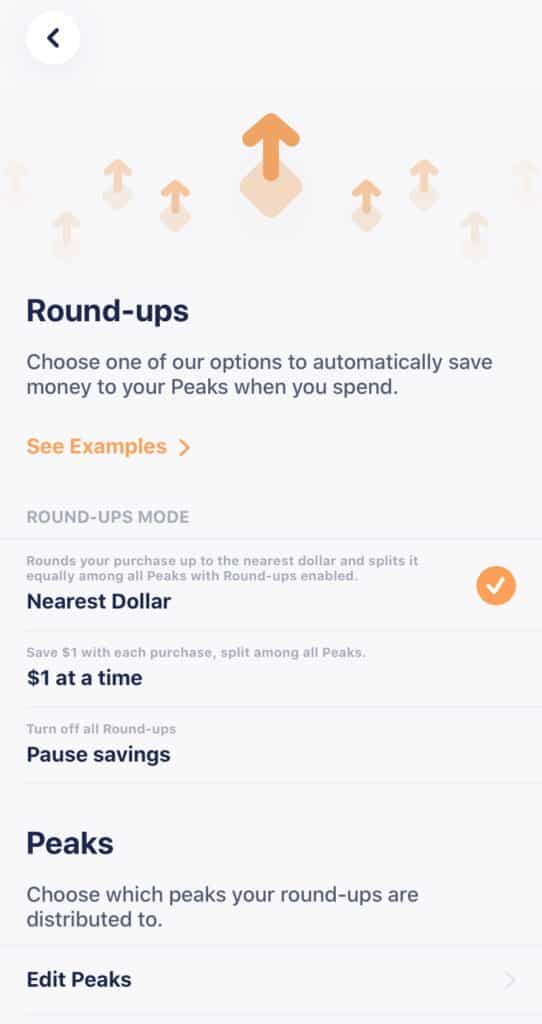

To create your own free version of Acorns, the first app you’ll need to download is Peak. Peak is a completely free savings app that, most importantly, has a roundup feature, which will allow you to get the same roundup result as Acorns.

Like with Acorns, you link your credit cards to Peak. Peak will then monitor all of your transactions, round up your transactions to the nearest dollar, and then save your spare change in an FDIC insured savings account.

You can set up different savings buckets in Peak, so what you’ll want to do is create a savings bucket labeled “roundups.” All of your spare change should automatically deposit into that bucket. Let it accumulate there until you’re ready to move it (which we’ll discuss in the next step).

I’ve written an in-depth review of Peak in an earlier post, so definitely check it out if you want to learn more about how Peak works and why I’m such a big fan of this app. The one downside is that Peak is currently only available on iOS.

Bonus Step: Another step you can take if you want to do more micro-saving is to use what I call “sweep” apps. These are apps that monitor your primary checking account and analyze your income and spending patterns using proprietary algorithms. The apps then pull out small sums on a weekly basis that they think you won’t notice. These apps are another way to automate some more microsavings into your money system. I personally use a free app called Dobot, which I’ve never had a problem with and I think works great (Feel free to check out my Dobot review post; and if you open a Dobot account with my link, you’ll get $5 to start off your account).

Step 2: Download M1 Finance And Invest Your Spare Change

The second app you’ll need to create your own free version of Acorns is a robo-advisor app called M1 Finance. What makes M1 Finance unique among robo-advisors is that it’s currently the only robo-advisor on the market that does not charge any management fees. This makes M1 Finance the perfect app for us to use to invest our roundups from Peak.

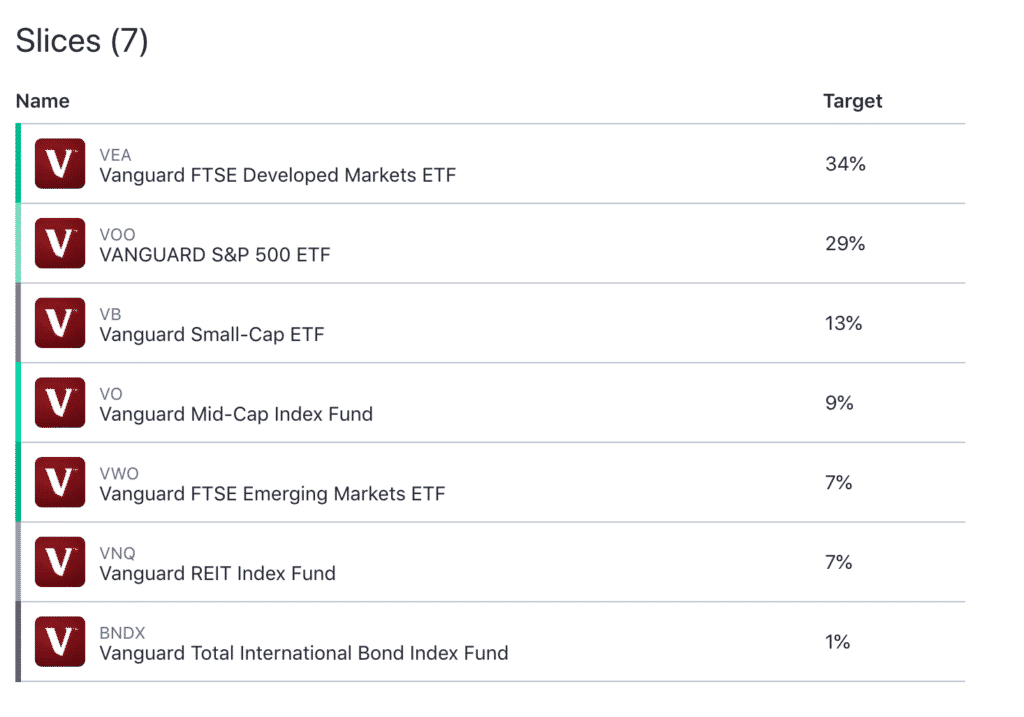

To do this, you’ll want to create a new investing account with M1 Finance. Once you create your account, you can then choose what you want to invest your funds into. You can either pick and choose your own stocks and ETFs, or you can choose one of the “expert pies” that M1 Finance has created.

Here’s an example of M1 Finance’s “Ultra Aggressive” portfolio, which invests your funds into 7 different low-cost Vanguard ETFs.

Personally, I don’t think you need to break up your investments into so many different buckets, especially if you’re only investing small amounts. In my own account, I have everything invested in VTI, which is a Vanguard Total Stock Market ETF. There are a lot of options when it comes to investing, so what you want to do is make it simple – pick a reasonable investment and go with it (reasonable means diversified and low-cost).

The main limitation is that M1 Finance has a $100 account minimum, so you’ll have to start off with $100 in your account to get yourself going. I don’t think that’s too big of a limitation, but it’s something to be aware of if you’re going to create your own free version of Acorns using a combination of Peak and M1 Finance.

If you open an M1 Finance account using my referral link, you’ll get $10 to start off your account.

Step 3: Putting It All Together

Now that you have Peak and M1 Finance set up, the last step is putting them both together. Peak will continue to monitor your transactions and save all your spare change for you in a separate savings account. You’ll then have an M1 Finance account that doesn’t charge you any management fees ready for you to fund.

If you want to make things easy, at the beginning of each month, simply move all of the spare change that Peak saved for you into your M1 Finance account. M1 Finance will then automatically invest those funds for you in the portfolio that you created. Yes, this is a step that you’ll have to manually do, but since it’s on your phone, it really won’t take you much time. Just a minute or two per month.

Note that Peak and M1 Finance won’t link directly to each other, so you’ll have to move your saved money from Peak into your primary checking account, then move money from your primary checking account into M1 Finance. This hasn’t really been much of a problem for me.

So one question is when could Acorns be worth using? At $1 per month, you’ll be paying $12 per year. Thus, if you have $1,000 in your Acorns account, you’d be paying a 1.2% annual fee, which is way too high to make it worthwhile.

At the $3,500 mark, you’d be paying a 0.34% management fee. That’s probably the minimum account balance you need to make Acorns worthwhile. Otherwise, the fees are simply too high a percentage of your assets under management. The thing is, the point of an app like Acorns is to help people without a lot of money start saving and investing. So will you really have that much in your Acorns account? Most people using an app like this won’t be at that point.

For now, this is how I’m doing it – Peak rounds up my transactions. Then, once per month, I move that money over to my M1 Finance account, where it’s invested into VTI (a Vanguard Total Market ETF). It’s not going to change my life or anything – but it’s just another thing I like to do to automate and squeeze out some extra savings each month.

Loved this post! I’ve been using Acorns for a while now and wasn’t aware I could make my own free version. Your steps were clear and easy to follow. Can’t wait to start using this alternative and saving even more money.

What are the transaction costs? I believe it is included in the Acorns model and fees?

Tried to download Peaks on iOS but I guess it’s not available in the USA when I try to download the app? Any other apps or work around?

You omitted a HUGE fact: M1 will NOT auto invest in your brokerage balance until it is at or above $25. So after your $100 initial deposit, if your monthly microsavings balance in M1 Finance is below $25 it will just sit there doing nothing. One idea could be to only transfer out of Peak once you reach $25. Or, if you want to “Supercharge” your savings, boost your monthly Peak microsavings to $25 on any month you don’t reach that with microsaving.

Good point and I didn’t even notice this limitation. Presumably, you’ll probably save $25 per month in spare change anyway, but if you don’t at worst, your couple of bucks is sitting as cash for 2 months max. That won’t have any real impact on your returns.

I agree, fees can’t be evaluated/analyzed in isolation. You really have to couple the fee associated to the investment amount. When I originally heard about Acorns, I was intrigued by it but when you do the math it just doesn’t make sense mathematically. The one thing I will say is that not everything is math. Similar to Dave Ramsey’s debt avalanche or debt snowball there’s a psychological piece to the story. At the end of the day investing is better than the alternative. Acorns has pros and cons, if someone still wants to use the app they should at least know both and decide accordingly. Last, once you graduate from Acorns, you might want to ditch and move into something like Vanguard/Fidelity, etc, or a robo (will also have fees and you need to know what those are).

I’m going to respectfully disagree with you about acorns. Not that I don’t see value in the M1 account that you talked about. However, with acorns, someone can start investing for as little as $5 a month who is on a strict budget but wants to get started investing. I get the whole fee issue that people have, but yet $1 a month is nothing. When you think about it, someone can start investing say $10.00 a month paying a $1 a month fee and start investing today and pay $12.00 for the whole year and not need to worry about a minimum amount. Whereas, someone who might not have $100 right now to start can get into the habit of putting money away to invest each month.

I noticed that M1 Plus has a $125.00 annual fee on top of the $100 minimum balance to be able to borrow at a 2% fee. Whereas the M1 Basic doesn’t seem to have an annual fee but the borrow rate is a variable even though it currently advertises for a 3.5% rate. It’s appears that M1 makes is profit off of loans and annual fee on the M1 Plus accounts rather than charging a monthly fee.

Having said that, I do like that M1 let’s you chose how to invest your funds into things like stocks and ETF’s as opposed to limited options like Acorns does. There’s advantages and disadvantages to both, but I think Acorns has it’s place for beginner investors and people on limited incomes.

Hey Daniel,

The problem is that proportional cost right there. Putting in $10 per month and paying $1 per month means you’ll pay $12 in fees and save $120. That’s a 10% management fee. Assuming the market goes up about 7% on average, you’ll literally end up losing money in those early days. It really takes several thousand dollars before the fee can even be justified. Most of us who understand how these fees work can understand this, but my issue is that Acorns targets new investors, which means most of them have no idea that $1 per month is very significant when your balance is tiny,

I don’t know much about the M1 plus thing, but it’s not even a feature I would ever use since I wouldn’t be borrowing money through an app like M1 Finance. So, they could charge $1 million a year for that if they want – really doesn’t matter to me since that’s not a feature I think anyone should use.

Nice write-up!

Thanks!

One thing you can do to avoid this is just withdraw the money so the account is at $0 most of the time. It won’t charge you the monthly fee then. This is annoying, but every once in a while a good cashback deal comes up through the app that isn’t available elsewhere.

Interesting. So you can have an account with no money in it and they don’t charge you then? I closed my Acorns account a long time ago because of the fee, but I do like having these accounts open so that I can at least check them out to see what’s new.