I started a new job back in June and with it, I needed to set up my new employer sponsored retirement accounts. I’ve never switched jobs before, so I thought it’d be a good bit of education to share how I chose to invest in my employer sponsored retirement accounts.

My original plan was to write about it all in one post, but as I was doing so, I realized that I was talking about things without really giving any background as to why I was making those decisions. Needless to say, as I started writing, I realized my post was getting way too long!

So, instead of writing one ridiculously giant post, I thought I’d do my first series of posts! Part 1 is right here and deals with my core investment philosophy. It’s the foundation for how I pick the investments for my employer sponsored retirement plans.

When it comes to investing, I basically believe in three things:

- I don’t believe that anyone can consistently beat the market.

- I believe in the value of equities (i.e. stocks) over the long term.

- My costs should be kept low.

Let’s delve a little deeper into these three topics.

You Can’t Consistently Beat The Market

So first, a little bit of background information for folks who might not be as familiar with investing. You probably hear the term “market” thrown around a lot. 99% of the time, this refers to something like the S&P 500, which is a group of stocks representing the 500 largest companies in the US. Basically, imagine that you own a bit of stock for each of those companies in proportion to how big that company is. Whatever return you got from those stocks would be the “market.”

In order to beat the market, you have to do two things right. You have to both buy at the right time and sell at the right time. I don’t believe that anyone can do this on a consistent basis. Sure, you can probably beat the market every once in a while. But I’m 29 years old with an investing timeline of potentially 60 years! That’s a long time to have to be right.

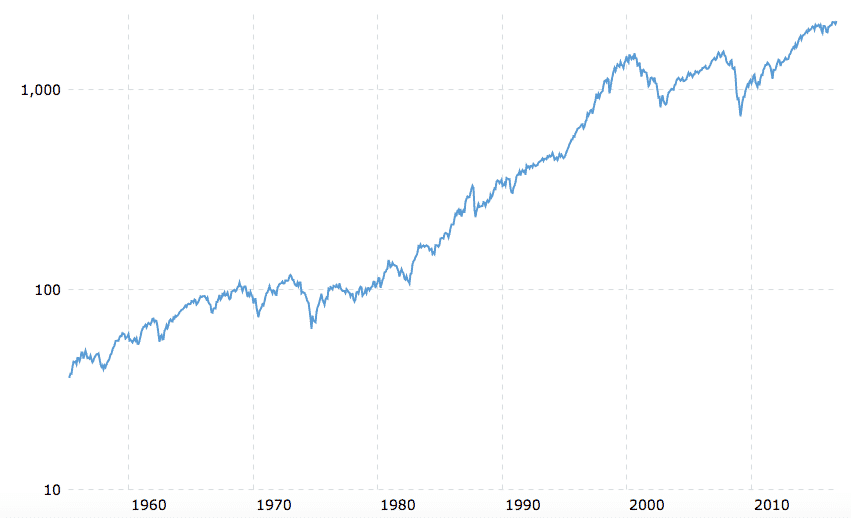

Just take a look at the S&P 500 over the past 60 years.

That’s a bumpy ride and you’d have to have some really good fortune telling abilities to be able to know when to buy and sell over those 60 years. If you mess up just one time, you can end up way behind the market.

If you really want to think about how hard it is to beat the market over the long term, just try to think about how well you can predict the future. I’m writing this post in 2016 from my Apple laptop, while watching YouTube videos on my iPhone. 60 years ago would bring us all the way back to 1956! Could anyone back then have even imagined the world we live today? Can you imagine the world we’ll live in 60 years from now? I can barely imagine what the world will look like 10 years from now, let alone 60.

Even if someone could beat the market over a long time span, you’d have to ask how much would they beat the market by. I can’t imagine anyone beating the market by a significant percentage. If you can reach your financial goals by simply matching the market, why even take the risk of trying to beat it?

So the first part of my investment philosophy – you can’t beat the market. So quit trying to.

Trust In Equities Over The Long Term

The second thing guiding my investment choices is a heavy reliance on equities (i.e. stocks).

Remember that S&P 500 chart above? Notice how, even with all the bumps and dips, it still has an overall upward trajectory. It’s obviously not a smooth climb. But through all the wars, oil crises, terrorist attacks, scandals, and financial crises, the market just figures out a way to keep going up.

This makes intuitive sense if you think about it. Companies become more valuable as technology improves. More goods and services are created as we become more productive as a society. We’ve created new industries that have never existed before. Just think about how different the world was, even a decade ago. Smart phones didn’t really exist yet. Social media was still in its infancy. Even the internet wasn’t nearly as ubiquitous as it is today. Imagine what the world might look like 10 years from now.

If you believe that people will continue to innovate and create, then you have to believe that equities will continue to grow over the long term. And here’s the beauty of the stock market…it can never go to zero! Even if one company disappears, another one will always come in to take it’s place. In contrast, the stock market can grow an infinite amount, forever!

So what about bonds? Since I’m young and have a long investing time horizon, I don’t really go for bonds in my portfolio. Bonds are definitely steadier when compared to stocks. If you’re the type of person who can’t handle the huge ups and downs of being entirely in equities, then sure, putting 10 or 20 percent of your money into bonds makes sense. The absolute worst thing you can do is freak out when the going gets tough. You’ve got to stay on the roller coaster.

But for me, since I’m young and likely don’t need my retirement funds for a long time (and since I need my money to last me a really long time), why would I have any of my money in an asset class that will under perform equities in the long term? I can also take comfort in the fact that the S&P 500 has never lost money over a 20-year period.

It’ll definitely be a wild ride, no doubt about it. But, I trust in equities over the long term, so that’s where my money goes.

Keep Costs Low

Finally, the important thing I look for when picking investments in my employer sponsored retirement plan – keep costs low! If you’re lucky, you have a good employer sponsored retirement plan with low cost funds. Unfortunately, a lot of people either aren’t so lucky or have no idea what their investments cost.

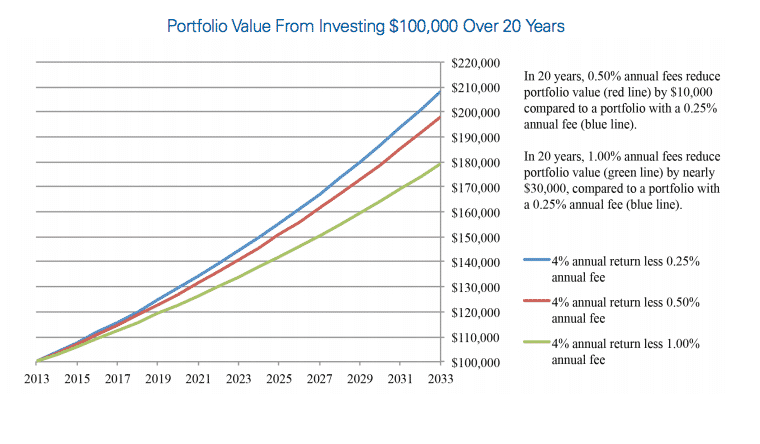

A fee of 1% might not look like all that much in the short term. But over time, those fees add up. This is because a fee does two things.

First, it reduces your rate of return. Let’s say you had 1 million dollars invested and got a 7% return on it. If you had a 1% fee, instead of making $70,000 in the year, you now only make $60,000. Obviously, a smaller fee means you make more money in the year.

Second, fees reduce the amount of money you have to invest. Let’s go back to that 1 million dollars. If you had a 7% return and reinvested all of it, that’s $70,000 going back into investments. If you lose 1% of it to fees, you now only have $60,000 to reinvest. $10,000 less to invest in a year adds up a lot of missing money over the course of decades. Early on, fees don’t look like much. It’s over the long term when you can really see the effect of fees on your return. Remember, compound interest works both ways.

Just look at the difference an annual fee of 1% can have on your investments. See the difference between the blue line and the green line? Notice how they really start to diverge from each other as the years go by?

You want to keep your fees low so you can stay on that blue line.

So that’s the three guideposts I use when picking investments in my employer sponsored retirement plan (or really any investments).

Hope that gives you a little background as to my investment philosophy. Tune in for a future post where I go more in-depth with setting up your retirement account and how I choose my investments.

Any core investing philosophies you follow that I didn’t mention here? If so, let me know!

Great intro for the series. Definitely agree with the points here.

Are you against purchasing individual equities?

We are for buying index funds for our portfolio, diversifying with REITs and bonds, and adding individual equities when we find them at value prices. We can’t wait to read the next pieces of the series to find out more.

I’m personally against individual equities, primarily because I don’t have the stomach for it. It goes up and down WAY too much for me, and even though I know you can make a lot of money if you pick right, it just seems like people who pick it right are just rationalizing their picks in hindsight.

I’ve actually got part 2 and part 3 right here if you’re interested!

Great philosophy! Your future self will thank you, I’m certain!

I didn’t really consider the fees until a few years ago (thank goodness for personal finance blogs!), so I’m sure we lost money over the years on that end. We’ve since corrected that and are invested in index funds.

At least you didn’t pay those high fees forever! With how technology works, I can only imagine that fees will keep dropping. It’s not too bad a time to be an investor, in my opinion.

Hard to argue any of your 3 points, unless you’re Warren Buffett with regards to point #1. I’ve never found too much use for bonds in my investment portfolio. I accept the fact there will be ups and downs in the market, and get all the comfort I need by looking at the historical returns over the last 80+ years. The worst thing you can do IMO is listen to the media. I’ve worked with many smart people over the years that let the media get in their heads and end up getting out of the market at the worst times and get back in at even worse times. It blows my mind at how really smart people can be so bad at investing. Stick your money in low cost index funds and trust the market will continue doing what it always has over time – go up!

It’s all about sticking it out. Admittedly, I worry that I might freak out when the next downturn happens, but I just hope that I’ve learned enough to keep a level head.

You have a smart plan. Trying to beat the market is too risky. There’s little need for bonds at your age. And why let fees cut into your gains when there are plenty of low cost ways to invest. Nice illustration with the blue line!

Thanks Mrs. Groovy! The thing too, why even beat the market if I can get to where I want to go with just regular old market returns? And yep, I just don’t see myself really needing bonds while I’m in my 20s and have a long investing timeline. My one concern is that I could freak out when the next downturn happens. But I’m really reading up and training myself to not let myself freak out.

I recently changed my employer 401k from a target retirement date fund to a 500 index fund.

While my target date fund was doing decent it also was charging a .46% fee vs the index funds .05%. Short-term, not a huge deal but long term it was an easy decision to make the switch.

Yep, not a huge deal. 46 basis points isn’t terrible. But if you can get basically the same result and only pay 5 basis points, and if it only takes you a second to do it, and has no tax implications, then why not?

A solid plan. You are ahead of the game getting started early and making wise choices. I think you will be very happy with your decision 20 years down the line 🙂

I hope so! Wish I had known this stuff when I was just entering college. I think I would’ve done a lot of things different.

Great post, FP.

Investing always makes me think of the knife fighting training I got in the Marine Corps. 1) You keep both the knife and your arms in close, no major movements during the fight, a knife is a terrible offensive weapon. The more you extend yourself the more you open yourself to losing it all. 2) You will be cut. It’s a knife fight, remember? Expect to bleed.

Same with investing! Manage the risk and expect some loss and you are already ahead of the game!

You are way more hardcore than I am! But not a bad way to think about it. You’re right, when you invest, you’ll definitely be cut. But give yourself some time and you’ll heal too!

Sounds like we have pretty similar investment philosophies. I’m a real stickler for minimizing fees. As your graph shows, fees can really eat into your returns over time. You can’t control or predict what the market will do in the future, but you CAN control the amount of fees you pay on your investments. Thanks for sharing!

Yep. I’m guessing a lot of folks in the PF community have the same investing philosophy. I’m definitely not original in my investing philosophy. Main thing is this is what guides me when I pick any investments.

One thing easy to overlook is the employee sponsored plan is by one part of your investment portfolio. Choose the low cost items available to you in it. For sectors you like but are overpriced in the employee plan, put them somewhere else. As long as they balance to your desired allocation it’s all good.

That’s definitely true! Not a bad idea to look at your portfolio as a whole. If you’ve got a really crummy plan, then not a bad idea to just pick whatever the cheapest thing in there is, then use the rest of your portfolio to get to your desired allocation. For sure, any investments that aren’t tax efficient should go in tax-advantaged accounts.

Agree totally that avoiding bonds at a young age is the way to go. Dollar cost average into an all equity portfolio will do you just fine for the first 15-20 years of your investing life. Look forward to seeing your investment choices and what you ultimately went for.

Thanks Mr. Pie! I’m fairly confident that an all equity portfolio should do fine for the first 15-20 years. No need for bonds really when I’m young and have plenty of time to ride the roller coaster.

Looking forward to reading the rest of the series, FP.

I wouldn’t think that 10%-20% in bonds is going to make much of a difference for the risk-averse. If people want have less volatility, they really need to go with a more balanced portfolio, but at the same time accept that they are probably not going to get as much growth and will need to work longer / have a higher savings rate.

I do disagree that fund managers can’t earn their fees but generally agree that monitoring fees (as well as portfolio turnover) are rather important and sticking to a broad index, whether the S&P 500 or Russell 3000 (or equivalent) is definitely the simplest strategy in minimizing fees and turnover.

Funny story about bonds, I put roughly 20% of my portfolio in them in September to have as a buffer for when I take some time off work, but the bonds have done nothing but go down in value…somewhere around 3% I’d say? but I guess that means the coupon payments should be going up. My REITs have been hammed too. If I just stuck with regular old U.S. stocks, I’d have a larger portfolio today, but diversification doesn’t always lead to a bigger value.

Thanks TJ. Admittedly, I’m writing this from the slant of a late 20s type person, so the idea of more bonds isn’t something I have too much experience with. You’re probably right, 10-20% in bonds isn’t going to smooth out the ride that much. I would say that a 50/50 split would probably be too much for any young person.

I’m sure there might be fund managers out there that can earn there fees, but the chances of picking the right one isn’t easy (and not worth trying, in my opinion).

That’s tough on the bonds, but one thing is, it’ll likely all even out in the end!

I’m 100% with you on the basics of your investing philosophy as reflected in this post. But a comment on your statement about fund managers:

I’d say zero of them have earned their fees, considering zero have beaten the market on a consistent basis for a long enough period of time to be worthy of my investing as a late-20s lawyer myself. But I know a few of these guys personally. They are seriously among the smartest people I have ever met! The minds of these guys are like CSI boards, with pins and yarn connecting all the various dots of company financials, market trends, international news, and personal relationships/knowledge of personal beliefs of various leaders of industry…it’s incredible. But also useless, because of the nature of the market: There are simply too many variables, too many inputs, for even these brilliant minds to figure it out and truly “earn their fees.”

Totally makes sense. Really makes you think. If a guy is charging you 1% to actively manage your investments, then he’s got to beat the market in the long run by more than that spread. Seems almost impossible to me.

It is nearly impossible! I think of it this way: Even if I give the fund manager a 70% chance of beating the market in any given year (which is historically very, very generous), each year is independent of the last, so the odds of him beating the market for 30 straight years are as simple as .7^30, which yields .00002253934. A .002253934% chance of beating the market by that 1% for 30 straight years. Yeah, I’ll take my chances with index funds and save the fees. And my 99.7746066% chance of beating the fund manager.

No wonder Warren Buffet is so confident in his bet.

That’s why I go with them index funds too!