Welcome back to another edition of the Financial Panther Side Hustle Report. Today we’ll be taking a look at what I was able to make from the gig economy in July 2020.

As a recap, over the past four years, I’ve tracked all of the side hustle income that I’ve made via gig economy and sharing economy apps. Each month, I share exactly what I made from each app and go into detail about how I made my money and the strategies that I’ve been using.

It’s hard to believe it, but I’ve been able to make over $100,000 over the past four years, just by taking advantage of all of these different apps. That’s pretty amazing to me, especially when you consider that when I started side hustling, I was also working a very demanding, full-time job as a lawyer.

Below is a breakdown of my earnings with each app in July 2020. As a side note, if you want to see a list of all of these different apps in one place, I wrote a really long post last month titled: The Ultimate List of Gig Economy Apps. Be sure to check that post out if you want to get some more ideas about how you can generate extra income via these apps.

Side Hustle Income for July 2020

- Rover: $171.70

- Postmates/DoorDash/Uber Eats/Grubhub: $3,431.29

- Wag: $22.05

- Shipt/Instacart: $8

- Lime/Bird: $3.25

- Selling Trash Finds/Flipping: $34.88

- ProductTube: $35

- Gigwalk/EasyShift/Field Agent/Merchandiser: $5

- ReceiptPal/Receipt Hog/Fetch/CoinOut/Trunow: $40

- Google Opinion Rewards/Surveys On The Go/1Q/Facebook Viewpoints: $29.41

Total Side Hustle Income for July 2020 = $3,780.58

July was another huge month for me on the side hustle and gig economy front, as I was able to bring in over $3,700 from a variety of gig economy apps.

As you can probably see, the food delivery game made up the vast majority of my side hustle income. I carefully tracked how much time I spent doing deliveries this month, so I have a lot of data that I can share with you later in this post. I think you’ll find the info very interesting.

Let’s take a more in-depth look at my earnings in July:

Rover Income: $171.70

My Rover earnings this month came from a mix of dog sitting and dog walking. On the dog sitting front, I watched one dog this month – a small white dog that I hadn’t watched before. I did a meet and greet with this pup a few days before the sitting and was pretty confident that he’d do well in our household. The funny thing is that the owner was really worried that her dog would be too wild, but I didn’t get that impression during the meet and greet and he was perfectly fine during his stay with us. He’s definitely a winner, so we’re hopeful that we can watch him again in the future.

On the dog walking front, I walked a couple of dogs in my neighborhood through Rover. One of the dogs I walked this month was a neighbor’s dog who literally lives in the house across the alleyway from my house. It seems like she has a regular dog walker, but I fill in every once in a while. Since she lives so close, it makes for a very easy walk.

The other dog I walked was a new dog that lives a few blocks from my house. This was also a pretty easy walk that didn’t take too much time.

Dog walking is something that I don’t do as often these days since I don’t find it quite as lucrative as some of my other gig economy options. That said, I still like to work in dog walking when I can, mainly because I find it fun. If this is something you think you might enjoy, you can sign up to be a Rover sitter or dogwalker using this link.

Postmates/DoorDash/Uber Eats/Grubhub Income: $3,431.29

At the moment, I’m having the best delivery stretch I’ve ever had. Here’s the breakdown of my earnings on each platform in July 2020:

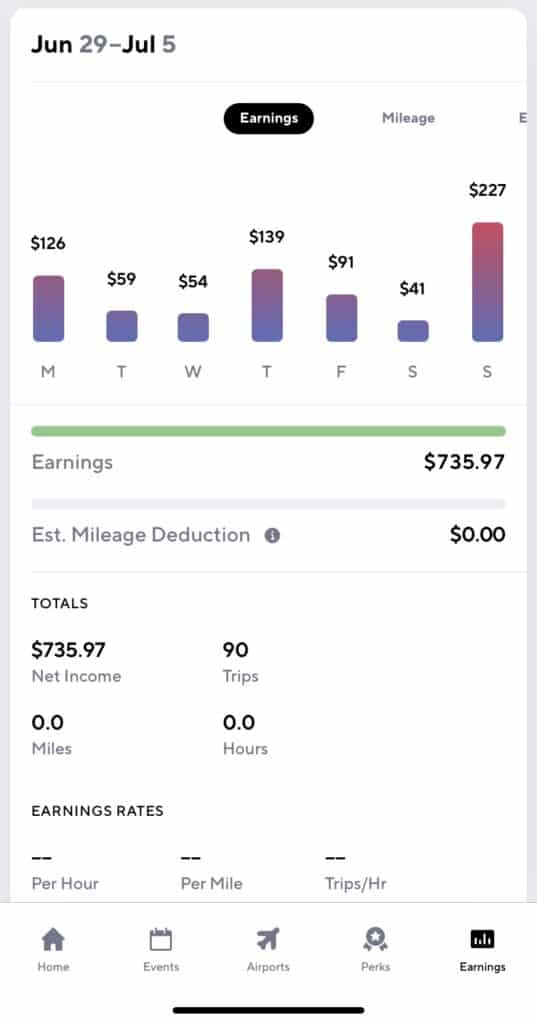

As mentioned at the beginning of this post, this past month, I carefully tracked my delivery earnings using a new app I found called Gridwise. This is a great, free app that can track your earnings on each delivery app, as well as track your time and your mileage. I’m not exactly sure how I stumbled onto this app, but so far I’ve been really impressed with how it works and the information that it’s able to provide me.

Here’s what’s crazy. Since the pandemic started back in March, I’ve found the delivery game to be highly lucrative. For the month of July, I averaged over $40 per hour working. This is timed from the second I walk out my door to the second I return back to my door, so I’m essentially also including any “commuting” time I might have (which usually isn’t any because my house is in a dense area where I’m able to get my deliveries while sitting in my house).

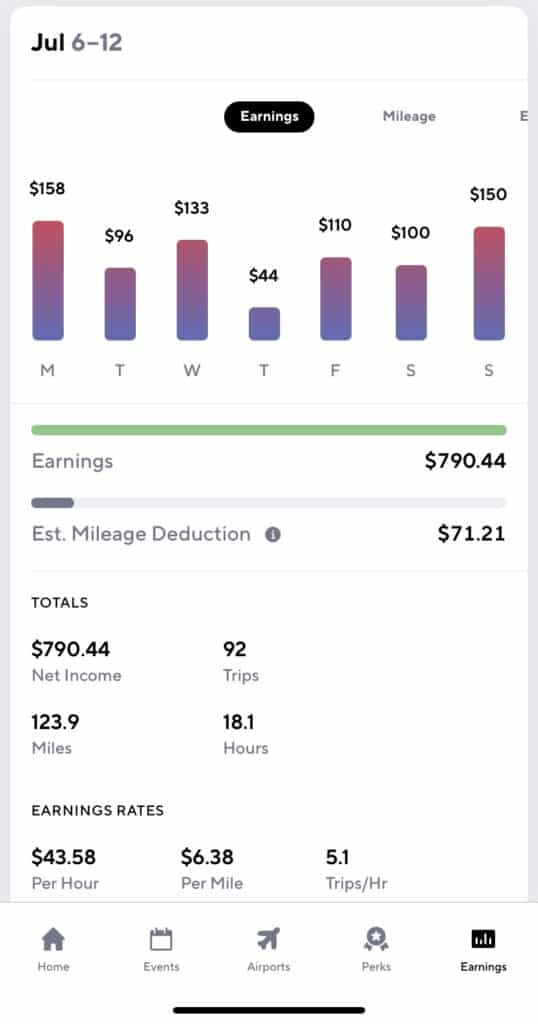

Here’s what I made in the first week of July. This was my first week using the Gridwise app and I didn’t realize that it could track my time and mileage, so as a result, you won’t see an hourly rate. For later weeks, the time is accurate.

In week 2, I ended up averaging $43 per hour and made almost $800 working just 18 hours.

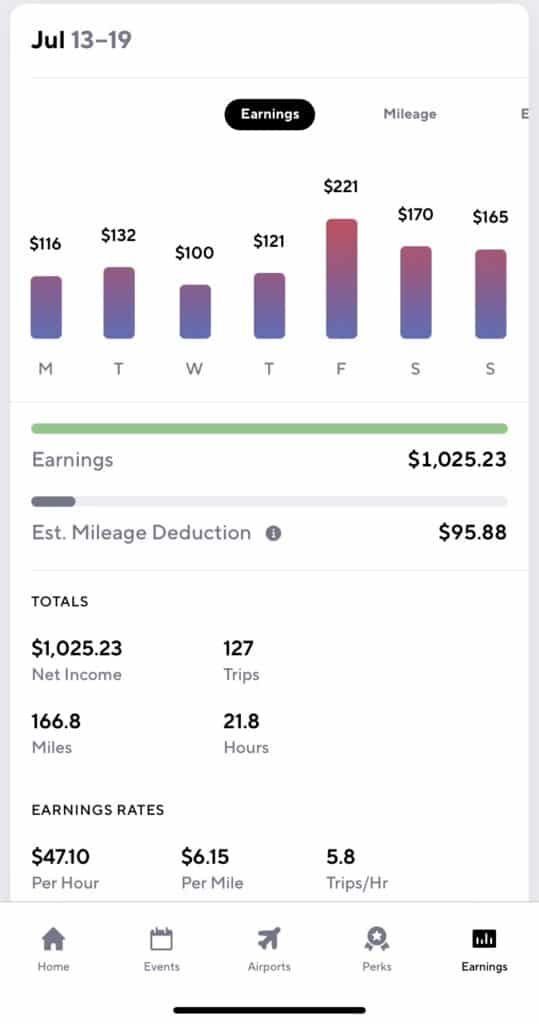

Week 3 was really crazy, as I specifically made it a goal to hit $1,000 for the week. I ended up averaging $47 per hour working 21-22 hours and hit my $1,000 goal.

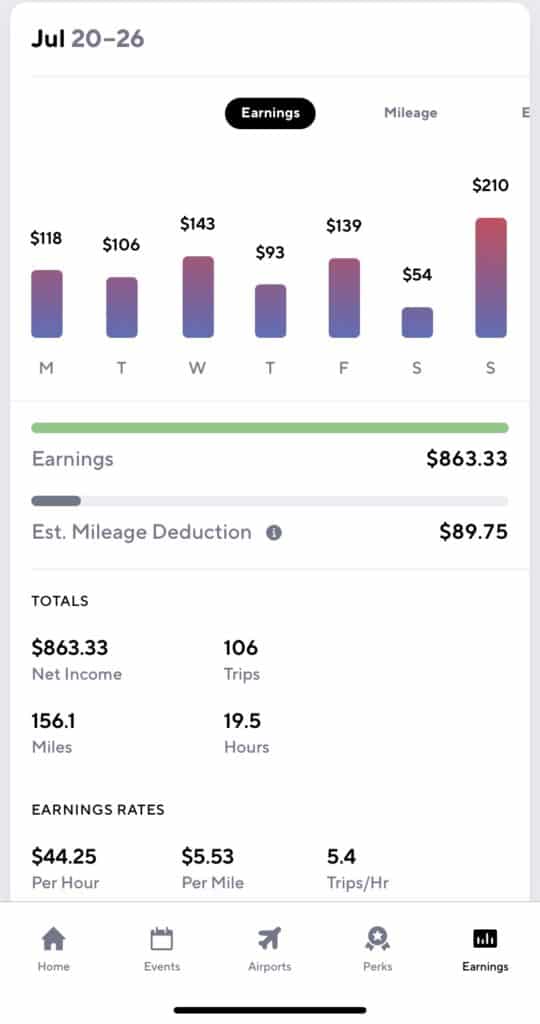

And then finally, in the final full week of July, I ended up averaging $44 per hour over 19 hours.

I did all of my deliveries using an ebike or an electric scooter, so my operating costs were basically negligible for the month. It’s pretty astounding that I’m able to average over $40 per hour delivering food on a bike. When you break it down, you can sort of see how the math works. Because I’m on a bike and I’m in a dense area and I run multiple apps at once, I’m able to complete a lot of deliveries while I’m working, especially when I can get multiple deliveries going in the same direction.

Typically, I’m able to complete 5-6 deliveries per hour through this strategy. So, breaking it down, if I average around $6 to $8 per delivery, I’m able to hit the $40 per hour range – give or take. If I average 5 deliveries an hour, then I need to make $8 per delivery to make $40 per hour, If I average 6 deliveries per hour, I can hit $40 per hour by making $6.67 per delivery. Remember, with gig economy work, you’re trading tasks for money, not time for money. This matters because it means you have more control over what you make.

Is this hourly rate sustainable over the long term? I’d say definitely not. I think there are a couple of things working in my favor right now, however.

- First, the pandemic has made pickups and dropoffs much more efficient. Restaurants are only doing carryout and delivery, which means the food is prepared much faster and I don’t waste a lot of time waiting around. And then with dropoffs, I’m usually able to leave the order at the door and move on to the next delivery, which also speeds things up.

- Second, because I don’t rely on deliveries as my full-time income, I’m able to work only during prime hours and I can work in short bursts. I rarely work more than 2 hours in a single stretch. If I were to stretch out my working time longer, I’d make less simply because demand fluctuates a lot over the course of a day. By working only during the peak lunch and dinner hours, I’m able to maximize my earnings for the time I’m working.

- Finally, we’re in a bit of a unique time right now where a lot of people are ordering food delivery since they can’t go into the restaurant to eat. If/when restaurants open back up, demand will probably drop again. In recent weeks, I’ve started to see a dip in demand as things start to open up again. I still think that I can consistently make $30 or more per hour at a minimum, even when things slow down. For now, though, I’ll take the $40 per hour delivery work.

If you’re interested in trying out the food delivery game and would like to support this blog, feel free to use my referral links below.

- DoorDash: Sign up for DoorDash here.

- Postmates: Sign up for Postmates here.

- UberEats: Sign up for Uber Eats here.

- Grubhub: No referral link, but you can sign up for it here.

Wag Income: $22.05

It’s been a while since I walked any dogs on Wag, but in July, I got a few Wag walks in for the first time since February. That’s a long time!

My Wag walks in July were at a house not too far away from me. I ended up walking that dog, then getting some work done at a nearby park. With deliveries doing so well these days, Wag isn’t a very high priority for me, especially since it’s a timebound task which requires me to do a task, but over a set period of time (in contrast, food deliveries are a non-timebound task, where I’m paid simply to complete the task, regardless of how long or short it takes me to complete the task).

As I continue to do this gig economy stuff, I’m starting to realize that timebound tasks aren’t ideal since there aren’t a lot of ways you can increase your earnings. If I’m scheduled for a 30-minute walk, there’s really nothing I can do to increase my earnings during those 30 minutes.

That said, Wag can work well in certain situations (and obviously, if you like walking dogs, then this is a side hustle for you). If you want more information about Wag and how you can make it work for you, check out my in-depth Wag post, where I discuss the strategies I’ve used with Wag in the past.

Shipt/Instacart Income: $8

My one Shipt delivery this month came about simply out of convenience. I had to drop my dog off at the vet and when I left the vet’s office, I noticed that there was a Shipt delivery at the Target right next to the vet’s office. This was a CVS prescription delivery, so all I had to do was walk up to the pharmacy and get the prescription. These prescription deliveries never come with tips, but if they pay a decent amount, I think they’re worth doing since you can do them really fast. The fact that I was literally next to the Target worked out really well.

Instacart also gave me a bit of scare this month when I logged in and discovered that my account had been deactivated. I don’t do a lot of Instacart so getting deactivated wouldn’t have been a big deal, but I still at least enjoy having Instacart available as part of my side hustle toolkit. After sending a few messages to their support team, they let me know that my account had been deactivated because of a security breach where someone was trying to access my account. After verifying my identity, my account was reactivated.

If you’re interested in learning more about Shipt, check out my Shipt Review where I go in-depth about what it’s like doing grocery deliveries with Shipt.

If you’re interested in Instacart, you can sign up to be an Instacart shopper using my referral link. I recommend signing up for both Shipt and Instacart if grocery delivery is something you’d like to try out.

Lime/Bird Income: $3.25

After a year, the scooters finally came back to the Twin Cities! Last year, I was making $700 to $1,000 per month charging up electric scooters. Since there were so many scooters by me, this took me no time, so I was earning a lot for the amount of time I was working.

Unfortunately, the scooter game is basically done for me this year. The city of Minneapolis approved two scooter companies for 2020 – Bird and Lyft. Lyft uses its own employees to charge scooters, so I can’t do that. Meanwhile, Bird used to use independent contractors but recently switched over to a “fleet manager” program, which basically requires you to charge scooters as a full-time job. That means Bird is out for me as well.

Lime, meanwhile, is the only scooter company left in my market that’s still using independent contractors. However, they’re only operating in St. Paul this year, which means if I want to charge Lime scooters, I have to drop them off in St. Paul. The drop off spots are all too far away for me to do this regularly.

I did charge and drop off one scooter in July, mainly because I wanted to keep myself active. Most likely, I’ll try to drop off one or two Lime scooters per month just so that the system knows I’m still working, but for the most part, this won’t be a real income source for me anymore.

Trash/Flipping Income: $34.88

I didn’t list any trash finds this month. My only flip for the month was a hat that I got from a fintech company a while ago. I thought it looked like a nice enough hat that someone might buy it, so I ended up listing it on eBay for 10 bucks. Surprisingly, someone did buy it.

My other sales for the month were some old clothes that I listed on eBay back when I was spring cleaning. I’ve had these clothes sitting in a box in the basement for a while now, so I’m glad that they’re slowly getting sold. I get $20 per month of shipping credit from my American Express Business Platinum, so I’ve been able to offer free shipping as well.

ProductTube Income: $35

ProductTube is a great app that everyone should have on their phone. This month, I did three ProductTube gigs that took me about 15 minutes total to complete. When you look at what you make for the time you have to spend doing these gigs, you can see that the hourly earnings are in the $100 per hour or more range. You can’t live off this app because of low volume, but it’s easy extra income that doesn’t take up much time.

Gigwalk/EasyShift/Field Agent/Merchandiser Income: $5

In July, I made $5 doing a mystery shop gig for Field Agent. This gig involved buying a specific item at a fast-food restaurant, then taking a photo of the item, and answering a few questions in the Field Agent app. This took only a few minutes to complete and I got some free food out of it too.

ReceiptPal/Receipt Hog/Fetch/CoinOut/TrunowIncome: $40

One of the little ways I generate extra income is by taking pictures of my receipts using what I call, “receipt apps.” I keep a bunch of these apps on my phone and each one pays me a small amount for each receipt that I get. Now, whenever I get a receipt, I snap a picture of it using these apps. Over the course of a year, I can usually cash out about $100 or so, which isn’t bad considering it takes me a second to take a picture of each receipt.

In July, I ended up earning enough points to cash out $40 on Receipt Hog, It’ll likely take me a year before I can cash out on this app again. Obviously, you can’t get rich from your receipts, but it’s essentially free money to me, so I’ll take it if I can.

I recommend downloading all of these apps and just keeping them on your phone. Whenever you get a receipt, just snap a picture of it with each app, then toss the receipt. Here are some of my affiliate links if you’re interested in trying out these apps:

- ReceiptPal

- Receipt Hog

- Fetch

- CoinOut

- TruNow (this one is for gas only)

Google Opinion Rewards/Surveys On The Go/1Q/Facebook Viewpoints Income: $29.41

I earned a pretty solid amount this past month from the short survey apps that I keep on my phone. Here’s the breakdown for July:

- Google Opinion Rewards: $4.52

- Surveys On The Go: $22.64

- 1Q: $2.25

The big one this month was Surveys On The Go, which netted me a little over $22. These surveys were all quick ones that I was able to complete on my phone while I was walking around or otherwise doing nothing.

The reason I use these survey apps is that, unlike a lot of other survey apps, the surveys on these apps only take a few seconds to complete. That makes them worth doing in my book given the amount you’re paid and the time it takes.

And that concludes the July 2020 Side Hustle Report!

July continues my strong side hustling summer. In the past, Airbnb was my big side hustle income generator, generally accounting for 50% of my side hustle earnings. I stopped doing Airbnb this year but food deliveries have picked up and are surpassing what I made doing Airbnb.

As a final parting word, a few people have asked me about how I keep track of all of this income. For side hustling, I typically recommend having a separate bank account that you use only for your gig economy apps. You then need to set up a separate tax account where you save money for taxes. Whenever you get paid, you should automatically pull a set percentage of your income into a separate tax account,

I currently use Chime as my gig economy bank account. Everything I make from my gig economy apps goes directly into this bank account. I then use an app called Catch, which is a great app that monitors my Chime account and pulls a set percentage of every dollar I make into a separate tax account for me. If you’re interested in learning more about how this system works, you can check out my post I wrote about these two apps here: Chime Bank + Catch App: The Combination I Use To Manage My Side Hustle Income.

Another bank account I’m very happy with is Lili. This bank account is designed specifically for freelancers and gig economy workers. Whenever you get paid, they automatically pull a percentage that you set into a separate tax bank account. This one makes it even easier since you don’t have to manage another account. I’m really happy with this business bank account, so they’re worth checking out if you’re trying to get yourself organized. I currently use Lili as my blog bank account, so whenever I pay myself a “paycheck” from my blog, I send it to my Lili account. It then saves away a certain percentage for taxes, all done automatically.

Hope all this info helps. See you all in next month’s side hustle report!

Hi! I love your site and all the reviews and reports you’ve done! I have recoomended your site and blog to family and friends! Question.. does doing all these side hustle leave you down time? such as family and social events?

Thanks for the kind words!

Yes, I do have plenty of down time still, but I’m also one of those people that gets restless if I’m not doing something. I don’t spend a lot of time binging netflix, for example.

Ultimately, it’s all about what we view as important. I binge-watched 10 hours of Tiger King in 2 days back when it first came out. Many other people did that too. We all have time, even if we don’t think we do.

Another great side gig report Kevin! Thanks for sharing. Looks like food delivery is where it’s at this month.

I focus on flipping stuff on amazon and eBay and have recently put my Airbnb side hustle on hold. I was thinking about trying Instacart because I’m usually out sourcing for stuff to resell anyways so I could get some synergy and accomplish both at once.

Thanks Justin! I’ve slowed down a lot on the flipping game mainly because of time constraints and I’m not as comfortable spending a lot of time in crowded indoor spaces looking for stuff. In the past, I used to hit up the Goodwill Outlet, which was an amazing place.

Lili looks interesting me as I have been doing some part-time financial consulting work. However, it looks like they have low limits on how much can be transferred out in a month ($1,000 per month max I think). So If I put money in there, I could see it having to take several month to move it out. Have you had to deal with that?

The way around this is to link to Lili using your primary bank account, then doing an ACH pull. So, my primary checking account is linked to Lili, then I initiate the transfer from that bank account, instead of from Lili.

So for example, if you use Ally as your primary checking account, link to Lili from your Ally account, then pull the money out of Lili via your Ally checking account.

Ah thank you! I knew you would have a way around this. 🙂

I read that the food delivery market is flooded with drivers now. The demand for Uber & Lyft drivers has cratered as people are staying home and telecommuting. Those drivers have switched to food delivery which is less lucrative but still better than zero income. The result is that there are more food delivery drivers than orders needing to be delivered. This doesn’t seem to have impacted you. If you are only working during peak periods, maybe supply & demand are more balanced during peak demand periods.

If you made ~$3,400 delivery food in July and averaged $40/hour, it means you worked 85 hours or 2.75 hours per day. That assumes you worked all 31 days in July which appears to be the case. Everyone is different but I think I would go crazy if I had to do that 31 consecutive days. It’s a big time commitment day in, day out.

I missed the post about you stopping Airbnb. Did you do this voluntarily or because the market dried up? Are you expecting to go back to Airbnb when the pandemic ends? I know someone who was doing Airbnb. The nightly rates he could charge dropped significantly. As he dropped rates to match demand, he found he was attracting “the wrong clientele.” He decided to suspend his participation on Airbnb. It was his vacation house and he is having a hard time making the mortgage payments w/o the Airbnb income. I suspect the same is true for Uber/Lyft drivers. I think many of them bought new cars for the primary purpose of making money as a driver. Now their income is reduced (driving people pays better than driving food deliveries) and they are having a hard time making the car payments.

Hey Dan,

I personally haven’t noticed any drop in demand in my market as of yet, and if anything, demand seems to have only increased. Why is this the case in my market? I really can’t say. My guess is that my city is more educated than most and has a lot of diversity in industries, so my guess is that fewer people are forced to turn to gig work? Obviously a lot of different cities in the US with different people and job opportunities. I think that during peak periods, there’s enough demand to keep most people busy in short bursts.

One thing to note is that I don’t “have” to do anything. I do it because I find it fun. I’m also doing these deliveries on an ebike or electric scooter, so I’m just having a blast doing it. If it weren’t fun, I wouldn’t do it.

As for the time commitment, again that’s up to each person. You can see how it comes out to 2.75 hours per day when you break it down. I go out for lunch rush and do 1 to 1.5 hours, I go out for dinner rush and do 1 to 1.5 hours. I will say that when I’m doing it, it sure doesn’t feel like I’m grinding or working at all. You could switch it up to however much time feels worth it to you – that’s the beauty of it.

Another thought about the time thing, consider the amount of time we all commit to things that we don’t even notice: the average time spent watching TV in the US, for example, is 4 hours per day. The average commute time is 1 hour per day round trip, etc. If anything, you could lump the delivery game in with your exercise time. If people spent even a fraction of that time exercising, they’d likely have better health. But do what works for you.

I stopped doing Airbnb because of two reasons: (1) I had a baby, so for at least a while, I don’t want to have someone else in my house, and (2) I don’t want someone in my house during the pandemic. My initial plan for 2020 was to rent my house out while I was traveling, but the pandemic cancelled all of my travel plans for 2020.

Kevin you are absolutely smashing it. You earn more than the average person in the UK just through side hustling. Love your work ethic.

I recently signed up for a food delivery company earlier this week to try and generate some side income.

All the best!

Josh

Thanks! I’ve just figured out what works for me and that’s what’s important. Figure out what works for you! Let me know how it goes.

Great job! Question- how much battery juice does gridwise pull? I find that I need to carry a charger brick if I’m out much past 2 hours, even if only running 2 apps. I’d assume that pulls even more.

Also do you have any tips to expedite GrubHub? I applied in February. My boyfriend, who applied in April, has been on for 2 weeks now. I can’t find a phone number just an email form. His weekly pay has gone up by 20-30% since he started including that app.

Yeah, I assume it pulls more juice. I always carry a battery pack with me anyway, even when I’m not doing deliveries, Just keep a battery pack with you in your bag.

Grubhub is a fickle one. It took me a year before I was able to get on it! And yeah, it’s a big deal to at least have access to a few grubhub orders each day.

What I ended up doing was setting up an automated email that went out on the 1st of each month to whatever that Grubhub email was. After a year, I guess it got annoying enough that I was finally activated. I’d recommend doing that. Do a search, but there are some chrome extensions that can add this auto-email feature into gmail for you.