One of the things I’ve always wondered is why anyone would invest in expensive mutual funds (I typically define an expensive fund as one with an expense ratio of around 1% or more). Since there are many mutual funds with expense ratios of 0.1% or less, it’s never made much sense to me why anyone would invest in anything else. Why pay ten times more to invest your money in what amounts to basically the same thing?

One problem I have is that, as someone who’s really into personal finance, I fall into a sort of personal finance bubble. I take a lot of the stuff I know for granted and assume that everyone just knows this stuff too. In reality, the vast majority of people have no idea what anything I said even means.

I was reminded of this fact recently when I was talking to my brother about what he’s investing his money in. It turns out that he was entirely invested in funds with a big-name financial services company, all with expense ratios of at least 1%. After a little bit more digging, I discovered that he gave his money to a guy he knows at this big-name financial company who then put the money to work for him. As my brother explained to me, he went to the guy, gave him his money, and said, “make it grow.”

My brother’s a smart guy – he’s always been good at earning and saving money. But when it comes to investing, he’s not particularly knowledgeable. All of the basic terms that personal finance people talk about – expense ratios, 401(k)s, asset allocation, etc – are gibberish to him. And he has absolutely zero interest in learning about any of that stuff.

Needless to say, I wasn’t too happy with his investment choices. Financial Panthers don’t invest in expensive funds like that. But my brother’s situation showed me exactly why people still invest in these types of funds.

The Reason People Invest In Expensive Funds

Ultimately, the reason people like my brother still invest in these expensive funds (instead of opting for cheaper alternatives) stems from a lack of knowledge. It basically boils down to four reasons why someone invests in these, essentially rip-off funds.

Someone Told You To Invest That Way

There’s nothing wrong with getting expert advice, especially in areas where you’re not all that knowledgeable. At the same time, though, you really need to take the time to scrutinize where your advice is coming from. Not everyone has your best interests at heart.

I don’t know enough about why my brother’s “guy” put him in the particular funds he’s invested in. The only thing I do know is that they don’t seem to be particularly smart investment choices. My guess is that there’s a commission or something else involved. It’s the only explanation I can think of for why a professional would pick funds like these.

Picking Funds Based On Brand Name

Going with brand names when it comes to investing isn’t necessarily a bad thing, mind you. Vanguard, for example, is a brand name I trust and if I knew absolutely nothing about your investment choices, I’d still say you can’t go wrong picking something from Vanguard.

At the same time, I’ve always seen funds in my employer-sponsored plans that seem way more expensive compared to the other options. I never understood why anyone would invest in those funds, but my guess is that people see the brand name and just decide it must be good.

Thinking Administrative Fees Are The Only Fees You Pay

One thing my brother told me to justify his investment choices was his belief that his investments were cheap. When I told them they were way too expensive, he explained to me that he only paid $7 per year in order to invest.

Setting aside the fact that I don’t think that number is accurate either, it’s not uncommon for people to think they’re paying very little or even nothing in fees. But everything you invest in has to have some internal costs. Most people don’t even realize that their 401(k) plan isn’t free.

In this case, my brother sat in these funds because he didn’t realize that his investment choices carried internal fees much higher than other alternatives.

Thinking They Can Beat The Market

I know most of us personal finance dorks know that the vast majority of funds will not outperform the market. Still, there are a shockingly high number of people who think that consistently beating the market is possible – as if we can all be Warren Buffet.

Do yourself a favor and don’t try to beat the market. You don’t need to beat it anyway. Good enough is all you need. And being average will do you just fine here.

What Are Your Alternatives?

So what’s a guy like my brother to do? He’s got well over $10,000 to invest. If he wanted to, he could basically invest with rock bottom costs.

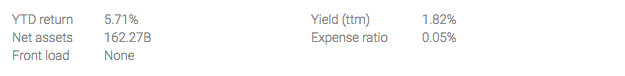

The simplest thing would be to invest his money with reputable, low-cost alternatives. Naturally, anything Vanguard would do. If he wanted to make it really easy, he could even invest all of his money into something like the Vanguard Total Stock Market Index Fund (VTSAX) and call it a day. With an expense ratio of only 0.05%, he’d be sitting pretty well.

Another potential option would be to go with the Fidelity Total Market Index Fund (FSTVX). It’s basically the same thing as the Vanguard Total Stock Market Fund. Again, with an expense ratio that low, you really can’t go wrong.

Even investing in just those funds might be too complicated for my brother. Remember, he has absolutely no interest in learning about this stuff and would rather someone just do it for him. Instead of giving the money to his guy and telling him to make it grow, he could just go with a roboadvisor such as M1 Finance. They don’t charge any management fees and will help novice investors have a good, low-cost, diversified portfolio.

Takeaways

It’s easy to get mired in paralysis analysis, so don’t get too caught up in trying to save a few tenths of a percentage point in expenses. But you’ve got to do some due diligence. To be fair, 1% fees probably won’t be the reason you don’t reach your financial goals. If you’re not going out and saving as much money as you can, it really doesn’t matter what your investment expenses are.

But it’s still easy enough to just avoid those expensive funds altogether. My brother doesn’t need to be in these types of funds. It’s just a waste of money. And really, to be blunt, he’s being scammed.

Don’t just trust a guy out there to invest for you. If you want to make it really easy on yourself, go with something I listed in the alternatives. This investing stuff doesn’t have to be hard or expensive. Save your money and use it on the more important stuff.

Personal finance is such a touchy subject. When I got into this, it took me another two years to learnd and understand about ETFs before making the switch from my traditional mutual funds to ETFs. I wasn’t going to change everything from day 1 because blogs spoke about it. But I sure did trust my banker’s, because hey.. he is a banker, not sales guy pushing product 😉 . You live and you learn.

Same in real life, I bite my tongue often at the office when people discuss their personal finance or spending habits. I don’t want to come over as preachy. So I drop a few clues and hope they see it as an invite to discuss and learn further. only one has stepped forward so far 🙂

I’m pretty similar when it comes to talking about personal finance with people in real life. I’m okay expressing my opinion but if I get some pushback, I just smile and nod. Now when it comes to family, I’m not shy about going all out with my explanations and expressing my beliefs.

Yep, I know a lot of smart well-educated people who think the same way. They just aren’t interested in finances and investing so they figure it’s best to leave it to an expert to take care of it. And to them, “1%” doesn’t sound like much when they assume their returns will be much higher. They don’t realize that index funds can do a better job at a much lower cost.

People don’t know because they’ve never heard these words. I know when I started investing, I had to learn what expense ratios meant. No one teaches us this stuff so we just let someone else handle it for us.

I agree in that most people just don’t know any better. They save money in their 401k’s or 403b’s (which is great) but don’t know anything about the underlying costs, fees, or investment options. I should know because I was this person early in my working career and during residency. An ER of 1%, on top of any administrative plan fees, adds up over time.

It totally does. Doesn’t make sense why anyone invests in that stuff except that they just don’t know any better.

Great points FP. This is why the financial planning industry will be around for the long haul. We may think it’s easy but I know plenty of very smart people who just have ZERO interest in educating themselves about it and would rather pay someone to do it for them.

Right. The vast majority of people I know do not want to learn this stuff. And there’s nothing necessarily wrong with that. I don’t know how to do fix a toilet or do other basic things that a lot of people would think is ludicrous. I’d probably end up paying someone to help me figure that out. The key difference though is that the cost of having someone take care of my money is way more expensive.

Great and necessary post!

Two years ago I met one of my academy classmates just to say “hello” (or so I thought). After the preamble, he jumped into selling me on his “guy.” He was super excited about Guy. How Guy got returns of 12% on average and only charged a small fee of 2-3%. If Guy brought in less than 6% return, Guy would not charge anything! He told my friend, “if you don’t eat, why should I eat.”

Unfortunately I laughed and said I’d rather invest in practically free index funds anyway than pay Guy. Since everyone in my friend’s small unit was feverish over Guy getting them rich, he took it personally and stomped off. Sad. I hope he does get rich, I just have different tactics.

A solid defense is nothing to sneeze at! Thanks for making a better articulated argument!

Thanks Jack! It’s tough in that situation because you don’t want to call your friend an idiot, but at the same time, you sorta need to. When it comes to my brother, I think it was okay for me to school him, but with someone else, I might just point it out and if they didn’t agree, I’d just smile and nod.

Right on! I have a lot of friends in the same boat. Most people just aren’t financially savvy and don’t know how easy it is to invest efficiently and effectively with index funds. Most financial advisers don’t help by pushing expensive fee laden products. Nothing beats the ease and effectiveness of investing in low cost index funds. It’s what got me to financial independence 🙂

Yeah man! We take it for granted that we just know this information. 99% of people have no clue what they’re doing and just give their money away to someone else.

My boss is one of those guys. He’s a very smart guy and built up his company to around 50 employees and has been in business for over 40 years.

However, we just talk last week about I was talking about some of the funds in the 401(k) plan we have and how I moved everything to the one Vanguard fund we have with next to nothing fees. I told him how much I would likely save in fees over the next 10 years (over $50k!!) and he argued that the information from Personal Capital was probably wrong and that the managed funds perform much better.

We agreed to disagree and left it at that, but that still seems to be the consensus out there. Kind of scary IMHO!

— Jim

You can’t really argue with those types of people. I just smile and nod my head in those situations!

Because they just don’t know any better. As you said, it’s all gibberish. People will spend hours studying fantasy football stats because they have a chance to win $100. Meanwhile, they’re losing $100 a day due to unnecessarily excessive fees on their investments.

1% is huge by the way. If you’re hoping for inflation adjusted returns of 3% to 5%, the fees drop your return to 2% to 4%. So one percent is more like 20% to 33%. Take compounding into effect, and those investment fees will cost you millions. Don’t believe me? Look: http://www.physicianonfire.com/investment-fees-will-cost-millions/

Cheers!

-PoF

Exactly right Doc! People don’t even realize those fees because they can’t see them. And 1% seems like nothing, but right, if you think about how much that is compared to a yearly average return, it’s a huge percentage. When I told my brother to just switch over to Betterment or Wealthfront since he doesn’t know what he’s doing, he immediately complained that it cost money (0.25% of assets under management). Little did he know his current investments are costing him over 1% of assets under management.

More on this quality comment, it would salient to provide a numerical example showing the dent high fees take from you in the blog. Seeing how much less YOUR money makes with excessive fees is something that makes it easier to understand. Seeing the different bottom lines based on different fees calculated over 10 or 20 years I think really makes it clear to folks how much money is basically given away. 2-3% sounds low, ya know? Seeing thousands of dollars of difference compared to a quality <1% fun drives it home how much the screw is turned on folks who buy expensive funds!

Thanks for the great advice, just trying to make it as strong as possible so people keep their money.