This Part 2 of my Decade-In-Review. Please read Part 1 if you’re interested in learning more about how I ended up here.

I left off my last post at the point where I’d just graduated from law school, moved into an apartment with my girlfriend, and was getting ready to start my first real job after having spent the summer studying for and then taking the bar exam. This was in September 2013 – four years after I had graduated from college, moved back home with my parents for a year, then moved to Minnesota to start law school.

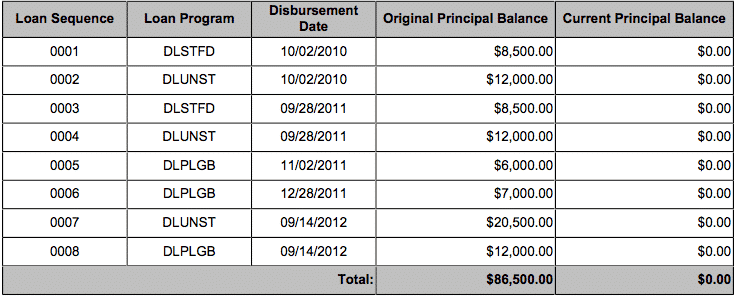

At this point, I had $87,000 worth of student loans and didn’t have any idea how I was supposed to handle it. I also had very little knowledge about how money worked in general, which isn’t the best thing when you consider that I was about to start a six-figure job at 26-years old after never having made any significant money in my entire life (before I started my first real job out of law school, I’d made a grand total of $31,000 in the previous three years, with $20,000 of that coming from my summer associate position).

I’d say the second half of the decade was when I started to learn more about who I was and what drove me. It also led me to start living life more out of abundance, rather than doing things out of fear. Let’s take a look at what happened over the rest of the decade.

A Rough Transition To The Working World

My first job was as an associate at a large law firm in Minneapolis. A sense of dread hit me soon into my career as the day-to-day reality of biglaw life started to take its toll on me. My issue was that this type of environment just wasn’t a good fit for me. I don’t think I was well-equipped to deal with the stuff that some people might thrive on – constantly hustling for work, billing hours, and dealing with office politics, all of which were things I was not good at and did not enjoy doing.

In retrospect, it’s sort of easy to see why biglaw (and corporate life in general) wasn’t a great fit for me. Up until this point, I’d been living a life that matched my personality pretty well. I’d had that one amazing year in 2010 where I’d lived at home and was working jobs that, even though they weren’t high paying, were at least fun to do and gave me a lot of freedom and autonomy to do my own thing while I was working.

My first year of law school was pretty miserable, but it still provided me with a lot of autonomy. Sure, I had basic parameters I had to work within, but my time was basically mine to use as I saw fit. I studied a lot, but it felt different because I could study wherever I wanted, whenever I wanted, and however I wanted. No one was looking over my shoulder and I didn’t have to report to anyone.

And then, those final two years of law school were basically college 2.0 in my eyes. I didn’t have a lot of worries since I had a good job waiting for me and thought that I had it made. Studying for the bar was also really enjoyable – again because it felt like I could do what I wanted and I made my own schedule without anyone looking over my shoulder.

I think that’s the theme of what type of work was going to make me happy. Having basic parameters around what I needed to do was fine, but I think I needed a sense of real autonomy more than anything. My “fake” low-wage jobs and law school provided that to me. I made my schedule around broad parameters, but it was up to me to decide how and when I got stuff done.

Feeling Trapped – So I Took Action

It was early in my legal career when I realized that the biglaw lifestyle wasn’t going to work for me. I was struggling professionally and never really felt like I was doing a good job. The constant stress also took a toll on me personally.

My only issue was that I still had $87,000 worth of student loans that I needed to get rid of. I was on a 10-year repayment plan. so my monthly payment was around $1,000 per month. As a point of comparison, my rent at the time was $575 per month and I didn’t have a car, so my highest monthly expense was my student loan payment. In other words, I needed this job.

2014 was when I started to take action on my student loans and also when I started to get very interested in personal finance. My first introduction to the personal finance world was through Dave Ramsey. I’ve got some problems with Dave Ramsey and a lot of the things he says, but I can’t deny that it was his YouTube channel that first made me feel like my debt was a problem and that it was something I could get rid of quickly if I really tried.

Later, I discovered the financial independence community, and this completely changed my world on what I thought was important. Instead of valuing stuff and prestige, I began to value time and freedom.

I ended up working at that biglaw job for about three years while I threw down as much money as I could into my student loans. During this time, I invested very little into my 401k, only putting about 5% of my income into it, which was the default amount that my employer took from our paycheck. From 2014 through 2016, I ended up paying a little over $102,000 towards my student loans and got them all paid off by the summer of 2016, about 2.5 years after I had started paying off my debt.

To do this, I did the basics that anyone paying off student loans has to do – I lived on much less than I earned and put the rest of my income towards my student loans. Doing this wasn’t particularly difficult for me, but it required me to do a few things that not everyone does.

- First, I lived in a “normal” apartment (i.e. not a luxury apartment). During my debt payoff journey, my wife and I always lived in 1-bedroom apartments, where my share of the rent was never more than $600 per month. We had one year in 2015 where we lived in a fancy luxury apartment because I took over a lease for a guy who had just signed it and needed to move. The cost for him to break his lease was really expensive, so he ended up paying for a few months of the rent so that I would take over his lease. Because of this, my share of the rent for this luxury apartment ended up being only $575 per month, which was a great deal for the fanciest place we’d ever lived in. This was the same apartment where I found that dumpster in the garage that literally made me $1,300 in a year.

- Second, I didn’t have a car and instead, I got around either by taking the bus, or even better, biking. I didn’t have my own bike either – instead, I used the Minneapolis bike share system, which cost me $65 per year and let me ride the bikes as many times as I wanted. There’s literally no cheaper way to get around a city – not even mass transit is cheaper than that.

- Third, I kept my food costs down a lot mainly because I took advantage of the perks that came with my biglaw job. Free food, for example, wasn’t hard to find most days. There were often CLE classes during the lunch hour where I could walk in and snag some free food pretty easily. During the summer, our meals were reimbursed if we went to lunch with summer associates, so from May to August, I’d basically eat for free every day.

During my time in biglaw, I made a lot of money, which is also why I was able to pay off my student loans as fast as I did. My starting salary in 2013 and 2014 was $110,000. In 2015, I got a raise to $115,000. And in 2016, my salary went up again to $125,000.

Turning To Side Hustles – But Not For The Normal Reasons

A lot of people think of this blog as a side hustle blog and it’s true that side hustling is something that has made up a big part of the last few years of my life. My side hustling adventure started in 2015 when a food delivery app called Caviar launched in Minneapolis. This was the first time I had used any of these gig economy apps and I became hooked on them. I didn’t have a car, so I used my bike to do my deliveries and for whatever reason, I found it ridiculously fun to do. In my mind, it felt like I was getting paid to go outside and bike, which was something that I was already doing anyway.

It was around this time that I realized the gig economy could be used by anyone, even someone like me who was working a lot of hours at a demanding, professional job. I found that all of these gig economy apps could easily fit into my day-to-day life if I used them right. As an example, on my way home from work, I’d turn on my delivery apps, find a few deliveries heading back towards my house, and deliver food to people on my way home. A few bucks here and there on my way home didn’t seem like a lot of money, but when I did the math, it surprisingly added up.

But side hustling did something even more important for me than to help me make a little bit of extra money. It served as a form of therapeutic relief from the daily stresses of work. After spending all day sitting at a desk and feeling stressed from so many obligations, there was some comfort in being able to get on my bike and do relatively simple tasks on my own schedule. It also gave me some confidence in knowing that I could figure out how to make things work and make money on my own, without relying on a normal job.

Over time, as I learned more about how to make side hustling work for me, I continued to add more side hustles into my repertoire. For example:

- In June 2015, I set up a profile on Rover and started my dogsitting business. My rationale here was that since I already had a dog, adding a second dog into the mix wouldn’t really be difficult. I already had to take care of my own dog, so in a way, dogsitting with Rover was a way for me to monetize the dog care tasks I was already doing anyway.

- In January 2016, my wife and I moved into a four-bedroom house. With so much space, we decided to start renting out a guestroom on Airbnb. This form of house hacking worked out very well and allowed us to dramatically reduce our housing costs over the next few years. On average, we made about $10,000 per year just from renting out one room in our house. In 2018, we increased our yearly earnings by occasionally renting out our entire house while we were traveling.

- In June 2018, Bird and Lime scooters were launched in Minneapolis and I signed up to start charging them. This was a side hustle that just a few years before, I’d have never even been able to imagine. Charging these scooters also got me obsessed with the idea of electric micromobility – which is something that I talk about a lot now when I’m around people.

Even though these gigs were “beneath” someone of my pedigree, I still did them. In a way, I think it helped keep me grounded and was part of the reason I was able to avoid the massive lifestyle inflation that often happens with bigshot lawyers.

New Jobs, But Still Not Happy

I ended up making my last student loan payment in the summer of 2016, about 2.5 years after I had started to pay them off. Paying off my student loans bought me a lot more flexibility since I didn’t have to worry about having a $1,000 per month fixed cost anymore.

So, in the summer of 2016, right after I paid off my student loans, I left my biglaw associate job and took a job as a public sector attorney at a large state agency. The new job paid $75,000 per year – i.e. a massive $50,000 pay cut from the $125,000 salary that I had before.

Unfortunately, this new job wasn’t what I expected. My thought going in was that it would have lighter hours and would maybe be a better fit for me. I struggled a lot at my biglaw job due to the pressure of billing and dealing with different partners. A government job, I thought, would be the opposite of that, with no pressure to bill and maybe less office politics to deal with. That wasn’t the case though. Instead, I felt like it was just as much a struggle for me. I worked a lot of hours, hated having to do status reports and deal with meetings, and worse yet, I was now making less money than I made before.

After a year in public service, I made another job switch in the summer of 2017, leaving my state attorney job to take a job as a legal attorney/editor at my state bar association. My thinking here was that I just wasn’t happy being an attorney, so maybe working in a sort of law-adjacent job would do the trick. The salary for this new job was $57,000 a year, so I took another big pay cut in my search for the right job for me. I was able to take another pay cut because I’d been used to living on less and didn’t have many expenses since I had already paid off my student loans.

This new job wasn’t terrible, but I also found myself not enjoying it very much. It turns out I’m not really great at editing and once again, I didn’t enjoy having to be an office every day, working on someone else’s schedule.

Quitting My Job

During this stretch, I’d been working on building up this blog and doing my side hustles, but my idea for financial independence and my future still came from working a job in the legal field for a decade or longer. I never thought about looking outside the legal field or looking inward at myself to see what I could do. My future, for some reason, always relied on someone else paying me.

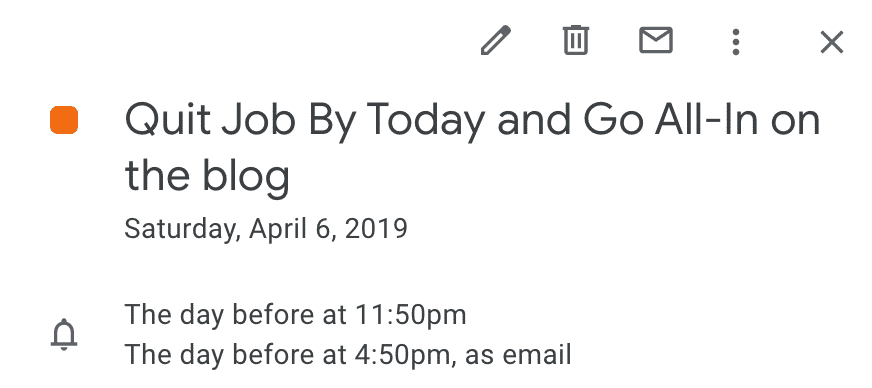

This changed in April 2018, when I had a really bad day at work. I ended up going to my calendar and writing a single goal to myself, which I still have saved. It said this:

After five years in the legal profession and three different jobs, it became clear to me that simply jumping around from one lawyer job to another wasn’t going to do the trick for me. I needed to take a leap and do something completely different.

I hit my goal sooner than I thought, quitting my job and making the leap to full-time blogging and side hustling in March 2019. Since then, I’ve felt a lot better and people have said they can see the difference in me.

There’s no doubt, my decade didn’t turn out the way I thought it would. At the beginning of the decade, I was all about following that clear, career path – studying hard in school, getting a good job, and working for someone until I could retire when I was old.

When I discovered financial independence, my view changed some more, with the idea that maybe I could move up that retirement date earlier. My future, however, would still be dependent on others employing me and paying me until I could quit and do what I wanted.

And when I started to believe in myself, my view changed some more again, with the idea that instead of waiting to do what I wanted to do, maybe I could go do it right now.

The important thing is, I took action to figure out what worked for me. This story obviously isn’t over – but one thing is for sure. I couldn’t have predicted my decade would turn out like this.

My Total Income Over The Decade

This is a personal finance blog, so of course, I think it’s helpful to see what type of income I’ve earned over the past 10 years of my life. Luckily, it’s not too difficult to pull this information up via the Social Security Administration website.

Below are what my taxable earnings have been from 2010 to 2018. I haven’t done my taxes yet for 2019, but most likely, my personal income will be around $60,000 to $70,000, so pretty similar to what it’s been in previous years.

- 2019: $60,000 – $70,000

- 2018: $76,479

- 2017: $76,676

- 2016: $98,140

- 2015: $114,478

- 2014: $106,675

- 2013: $41,963

- 2012: $20,160

- 2011: $526

- 2010: $10,822

One interesting thing I never realized. In the past decade, I made over $600,000 in income. That’s a lot more than I thought I had made.

A Timeline Of My Big Events Over The Past Decade

- August 2009: Moved back to my parent’s house. Spent the time working low-wage jobs and applied to law school.

- September 2010: Moved to Minnesota and started law school.

- September 2011: Interviewed and received an offer for a summer associate position at a large law firm in Minneapolis. I accepted the offer.

- December 2011: Met my wife, who was then in her second year of dental school.

- August 2012: Received an offer to return as an associate at the law firm I worked at over the summer.

- May 2013: Graduated from law school.

- September 2013: Started my first job as an associate attorney.

- June 2016: Paid off my student loans, then started a new job as a public sector attorney.

- April 2017: Got married.

- July 2017: Left my public sector attorney job and started a new job as a non-profit attorney/editor.

- March 2019: Quit my job to try my hand as a full-time blogger.

- Future: Unknown

Loved your story. Keep it up. Not sure how I ended up on your blog, but I will be coming back. 😉

I’ve been looking forward to reading your second installment. It’s very insightful to read about someone thinking through what really makes them happy in a profession. Great work! I love your blog and have pointed many colleagues in your direction when they inevitably share dissatisfaction with Attorney life. My favorite post you’ve done so far is the post about prestige. It helped me better articulate my own reasons for leaving regular law practice and I’m very grateful for that. Keep up the good work!

Thanks Teja! Appreciate the support. The prestige issue is something I still deal with, especially when people ask me what I do and I say I’m a “writer” or “blogger” which sort of sounds like I’m a bum.

Great article, thank you for sharing!!! Do you think you’ll ever, eventually go back to a law job or a traditional job?

What is the hardest part of being your own boss? What’s the best part? do you miss anything about practicing law?

What are your goals for 2020?

I’M NOSY!

I don’t think I can go back to law. My plan B and plan C are go back to school and get a library science degree to try to be like a librarian or law librarian, or go to a coding boot camp and learn to code and then just get a job doing that.

Best part of being my own boss is not having the anxiety of performance reviews and that kind of stuff. That always brought me a lot of anxiety.

Hardest part is, of course, motivating myself to hustle. In a job, my motivation is to not get fired or embarrassed at work. When you work for yourself, the motivation I guess is to be able to survive, which is sort of a different feel.

The only thing I miss about practicing law is the prestige it brought me, because it made me feel important.

Your story is so inspiring! I never thought to ask this before, but do you plan to keep up with your law license now that you’re not actively practicing law? I’ve only been practicing law for two years and I’m already looking at exit plans myself. Whether or not to keep up with my bar dues and CLE requirements when I leave to invest in real estate full time is something I’m trying to decide is worth it or not.

So, I am keeping my law license right now just because, like many of us, I’m scared and like the comfort of knowing I could maybe go back to something if I had to.

It’s $250 per year for me to keep my license and then I think I can mooch free CLEs from affinity groups and from my friends that work at law firms.

I find your blog very intriguing! Some questions immediately popped into my mind…I’m wondering throughout your entire career journey, was your wife always supportive of your decisions or were there moments of reluctance? In addition, because your wife is a dentist, which presumably makes a good salary, did that enable you to take more risk to leave your higher paying job(s)? Lastly, will any of your perspectives change when/if you have children? Babies and college can be expensive! 🙂

Good question Annie. Yes, my wife was supportive throughout. She could tell that I was not doing well working for others. Of course, there was reluctance, but we’ve been really seeing that money is out there.

My wife is absolutely the reason I made this jump and makes it much easier. In fact, the only reason I didn’t make the jump earlier was because we wanted to make sure my wife was settled in her business before jumping. She owns her own practice, so we’re already pretty big risk takers.

Children are on the horizon, and I don’t think it’ll change my perspective. If I made more money as a lawyer, then sure, but for me, the way I look at it, my income ceiling is far higher working for myself then it is doing law unless I went back into corporate law, which I know I cannot do for the rest of my life.

that’s guts – to leave high paying job to pursue satisfying ones 🙂 lovely read mr. panther.

Thanks! There’s a fine line between guts and stupidity. I guess we’ll see which one it is. In a few more months, it’ll be a year since I quit my job to go all-in on myself.