A little while ago, I wrote a post that I called, “How To Afford Anything You Want.” As the name suggests, the thesis of that post was that anyone can afford to buy whatever it is they want – it just requires creating a few systems and taking a little bit of time to plan things out in advance. My suggestions were pretty straightforward.

- First, create a system of sub-savings accounts using banks like Ally, Discover, or Capital One 360. These banks are good because they let you make as many different savings accounts as you want and allow you to label them with different names.

- Second, figure out how much money you need for each goal and how long you have to save for that goal.

- Finally, using the above information, automate weekly or monthly transfers into those different sub-savings accounts. You can then buy whatever it is you want, guilt-free and without any pain.

When you break things down into weeks or months, you often find that most things don’t require you to save as much money as you think. A new phone, for example, might cost $1,000. That can seem like a daunting amount, but if you break down that cost, you’ll find that you only have to save $1.37 per day to be able to buy a new phone every 2 years. That’s such a small amount of money that many people won’t even notice it.

Saving for short-term goals is one thing, but most of us probably also have things that we know we’ll need to buy at some point in the near future, although not necessarily in the immediate future. For example:

- A lot of us probably buy a new laptop every couple of years. I bought my first laptop in 2005, bought my second laptop in 2010, and bought my current laptop in 2015. It’s a fair assumption that I’ll probably buy a new laptop in the coming years.

- A few years ago, my old dryer finally broke down. My washing machine is still going strong, but it’s also just as old, so I imagine it’ll break at some point. I have no idea how long washing machines or dryers typically last, but I think it’s probably not uncommon to buy a new one every decade or so.

- I’ve never bought a car before, but if I was someone who bought cars, it would probably make sense to plan this purchase out as far in advance as possible. A Google search says that the average person buys a new car every 6 or 7 years. We folks in the financial independence community probably hold our cars longer, but it’s not crazy to think that most people will buy a new car about once per decade.

As with short-term goals, it also makes sense to break down longer-term goals into smaller chunks. The key difference with longer-term goals, however, is the way you save for them. While it makes sense to use sub-savings accounts for short-term goals – after all, we don’t want to take on market risk if it’s money that we need pretty soon – for longer-term goals, it makes a little more sense to invest the money that we’re saving, especially since we have the added benefit of time to assist us.

The issue comes with how to set up these longer-term savings goals. In the past, investing small amounts wasn’t very realistic simply due to account minimums and fees. But these days, thanks to all of the fintech apps that are out there, it’s actually possible to create multiple sub-investment accounts that we can use for our longer-term goals. In fact, it’s so easy that we can literally set these up in seconds using our phones.

In today’s post, I’m going to walk you through the systems and tools I’ve been using to save for these longer-term savings goals and how you can utilize these same strategies for your own financial system.

*As a bit of a side note, when I talk about longer-term savings goals, I’m not talking about retirement or college savings. These are long-term goals that obviously require investing, but they’re in a different category compared to the longer-term savings goals that I’m talking about here. Rather, when I talk about longer-term savings goals, I’m thinking about things that you probably buy once or twice a decade, but that you don’t necessarily need to buy if something unexpected happens.

Using Sub-Investment Accounts For Longer-Term Savings Goals

The strategy for saving for longer-term savings goals is pretty much the same as the strategy I use for short-term goals, only instead of creating sub-savings accounts, I create different sub-investment accounts using a variety of free robo-advisors that allow you to invest small amounts on a weekly or monthly schedule.

Here’s what I do. Whenever I know I’m going to buy something in five or more years, I create a sub-investment account for that goal, automate a weekly or monthly transfer into that goal, and then allow that money to continue to grow and compound over time. When the time comes to buy whatever it was I was saving for, I simply sell my investments in that sub-investment account and go buy what I want. Anything that’s left over is kept in there to continue to grow. And then the cycle repeats itself again.

An example will help explain the process. Back in 2015, I purchased a new laptop – a Macbook Air that also happened to be my first Apple computer. Over the prior 10 years, I’d purchased two laptops – a Dell laptop that I got when I started college in 2005, and a Toshiba laptop that I got when I started law school in 2010. When I looked back at my purchase history, it seemed like I tended to buy a new laptop every five years. So, given this fact, I decided to give myself five years to save for my next laptop. I figured that if I saved $1,200, that’d be enough to buy a pretty good laptop in the future.

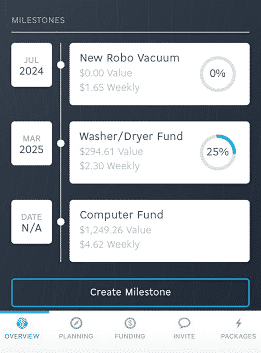

Five years is a long time. Given that time frame and the fact that I could afford to take some risk, I decided to create an investment account that I earmarked as my computer fund. I opened up this account in 2015 with WiseBanyan, a free robo advisor that was perfect for this strategy since there were no minimums and no management fees. Once I had this investment account set up, I automated a weekly transfer of $4.62 into this account – over five years, I’d likely have more than $1,200 saved.

The way I saw it. Worst case scenario – the market would take a dip in five years and I’d either just hold off on buying a new laptop or buy the laptop with what I had and cover the rest on my own. Best case scenario, I’d have more money in there than I had anticipated and could pull out what I needed and leave the rest to continue to grow while I continued to put more money in there to buy my next laptop in another 5 years.

How To Use Sub-Investment Accounts For Longer-Term Savings Goals

So, the overall system here is pretty simple. Basically, you do the following:

1. Figure Out What You Need To Buy. Think about things that you’ll probably need to buy in the next 5-10 years. Importantly, whatever it is you’re thinking of buying should be something that you could live without or could afford to cover with a little bit of your own money in the event there’s a big market downturn down the line. Investing for things like computers or big appliances I think makes sense. I’m hesitant to invest a down payment for a house though.

2. Figure Out How Much Money You Need And How Much Time You Have To Save.Calculate how much you need to save and how long you have to save for it. I often like to think of my savings in terms of the weekly amount I need to save since it makes me feel like I have to save less. So, if you have 5 years and need to save $1,000, simply divide that amount into 260 weeks and you’ll find that you need to save $3.84 per week.

3. Create A Sub-Investment Account And Automate Your Savings Using A Free Robo Advisor. There are several robo advisors that charge no management fees and allow you to create multiple sub-investment accounts that you can then earmark for each specific goal. You’ll want to use these to automate your sub-investment accounts since they allow you to invest with very small amounts. (I’ve primarily used WiseBanyan to do this, but I’ve also been trying out M1 Finance and I have used SoFi Invest in the past)

4. Buy What You Need Once You Have The Money And Continue Investing For Your Next Goal. Once you hit your target number, feel free to sell what you need in that account, then leave the rest of your investments in there to continue to grow. If this is something you regularly purchase, continue to save for the next time you need to buy something. Remember, your money is compounding, so this time, you should be able to hit your savings target even faster than before.

The Best Free Robo-Advisors To Use For Longer-Term Savings Goals

There are a ton of robo-advisors out there, but there are a particular few that work out really well for creating sub-investment accounts. That’s because they do two things:

- They’re totally free and charge no management fee; and

- They allow you to create multiple sub-investment accounts.

Below are three free robo advisors that I recommend for implementing this sub-investment account strategy. All three robo advisors have no fees and automatically invest your money in passive, low-cost ETFs (basically, it invests your money cheap and in the right way).

WiseBanyan. I’ve been primarily using WiseBanyan to create my sub-investment accounts, mainly because when I first implemented this strategy, WiseBanyan was the only free robo advisor that existed. WiseBanyan lets you create multiple sub-investment accounts and lets you nickname each sub-investment account, which really helps for creating these goals (the screenshot in the previous section of this post is from my own WiseBanyan account). When you create a sub-investment account, WiseBanyan will ask how long you need to save for, how much you’re trying to save, and will then recommend a portfolio for you. It invests in Vanguard ETFs and bonds. Importantly, WiseBanyan also lets you create a sub-investment account and start investing with just $1, which is very helpful when you’re starting a new investment goal.

M1 Finance. M1 Finance is a newer app that I finally got around to using this past year. They’re also free and allow you to create multiple sub-investment accounts. Interestingly, M1 Finance actually lets you pick your own investments, which means that rather than investing in an automatically created portfolio, you could actually just create sub-investment accounts and invest it all into a Total Stock Market ETF like VTI. From a tax standpoint, this makes can make things much easier since you’ll only have to worry about dividends and won’t have to worry about rebalancing. The only downside with M1 Finance is that they currently don’t let you nickname each sub-investment account, which is sort of annoying.

SoFi Invest. SoFi Invest is a free robo advisor that I’ve used for over a year now. Instead of investing in Vanguard ETFs, SoFi invests in its own ETFs that are weighted by “growth signals,” rather than market capitalization. They used to invest in Vanguard funds, but then recently did this strange (and obviously money making) thing of switching over to their own funds. This was annoying, which is why I’ve cut back on putting money into my SoFi invest account, but in the interest of completeness, I’m still including it here in case this is something that interests people. Like with WiseBanyan and M1 Finance, SoFi Invest lets you create multiple sub-investment accounts that you can earmark for a particular purpose.

Takeaways

In the end, a lot of life’s “unexpected” things can be predicted pretty easily. Appliances are going to break. Computers will need to be replaced. People will need to buy new cars. These are things that we know will happen. And we can plan for them.

For short-term goals – something that you’ll need in a few months or a few years – it makes sense to save for those in savings accounts. Create a sub-savings account for each goal, automate your savings, and then buy what you want when you have the money.

For long-term goals, we can use the power of time to allow our money to grow a little bit more. Free robo advisors that allow us to invest small amounts and allow us to create multiple sub-investment accounts allow us to do exactly that.

There are downsides to these free robo advisors that do need to be considered before we conclude. The primary thing you wonder about is whether a free robo advisor has the staying power to last long term. One of the reasons I’ve always hesitated to push WiseBanyan, for example, is because, to be honest, I wasn’t exactly sure whether their business model could last. These robo advisors are all covered by SIPC, so you won’t ever lose your money if they go out of business, but it’ll at least be annoying to deal with if they do go out of business.

The other issue is that business models can change. These robo advisors are all free now. But will they be free forever? Who knows? SoFi Invest recently angered a lot of people (myself included) when they liquidated all of our accounts and switched over our funds to their own proprietary SoFi ETFs – which most of us did not want to buy. This also left some people dealing with potential tax issues that they didn’t expect. Luckily, I didn’t have too much money in my SoFi Invest account, so it won’t impact me too much, but there’s no guarantee that other robo advisors won’t do the same one day.

Still, I think the upsides of using sub-investment accounts for longer-term savings goals makes this a strategy worth doing. Use time and technology to your advantage. You’ll find things just aren’t as expensive as they seem when you save for them.

Axos (WiseBanyan) is no longer free and charge a .24% aum on all accounts.

Thanks. I need to update this post. It’s a bummer they added the AUM fee.

Thanks for the info! One thing I was looking for in your post was the potential loss, as with any investment, one could incurr in these robo investment accounts. What is your take on that? Would you consider this a low risk investment? and what kind of growth have you seen with your money?

Yes, potential loss is a risk, which becomes less of a risk the longer your time horizon is. This is also the reason why I recommend using sub-investment accounts for longer-term goals when two conditions are met: (1) you have a decently long time horizon, I’d say of 5 years or more, and (2) you can afford to either not buy the thing if there’s a market downturn or cover the difference with your own money.

So, take the example of a new laptop that I buy every 5 years. In 5 years, more often than not, I’ll have more than I did if I kept it in a savings account. At the same time, if it hits a bad 5-year stretch, I have two choices. I can either just not buy a laptop and wait for the market to go back up. Or I can cover the losses with my own money anyway. For a $1200 laptop, even if I hit a horrible 5 year stretch and lost 50% of its value, then I’m not completely done. I can still just pay for it with my own money to cover the difference.

This last 5 year stretch has obviously been good, so I’ve seen good growth. My laptop fund is already enough to cover a new laptop, but it hit that point in 4 years, rather than 5 years.