Now that I’ve recently changed jobs, I’m once again trying to figure out what to do with all of my old retirement accounts. Luckily, I’ve got a little bit of experience in this area. I’ve switched jobs twice in a little over a year – first leaving my biglaw associate position to work as a state attorney, then leaving that job to take a non-traditional attorney position with a branch of my state bar association.

With my latest job change, my retirement savings are now scattered throughout a bunch of different retirement accounts held by my old employer. That’s actually not that big a deal since I use apps like Mint and Personal Capital to track my investments, but it still helps to think about what I should do with all of that money now that I have this new job. Today’s post addresses that question.

*Note that for simplicity, I refer to 401k’s throughout this post, but everything here applies to any retirement accounts you might have with prior employers, including 403b’s, 457s, and certain types of pension plans.

What Should You Do With Your Old 401k?

401k’s are an interesting beast. When you’re working for your employer, there’s not a lot you can do. In general, it’s just put money in, look for low cost, index options, and sit back and relax.

Where things get interesting is once you leave your employer. It’s like a switch gets turned on and suddenly, you have a whole bunch of options in front of you.

Most people, when faced with all of these choices, do the same thing – nothing. That’s what happened with my wife. She completed a one-year hospital residency a few years ago, started a new residency right after that, and simply forgot about the money that she had saved in her 403b.

To be fair, sometimes, doing nothing is the right choice. But, we want to be making our choices actively. You don’t necessarily have to act right away, but eventually, you do want to take action with your old 401k once you’ve had time to assess your situation.

So what are some of the things you can do with your old 401k?

1. Leave It Where It Is.

This is a pretty easy and straightforward option. If you have a good, low-cost 401k with your old employer, then it might make sense for you to just leave it where it is.

Most 401k plans should have an option that’ll automatically rebalance your accounts. Just set it up to rebalance your account once or twice per year and you should be set. If you use apps like Mint and Personal Capital to track your accounts, you won’t even have to log into them to see how things are going.

2. Roll It Over Into A Traditional IRA.

A lot of experts blindly say to rollover your 401k into a traditional IRA whenever you leave a job. This has the nice advantage of giving you access to potentially cheaper and better investment options than what you might otherwise get through your employer sponsored plans.

However, if you’re in a high tax bracket and want to maximize all of your potential tax-advantaged space, then this option might not be optimal. That’s because, in order to take advantage of a backdoor Roth, we’ll need to leave all of our traditional IRA space empty. Whether you take this option will really depend on your current or anticipated income level and whether you have ways to get any money you put into a traditional IRA back into a 401k bucket.

3. Roll It Over Into Your New Employer’s Retirement Plan.

If you have a good retirement plan at your new job, then it’ll often make sense to just roll over your old 401k into your new plan. In many ways, this is the simplest option – you’ll have all of your retirement funds in one place, instead of scattered everywhere. If your new 401k plan stinks, then obviously, you won’t want to do this.

4. Other Potential Options For Your Old 401k.

To be sure, the above choices aren’t your only options. You could cash out your retirement savings, which I obviously wouldn’t recommend because it’s stupid.

Another option would be to roll over your funds into a Roth IRA and pay taxes on the conversion. If you’re saving aggressively, this probably won’t be a realistic option just because of how much money you’d be converting, but it could be something you can do if you’re converting a small amount into a Roth or if you’re in a particularly low-income year and can afford to pay the taxes.

An interesting option that I’ve been thinking about is rolling over your old 401k into a Solo 401k. Not all solo 401k plans allow rollovers from other retirement accounts, but the Solo 401k I have with Fidelity does appear to allow this. If you’ve been side hustling, you should have already created a Solo 401k for yourself – it’s the bonus retirement account that side hustlers get to have. I see the 401k to solo 401k rollover as useful for someone who’s moving into a job that doesn’t have a great 401k plan, has an old 401k that isn’t all that great, and still wants to leave their pre-tax IRA space empty in order utilize the backdoor Roth.

Things To Consider When Deciding What To Do With Your Old 401k

1. Simplicity.

This is pretty self-explanatory. The more retirement accounts you have, the harder it might be to keep track of everything. For many people, rolling over funds into their new employer’s 401k makes sense simply because it keeps their money all in one spot.

2. Administrative Fees.

I feel like this aspect of retirement plans doesn’t get talked about enough. Most people I talk to don’t even realize that their employer sponsored retirement plan probably isn’t free. I’ve now had three different employer sponsored retirement plans, and all three plans charged some sort of administrative fee. It’s possible that your employer paid your administrative fees for you when you were employed with them, but once you leave, you’ll probably have to pay those fees yourself.

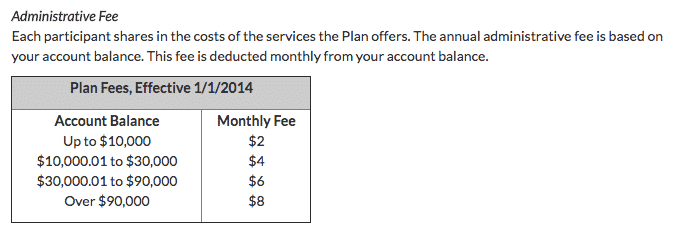

Administrative fees will generally come in two types – either a fixed fee (i.e. the plan will charge you a fixed dollar amount each year) or a percentage based fee (i.e. the plan will charge you a percentage of assets you have in the plan each year). The 401k at my biglaw firm charged a fix administrative fee of around $89 per year. My 457 plan with the state charges an annual administrative fee of 0.1% on the first $125,000 I have in the plan, while my state pension plan charges me $4 per month on amounts over $10,000 and under $30,000.

As you can probably tell, a fixed administrative fee can be problematic if you don’t have a ton of money in your old 401k, which, if you change jobs often, can be pretty common. Fixed fees have less impact as your account grows – the bigger your account gets, the lower percentage of your account the fixed fee will be. However, if you’re not contributing to the account anymore, your account can’t grow as quickly. Thus, if you’re paying a fixed, administrative fee, it’ll often make more sense to get your old 401k’s into one plan in order to avoid paying multiple, unnecessary administrative fees.

3. Backdoor Roth Eligibility.

If you’re a high-income earner, you’ll want to consider whether you want to be able to make it easy for yourself to utilize a Backdoor Roth. To take full advantage of a backdoor Roth, you’ll need to make sure that you keep all of your pre-tax IRA space empty. Otherwise, you’ll be stuck dealing with the pro-rata rule, which, in many cases, will basically make it impossible for you to use a Backdoor Roth.

This is why I think the conventional wisdom to rollover your 401k into a traditional IRA isn’t necessarily right for everyone. Many of us current and future high-income earners are going to want to keep all of our IRA space empty.

One thing to note is that, if you do have money in a traditional IRA, it’s not very hard to get it out of there. You can pretty much roll over any money you have in a traditional IRA into any pre-tax 401k type plan. You’ll just have to check to see if your employer sponsored plan allows you to rollover traditional IRA funds into it or if your Solo 401k plan allows you to do the same.

4. Any Special Characteristics Of Your Old Retirement Plans.

The final consideration to think about is whether your old retirement plans have any special characteristics to them that make keeping your money in them advantageous.

The big thing that comes to my mind is money that you have in a 457 plan. The amazing thing about a 457 plan is that any money you contribute to it can be withdrawn, penalty free once you leave your employer. In other words, a 457 is basically a tax-deferred account that you can take money from, without penalty, just like a regular taxable account. You basically get the best of all worlds with a 457 plan – tax-deferred growth and the ability to withdraw your money when you need it.

You lose these advantages if you roll over your 457 funds into a different type of retirement plan. So, before you do anything, make sure to check whether your old retirement plan has some sort of special benefit that makes you want to keep your money there.

What I’ll Do With My Accounts

So what’s my retirement world look like? My new job only gives me access to one type of account – a 403b plan. It’s a pretty crappy plan, at least when compared to the plans that I had access to before.

For sure, I’m going to keep all of my 457 contributions where they are. The administrative fee is only 0.1%, which is completely reasonable, and since the majority of my contributions in the 457 plan are invested in Vanguard funds, I’m only paying a few basis points per year in expenses. But, most importantly, I don’t want to move my 457 contributions out of that plan because I want to be able to have the possibility of accessing those funds later without an early withdrawal penalty.

My state pension plan is another story. Our contributions were fixed by state law – 5.5% from me and 6% from the state – which means that I only have a little over $10,000 in the pension plan. A monthly fee of $4 on a $10,000 balance isn’t ridiculous, but it’s also unnecessary and pretty duplicative of other administrative fees I’m already paying. Luckily, I found out that once I leave state service, I can rollover my state pension plan funds into my 457, which is what I’m going to do.

Final Thoughts

There’s a bit of thought that goes into figuring out what to do with your old 401k’s. I’d say the main things to think about are whether your old plans are any good, what sort of fees you’re paying in them and whether your new plans are good. Remember that the expense ratios of the funds you’re invested in probably aren’t the only fees you’re paying.

Don’t be like most people who do nothing with their money and then forget where it is or how to even find it. Instead, put a little thought into what you want to do with all of that hard earned money you’ve been saving away.

Finally, make sure you track your accounts using apps like Mint or Personal Capital. These apps allow you to see all of your accounts in one spot, so you don’t have to go around manually looking at every investment account you have.

If you’re trying to get a good, overall picture of your investment accounts, I recommend you sign up for Personal Capital and link of your accounts to it. Best of all, it’s completely free to use, so you have nothing to lose.

I have a 457 plan and I was pretty excited when I learned that you can withdraw the money penalty free. Definitely a big plus if I can retire early. I worked in the federal government for the first few years after college and I left my money in the TSP (401k for fed govt workers). The costs are even lower than Vanguard so you can’t beat that. How long were you in state government? Is your pension/457 money vested?

TSP is definitely sweet. You can’t beat that.

My 457 money was all my own contributions, so that’s vested, of course. My Pension also had immediate vesting, so everything was vested automatically as it was contributed.

Ahh yes, this little detail! Admittedly it’s been almost 12 years since my last company move, but I took the rollover option from company A to company B. Keeps it simple, and avoids any tax implications.

Yep. Easy peasy to just roll it over to your current plan, if you’ve got a good plan.

Interesting advice about using a 457 account. I don’t know much about 457s and will have to study up on them. Do you have to work for a non-profit to open one? Do they have solo 457s like solo 401ks?

457’s are a really unique and awesome retirement account if you happen to have one. I’ll probably write an in-depth post about it since I get some questions about it every once in a while. I’d never heard about a 457 either until I actually had one.

They’re really only available in two settings – state government jobs or some non-profits. The typical people who have 457s are people like state government workers (every State of Minnesota employee has a 457), teachers, university employees, and hospital employees. So, for example, my brother and sister in law both work for a hospital and have both a 401k and a 457.

They don’t have Solo 457s. For people who earn 1099 income, your options are generally Solo 401k or SEP-IRAs, and for a number of reasons, I recommend the Solo 401k over a SEP.