With June recently in the books, it’s time to take a look back at what I was able to make side hustling over the past month. As regular readers know, each month I document exactly what I was able to make from side hustling using gig economy apps. My goal with these posts is to give you an idea of what is possible with the gig economy.

On the personal front, June was a crazy month, as I imagine every month has been for most of us. We have a pandemic continuing to rage here in the United States, which has isolated us as we’ve socially distanced from our family and friends. Right now, any interaction we do have is exclusively outdoors, which the research says is much less risky compared to indoor gatherings. It’s been tough though, as our baby definitely is missing out on a lot of hugs and smooches he should be getting from his aunts and cousins.

Adding to the craziness, my wife recently reopened her practice, which means she’s back at work now while I’m at home with the baby. One of the advantages of this move towards self-employment is that my schedule is completely flexible, which has helped with child care (of course, if I was working at my old job, I’d probably be working from home now, so maybe this point is moot).

Right now, I’m working from home and I handle the primary child care duties three days per week. In general, I try to get what I can get done between naps and then do about an hour or so of gig economy work in the evenings, with the goal of making $30 to $50 most days (my reason for doing this is to keep up with my $1,000 per month challenge, which I’m crushing this year).

For the most part, I’m spending about 60 to 90 minutes most days doing gig economy stuff and then fitting whatever blog stuff I can get in during the gaps in my day and in the late evenings. You’d think I could get more stuff done with how much babies need to sleep in those early months of life, but I still haven’t been able to figure it out.

With all that said, let’s take a look at what I made in June 2020:

Side Hustle Income for June 2020

- Airbnb: $0

- Rover: $153.85

- Postmates/DoorDash/Uber Eats/Grubhub: $2,866.02

- Wag: $0

- Shipt/Instacart: $19.61

- Selling Trash Finds/Flipping: $0

- TaskRabbit: $18

- WeGoLook: $46

- ProductTube: $75

- Gigwalk/EasyShift/Field Agent/Merchandiser: $10

- VoxPopMe: $16.05

- Google Opinion Rewards/Surveys On The Go/1Q/Facebook Viewpoints: $4.79

Total Side Hustle Income for June 2020 = $3,209.32

June was a very productive month on the side hustle front, and looking back at it, I’m shocked at how much I was able to bring in from side hustling. It’s basically a full-time income for what doesn’t feel like very much work on my end.

The pandemic continues to rage on, which means that demand is non-existent for some of the gig economy apps and extremely high for other gig economy apps. As in past months, the delivery game has been off the charts. At this point, if I wanted too, I could probably make a full-time income just doing food deliveries. Recently, CNBC had a profile about a guy who made $8,000 working 12 hour days every single day in June. I suspect that if I did the same thing, I could probably do that working 8 hour days, 7 days a week.

Some of the gig economy sectors that were really hit hard by the pandemic are starting to come back as well. I had nothing going on with Rover for months since people were staying at home, but with the summer months and the gradual reduction in lockdowns, people are starting to hit the road again, which means dogsitting demand should be moving back up.

Let’s take a more in-depth look at how I earned my side hustle money in June 2020:

Airbnb Income: $0

Nothing to report on the Airbnb front. With a new baby, we’re no longer renting out the spare room and unless we can travel this year, we’re not able to rent out the entire house either. My guess is that we won’t be doing any Airbnb at all this year unless things dramatically change with the pandemic and travel.

- If you have extra space and want to earn extra income using your home, you can sign up to be an Airbnb host using my referral link.

- Airbnb is also one of the most affordable ways to travel. If you’ve never used Airbnb, sign up for Airbnb with my link in order to get $40 off your first stay.

Rover Income: $153.85

When the pandemic broke out in March, Rover bookings dropped down to nothing as people canceled trips and stayed at home. I ended up with zero Rover bookings in April and May. With the summer coming up and lockdown orders being loosened, it looks like people are starting to travel again, which means I’ve been getting a few of my usual clients back.

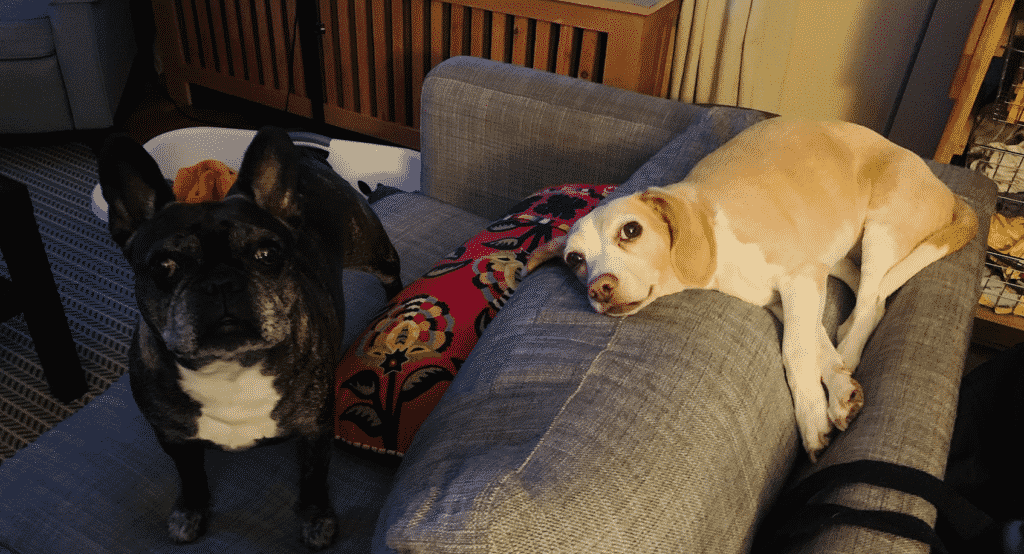

In June, I watched two dogs, both repeat pups. One was a French Bulldog that I’ve watched for many years. The other was a Papillion with one eye. Both are adorable, well-behaved pups that fit in very well with my family’s day-to-day life. The income I earn from watching dogs like this is basically passive.

The main concern for me now is that any dog I watch has to be good with babies. Since I’m watching small, friendly dogs, I haven’t had any problems. In fact, I’ve discovered that the pups I’ve been watching get along better with my baby compared to my own dog.

If dogsitting makes sense for you, you can sign up to be a Rover host using this link.

Postmates/DoorDash/Uber Eats/Grubhub Income: $2,866.02

The delivery game continues to be wild, with the demand off the charts. Right now, it’s so lucrative that if I spent a month working full-time on deliveries, I think I could easily pull in $5,000 in a month. I don’t know if it’s just my area, but each time I go out to do deliveries, I almost always make around $40 per hour (during prime hours, I always make between $40 and $50 per hour, with my hourly earnings occasionally greatly exceeding that).

To get a sense of how crazy things have been, I had one evening where I spent 76 minutes doing deliveries and made $131.96. That comes out to earnings of $1.73 per minute or $104.17 per hour. Generally, I aim to make at least 66 cents per minute, which comes out to $40 an hour or more. On really good days, I’ll make close to $1 per minute when I go on my delivery runs.

In terms of logistics, I’ve been doing all of my deliveries this summer on an ebike, typically spending 1 or 1.5 hours per day doing deliveries (I use a RadPower bike that I bought last year). I’ve been running all four delivery apps at once, which has allowed me to greatly increase my earnings by picking up multiple orders at the same time. Since I don’t have to worry about parking or getting in and out of a car, I’m able to multi-app really well. The ebike also means I’m moving at really high speeds (much faster than the average car speed in a city, especially since I can cut through sidewalks and other barriers that cars can’t go through). And of course, I have minimal costs since I don’t have to worry about wear and tear on a car.

The delivery bag that I’ve been using for my food deliveries finally broke down, so I ended up buying an Uber Eats delivery backpack for $20. This is actually a pretty sweet bag that I could use for other things as well. And of course, since it’s a delivery backpack, I’ll deduct it as a business expense, which means I paid for it using pre-tax dollars. It’s not a huge savings or anything, but figuring out ways to deduct things as business expenses is one of the few ways to earn income without having to pay taxes on it.

Anyway, here’s a breakdown of my earnings on each delivery platform in June:

Even though I break down these delivery earnings to an hourly basis, it’s important to remember that even though food delivery might seem like a time-for-money job, it’s not actually a time-for-money job in the traditional sense. Rather, it’s a task-for-money job, where you’re getting money in exchange for a task. This is an important distinction because it means you have the power to control what you make for the time you are working.

On a practical level, what this does mean is that you need to think about your delivery side hustle as a business, not as a job. Accepting the right deliveries is very important. My acceptance rate for all of these apps is always well under 50%, sometimes dropping as low as 10%. I pick the gigs that are right for me and I reject the ones that don’t make sense.

If you’re trying to think about the delivery game in a business sense, I highly recommend checking out Entrecourier and his Deliver On Your Business Podcast. I discovered this podcast a few weeks ago and thought he did a great job of helping people think about how to approach deliveries. The first 31 episodes are especially worth listening to – he calls it his 31-day delivery MBA and if you listen to those episodes, you’re going to approach deliveries in a much savvier way.

If you are interested in delivering for Doordash, you can sign up using my referral link.

If you are interested in delivering for Postmates, you can sign up using my referral link.

If you are interested in delivering for UberEats, you can sign up using my referral link.

Wag Income: $0

I had no Wag income last month. It looks like more Wag walks are starting to pop up as people venture outside of their homes more. I’m personally opting to skip the Wag walks unless it happens to be one that’s really close to me since I can currently make much more by doing deliveries.

If you want more information about Wag and how you can make it work for you, check out my Wag post.

Shipt/Instacart Income: $19.61

In June, I ended getting paid for one Shipt shop that I completed back at the end of May. This was a quick shop that paid me $7.61 for the shop, a $7 bonus, and a $5 tip. You can see that without the bonus and the tip, I wouldn’t have made very much.

In my opinion, these grocery delivery apps have some potential, but it definitely takes practice to make this a profitable endeavor. I still do them every once in a while because I find them weirdly satisfying, but I still haven’t been able to figure out how to make grocery delivery pay at the same rate as my food delivery gigs.

If you’re interested in learning more about Shipt, check out my Shipt Review to learn about my experience with Shipt.

If you are interested in Instacart, you can sign up to be an Instacart shopper using my referral link.

Trash/Flipping Income: $0

I ended up selling nothing for profit last month. Much of this is due to simply not putting in any effort to finding things to list. It doesn’t mean I don’t have stuff in my house I could sell because I definitely do. I’m just finding myself unmotivated to get things listed up.

In June, I did sell a couple of Samsung External Hard Drives on eBay that I bought using my Dell credit for my American Express Business Platinum card. This card normally gives me $100 of Dell credit every 6 months, so my strategy has been to buy things on Dell that I can easily resell, with the idea that I can use that money to recoup some of my annual fees for the card. Because of the pandemic, American Express temporarily doubled this credit to $200 every 6 months (so for 2020, I have $400 in Dell credit per card to use).

Since my wife also recently got this card, we ended up with $300 of Dell credit to use in June, so I ended up buying three external hard drives for $100 and sold them at a slight loss on eBay. By combining this with some American Express offers plus the Rakuten cashback app, I was able to basically convert $300 in Dell credit into about $300 worth of cash.

TaskRabbit Income: $18

It’s been a while since I’ve received a TaskRabbit gig, so I was actually pretty excited about this one. It ended up being a super easy delivery gig, where I only had to deliver a pack of water and some chips. I have no idea why someone would pay someone to deliver such a small number of items, but I’ll take it.

This delivery also worked out perfectly for me because it was going downtown and I was already planning to go downtown to run some errands. The interesting thing about TaskRabbit is that the minimum invoice amount is 1 hour. My delivery gig is set at $18 per hour, but it only took me about 15-20 minutes to complete this gig. So, even though it didn’t take me long to complete, the customer still had to pay for a full hour of work.

WeGoLook Income: $46

WeGoLook was the same as usual. My gigs were all car inspection gigs, where I had to take photos of a car for an insurance company. These gigs were all nearby and only took me a few minutes to complete. I like doing these gigs because I can usually make them fit in with the things I’m already doing. I often try to fit these gigs in while I’m doing my food deliveries, which helps me increase my earnings since I’m able to stack multiple apps together.

ProductTube Income: $75

I’ve said before that I think ProductTube is super underrated. A decent number of my ProductTube gigs this month were ones I could do from home on my computer, so I didn’t even have to leave my house to complete them. None of the ProductTube gigs took me more than 5 minutes to complete, so if you break down the time, my hourly rate with this app is easily in the $100 per hour or more range. Payment is made via Amazon gift cards, which is basically as good as cash for me.

Gigwalk/EasyShift/Field Agent/Merchandiser Income: $10

I did one Field Agent gig in June. This gig involved taking pictures of the toilet paper aisle at a local grocery store. I timed this gig to coincide with a shopping trip, so I was able to make $10 while I was already shopping for groceries. The gig itself was easy to complete and probably took me about 5 to 10 minutes total to answer the questions in the Field Agent app and take the required photos.

VoxPopMe Income: $16.05

It’s been a while since I’ve talked about VoxPopMe. This is a market research app where you answer a survey question in a 15-second video. Each video pays you 50 cents, so that’s well worth it for how little time it takes. The downside to this app is that you can’t cash out until you hit $15, which can take a while because there often aren’t many survey questions to answer.

Looking back at my survey history, I did a survey in August 2019, then didn’t have any survey questions until February 2020. From there, I started getting regular survey questions about once or twice per week, until I finally earned enough to cash out. This is an app I keep on my phone just because it’s good for small amounts of money. Just be aware it’ll take some time before you can cash out.

Google Opinion Rewards/Surveys On The Go/1Q/Facebook Viewpoints Income: $4.79

The short survey apps were about the same as usual. Here’s the breakdown for June:

- Google Opinion Rewards: $4.54

- Surveys On The Go: $0

- 1Q: $0.25

Google Opinion Rewards did its usual thing (I typically make between $2 and $5 per month from Google Opinion Rewards). 1Q was quiet this month. I only received one question for the month, which paid me 25 cents for 2 seconds of work. Surveys On The Go hit $6 this month, which wasn’t enough to cash out (you need to hit $10 to cash out). I’ll probably be able to hit that $10 mark this month, assuming I keep up the same pace.

And that concludes the June 2020 Side Hustle Report!

A $3,000+ side hustle month is a pretty big deal – enough for many people to fully cover their living expenses just with those side hustle earnings. I was worried at the start of the year about how losing Airbnb would impact my side hustle earnings – enough to the point that I told myself I needed to actively try to make $1,000 per month or $33 per day side hustling.

Turns out that even with my biggest side hustle revenue source gone, I’m still doing great with the side hustle game simply by taking advantage of my other gig economy options. Given how things are going, I’m pretty sure I can keep up this pace. It’s comforting to know that I can create a solid income floor just by doing the things I’ve been doing for years.

My final thoughts for June:

- The delivery game continues to be ridiculous in my city to the point where I don’t really need to do a lot of other gig economy apps besides the deliveries. It’s possible there’s a slowdown at some point, but I think that given that most people are now working from home, there’s a good chance that delivery demand stays consistent.

- As lockdowns come to an end and people start traveling more, some of these gig economy apps that are based on travel are starting to return. People doing Airbnb will probably start to see more bookings again as travel picks up (especially domestic travel). Rover sittings look like they are also on the rise again as well as people venture out of their homes and need sitters.

- Making $500 or $1,000 per month is enough to fully fund one or two Roth IRAs by the end of the year. $500 per month requires you to make $16.43 per day. $1,000 per month requires you to make $32.87 per day. I think most people have the ability to do that.

After reading this post, I’m seriously thinking about doing Uber Eats again. I havent done any deliveries since March.

Wow! I can’t believe how much you made doing food delivery. That is amazing. You definitely are a great example to each and every one of us.

Great post, and the breakdown is so granular, I love it!

Thanks Gale!

Regarding your “Trash/Flipping” income, I’ve recently had a lot of luck with Mercari. I was using Poshmark before to sell clothing but items weren’t moving. Mercari takes a 10% commission (not exactly sure how eBay compares) and users can pay for shipping or shipping costs can be deducted from your sale profit. Pretty much anything around the house from kitchen items to clothing to knick knacks can be posted. I like to keep my earnings in the app as almost a tax-free way to make other purchases. Check it out!

Will do. I’ve seen ads for mercari, but never personally used it myself. But I probably should because no harm in getting more eyes on my stuff.

Side hustling in today’s era is surely changing the history of human thought. I love to hear, read, and view the transformation success stories of everyday people who used to go to work for unthankful employers and succeeded in entrepreneurial transformations to full time online CEO’s. Starting a side hustle online is not a smooth ride, but anyone can achieve the future status of “side hustle millionaire,” if they believe in themselves and stay “consistent” with doing the transformation business work, out of inspiration or desperation.

So you did 70 hours of food delivery in June, is that correct? I’m thinking of doing this on the weekends and weekdays off my main job but I need a realistic average of what I can make per hour.

You said you could make $5000 a month if you did this full-time. So averaging 21 working days a month, 8 hours a day, that comes out to 28.76 an hour. Are non-peak delivery hours often less than $20/hour?

Stay tuned for July’s Side Hustle Report. In July, I tracked my time working from door to door (from when the moment I left the house to the moment I walked back through my front door) and found that I averaged over $40 per hour over the course of a week. Even during non-peak times, I still hit $30 an hour.

Now, are those results typical? No way – it’s definitely going to depend on your market, your skill and understanding of how these apps work, and some luck factored in. All I can say is I seem to have figured out how to work these apps well – but I’ve also been using these apps since 2015, so I’ve figured out my system.

I am curious:

For apps like Doordash, Grubhub and others, what percentage of your money did you end up keeping after app fees and taxes?

I typically set aside 1/3 of my 1099 income for taxes. With 1099 income, you have to pay regular income tax like everyone else, and then you also have to pay self-employment taxes. However, 1099 income gives you much more options to do business expense deductions. As well, under the new tax plan, you get a 20% pass through deduction, so you pay taxes on 80% of your 1099 income now. Finally, since you pay taxes yourself, you can also be strategic and pay taxes with a credit card in order to hit signup bonuses, thus effectively cutting down your tax burden some more in the form of what is essentially a rebate from earning signup bonuses.

I have a post here: Understanding your side hustle taxes – although I need to update it given the current 20% pass-through deduction.

Also, here’s a post on: paying taxes with a credit card.

I just started reading your blog and love your content and vibe. Thanks for all the resources you provide too!

I would love to see a post on the cost of expanding your family if you’re comfortable. Congratulations!

Good idea. We do have a lot of big costs, so I’ll break them down in a future post.

Good question on the locking up. That’s one thing that slowed me down on my bike deliveries. Someone needs to come up with a quick locking mechanism, maybe with a key fob. Or maybe someone already has and I don’t know about it.

Hey Panther

Do you check the food orders to make sure all the items are there before leaving the restaurant? Also, do you have to lock up your bike before going in to the restaurant, or is it quick enough of a transaction that you don’t have to? Can you use the drive-thru?

I use basic common sense. If it’s sealed, I just go by what the restaurant said – I’m not opening someone’s food. Really, the only things I check for are drinks, but often those get put in the bag too now.

I don’t usually lock up my bike. I just leave it out front where I can see it (most restaurants have big windows). If its a restaurant without a big window, I usually wheel it into the entryway. Never have any issues. And since there’s a pandemic going on, I’m never deep into the restaurant anyway.

I love what you said about a task for money thing with the gig economy hustles. I might have to steal that from you!

Way to kill it out there. I’m thinking of converting my bike to an eBike and shifting to more bike deliveries. I rented one one day just to see how it goes and it was a blast.

Thanks for the shout out!

I really enjoyed your podcast – you approach the delivery game exactly how I’ve been unconsciously thinking about it over the years.

I think an ebike, potentially with multiple batteries if you’re planning to do a long delivery day, would really solve some of the biking slowness that you mentioned in one of your podcasts. I believe you’ve mentioned that you live in Denver and my guess is you’d likely be able to move just as fast or faster than a car in most places. The advantage most people don’t think about with bikes, scooters, etc, that does dramatically speed them up for city movement and for deliveries is:

(1) you can go through lights when there are no cars (yes, I know you’re not “supposed” to, but it’s similar to jaywalking in that everyone does it and you’re unlikely to get a ticket for doing it);

(2) you can hop on sidewalks and take shortcuts that way;

(3) you can go the wrong way down one-way streets by hopping on the sidewalk (at least for a short distance or when there aren’t a lot of people around);

(4) you save a lot of time with not having to get in and out of a car. It doesn’t seem like much time, but over the course of a day, week, month, etc, jumping in and out of a car adds a lot of time vs. pulling right up to the door and stepping off a bike.

And task for money – exactly. We don’t trade time for money with these gigs – at least not exactly.