For me, 2016 will go down as the first year I began aggressively saving for retirement. It sort of bums me out that I’m getting into the savings game so late. At 30 years old, I’m way behind my more financially literate peers, some of whom have already retired or established huge treasure troves of savings. See folks like Millennial Revolution, Money Wizard, and Fiery Millennials.

A part of it is a byproduct of me entering a profession that requires years of extra schooling and a ton of student loans. While most people start their first job at 22 years old, most lawyers won’t start their first job until they’re 26 or 27 years old.

To make matters worse, the vast majority of lawyers enter their first job with six-figures or more of student loan debt, requiring years to get back to a net worth of zero. And while debt can often be avoided, the legal field sometimes makes it hard to do that. Stupid as it is, law is a profession built on pedigree. The highest paying legal jobs base almost all of their hiring decisions on just three things: (1) how good your school is, (2) your first-year grades, and (3) your ability to be sort of normal in a job interview. As a result, school choice matters a ton and you can’t always go to the cheapest law school.

If you think I’m getting a late start, it’s even worse for people like my wife (yep! my wife now – it’s weird to type that) who chose to pursue advanced careers in dentistry. She ended up with four years of dental school, a one-year general practice residency, and now three more years of a specialty residency. Add up those 8 years of post graduate training and she won’t even start her first real job until she’s 32 years old! The real kicker is that, unlike doctor residencies, most dental residencies are unpaid or pay such a meager stipend that it might as well be unpaid. Mrs. FP – now also 30 – has essentially never earned a real income. She’s been a student throughout her entire 20s.

The late start means it’s super important for people like me to save aggressively. A standard 10% or 20% savings rate just isn’t going to cut it.

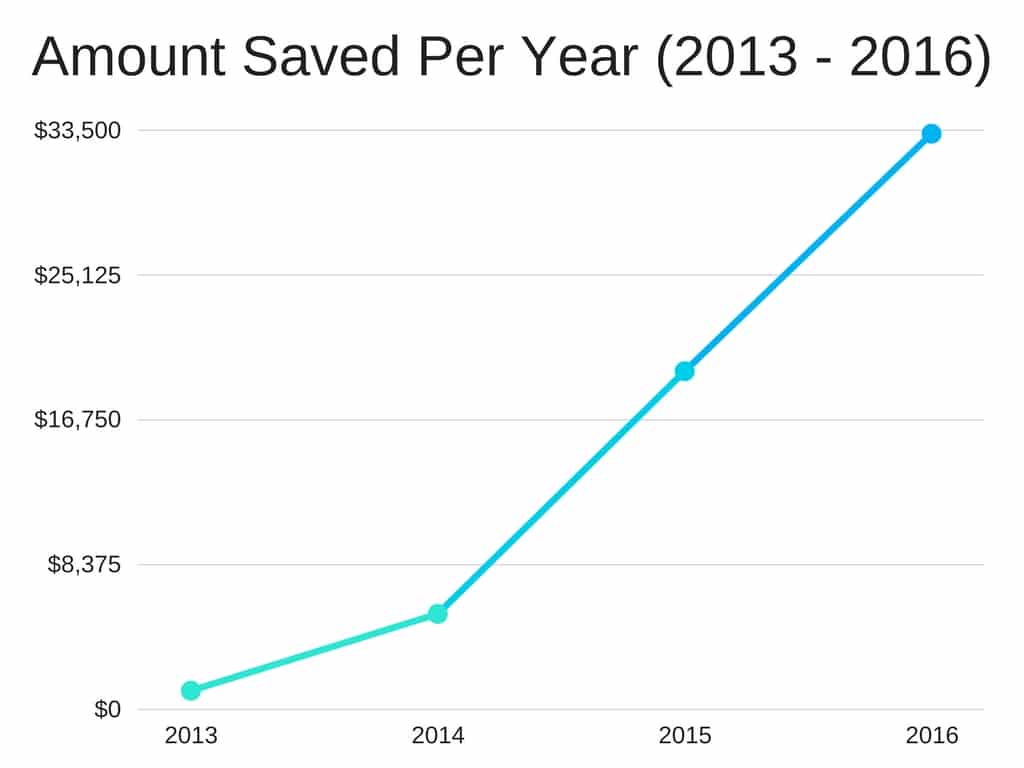

How Much Did I Save In Prior Years?

Before we look at what I saved in my retirement accounts this year, let’s take a step back and look at what I’ve saved for retirement in past years. A warning – it won’t look pretty.

Here’s what my yearly savings looked like through 2015, along with my age during those years:

- 1987 to 2012 = $100 // 0-25 years old

- 2013 = $1057.70 // 26 years old

- 2014 = $5,500 // 27 years old

- 2015 = $19,531.75 // 28 years old

Ouch. That doesn’t look so good. In my defense, the amounts I saved for retirement in 2014 and 2015 were a deliberate choice. Both of those years saw me pay over $40,000 towards my student loans. If you include that as savings, the amount I “saved” in both of those years jumps quite a bit.

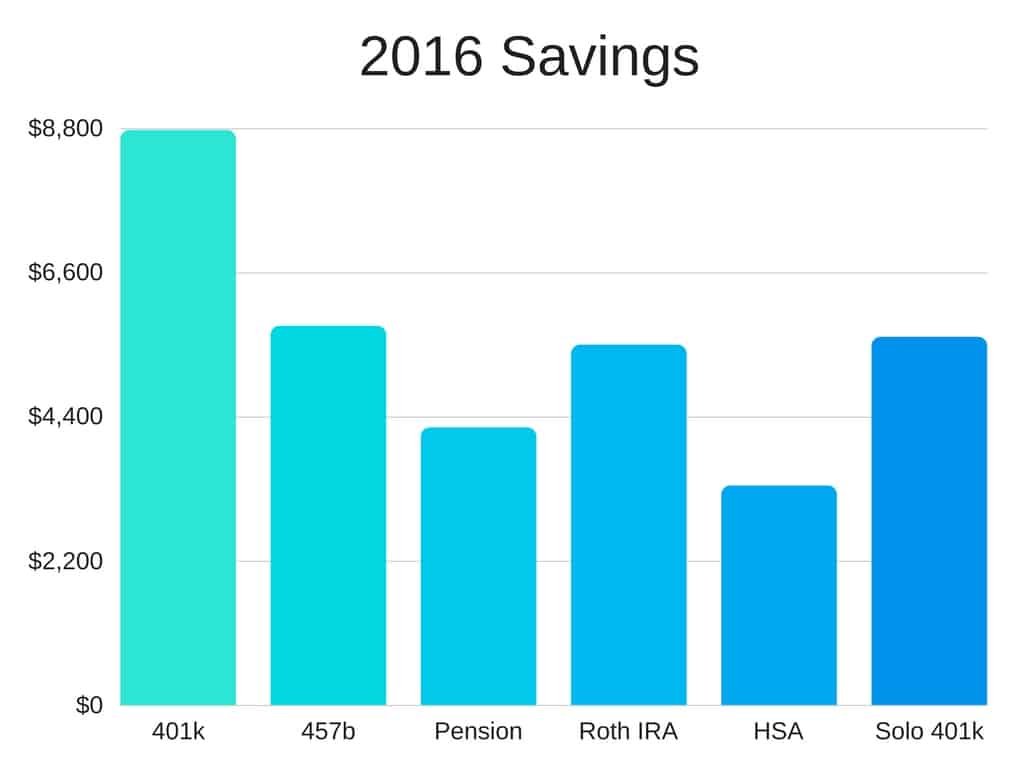

Retirement Savings for 2016

With that background out of the way, let’s jump into my 2016 savings. For 2016 I was able to save into 6 different types of tax-advantaged accounts. These included the following:

- 401k

- 457b

- Defined Contribution Pension

- Roth IRA

- HSA

- Solo 401k

Not everyone will have access to so many different types of accounts. My saving situation for 2016 was a little bit unique because I switched jobs in the middle of the year, moving from the private sector into the public sector. Doing this opened up a bunch of other retirement accounts that I wouldn’t have in the private sector.

Anyway, here’s what my savings looked like for 2016:

- 401k = $8,774.96

- 457b = $5,787.03

- Defined Contribution Pension Plan = $4,236.68

- Roth IRA = $5,500

- HSA = $3,350

- Solo 401k = $5,620

Total: $33,268.67

In addition to my tax-advantaged savings, I also paid $15,740 to finish off the remainder of my student loans in 2016.

A couple of things to point out here:

401k Contributions

My 401k contributions represent the amount I contributed to the 401k at my previous job. At the beginning of 2016, I calculated the percentage I needed to save in order to max out my 401k by the end of the year, then left my 401k to its own devices. When I left my private practice law firm job and moved into the public sector, I discovered that my new employer didn’t offer a 401k. Hence, why my 401k contributions stopped in the middle of 2016.

457 Contributions

While my new job doesn’t give us a 401k, it does give me access to two special tax-advantaged accounts that most people in the private sector won’t have. The 457 is probably one of the best retirement accounts you can have, especially if you work for a government entity. There are two reasons for this:

- 457 contribution limits are calculated separately from 401k or 403b contributions.

- There are no early withdrawal penalties.

This basically makes it a tax-advantaged account with no downside. My contributions for 2016 represent about half the year. I started out slow with it and then beefed it up as I realized how valuable the 457 was.

Defined Contribution Pension Plan

My defined contribution plan is basically like another 401k. The main downside is that I can’t change the amount I contribute to it. By state law, I’m required to contribute 5.5% of my salary and my employer throws in 6%.

Thus, for 2016, $2,210.46 of my savings came from my employer. The rest of my savings came from me. Like most law firms, my old firm gave us no match.

Roth IRA

Nothing too special here. I automate my Roth contributions so that an equal amount comes out of my bank account every two weeks. This syncs up with my paycheck cycle.

Once Mrs. FP starts working, I’ll need to utilize a Backdoor Roth like Physician On Fire did this past year. PoF has a great walkthrough on how to do a Backdoor Roth and it’s bookmarked for my future use. For now, though, I don’t need to do anything special for my Roth IRA contributions besides just putting the money in.

HSA

I had a high deductible health plan for all of 2016, which made me eligible to contribute to a Health Savings Account. This was spread out between two jobs. My old employer’s preferred HSA provider was Fidelity, so I initially had my HSA contributions going in there. I thought Fidelity was pretty good.

My new employer uses a company called Select Account, which seems fine to me. It’s fairly inexpensive and they have Vanguard funds as well. The only thing I don’t like is that I’m required to keep $1,000 sitting as cash.

When possible I prefer doing payroll deductions into my HSA because it allows me to reduce my FICA tax liability. I don’t know why, but for some reason, you don’t have to pay FICA taxes on HSA contributions that are done through payroll deductions. As far as I can tell, it’s the only way to avoid paying FICA taxes on your income.

Solo 401k

The nice thing about now having a 457 instead of a 401k is that it essentially allows me to bank all of my side hustle income since 457 contribution limits are counted separately from 401k contribution limits.

By opening up a Solo 401k, I was basically able to create even more tax-advantaged space for myself and bank almost all of the 1099 income I earned that was eligible to go into a solo 401k. This not only saved me a ton on taxes, but it also made it so that I essentially created a second IRA for myself.

If you want more info about solo 401ks, check out my previous posts on the subject. This tax-advantaged account is a great way to reduce your tax liability when it comes to your side hustles, especially if you’re not able to fully take advantage of your 401k at work.

- Fidelity Solo 401k: A Step By Step Guide To Setting Up Your Self Employed Retirement Plan

- The Solo 401k: The Side Hustler’s Bonus Retirement Account

Takeaways

So, that’s what my savings picture looked like for 2016. I was actually surprised at how much I ended up saving for the year, especially because I expected my savings to go down due to me taking a massive pay cut.

Here are a few things that come to mind after looking at all of this information:

- You Can Save A Ton Of Money If You Make It Automatic. Saving is a lot like portion sizes when you’re eating – you sort of just make do with whatever you have in front of you. By making my savings automatic, I pretty much didn’t even notice I was saving. Instead, my paycheck comes with all of my savings already completed. I then just have to figure out how to make do with what’s left over.

- If You Don’t Have a 401k (Or If You Have A Crappy 401k) A Side Hustle Becomes Even More Valuable. I’ve always thought side hustling was so valuable because it allows you to save more money. Remember, every dollar you earn in a side hustle is a dollar you can save. It’s technically money you don’t need. If you don’t have a 401k at work or you have a crappy 401k, opening up a solo 401k is even more valuable because it essentially allows you to bank all of your side income into a tax-advantaged account with good investment options. Instead of paying a 28% or more marginal tax rate on my side hustle income, I can set it all aside and take it out again one day when my income is much lower.

- Not Having Debt Makes It So Much Easier To Save. 2016 was the first year that didn’t have debt and it was amazing. You can do so much more with your money once your debt is gone.

If you haven’t already yet, I say to grab all your tax stuff and figure out exactly how much you saved in 2016. It’s a good way to see if you’re still meeting your savings goals.

A great way to track your savings progress is to use an app like Personal Capital or Mint. I use both of these apps every day to track my financial progress. And best of all, they’re both totally free.

Another interesting way to get just a little bit more savings is through using microsaving apps. Check out my reviews on Dobot and Qapital to learn how you can save just a little bit more money without even realizing it.

How much did you end up saving in 2016? Let me know!

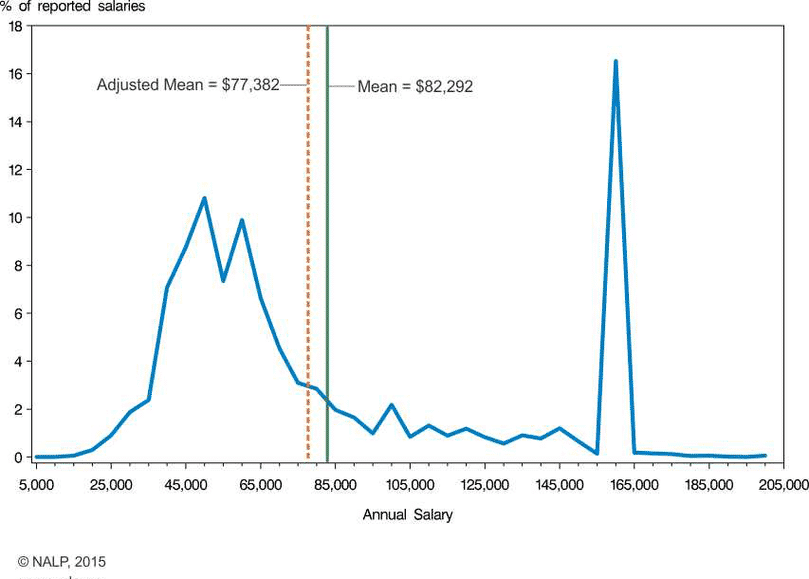

It always baffled me to see the two very distinct pay trenches for lawyers. So little middle ground.

Congrats on getting married!

The pay scale is crazy! It’s either baller or pretty average.

And thanks!

It’s even crazier when you think that the first hill in the pay distribution is clustered around 40-70k. There are plenty of good careers where you can make that or more with a normal 4 year bachelors degree and not have to pay 3 years of law school costing several hundred thousand in total and not skipping 3 years of income and career growth. The math on that isn’t pretty. I always advise people to consider the cost, benefit, risk analysis in addition to their dreams when considering law school .

I’m like you, large student debt. Late start secondary to grad school. I like to think of my student loan debt as similar to bonds. Low risk, low reward.

Interesting way to think about it. It’s guaranteed rate of return. You can’t really go wrong paying off debt I feel like.

Excellent work – and I mean both with savings and in this post. You’ve got a great knack for explaining things with a lot of moving parts in a way that doesn’t lose me (and I do get lost sometimes reading blogs with an overabundance of information).

I agree with Mr. LostinJourney that your dual incomes will be higher than most who might have started saving earlier. You’ll more than make up for any years you missed. I’m excited for you and Mrs. FP.

Thanks so much Mrs. Groovy! Really appreciate the kind words. It means a ton coming from you!

And yep, I do agree that our incomes will be higher than most. The big key for us next will be to pay down her debt, then avoid lifestyle inflation. It’s so easy for that to happen when you start making a gigantic income.

$30k in a year is great!

It’s really refreshing to see that not everybody has been a super saver since birth. And you’re right about the debt being a major hurdle in terms of being able to save significantly. That’s my one saving grace–I only had $17k of student loans so it wasn’t a huge deal to pay off. And even though I barely saved for 3 years after school, I’m in a decent spot right now because I’ve been playing catchup. Once your wife starts working I’m sure you’ll be able to fast-track your savings if you keep living modestly.

That’s what we’re hoping to do. The good thing is we’re pretty used to living modestly, so we just need to make sure we don’t fall into that lifestyle inflation trap too badly.

Nice to run across a fellow Minneapolis resident in the FI blogoshpere . Even though you and your wife (Congrats!) are late starters due to school, your income will be where most peoples never get to. You are already rocking it by paying off debt and a positive retirement savings. Keep it up and you will see the savings really start to pile up as the snowball rolls down the hill.

Love to grab a beer sometime,

-Mr.LIJ

Definitely looking forward to seeing that snowball grow! And it’s crazy how many Minnesota bloggers are out there. We must be a good with money or something. I’d definitely be up for grabbing a beer sometime.

Not bad! You’re doing great for your age! When I was your age, I was still a solid six-figure negative net worth from student loans, along with a pretax income around $40k.

Congrats on the wedding!

Thanks Smart Money MD. Appreciate the kind words!

Thanks for sharing my tutorial, FP. Once your new bride starts making dental dollars, you won’t be eligible for standard Roth contributions, but with any luck, the back door Roth will remain an option.

Also, your retirement savings (as a couple) should skyrocket!

Cheers!

-PoF

No problem! It was a great tutorial. And yep, we’re keeping our Traditional IRAs empty simply because we know our income is going to be too high to do normal Roth contributions in the future. The plan then will be to play catch up.

Great job, Panther!

Don’t feel bad, as you addressed, you are bouncing back from a BIG HIT during all that legal training.

As for as 2016 saving, I’m proud to have maxed out my 457 and the IRAs for my wife and I. Seeing as how 14% of my income also goes to my city’s pension plan, I’m satisfied to continue saving that much and chipping away at my mortgage with extra payments.

I’d be excited to open a solo 401k, but I’d actually need Blog income for that, lol!

Awesome job! With maxing out all of those accounts, I think you’re doing amazing.

Thanks for sharing, FP. Nice work and good luck on the wedding!!

In 2016, we saved a little over $27k -401k, HSA, And Roth IRA. However, we too were paying off a significant amount of debt ($97k). I have big goals for 2017 to save close to $37k and another $3k into our daughters UTMA.

Thanks! And great job with that savings!

I don’t believe I saw any earlier announcement, so congratulations on getting married to Mrs. FP!

Keep up the badass saving/investing!

Thanks so much! Will definitely try to keep it up.

I think you’re short-changing yourself by not counting debt pay down as savings. You’re moving an asset (cash) to pay down a liability (student loans). Has the same effect on your net worth as moving cash to investments. Add that in and you’ll definitely feel better and it’ll show you’re definitely kicking ass.

2016 was my best savings year to date with a 73% savings rate (64% net). Had a fairly high income year which I’m not sure will repeat this year, but hoping for the best!

Very true! It’s definitely savings in my head when I think about it, but it always stinks that I don’t have actual money to look at after I paid off my debt, haha.

73% savings rate is insane! Holy crap that’s awesome!