If you’re wondering why DoorDash is so slow, this post can help you understand what’s going on. There are two people who might be wondering why DoorDash is slow. These include the following:

- You’re a DoorDash driver (Dasher) and aren’t receiving any orders.

- You’re a customer and are waiting a long time for your order to arrive.

Let’s take a look at all of the reasons why DoorDash could be slow.

I’m A Driver – Why Is DoorDash So Slow?

There are four main reasons why things might be slow when you’re Dashing. These include the following:

- You’re Dashing during non-peak hours.

- The DoorDash app is down.

- You’re not in a busy area.

- There are too many Dashers signed in.

Let’s address each of these in turn.

1. Dashing During Non-Peak Hours

Food delivery is predictable. People order food during two main hours – lunch and dinner. For the most part, you want to stick to doing deliveries during these times. That mainly means working between 11 am and 1 pm, and from 5 pm to 8 pm. I generally stick to working only during these prime hours so that I don’t waste my time sitting around.

Mornings are typically very slow on DoorDash, as people don’t seem to order breakfast food for delivery as much as they order lunch or dinner. While this might differ depending on your market, I’ve rarely had much luck working during the morning hours.

Mid-afternoon is also a bad time to dash. Again, you can understand why by thinking about eating patterns. Most people eat during lunch or dinner, so they’re not going to be ordering a lot of food during the mid-afternoon.

The exception to this is during the weekend. It seems like on weekends, people shift their eating styles, so you can have pretty constant delivery requests throughout the day. In addition, if there is a special event going on, that can change when you might want to start Dashing.

2. The DoorDash App Is Down

DoorDash is sometimes referred to by the pejorative – DoorCrash. And this is true. The DoorDash app is notorious for crashing, especially during peak hours.

If you’re logged in during peak hours and you find that you aren’t getting deliveries and there isn’t any other reason why DoorDash is slow, likely, the app is down.

To find out if the DoorDash app is down, I usually check the DoorDash customer service Twitter account. You can also search on Twitter for the term DoorDash. If the app is down, you’ll see tons of people complaining about it. Finally, the DoorDash subreddit is also a good place to check if the app is down.

3. You’re Not In A Busy Area

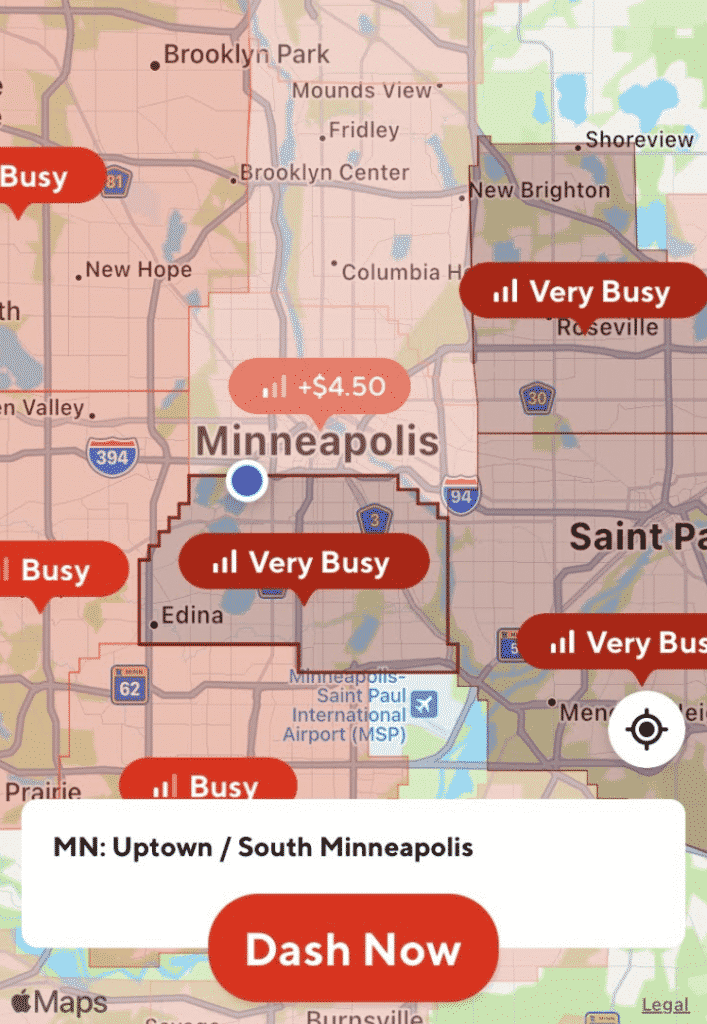

If you find that DoorDash is slow for you, it might be because you’re not in a busy area. DoorDash keeps track of hot zones in the Dasher app. While these zones aren’t perfect, they do give you a general idea of where you should be to get orders.

In general, you want to head towards busy downtown areas and areas with a lot of young people. Neighborhoods with young professionals are usually busy. College campuses are also generally busy. If you’re fortunate to live in an area like this, you can even get orders without having to leave your house (I live in a busy area, so I can sit on my couch and wait for orders).

4. There Are Too Many Dashers Logged In

There’s a paradox that happens with DoorDash. When demand is high, DoorDash often gives Dashers a bonus on every delivery. But when the bonus gets too high, every Dasher logs in to try to make some extra money, and then you end up getting few or no deliveries.

If you see a high bonus being offered, there’s a good chance that you’ll end up with few deliveries because so many Dashers will log in. It’s still worth logging in, but be careful about chasing bonuses because you might find yourself making less than if you had gone to a less busy area.

I’m A Customer – Why Is DoorDash So Slow?

If you’re a customer and DoorDash is slow for you, the primary reason is likely that you aren’t tipping. Dashers are paid per delivery and can accept or reject orders that get sent to them. The payment is made up of two parts – the base pay from DoorDash + the tip the customer leaves.

DoorDash generally pays a low base pay of $2-4. That means if you don’t tip, a Dasher might only get offered $2 or so for a delivery. At that amount, most Dashers won’t accept the order. As a result, your food will sit at the restaurant for a long time if you don’t leave an appropriate tip so that Dashers will accept your order.

And while Dashers can’t see the exact tip you leave until after they deliver your order, they can still get an idea if you tipped based on the payout being offered. The takeaway is if you want your order delivered to you quickly, be sure to tip.

The other reason DoorDash could be slow is that you’re ordering from a restaurant that’s too far away from your location. Again, Dashers are paid per delivery, so if your delivery address is too far away from the restaurant, most Dashers will reject the order and wait for a closer one. My recommendation is to order from restaurants that are closer to you.

Finally, it’s possible your Dasher is delivering multiple orders, which could slow them down. DoorDash Dashers can pickup multiple orders, which means your order won’t always be the only one. If they look like they aren’t moving, it’s possible they are dropping off an order with another customer.

Strategies For When DoorDash Is Slow

If you’re working as a Dasher and DoorDash is slow, your best bet is to multi-app. That means signing up for multiple delivery apps and turning them all on at the same time. That way, if DoorDash is slow, other apps can make up the slack.

Check out my post, How To Make $500 A Week With DoorDash. I have some good strategies there that can help you out.

And check out some of my other delivery app posts for more information:

Door dash just simply doesn’t want to pay any higher . $2 orders & $4 orders are supposed to help with what exactly ? Not pay rent . Just a waste of gas & money. Working for door dash isn’t worth it

Lately I’ve had to cancel 2 walmart, 1 Sam’s, and a pizza delivery due to slow or non-existent DD drivers. The concept is good but apparently the business model is not sustainable as it currently exists. And I always tip extra… I’m just a little further out, I guess. Can someone please fix this?

Hi, DD & Lyft driver here.

My question is if you are delivering for two food apps at the same time, do you get the nasty notes from DD about not being on the route to get to the delivery?

BTW, about died last night when Walmart wanted me to do multiple deliveries. Turned out in closer look it was 10 deliveries, 52 miles for $52…..And you know Walmart will have a million bags for each order! I declined!

I never get any of that. My main thing is just making sure I’m picking orders that are nearby or going in the same direction. With DoorDash, as long as you pick up the order within 10 minutes of the pickup time (i.e. don’t be more than 10 minutes late to pickup), then you’re good. And as long as you deliver it within 10 minutes of the delivery time, you’re good too.

You just gotta be picky and strategic about which orders you accept when you multi-app.